Compounder Fund: Fiverr Investment Thesis - 10 Mar 2021

Data as of 8 March 2021

Fiverr International Ltd (NYSE: FVRR) is one of the three companies in Compounder Fund’s portfolio that we invested in for the first time in January 2021. This article describes our investment thesis for the company.

Company description

Incorporated in Israel in 2010, Fiverr offers a digital marketplace that connects freelancers with businesses. Today, Fiverr is still based in Israel, but its shares are listed in the USA.

As of 31 December 2020, Fiverr had more than 500 categories of service listings (Fiverr calls them gigs), such as graphic design, website building, voice-over, scriptwriting, and video creation and editing, just to name a few. One gig on Fiverr can cost anywhere from US$5 to thousands of dollars. Here’s a fun fact: Compounder Fund’s logo was designed by a designer we connected with through Fiverr’s platform (we paid slightly over US$5!).

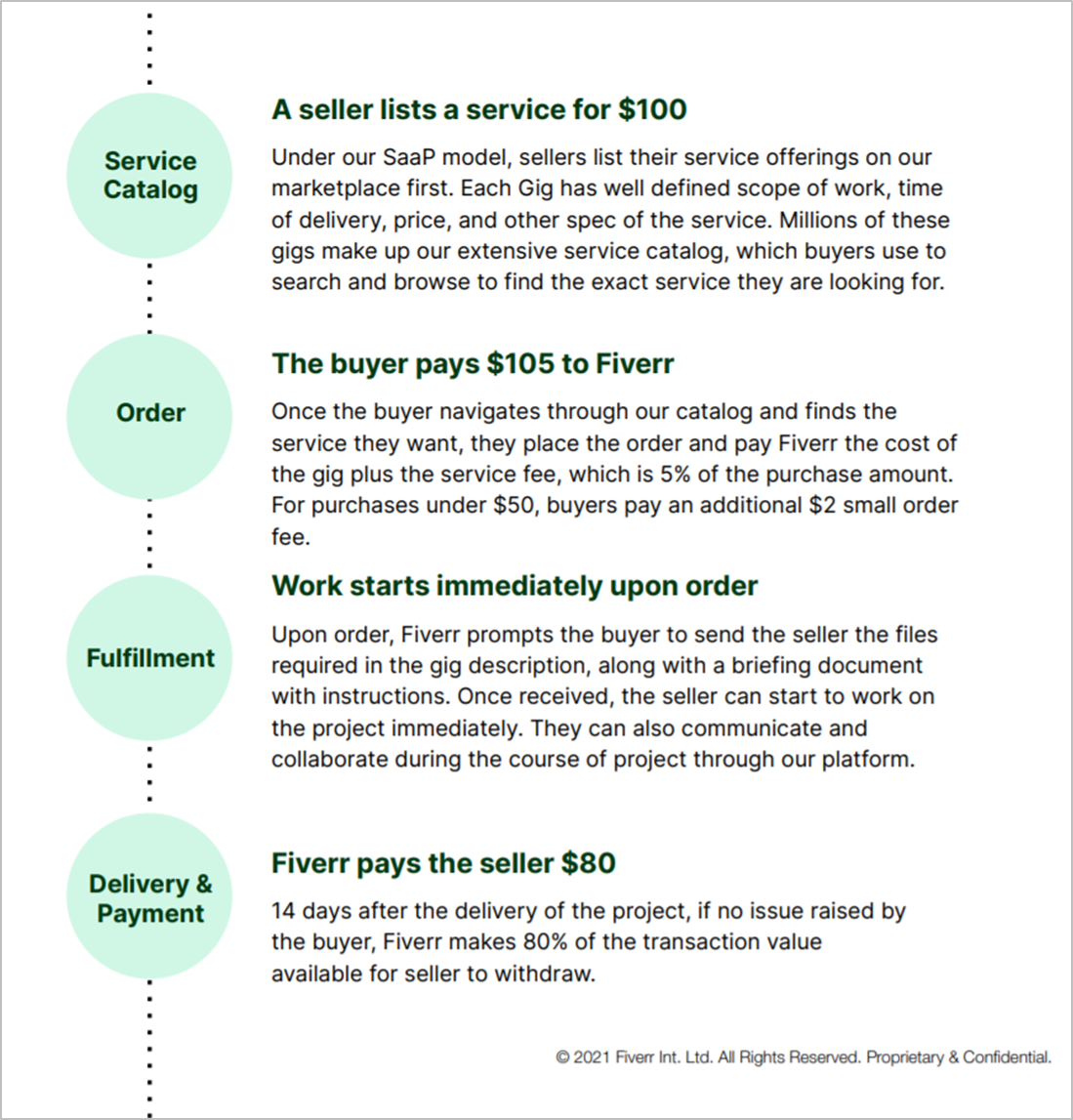

Nearly all of Fiverr’s revenue – US$189.5 million in 2020 – comes from transaction and service fees that are based on the total transaction value that happens on its platform. Here is an example of how a typical transaction on Fiverr’s platform works (freelancers that list their services on Fiverr’s platform are known as sellers):

Source: Fiverr February 2021 Investor Presentation

From a geographical perspective, Fiverr is somewhat diversified. 53.1% of its revenue in 2020 came from buyers that are located in the USA. Buyers in Europe, Asia Pacific, Israel, and other parts of the world accounted for 25.5%, 12.0%, 1.0%, and 8.3%, respectively, of Fiverr’s total revenue in 2020.

Investment thesis

We have laid out our investment framework on Compounder Fund’s website. We will use the framework to describe our investment thesis for Fiverr.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

The gig economy is huge. According to Fiverr, which used US Census Bureau Nonemployer Statistics data, the estimated annual total freelancer income in the USA alone is US$815 billion at the moment. If we’re looking only at the services that are most relevant to Fiverr, the freelancer income in just the USA is US$115 billion. With the USA making up only around a quarter of global GDP (gross domestic product), we think it’s reasonable to assume that the combined freelancing market in other parts of the world is at least equal in value to that in America.

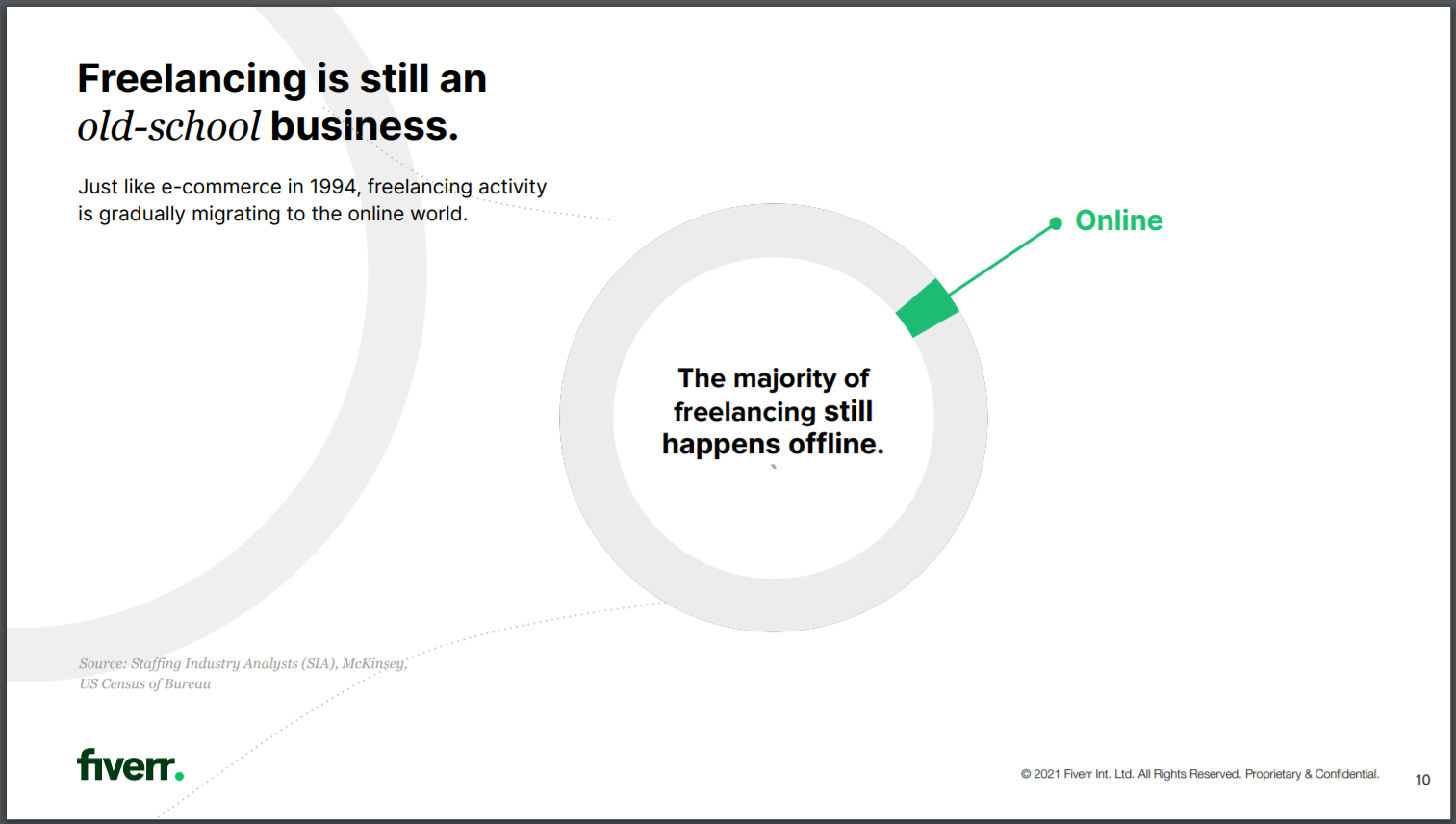

Meanwhile, Fiverr’s platform enabled US$699.3 million in total gross merchandise value (GMV) in 2020, which resulted in US$189.5 million in revenue. These numbers are merely a tiny fraction of the market opportunity that Fiverr has, and in our view, signifies a long runway for growth for the company. It’s also worth noting that the majority of freelancing is still happening offline, as shown in the first chart below, which again points to plenty of white space for Fiverr to grow into.

Source: Fiverr February 2021 Investor Presentation

We believe that a well-run marketplace that connects freelancers with buyers of freelancing services can provide tremendous value to both parties. As it stands, there’s plenty of friction involved with traditional freelancing, which is conducted mostly offline. For example, buyers have to stress over: Finding the right talent; collaborating with and supporting a freelancer during the course of the project; determining the quality of the freelancers they’re working with; and negotiating the deal. For sellers, they are worried about: Finding customers; winning bids for projects; dealing with payment-related uncertainties; and the proper channels to deliver the completed projects. These are all problems that Fiverr’s platform can help solve:

- For buyers:

- They are able to easily find the right freelancers with the intuitive browse, search, and click-to-order experience that Fiverr’s platform offers.

- They get transparency and certainty on price, duration, and scope of work.

- They are able to buy with confidence as Fiverr’s platform displays each seller’s transaction history, reviews, and a portfolio of past projects

- For sellers:

-

- They can connect with potential buyers globally through Fiverr’s platform

- They do not need to spend a large amount of time marketing their services and bidding for projects

- Once an order is placed, Fiverr provides freelancers with the administrative and logistical support necessary for them to manage and run their business efficiently.

- They do not have to worry about getting paid as Fiverr collects the fees from buyers upfront before releasing them in a timely manner to the freelancers when the project is completed.

We believe that Fiverr has a high chance of being able to take advantage of the growth opportunities that it sees in the freelancing market. Besides the advantages – discussed above – that Fiverr’s platform hold over the traditional way freelancing is done, there are a few other reasons why we think so:

- Fiverr has shown excellent execution in making its marketplace well-liked by both buyers and freelancers; the company boasts excellent net promoter scores (NPS-es) for both buyers and sellers at 67 and 79, respectively, as of 31 December 2020. (The NPS ranges from -100 to +100 and it measures the willingness of customers to recommend a company’s product or service to others and can be a gauge of customer loyalty and satisfaction.)

- Fiverr has been innovating constantly (more on this later) and this drive for improvement should set the company up nicely to be a winner in the space.

- Fiverr already boasts a sizeable network of buyers and sellers. The company reported 3.4 million active buyers at end-2020, up from 2.4 million at end-2019, and 2.1 million as of 31 March 2019. The latest data we have on the number of active sellers on Fiverr’s platform is 255,000 as of 31 March 2019; but given the significant increase in the active buyer count, it’s reasonable to assume that the number of active sellers has also increased substantially since. We think that a marketplace type of business that Fiverr operates exhibits network effects, where more high-quality buyers leads to more high-quality sellers, which leads to even more high-quality buyers and so on. It will become increasingly difficult over time for new entrants to compete with Fiverr as the company continues to scale its platform.

And underpinning all of our discussion on Fiverr’s growth opportunities is our belief that the freelancing economy is likely to grow in the years ahead, spurred on by Fiverr and its competitors such as Upwork. The existence of freelancing platforms make it easier for businesses and freelancers to connect, and could be a catalyst for more workers to embrace freelancing. There are three things we want to point out:

- Upwork recently published its seventh annual study on freelancing, Freelance Forward, that surveyed 6,000 American workers. Among the study’s findings are (1) freelancing increased a worker’s earning power and ability to pick up new skills, and (2) 58% of non-freelancers surveyed who experienced remote work because of COVID-19 are now considering freelancing in the future.

- Total freelancer income in the USA had increased from US$750 billion in 2016 to US$815 billion currently.

- Fiverr’s 2020 fourth-quarter shareholders’ letter contained commentary from the company’s management team that address the ascendance of freelancing (emphasis is ours): “We are witnessing the dawn of a massive shift towards a more modern, flexible and resilient workforce infrastructure that is sweeping every company and every industry around the globe. Fiverr is powering these shifts with the world’s largest freelancer network and most comprehensive digital service catalog.”

2. A strong balance sheet with minimal or a reasonable amount of debt

Fiverr ticks this box. The company exited 2020 with US$715.5 million in cash and investments while holding only US$356.6 million in debt, of which US$352 million are convertible notes.

It also helps that Fiverr has started to generate free cash flow. This is something we will touch on later.

3. A management team with integrity, capability, and an innovative mindset

On integrity

Fiverr was founded by Shai Wininger and Micha Kaufman in 2010. While Wininger has since left Fiverr to co-found a tech-focused insurance company, Lemonade, in 2015, Kaufman has continued to lead Fiverr as CEO, a role he’s held since the company’s birth. So to us, Kaufman is the key leader of Fiverr.

In 2020, Kaufman’s total compensation was a reasonable US$2.96 million, of which US$2.22 million (nearly 75%) came from the value of stock awards such as stock options and restricted stock units. The stock awards are well designed, in our opinion, as they generally vest over a four-year period. The multi-year vesting means that the lion’s share of Kaufman’s compensation in 2020 depends on Fiverr’s long-term business performance. We think this compensation structure aligns the interests of Kaufman and Fiverr’s other shareholders.

And speaking of alignment of interests, Kaufman also has significant skin in the game. As of 31 December 2020, Kaufman controls 2.123 million Fiverr shares, or 5.9% of the company. Based on Fiverr’s share price of US$196 on 8 March 2021, his stake is worth US$417.1 million.

Another important member of Fiverr’s management team is Ofer Katz, who has been the company’s CFO since February 2011 (he was on a contract-basis from February 2011 to June 2017, and then on a full-time basis since July 2017). His compensation in 2020 was US$1.76 million, of which 66% came from stock awards that have the same structure as Kaufman.

On capability and ability to innovate

We rate Kaufman and his team highly on this front and there are a few things we want to discuss.

First, Kaufman and Wininger started Fiverr after they both ran into problems associated with hiring talent on a very short-term basis to get something done. Here’s Kaufman describing the founding story of Fiverr in his letter to investors in the company’s IPO prospectus:

“Fiverr was originally created to solve a problem we had ourselves. As entrepreneurs we always relied on help from others. What we realized over the years was that not every task required hiring someone on a full time basis, or even part time. We realized that it was not about the hiring, but about getting something done. Something that required specific knowledge and talent. The problem we faced was that finding that talent was hard. It was mostly based on other people’s recommendations, and even if you found someone, the vetting process and figuring out if that person was right for the job was time-consuming and extremely inefficient. Even after finding a person for the job, other challenges appeared, challenges of working together: communication, contracting, sorting out payment, providing feedback, and if things do not go smoothly — solving the problem. We imagined a world where these complex problems could be solved elegantly, through technology. We were on a mission — a mission to change how the world works together.”

We are attracted to companies that are created because their founders saw a big problem that needed fixing – to us, it’s a sign of the entrepreneurial drive and innovative mindset of the companies’ leaders.

As its name suggests, in Fiverr’s earliest days, each gig that was posted on the company’s platform was only US$5 (today, there are gigs on the company’s platform that cost thousands of dollars). This is the second thing we want to discuss. It was a counter-intuitive move by Kaufman and Wininger. Why would freelancers even want to accept five-dollar jobs? Why would businesses even need to look for people to fulfill five-dollar work? There was creative thinking behind the pricepoint. Here’s an article from Fiverr describing Kaufman and Wininger’s thought process:

“Kaufman and Wininger wanted to make it easy for people to commit to buying and selling services online. They realized that starting from a low price point – [US]$5 – made the exchange less risky for both the freelancer and the customer. “We wanted to take away the friction of price negotiation,” says Kaufman.

Most freelancers would raise a brow at such a low rate. What can you actually get for five bucks? But the founders had a hunch the price would give freelancers “a way to slice their skills thin enough.” They were right. Freelancers began signing up in droves. While the $5 focus was a great launching off point, after nearly a year of growth, the founders realized they needed to give freelancers a way to expand their services and rates.”

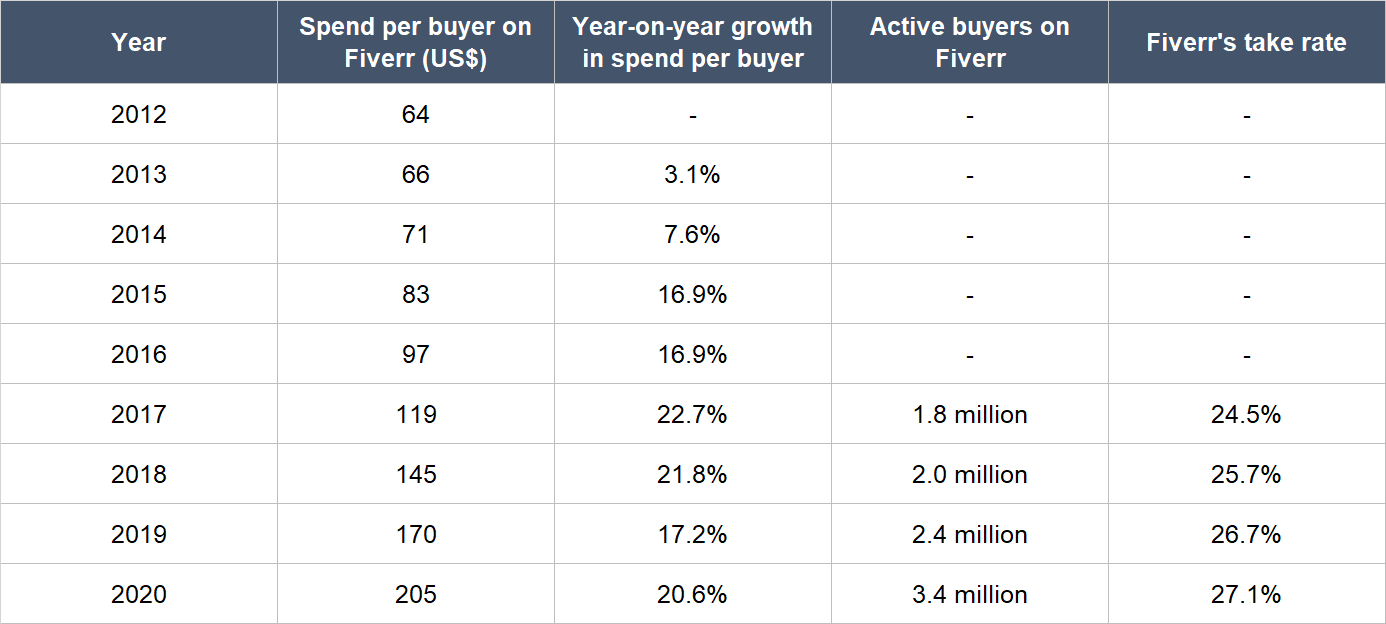

Third, there are a few metrics that we think are important to track as signals for the health of Fiverr’s marketplace: Spend per buyer; number of active buyers; and the company’s take rate (the take-rate is the amount of revenue earned by the company per dollar of transaction that its platform processes). Kaufman and his team have done an excellent job over the years at maintaining a high take rate and growing Fiverr’s spend per buyer and number of active buyers. The table below shows that the spend per buyer has increased by 15.7% annually from 2012 to 2020 (with recent growth rates being even faster) and active buyers have increased by 23.6% annually from 1.8 million in 2017 to 3.4 million in 2020. Meanwhile, the take rate has increased slightly in each year from 2017 to 2020 and has stepped up from 24.5% to 27.1%.

Source: Fiverr investor presentations, annual reports, and IPO prospectus

Fourth, Fiverr isn’t merely a simple marketplace – the company also leverages technology to personalise and improve its services for both buyers and sellers. For instance, Fiverr uses its years of transaction data – now 11 years and counting – such as budget, design taste, and past purchase patterns, to better match buyers and sellers at the gig level. It also uses machine learning to improve the quality of the gigs and sellers on its platform – this is really important, because the quality of Fiverr’s platform essentially depends on the quality of the buyers and sellers that are on the platform.

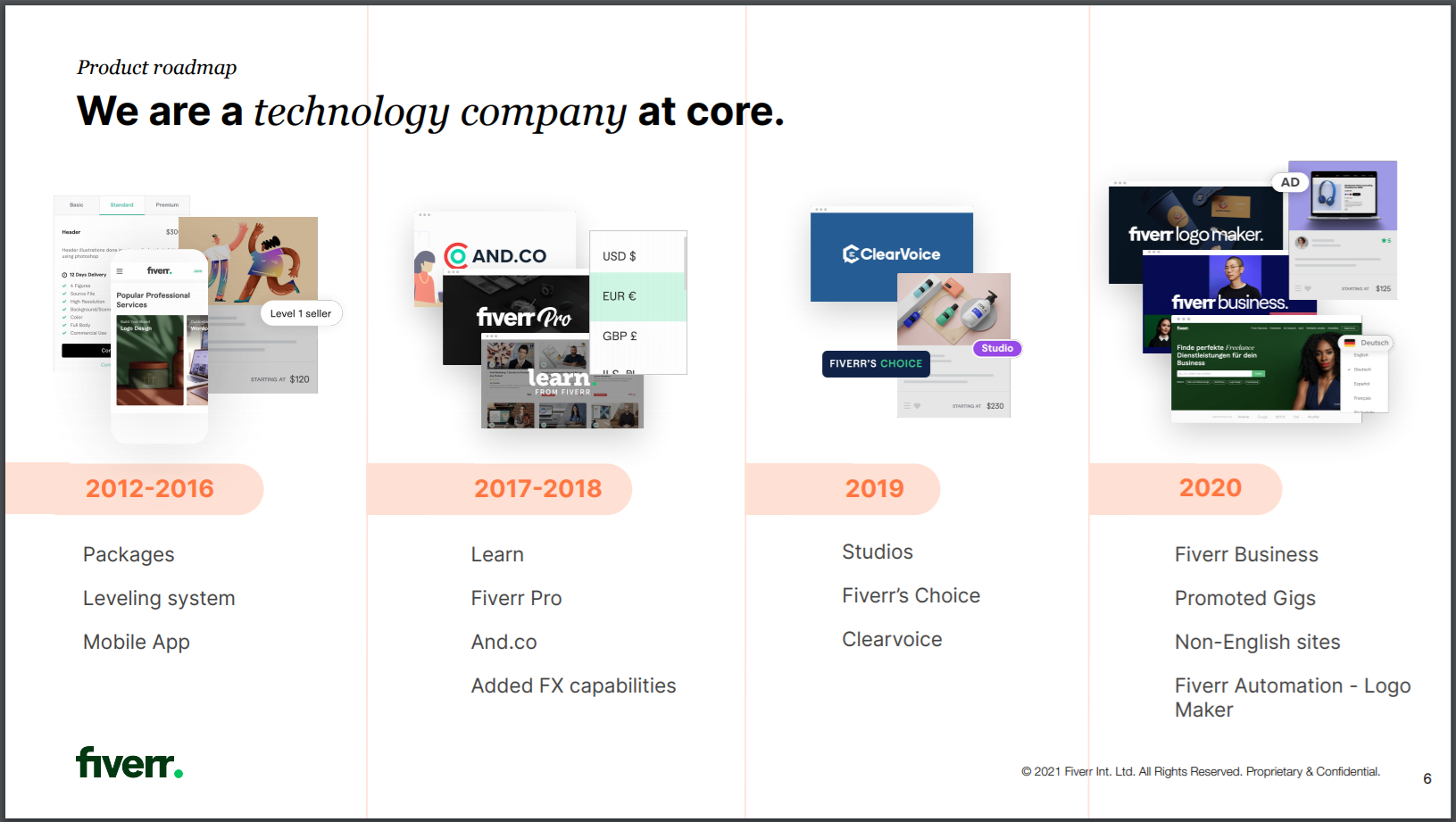

The fifth point we want to discuss is connected to the fourth, and that is Fiverr has a good track record of innovation and execution. The chart below is an example of Fiverr’s product introductions since 2012. Some recent products launched by Fiverr that caught our eye include Promoted Gigs, Fiverr Business, and Subscriptions. Promoted Gigs was introduced in July 2020 and it’s a tool for sellers to advertise their services on Fiverr’s platform. Fiverr Business was announced in September 2020 and it is a subscription software service that helps businesses manage all the projects they are collaborating on with Fiverr freelancers. Meanwhile, Subscriptions was introduced in February 2021 and it allows buyers on Fiverr’s platform to subscribe for services provided by sellers – this helps freelancers on Fiverr’s platform to build longer-term relationships with their customers. Previously, Fiverr only allowed buyers to pay on a per-project basis.

Source: Fiverr February 2021 Investor Presentation

We think the innovative streak at Fiverr also shines through in a few other ways:

- In 2010, Fiverr went live with just eight categories of digital services on its platform. By 2018, this had increased to more than 200. Currently, Fiverr provides more than 500 categories of digital services.

- Earlier, we shared that Fiverr’s platform boasts impressive NPS-es for both buyers and sellers.

Sixth, Fiverr appears to have a great corporate culture. According to Glassdoor, a website that allows a company’s employees to rate it anonymously: Fiverr currently has a 4.4-star rating out of 5; 87% of Fiverr-raters would recommend a friend to work at the company; and Kaufman has a 95% approval rating as CEO, far higher than the average Glassdoor CEO rating of 69% in 2019.

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

There are a number of things that we think highlight the strong recurring nature of Fiverr’s revenues.

First, we mentioned earlier that Fiverr’s revenue comes predominantly from transaction and service fees that are based on the transaction value that happens on its platform. In other words, Fiverr earns revenue from every transaction it processes.

Second, we mentioned earlier that Fiverr has experienced (1) pleasing growth in its number of active buyers and spending per buyer over the past few years, and (2) a stable and high take-rate for the same time period.

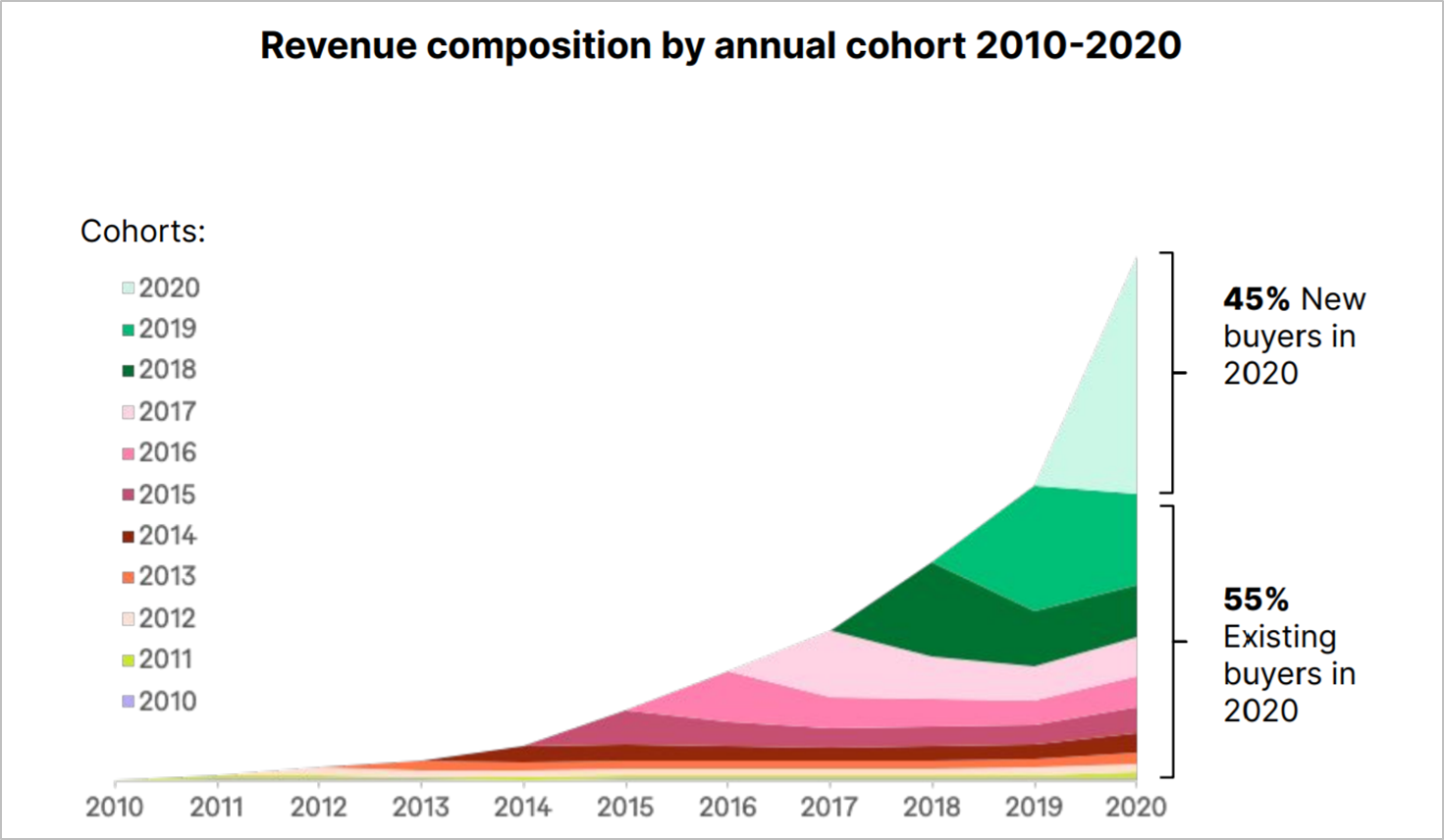

Third, repeat buyers accounted for 55%, 57%, 58%, and 55% of Fiverr’s total revenue in 2017, 2018, 2019, and 2020 respectively. Fiverr’s buyer cohorts in each year since 2010 have also continued to contribute revenue to the company in 2020, as the chart below illustrates.

Source: Fiverr February 2021 Investor Presentation

Fourth, prior to 2020, Fiverr already had subscription-based products that complemented its core freelancing digital marketplace. Over the past year, Fiverr has introduced new subscription products such as Fiverr Business and Subscriptions that we touched on earlier.

5. A proven ability to grow

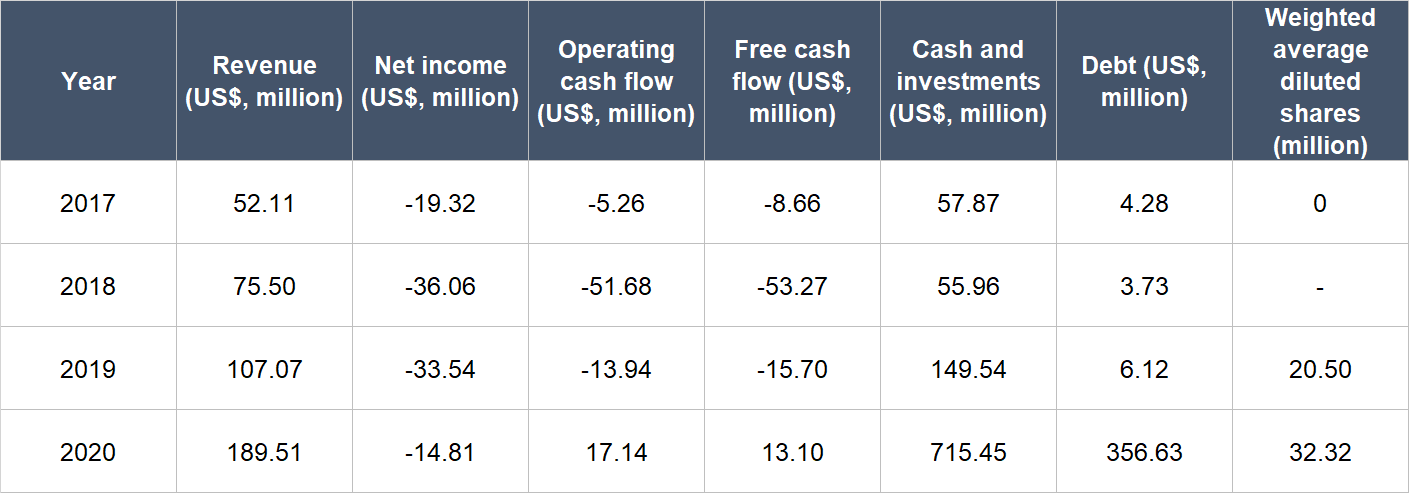

Fiverr has a short history as a public-listed company (its IPO was only in June 2019) so we don’t have much financial data to study for the company. But we like what we see. The table below shows the key financial figures for Fiverr that we can obtain:

Source: Fiverr IPO prospectus and annual reports

A few key things to highlight from Fiverr’s historical financials:

- Revenue has compounded at an excellent annual rate of 43.3% from 2017 to 2019. Fiverr’s revenue growth accelerated to 77.0% in 2020 partly because the ongoing COVID-19 pandemic increased the demand from businesses for freelancing work.

- Fiverr’s still generating negative net income, but the trend is in the right direction, with the net income margin having narrowed from -37.1% in 2017 to -7.8% in 2020. Our focus is also not on Fiverr’s net income at the moment, but on its cash flow.

- The company reached a significant milestone in 2020 as it produced positive operating cash flow and free cash flow. We believe Fiverr will continue to benefit from operating leverage as its business scales, leading to stronger free cash flow margins over time. For context, Fiverr’s free cash flow margin (free cash flow as a percentage of revenue) for the whole of 2020 was 6.9%, up from -14.7% in 2019 and -70.6% in 2018.

- The company’s balance sheet was strong throughout the time frame under study, with cash and investments being significantly higher than debt in each year.

- We only started looking at Fiverr’s share count in 2019 since it was listed in June of the year. At first glance, Fiverr’s share count appears to have increased tremendously from 2019 to 2020 (a 58% jump). But the number we’re using is the weighted average diluted share count. Right after Fiverr got listed in June 2019, it had a share count of around 31.8 million. This means that the increase in 2020 was much milder (at less than 2%) and at a level that we find completely acceptable.

Looking ahead, in Fiverr’s 2020 fourth-quarter shareholders’ letter, management shared their belief that “the impact of COVID-19 should drive a long-term sustainable tailwind for freelancing services and investments in digital channels.” We agree. But even if there wasn’t a COVID-19 tailwind, the growth opportunities that Fiverr had were already highly attractive. For perspective, when total freelancer income was US$750 billion in the USA in 2016, the services that were most relevant to Fiverr already represented a US$100 billion opportunity.

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

As mentioned previously, Fiverr started producing positive free cash flow in 2020 and has seen its free cash flow margin improve over time.

We think that Fiverr can likely continue to improve its free cash flow margin significantly as its business scales. Fiverr’s marketplace has a two-sided network effect at play (businesses on one side, and freelancers on the other) and such marketplaces tend to have high free cash flow margins when mature because of the asset-light nature of their businesses. For instance, eBay – which was founded in 1995 and runs an eCommerce marketplace – had an average free cash flow margin of 24% from 2016 to 2020, the years after it separated from PayPal.

And as previously discussed, Fiverr’s business has significant room to grow and we think the company has a great chance of being able to capitalise on the growth opportunities that it sees. In the years ahead, Fiverr could deliver a one-two punch of much higher revenue and much higher free cash flow margins compared to today.

Valuation

We completed our initial purchases of Fiverr shares in early January 2021. Our average purchase price was US$210 per share. At our average price and on the day we completed our purchases, Fiverr’s shares had a trailing price-to-sales (P/S) ratio of around 42. We like to keep things simple in the valuation process. In Fiverr’s case, we think the P/S ratio is currently an appropriate metric to gauge the value of the company, since the company does not have a long history yet of generating free cash flow.

There’s no need to consult any historical valuation chart to know that the P/S ratio of 42 is high – and that’s a risk. For perspective, if we assume that Fiverr has a 30% free cash flow margin today, then the company would have a price-to-free cash flow ratio of 140 (42 divided by 30%). But we think Fiverr has years of rapid growth ahead of it, given the low penetration rate of its digital freelancing marketplace, the high popularity of its marketplace amongst both businesses and freelancers, and the formation of a strong two-sided network effect on its marketplace. This makes us comfortable with paying up for Fiverr’s shares, since we think the company has a good chance of being able to grow into its valuation.

For perspective, Fiverr carried a P/S ratio of around 34 at its 8 March 2021 share price of US$196.

The risks involved

There are four main risks that we see with our investment in Fiverr.

Key-man risk: We think that the leadership of Micha Kaufman has been one of the main reasons for Fiverr’s success thus far. He has been leading the company as CEO since its founding in 2010. Should Kaufman leave for any reason, we’ll be watching the leadership transition. The good thing is he is relatively young at 50 years old, so he should have plenty of gas left in the tank to continue leading the company.

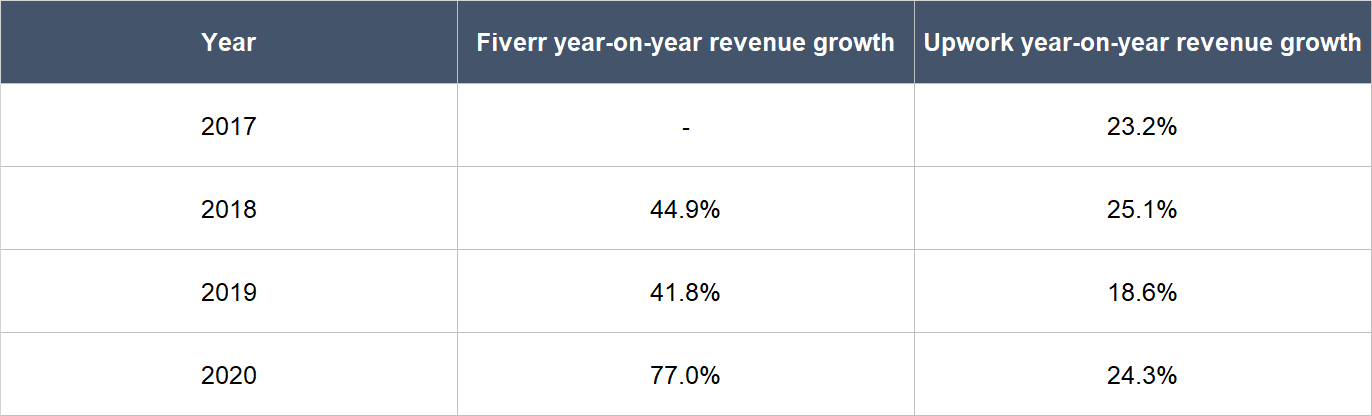

Competition: We currently identify Upwork as Fiverr’s key competitor, but Microsoft’s Linkedin (the “Facebook” for professionals) announced earlier this year that it is building its own freelancing marketplace and is aiming to launch the service as early as September. The entrance of LinkedIn, which is backed by the financial might of Microsoft, is something we’re watching. We’re comforted by Fiverr’s excellent execution over the past few years (for instance, Fiverr was always growing significantly faster than Upwork, as the table below shows) and also its growing network effect. But things could change.

Source: Fiverr and Upwork annual reports

Geopolitical risk: Fiverr is headquartered in Israel and at the end of 2020, it had 545 employees. We can’t tell how many of Fiverr’s employees are based in Israel, but we know for sure that there are Fiverr employees in the country. For example, the company’s key leaders (this includes Kaufman) and most of the research and development team are there. Historically, Israel has had – and continues to have – tense relationships with its neighbouring countries. But we’re comforted by the fact that Fiverr has managed to grow strongly since its founding in 2010 despite Israel having been in multiple armed conflicts with its neighbours over the past decade. Nonetheless, we’re keeping an eye on the situation.

Valuation risk: We think Fiverr’s business is likely to grow at a rapid clip for many years and so it deserves its premium valuation. But if there are any hiccups in Fiverr’s business – even if they are temporary – there could be a painful fall in the company’s share price. This is a risk we’re comfortable taking as long-term investors.

Summary and allocation commentary

To sum up Fiverr, it is a company that has:

- A huge and growing market opportunity in the form of the freelancing economy, and a digital freelancing marketplace that has a growing network effect

- A robust balance sheet that has significantly more cash and investments than debt

- A management team with well-aligned incentives, and a great track record of execution and innovation

- A high level of recurring revenue from customer behaviour

- A strong, albeit short, history of revenue growth

- A high chance of producing a growing stream of free cash flow in the future

There are risks to note, such as key-man risk, an intensifying competitive landscape, geopolitical uncertainty in Israel, and a high valuation carried by the company’s shares.

After weighing the pros and cons, we decided to initiate a position of around 1.5% in Fiverr in January 2021. We appreciate all the strengths we see in Fiverr’s business, but our enthusiasm is tempered slightly by its high valuation.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share. Of all the other companies mentioned, Compounder Fund also owns shares in Microsoft and PayPal. Holdings are subject to change at any time.