Compounder Fund: Portfolio Update (October 2023) - 11 Oct 2023

Jeremy and I intend to share frequent but non-scheduled updates on how Compounder Fund’s portfolio looks like. The last time we shared an update on this was for Compounder Fund’s portfolio as of 9 July 2023.

In it, I mentioned a few things: (a) all 50 holdings that were in the fund’s portfolio at the time; and (b) updates on the acquisition of Activision Blizzard by Microsoft. Since then, we have removed Activision from the portfolio.

We sold Compounder Fund’s Activision shares earlier this month for two reasons. First, Activision’s stock price had steadily drifted higher since the July 2023 update and we managed to sell the shares at US$94 apiece, a hair’s breadth from the price of US$95 per share offered by Microsoft. We think the gradual climb in Activision’s stock price happened partly because of recent positive developments for the deal on the regulatory front. In our July 2023 update, I mentioned that the UK’s CMA (Competition and Markets Authority) decided in April to prevent the acquisition. In response, Microsoft made changes to the deal’s terms to assuage the CMA’s concerns. The regulatory body eventually gave preliminary approval for the transaction in September. Second, we wanted capital to add to Compounder Fund’s position in Adyen, an existing holding, after a sharp decline in the company’s stock price in recent months.

Compounder Fund is able to accept new subscriptions once every quarter with a dealing date that falls on the first business day of each calendar quarter. Jeremy and I have successfully closed Compounder Fund’s 12th subscription window since its initial offering period (which ended on 13 July 2020). This new capital, along with part of the proceeds from the sale of Compounder Fund’s Activision stake, were deployed quickly in the days after the last subscription window’s dealing date of 2 October 2023. Besides the aforementioned addition to Adyen, which was the largest, we also added to two existing Compounder Fund holdings, Meta Platforms and MongoDB.

Adyen is currently in a situation where many investors are not aligned with the management team’s investment horizon. The digital payments services provider (we described the company’s business in our thesis here) released its 2023 first-half earnings on 17 August. It was a bad day for the company’s stock price, which slid by nearly 40% to €898; the stock price has continued to fall in the weeks since, and ended September at €706. Shortly after Adyen’s results were out, analysts from JPMorgan wrote (emphasis is mine):

“[Management] kept highlighting the focus on mid-long term on the call when most investors have 12-18 month investment horizon.”

During the first half of 2023, Adyen grew its revenue by 21.5% from a year ago to €739.1 million. But its free cash flow fell by 16.6% to €263.9 million as a result of its free cash flow margin compressing from 52.0% in the first half of 2022 to 35.7%. The company’s revenue growth, while still healthy, was lower than expected for management and for some market participants. Adyen encountered stiffer price-competition in the USA, which induced some merchants to switch payment providers for some of their payment volume, as Adyen’s management refused to participate in a price war. Meanwhile, the decline in Adyen’s free cash flow margin was predominantly caused by management choosing to grow the company’s headcount in the first half of the year; Adyen made 551 new hires, bringing its team to 3,883 full-time employees. Our previous addition to Adyen was this April. In my discussion of the addition, I mentioned:

“We also applaud Adyen’s recent contrarian move in hiring. While technology companies in the West have mostly been cutting headcount in recent months, Adyen has continued to expand its team as talent has become more affordable and the company wants to support its long-term growth plans. Adyen plans to add around 1,200 employees in 2023, building on the 757 it added in the second half of 2022, an increase of nearly 30% from the first half of the year.”

It turns out that Adyen’s management has kept to their word and has continued to hire counter-cyclically, a move we support. In Adyen’s shareholder-letter and earnings conference call for the first half of 2023, management mentioned that they are keen to bolster Adyen’s headcount because it is the “primary means of investing in [the company’s] future,” even if it hurts the company’s financials in the short-term. Management also took pains to share the following:

- They continue to have confidence in Adyen’s long-term growth prospects. This stems from their belief that Adyen’s payments platform – built entirely from scratch on a single code-base – offers the lowest total cost of ownership for merchants in the USA and elsewhere.

- Adyen’s pace of hiring-growth would slow down in 2024. Management thinks Adyen would largely have the right amount of talent by then to seize the growth opportunities that exist.

- Operating leverage would show up in Adyen when hiring slows down. Moreover, management sees no change in Adyen’s long-term EBITDA (earnings before interest, taxes, depreciation, and amortisation) margin target of 65%. For perspective, Adyen’s EBITDA margin was 43.3% in the first half of 2023, down from 58.5% a year ago.

Jeremy and I are on the same page as Adyen’s management, which explains why we added to our Adyen position to take advantage of the lower stock price. But we certainly are not on the same page as the investors with the “12-18 month investment horizon” whom JPMorgan’s analysts interacted with. In an environment where many investors cannot, or are unwilling to, invest with patience, being able to do so is a structural advantage.

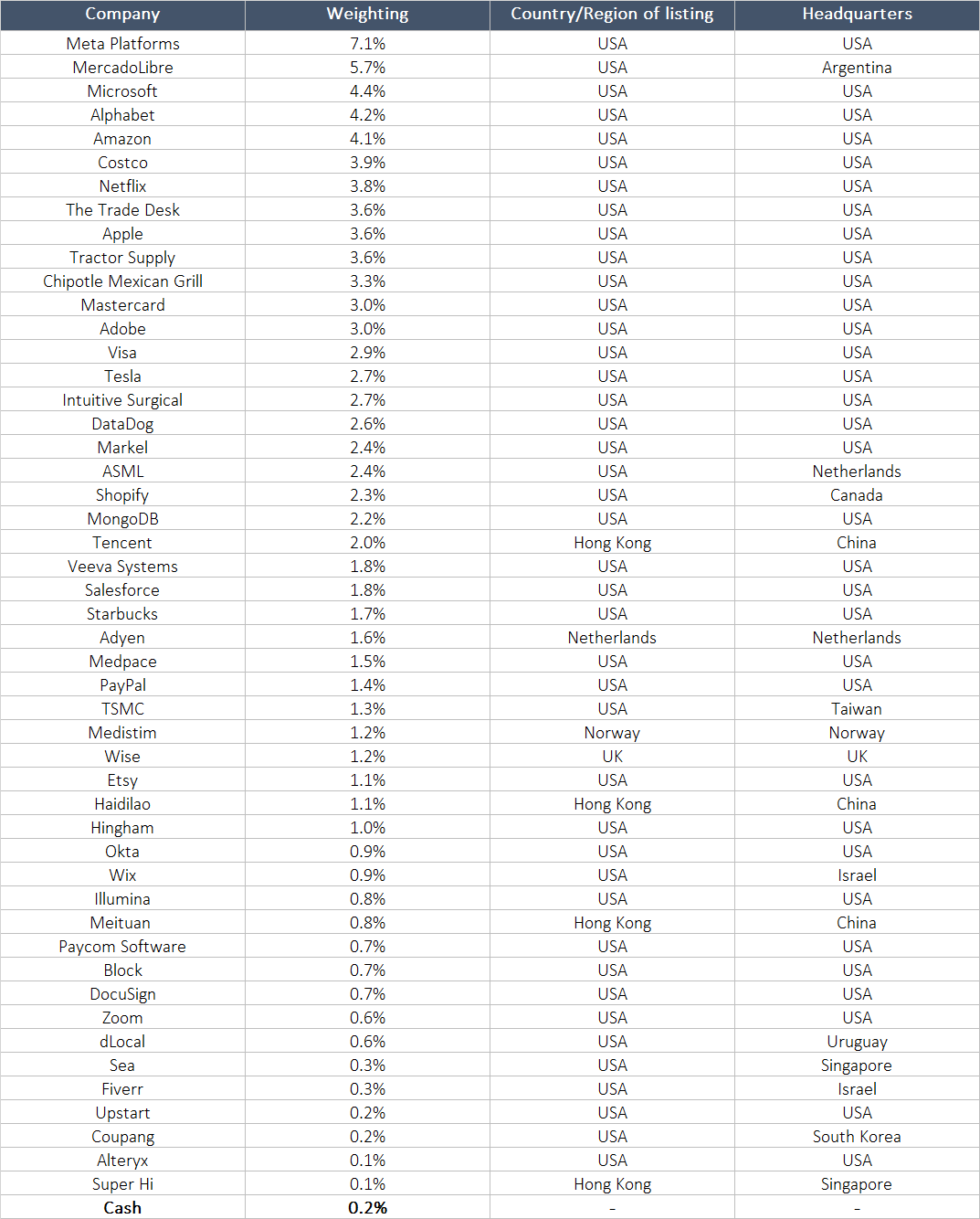

Here’s how Compounder Fund’s portfolio of 49 companies looks like as of 8 October 2023:

Table 1

We’re sharing all this information with the public and with the fund’s investors for two reasons. First, we believe deeply in investor education and want Compounder Fund’s return and actions to be a source for people to learn about investing. Second, we believe that this transparency will help investors of Compounder Fund develop comfort with our investing process over time, which is great; in turn, this will also free us from the time-consuming activity of dealing with questions on how we invest, and thus give us more to invest better for our investors.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share. Holdings are subject to change at any time.