Compounder Fund: Portfolio Update (July 2023) - 12 Jul 2023

Jeremy and I intend to share frequent but non-scheduled updates on how Compounder Fund’s portfolio looks like. The last time we shared an update on this was for Compounder Fund’s portfolio as of 12 April 2023.

In it, I mentioned a few things: (a) all 50 holdings that were in the fund’s portfolio at the time; and (b) updates on the acquisition of Activision by Microsoft. Since then, there have been no changes to the fund’s holdings.

Coming to Microsoft’s pending acquisition of Activision, there have been further positive developments. In the April 2023 update, I wrote that “the US FTC (Federal Trade Commission) had challenged the deal.” The FTC eventually filed a lawsuit against Microsoft in June to block the acquisition from closing before the regulator provides its own verdict in its in-house court. The hearing for the June lawsuit, which was presided by US District Judge Jacqueline Scott Corley, ended on the 29th. Corley released her verdict earlier this week and it was in favour of the union between Microsoft and Activision. She wrote:

“Microsoft’s acquisition of Activision has been described as the largest in tech history. It deserves scrutiny. That scrutiny has paid off: Microsoft has committed in writing, in public, and in court to keep Call of Duty on PlayStation for 10 years on parity with Xbox. It made an agreement with Nintendo to bring Call of Duty to Switch. And it entered several agreements to for the first time bring Activision’s content to several cloud gaming services. This Court’s responsibility in this case is narrow. It is to decide if, notwithstanding these current circumstances, the merger should be halted—perhaps even terminated—pending resolution of the FTC administrative action. For the reasons explained, the Court finds the FTC has not shown a likelihood it will prevail on its claim this particular vertical merger in this specific industry may substantially lessen competition. To the contrary, the record evidence points to more consumer access to Call of Duty and other Activision content. The motion for a preliminary injunction is therefore DENIED.”

The FTC could still appeal against the decision, so there’s no official green light given yet for the acquisition. Meanwhile, I also mentioned in the April 2023 update that the UK’s regulator, the CMA (Competition and Markets Authority), announced in late-March 2023 that “the transaction will not result in a substantial lessening of competition in relation to console gaming in the UK.” But a month later, CMA released its final decision to prevent the acquisition. Microsoft has been in dialogue with CMA on possible tweaks to the deal to assuage any concerns that the UK regulator has.

We have no special insights on the thought processes of the regulators that are relevant to Microsoft’s attempt to acquire Activision. So we’re watching how the situation unfolds. As first discussed in an April 2022 update, Jeremy and I intend for the fund to hold onto its Activision shares and receive the cash from Microsoft if and once the acquisition is completed (but our intention could change depending on developments at both companies and the stock market in general).

Compounder Fund is able to accept new subscriptions once every quarter with a dealing date that falls on the first business day of each calendar quarter. Jeremy and I have successfully closed Compounder Fund’s 11th subscription window since its initial offering period (which ended on 13 July 2020). Part of this new capital was deployed quickly in the days after the last subscription window’s dealing date of 3 July 2023 and we added to one existing Compounder Fund holding: Paycom Software.

In Compounder Fund’s Owner’s Manual, we mentioned that “if Compounder Fund receives new capital from investors, our preference when deploying the capital is to add to our winners and/or invest in new ideas.” This is the first time we had added to the fund’s position in Paycom after the initial investments were made in July 2020. The company’s stock price at our latest addition is only modestly higher compared to the initial purchases. But importantly, Paycom has been executing brilliantly, so it has been a clear winner, according to our definition.

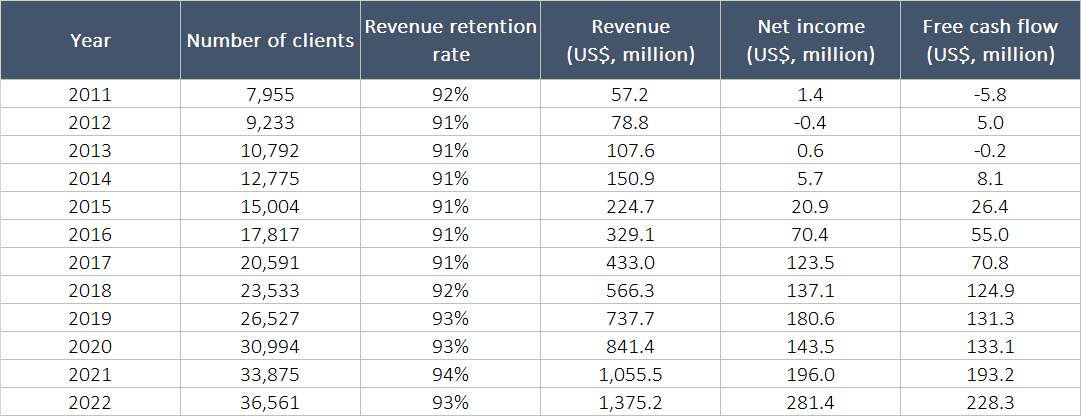

In our Paycom thesis, we mentioned the company’s excellent history up to 2019 of growing its client base and retaining them. We also discussed Paycom’s financial track record till the first nine months of 2020 and highlighted its strong top-line growth, profitability, and free cash flow. All these positive factors have continued to be in place – Table 1 shows the important metrics up to 2022. Moreover, in the first quarter of 2023, Paycom’s revenue, net income, and free cash flow, all grew at impressive rates of 27.8%, 29.8%, and 27.5%, respectively.

Table 1; Source: Paycom annual reports

Beyond the numbers, Paycom has also made significant improvements to its product suite since our initial investment. BETI (Better Employee Transaction Interface), Paycom’s self-service payroll technology for employees to do their own payroll that was launched in July 2021, is a great example. The app, the first of its kind in Paycom’s industry, has become a key differentiator for the company. 50% of Paycom’s clients’ employees are currently using BETI for their own payroll. BETI is a valuable product for companies. A recent study by Ernst and Young found that a 1,000 employee-company could incur nearly US$1 million in annual costs that are related to payroll mistakes; a self-service payroll product such as BETI helps remove these unnecessary costs. As cherries on the cake: (1) Paycom has today captured just 5% of its addressable market, suggesting significant room for future growth, and (2) at the time of our addition, Paycom’s P/E and P/FCF ratios of 59 and 73, respectively, while still high, were noticeably lower than when we first invested (88 and 141).

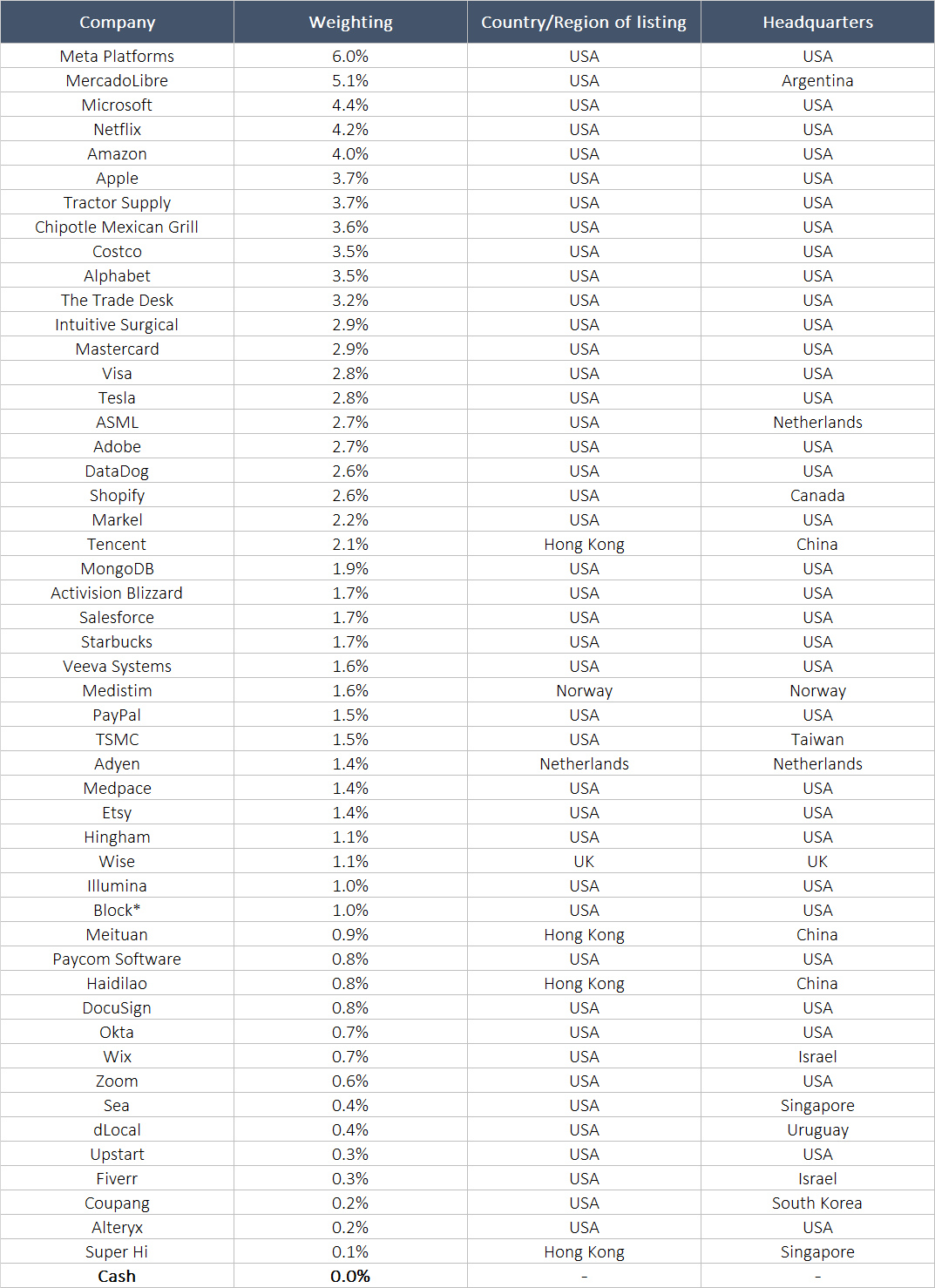

Here’s how Compounder Fund’s portfolio of 50 companies looks like as of 9 July 2023:

Table 2

We’re sharing all this information with the public and with the fund’s investors for two reasons. First, we believe deeply in investor education and want Compounder Fund’s return and actions to be a source for people to learn about investing. Second, we believe that this transparency will help investors of Compounder Fund develop comfort with our investing process over time, which is great; in turn, this will also free us from the time-consuming activity of dealing with questions on how we invest, and thus give us more to invest better for our investors.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share. Holdings are subject to change at any time.