Compounder Fund: Portfolio Update (April 2023) - 14 Apr 2023

Jeremy and I intend to share frequent but non-scheduled updates on how Compounder Fund’s portfolio looks like. The last time we shared an update on this was for Compounder Fund’s portfolio as of 9 January 2023.

In it, I mentioned a few things: (a) all 50 holdings that were in the fund’s portfolio at the time; (b) Tencent’s distribution of Meituan shares and our intention for Compounder Fund to retain the distributed shares; and (c) updates on the acquisition of Activision by Microsoft. Since then, there have been no changes to the fund’s holdings and Compounder Fund received Meituan shares from Tencent on 24 March 2023, all of which are currently still in the portfolio.

Coming to Microsoft’s pending acquisition of Activision, there have been some positive developments. Activision’s CEO, Bobby Kotick, sent a publicly-available email to staff on 28 March 2023 reiterating his confidence that “the transaction will ultimately be approved.” He also shared that Microsoft and Activision’s leaders have been meeting with regulators in Europe and the UK and that Microsoft has “proposed thoughtful, generous remedies to address regulators’ concerns.” On the same day that Kotick emailed Activision’s staff, the Japan Fair Trade Commission also approved the deal. Moreover, roughly a week before Kotick sent his email, the UK’s regulator, the CMA (Competition and Markets Authority), announced that “the transaction will not result in a substantial lessening of competition in relation to console gaming in the UK.” The CMA is still conducting its investigation on the acquisition and will present its final report by 26 April 2023. In the January 2023 portfolio update, I mentioned that the US FTC (Federal Trade Commission) had challenged the deal; there’s so far been no material updates on that front.

We have no special insights on the thought processes of the regulatory bodies around the world that are relevant to Microsoft’s attempt to acquire Activision. So we’re watching how the situation unfolds. As first discussed in an April 2022 update, Jeremy and I intend for the fund to hold onto its Activision shares and receive the cash from Microsoft if and once the acquisition is completed (but our intention could change depending on developments at both companies and the stock market in general).

Compounder Fund is able to accept new subscriptions once every quarter with a dealing date that falls on the first business day of each calendar quarter. Jeremy and I have successfully closed Compounder Fund’s 10th subscription window since its initial offering period (which ended on 13 July 2020). This new capital was deployed quickly in the days after the last subscription window’s dealing date of 3 April 2023 and we added to five of Compounder Fund’s existing holdings (in alphabetical order): Adyen, Datadog, Hingham Institution of Savings, TSMC, and Wise.

In Compounder Fund’s Owner’s Manual, we mentioned that “if Compounder Fund receives new capital from investors, our preference when deploying the capital is to add to our winners and/or invest in new ideas.” None of the five existing holdings in the portfolio that we added capital to have seen their stock prices rise strongly after we initially invested in them. But all of them – with perhaps Hingham as the exception – have executed well since our investments and they’ve produced solid business results as I’ll soon touch on later. Here’s how Compounder Fund’s portfolio of 50 companies looks like as of 12 April 2023:

Table 1

Our additions to Adyen, Datadog, Hingham, TSMC, and Wise in early-April 2023 were made with roughly equal amounts of capital. Adyen, DataDog, and Wise can be categorised in one group with a commonality that the trio have been executing brilliantly business-wise and each carries a decent valuation. Meanwhile, we added to Hingham and TSMC predominantly because they have valuations that look highly attractive to us (although TSMC also produced excellent business results). Let’s dive further into all five companies.

Roughly a year has passed since we invested in digital payments services provider Adyen for the first time in April 2022 and the company’s business has continued to grow impressively. In the first half of 2022 (Adyen reports its financials every six months), Adyen’s net revenue was up by 36.7% to €608.5 million and it produced €316.3 million in free cash flow, representing year-on-year growth of 26.0% and a free cash flow margin of 52.0%. The picture was similar in the second half of 2022, as Adyen’s net revenue jumped by 29.7% to €721.6 million. Even though the company’s free cash flow for the period inched lower to €312.9 million from €324.6 million a year ago, the free cash flow margin was still excellent at 43.4%. We also applaud Adyen’s recent contrarian move in hiring. While technology companies in the West have mostly been cutting headcount in recent months, Adyen has continued to expand its team as talent has become more affordable and the company wants to support its long-term growth plans. Adyen plans to add around 1,200 employees in 2023, building on the 757 it added in the second half of 2022, an increase of nearly 30% from the first half of the year. As of the end of 2022, Adyen had a total of 3,332 employees. Here are relevant comments from Adyen’s management that were shared in the company’s shareholder letter for the second half of 2022:

“Amid a backdrop of widespread tech lay-offs and hiring freezes, we consciously grew our team in order to further scale the business. During this time, the labor market proved favorable for reaching our intended hiring speed. While this backdrop supported our headcount goals, it did not dictate them. We did not adjust our plan nor meet quotas because candidates were more widely available.

Rather, we have always been efficient about the number of people required to solve problems. This held true during the initial pandemic years, when we were not distracted by e-commerce or in-store volume fluctuations. Our approach remains the same today. We continue to look beyond short-term changes, and are instead committed to our long-term growth. By staying critical of both the quantity and quality of people we hire, we are building a team that is capable of realizing it.”

It helps too that we managed to add to Adyen at a price-to-free cash flow (P/FCF) ratio of around 71, which is lower than the P/FCF ratio of 101 at our initial investment.

Turning to Datadog, which provides a software platform for companies to monitor and analyse the performance of their technology stack, Table 5 below shows the company’s revenue growth and free cash flow margin dating back to 2020; note the rapid increases in revenue and the improvement in the free cash flow margin to a respectable 20.5% currently. The table also highlights Datadog’s high dollar-based net retention rate and robust customer growth.

Table 2; Source: Datadog earnings updates and annual reports

Datadog’s revenue growth rate slowed throughout 2022 as customers sought to optimise their spending on cloud computing services, which included those provided by the company. But Datadog’s pipeline of new customers remains robust and its products remain mission-critical, as evidenced by a high revenue gross retention rate ranging in the mid-to-high 90s percentage range. Furthermore, long-term business trends still appear to be heavily in Datadog’s favour. During Datadog’s earnings conference call for the fourth quarter of 2022, management shared their thoughts on the company’s long-term growth opportunities amid customers’ ongoing optimisation of cloud spending:

“Although we are seeing customers be more cautious with their cloud usage expansion in the near term, we see no change to the long-term trends towards digital transformation and cloud migration. We think it’s healthy for customers to optimise, and we believe that the ability to correct course and continually align the nature and scale of their applications with their business needs is one of the key benefits of cloud transformation. At Datadog, we have always organised our products and our business around helping customers gain agility and reduce costs, and we do it by enabling stronger business performance and efficient use of their engineering and infrastructure spend. Regardless of near-term macro pressure, we believe it is still early days, and we expect that companies worldwide will continue to grow their next-gen IT footprint to deliver value to their customers.”

We added to Datadog at price-to-sales (P/S) and price-to-free cash flow (P/FCF) ratios of around 12 and 59, respectively. These are much better valuations than when we first invested in Datadog in July 2020. Back then, Datadog had a P/S ratio of around 69 and only minimal free cash flow, so the P/FCF ratio was not meaningful.

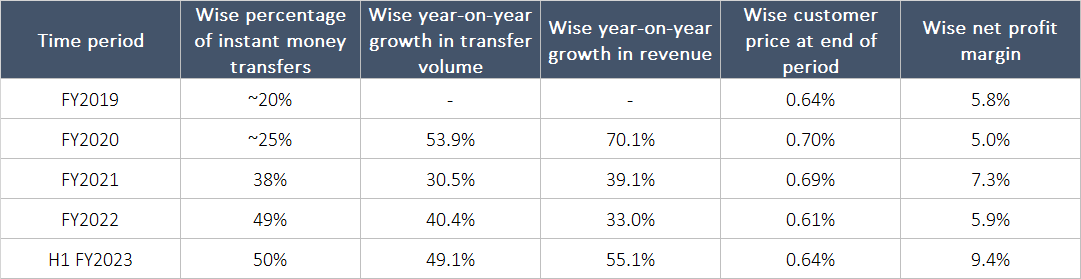

Back in October 2021, when we first invested in Wise, an international money transfer service provider, we were impressed with many aspects of the company. These included, among other things: (a) the growth in the number of transfers that the company can process instantly; (b) the rapid increase in the company’s revenue and processed volume; (c) the progress Wise had made in keeping costs low for customers; and (d) an improving net profit margin. As Table 6 below shows, Wise has continued executing brilliantly on these fronts. As cherry on the cake, our addition to Wise was made at a P/S ratio of 7, which is a significant improvement from the ratio of 23 seen when we first invested in the company.

Table 3; Source: Wise earnings updates and annual reports (Wise’s financial year ends on 31 March; FY2019 refers to the financial year ended 31 March 2019)

Hingham, an American bank based in the state of Massachusetts, has seen its stock price decline by nearly half from a peak of US$431 reached in January 2022. This has caused its price-to-book (P/B) ratio to fall to 1.2 when we added to it. This valuation looks attractive to us for two reasons. First, it is near a 10-year low, as shown in Figure 1 below, and it is also lower than where it was when we first invested in Hingham in December 2022 (around 1.6 back then). Second, we think the concerns that we see surrounding Hingham today are merely short-term in nature and do not point to any deterioration in the bank’s long-term prospects.

Figure 1; Source: Tikr

The first concern is related to the collapse of Silicon Valley Bank in the USA last month due to a bank run that happened with unprecedented speed, and the consequent spread of fear about the survival of banks across the country. At a simplified level, banking involves taking in deposits and distributing the capital as loans to borrowers. A bank’s assets (what it owns) are the loans it has doled out, and its liabilities (what it owes) are deposits from depositors. When depositors withdraw their deposits, a bank has to return cash to them. Often, depositors can withdraw their deposits at short notice, whereas a bank can’t easily convert its loans into ready cash quickly. So when a large group of depositors ask for their money back, it’s difficult for a bank to meet the withdrawals – that’s when a bank run happens. We think it’s unlikely that Hingham will suffer from a bank run. Jeremy and I shared in our investment thesis that Hingham has a history of growing its deposits even during the Great Financial Crisis, a period that also saw a massive bank run. Moreover, Hingham has, for a long time, offered full insurance for its depositors’ capital by tapping on both the FDIC (Federal Deposit Insurance Corporation) and Massachusetts Depositors Insurance Fund. This sets Hingham apart from many other banks in the USA that only offer deposits insured up to the FDIC-limit of US$250,000 per depositor.

The second concern involves Hingham’s net interest income, which is under pressure due to a rising cost of funding. Short-term interest rates rose rapidly in the USA in 2022 and have continued climbing this year. As interest rates increase, Hingham has to offer higher interest on deposits to retain depositors and borrow more expensive debt from the Federal Home Loan Bank of Boston (FHLB). The rapid rise in short-term rates has left a mark on Hingham’s results. For example, in the fourth quarter of 2022, Hingham’s net interest income fell by 24.1% to US$21.0 million despite a 33.3% increase in total dividend and interest income to US$39.2 million. The culprit was a 10x jump in total interest expense to US$18.3 million. Hingham released its results for the first quarter of 2023 after we added to it. While total interest and dividend income was up by 35.0% year-on-year to US$40.7 million, a 1,193.3% surge in total interest expense to US$25.8 million caused net interest income to decline by 47.1% to US$14.9 million. Jeremy and I do not know how long the pressure on Hingham’s net interest income will last but it will eventually dissipate. Thus, the more important question for us is whether Hingham can survive until the pressure abates. We have high confidence the bank will; we discussed this in depth in “The risks involved” section of our Hingham thesis. A pertinent comment from management in Hingham’s annual report for 2022 lends further weight to our view:

“As we have repeatedly discussed, the most dangerous response to short-term challenges is to make changes that have long-term consequences. We will not add incremental risk, either in our lending or investment operations, and we will continue to make the appropriate investments to support our long-term objectives outlined below.”

Then there’s TSMC, the preeminent contract-manufacturer of semiconductor chips. In our investment thesis, Jeremy and I shared that the most important risk we see with TSMC concerns geopolitics. Specifically, the independence of Taiwan – where the company is based at and where its manufacturing activities are concentrated – is a major point of contention between the territory and China. Complicating things further is the involvement of the USA, which has an incentive to protect Taiwan’s sovereignty. TSMC manufactures most of the world’s cutting-edge chips. Given the USA and China’s increasingly belligerent relationship, the USA’s future technological progress and economic growth could face a major setback if China were to seek unification with Taiwan forcefully and restrict the sale of TSMC’s chips. We think this geopolitical risk has not diminished since we first invested in TSMC around a year ago in April 2022. In fact, the risk seems to have worsened since then, in our view, as the USA has tightened China’s access to advanced semiconductor manufacturing technologies in recent months. Moreover, TSMC’s business is under pressure lately. During the company’s earnings conference call for the fourth quarter of 2022, management commented:

“As overall macroeconomic conditions remain weak, we expect our business to be further impacted by continued end market demand softness and customers’ further inventory adjustment.”

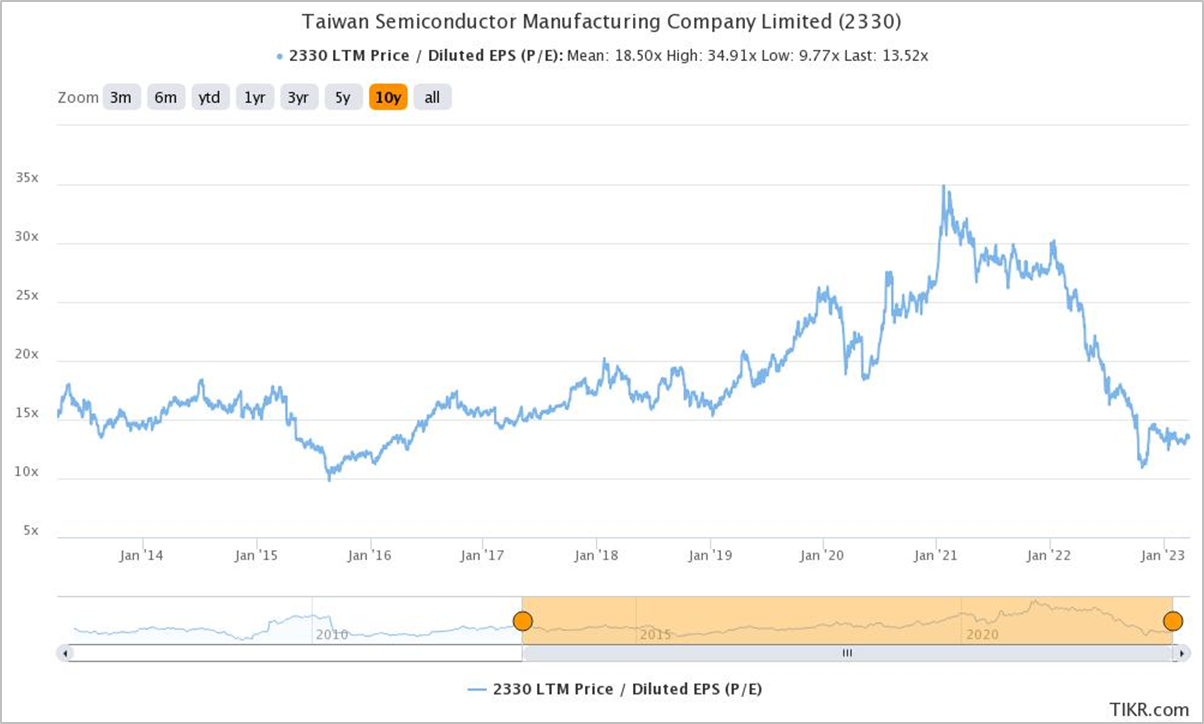

We believe that the challenges outlined above have led to a decline in TSMC’s valuation over the past year. As shown in Figure 2 below, its P/E ratio had fallen to 14, which is close to a 10-year low, at the time we added to our position. So the increased risks have presented us with a better valuation. The P/E ratio of 14 also looks like an attractive valuation to us, as we think the long-term prospects for TSMC’s business have not diminished. Nothing new we’ve learnt about the world since we first invested in TSMC suggests that the demand for advanced semiconductor chips will weaken in the years ahead. In fact, TSMC might even enjoy a stronger tailwind than before with the global excitement about recent developments in the field of artificial intelligence (AI), such as the generative AI services introduced by OpenAI over the past few months. The deployment of AI requires powerful chips, and TSMC is the best in the world at manufacturing them.

Figure 2; Source: Tikr

We’re sharing all this information with the public and with the fund’s investors for two reasons. First, we believe deeply in investor education and want Compounder Fund’s return and actions to be a source for people to learn about investing. Second, we believe that this transparency will help investors of Compounder Fund develop comfort with our investing process over time, which is great; in turn, this will also free us from the time-consuming activity of dealing with questions on how we invest, and thus give us more to invest better for our investors.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share. Holdings are subject to change at any time.