Compounder Fund: Portfolio Update (April 2024) - 12 Apr 2024

Jeremy and I intend to share frequent but non-scheduled updates on how Compounder Fund’s portfolio looks like. The last time we shared an update on this was for Compounder Fund’s portfolio as of 07 January 2024.

In it, I shared all 46 holdings that were in the fund’s portfolio at the time. There have been no changes to the list of holdings since then. But Jeremy and I have made small tweaks to the composition of the portfolio. The most prominent of these small tweaks were (1) trims we made to Compounder Fund’s positions in Chipotle Mexican Grill, Costco, Etsy, and Fiverr, and (2) additions to Coupang and dLocal using capital from the trimming.

We trimmed Etsy and Fiverr because we have been disappointed – relatively speaking – with the recent developments in their businesses. In their 2023 fourth-quarter earnings updates, the duo issued lacklustre guidance for their 2024 results. In the case of the e-commerce marketplace for unique craft items, Etsy, management guided for its GMS (gross merchandise sales) to decline in the low single-digit percentage range in the first quarter of 2024, accompanied by revenue growth in the mid single-digit percentage range at best. We expected more, given that Etsy currently has just a 2% share of a US$500 billion market opportunity based on the size of the online markets across geographies and retail categories that are relevant to the company. Coming to Fiverr, the leaders of the freelancing platform company expect GMV (gross merchandise volume) growth in 2024 to accelerate by merely 1-2 percentage points above 2023’s GMV growth of just 1%, leading to meagre revenue growth of 5%-7%. In contrast, Fiverr’s larger competitor, Upwork, is projecting revenue growth of 10%-13% for 2024.

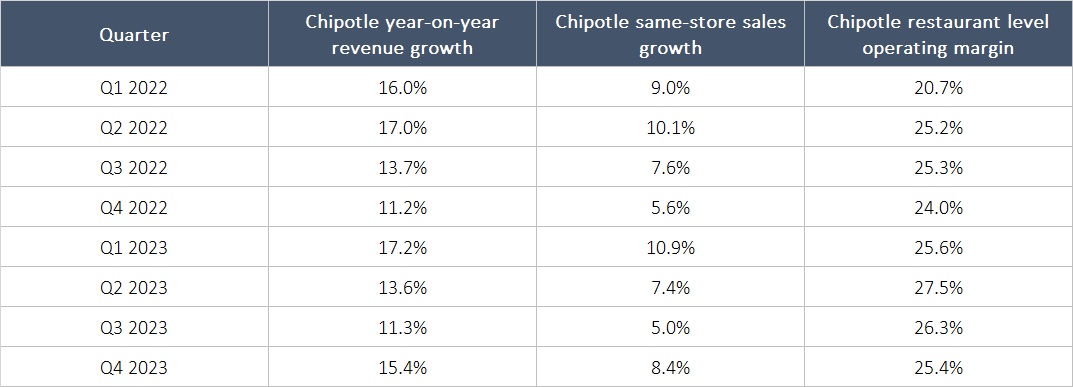

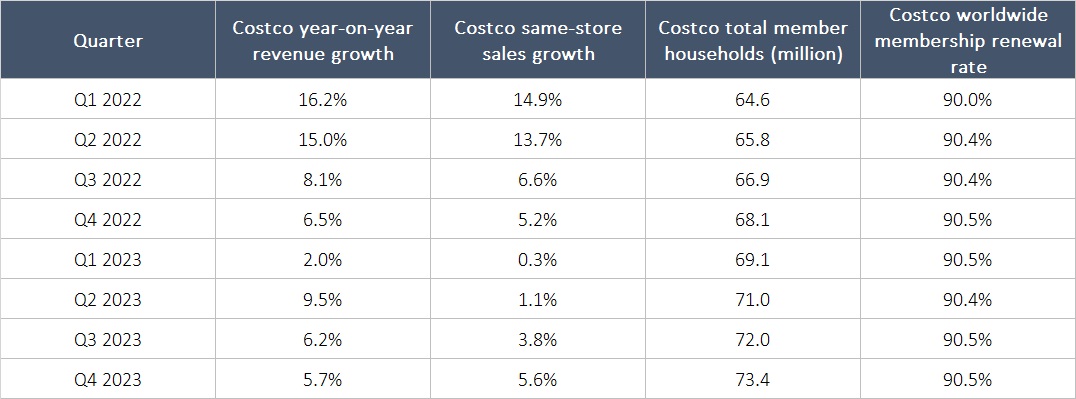

As for Chipotle and Costco, we have been pleased with both companies’ business results since our first investments that were made in July 2020. Table 1 below shows the impressive revenue growth, same-store sales growth, and restaurant-level operating margin (note the year-on-year increases in the restaurant-level operating margin too) since the first quarter of 2022 from Chipotle, which runs fast-casual restaurants specialising in Mexican fare. Meanwhile, Costco, the membership-based warehouse retail giant, has been consistently growing its membership count and putting up high membership renewal rates of at least 90%, in addition to posting positive revenue growth and same-store sales growth, over the same period; these are shown in Table 2.

Table 1; Source: Chipotle earnings releases

Table 2; Source: Costco earnings releases

We’re still really positive on the future growth potential of Chipotle and Costco’s businesses. Chipotle ended 2023 with 3,437 restaurants, average annual sales per restaurant of US$3.0 million, and a restaurant-level operating margin of 26.2%. These compare with management’s view on Chipotle’s long-term potential for reaching 7,000 restaurants (which is up from a previous target of 6,000), average annual sales per restaurant in excess of US$4 million, and a restaurant-level operating margin in the 30% range. If they come to pass – and we have confidence they would, given management’s continued emphasis on the company’s food- and people-culture – Chipotle is on a multi-year journey towards tasty revenue and free cash flow growth. As for Costco, management gave a good description of the company’s long runway for growth in its 2023 fourth-quarter earnings conference call (emphases are mine):

“But what’s interesting is we have a lot more runway than we ever thought possible. If you had asked us 5 years ago, by now, how many would we be putting in this year in the U.S., we would not have said 20-plus. It’s got to slow down at some point. But the volumes that we’re now doing in these locations, we’ve got to bleed some of that off. And so that’s one good point. And then we still got plenty of going on overseas. And you’ll see that continue to ramp up as well…

… If you announced this 10 years ago, will you ever have 150 of your 600 U.S. locations doing over [US]$300 million and 40 of them doing over [US]$400 million? The answer would be no, no way, even with inflation. The fact is we’re doing a lot more volume than we’ve ever thought we would do. And so the biggest answer of not only making it a little more efficient but driving more sales is cannibalizing. We find existing members that sometimes will say, “I don’t want to go there. It’s too busy today.” And by opening up that third or fourth unit in that city, we’re seeing not an increase by 1/3 or 1/4 of the membership base but a significant increase in sales.”

But both Chipotle and Costco’s valuation multiples have run up in recent months. They ended March 2024 with high price-to-earnings ratios of 66 and 48, and high price-to-free cash flow ratios of 66 and 53, respectively. So we thought it makes sense to take a small number of chips off the table.

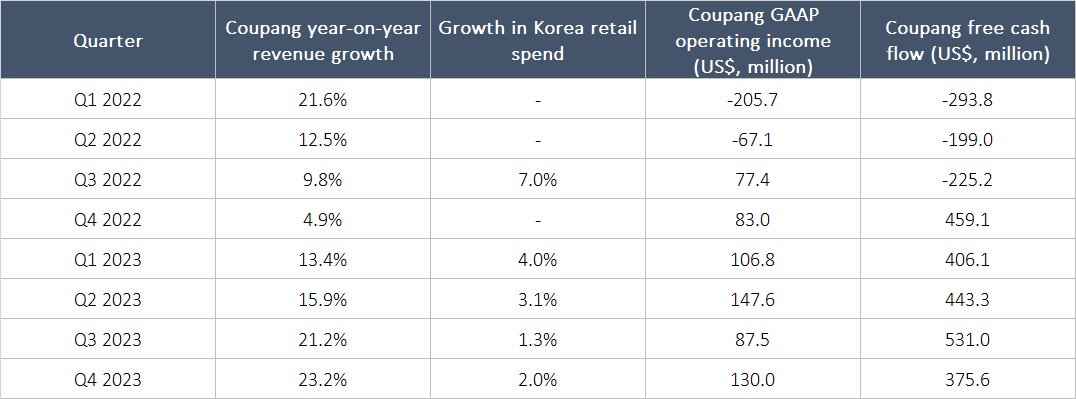

We added to Compounder Fund’s position in Korean e-commerce company Coupang for two reasons. First, there’s Coupang’s impressive inflection to positive free cash flow and GAAP (Generally Accepted Accounting Principles) operating income in recent quarters while posting healthy revenue growth – see Table 3. It’s worth noting too that Coupang’s top-line has grown significantly faster than Korea’s overall retail spend. Second, the company was carrying a price-to-free cash flow (P/FCF) ratio of just 18 at the end of March 2024.

Table 3; Source: Coupang earnings releases and earnings conference calls

Coupang also acquired Farfetch, an online marketplace focusing on luxury products, earlier this year and now has a new commerce-vertical for future growth. The deal is a risk for Coupang since Farfetch was burning through cash throughout its life as a public-listed company (Farfetch held its initial public offering in 2018). In fact, Farfetch was close to bankruptcy when Coupang swooped in. But Coupang’s management team shared in the 2023 fourth-quarter earnings conference call that they are “already executing on a plan to make Farfetch self-funding with no additional investments beyond the announced capital commitment” and that they “see many paths to making this a worthwhile investment for shareholders.” Moreover, we estimate the capital commitment mentioned by management to be not more than US$500 million; with net-cash of US$2.5 billion (total cash less total debt and operating leases) at the end of 2023, Coupang should have plenty of financial cushion for the deal. Coupang still has plenty of headroom for growth as its revenue of US$24.4 billion in 2023 remains a tiny fraction of the US$560 billion in total commerce spend that is expected to take place in Korea in 2027.

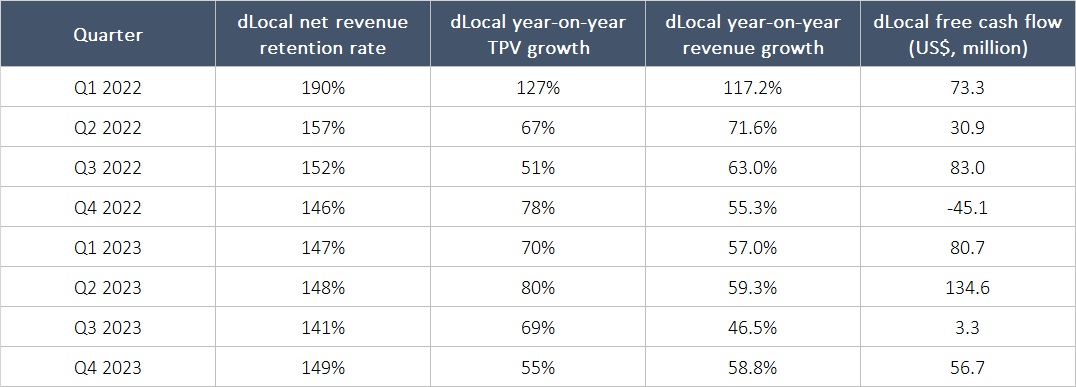

Coming to dLocal, the emerging markets digital payments specialist has been producing high net revenue retention rates and strong growth in TPV (total payments volume), revenue, and free cash flow for some time. These are shown in Table 4.

Table 4; Source: dLocal earnings releases and earnings conference calls

dLocal’s already-strong management team was strengthened significantly, in our opinion, with the arrival in August 2023 of Pedro Arnt as co-CEO alongside Sebastian Kanovich. Arnt, 50, has an impressive resume: He was CFO of MercadoLibre, a role he had held since June 2011, just prior to joining dLocal. MercadoLibre is a fellow Compounder Fund holding and a Latin American e-commerce and digital payments powerhouse. Kanovich, who is one of dLocal’s founders, stepped down as co-CEO in March this year but will remain active in the company as the leader of a newly established Commercial and M&A (mergers & acquisitions) committee within its board. This leaves Arnt as the sole CEO.

During dLocal’s recent 2023 fourth-quarter earnings conference call, Arnt shared that he joined the company “with the strong belief this is an outstanding business with significant opportunities ahead” and that the “conviction has done nothing but increase in [his] time [with dLocal].” Importantly, Arnt also reiterated dLocal’s previous mid-term targets of producing a 25%-35% compound annual growth rate in gross profit, and an adjusted EBITDA (earnings before interest, taxes, depreciation, and amortisation) margin of more than 75%. At the end of March 2024, dLocal carried a low P/FCF ratio of merely 16.

Here’s how Compounder Fund’s portfolio of 46 companies looks like as of 7 April 2024:

Table 5