Compounder Fund: Microsoft Investment Thesis - 30 Sep 2020

Data as of 29 September 2020

Microsoft Corporation (NASDAQ: MSFT) is one of the 40 companies in Compounder Fund’s initial portfolio. This article describes our investment thesis for the company.

Company description

Founded in 1975 by Bill Gates and Paul Allen, Microsoft has grown to become a tech juggernaut and one of the largest companies in the world by market capitalisation. At its 29 September 2020 share price of US$210, Microsoft’s market cap was a staggering US$1.57 trillion.

Much has changed about Microsoft’s business. In the past, the company was largely reliant on selling its productivity software tools to consumers and businesses, and its Windows operating system software to manufacturers of personal computers. Today, there’s so much more to Microsoft’s business.

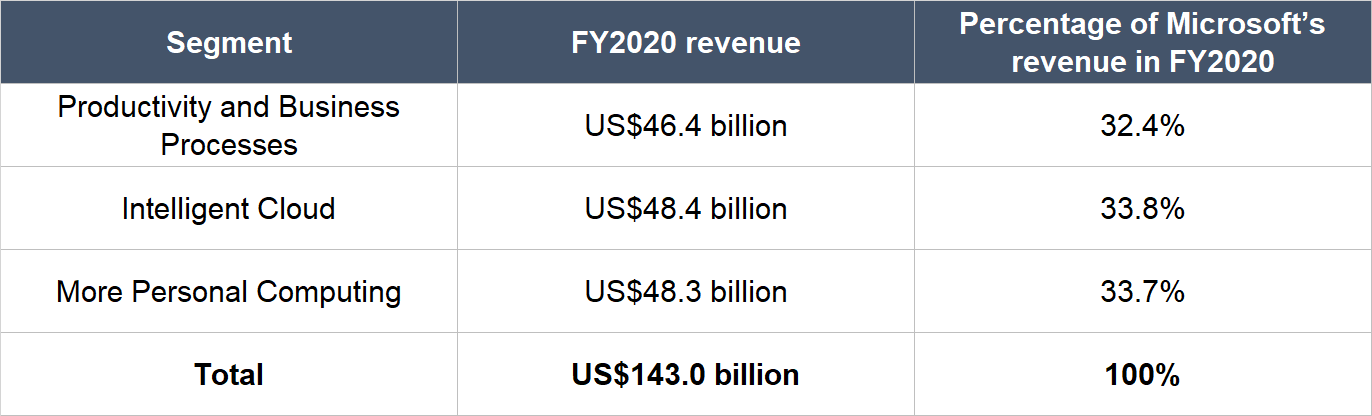

In its fiscal year ended 30 June 2020 (FY2020), Microsoft earned US$143.0 billion in revenue from its three operating segments: Productivity and Business Processes; Intelligent Cloud; and More Personal Computing. The revenue contributions from the three segments are evenly split, and they can be seen in the table below:

Source: Microsoft annual report

Each of Microsoft’s operating segments can be further split into multiple sub-segments. The following are brief descriptions of what these sub-segments are:

- Productivity and Business Processes: This segment houses products and services from Microsoft that deal with productivity, communication, and information services. It comprises:

- Office Commercial, which includes Office 365 subscriptions, the Office portion of Microsoft 365 Commercial subscriptions, and on-premise licenses of the Office software. You can think of these as software that improves personal, team, and organisational productivity. There’s an ongoing effort by Microsoft to shift Office on-premise licenses to Office 365 Commercial subscriptions.

- Office Consumer, which includes many of the above software, but with versions focused on individual consumer use. In a similar manner to the Office Commercial sub-segment, Microsoft is continuing to shift consumer Office software licenses to the consumer version of the 365 subscriptions (named Microsoft 365 Consumer). The Office Consumer segment also contains Skype, Outlook.com, and OneDrive services, which are driven by subscriptions, advertising, and the sale of minutes.

- Linkedin is a professional network on the Internet for people to display their professional experience (there are currently over 700 million members on LinkedIn) and for companies to share their profiles. LinkedIn provides paid subscriptions to (1) tools to help organisations hire and develop talent, grow skillsets, and sell better online, and (2) tools for individuals to manage their professional identity and grow their network. LinkedIn also provides a paid online marketing service.

- Dynamics, which provides cloud-based and on-premise software for financial management, enterprise resource planning (ERP), customer relationship management, supply chain management, and application development platforms for both large and small companies. The Dynamics sub-segment is also shifting from on-premise software products to its cloud-based Dynamics 365 solution.

- Intelligent Cloud: This segment houses Microsoft’s cloud computing services and public, private, and hybrid server products. It comprises of:

- Server Products that include SQL Server, Windows Server, Visual Studio, System Center, and GitHub. These are mostly server software, integrated server infrastructure, and middleware designed to support software applications built on Windows Server operating systems. Github, which Microsoft acquired in 2018 for US$7.5 billion (paid in Microsoft shares), is an open-source collaboration platform for software developers. Revenue sources for the Server Products sub-segment include sales of volume licensing programs and licenses to OEMs (original equipment manufacturers).

- Cloud Services, which consists of Azure. Essentially, Azure is a cloud-computing service and it can be used for “computing, networking, storage, mobile and web application services, AI [artificial intelligence], IoT [internet of things], cognitive services, and machine learning.” Customers are charged based on consumption or number of users.

- Enterprise Services, where Microsoft helps its enterprise customers in deploying its server and desktop solutions, among other support services.

- More Personal Computing: It includes:

- Windows, which is the most widely used operating system (OS) on personal computers. This segment depends on the purchase of the Windows OS licenses by (1) device manufacturers to pre-install on the devices they sell, and (2) commercial clients.

- Devices, which involves the sale of devices that are designed and manufactured by the company, including the Surface product and other intelligent devices.

- Gaming, which houses (1) the Xbox family of video gaming consoles, (2) video gaming-related streaming services, (3) Xbox Game Studios, a creator of video games, and (4) Xbox Live, a platform for gamers to connect and share their gaming experience. Revenue from the Gaming sub-segment comes from subscriptions, sales of first- and third-party content, and advertising.

- Search, where Microsoft monetises its Bing online search engine through online advertising services. This sub-segment also houses the Microsoft Advertising online advertising service.

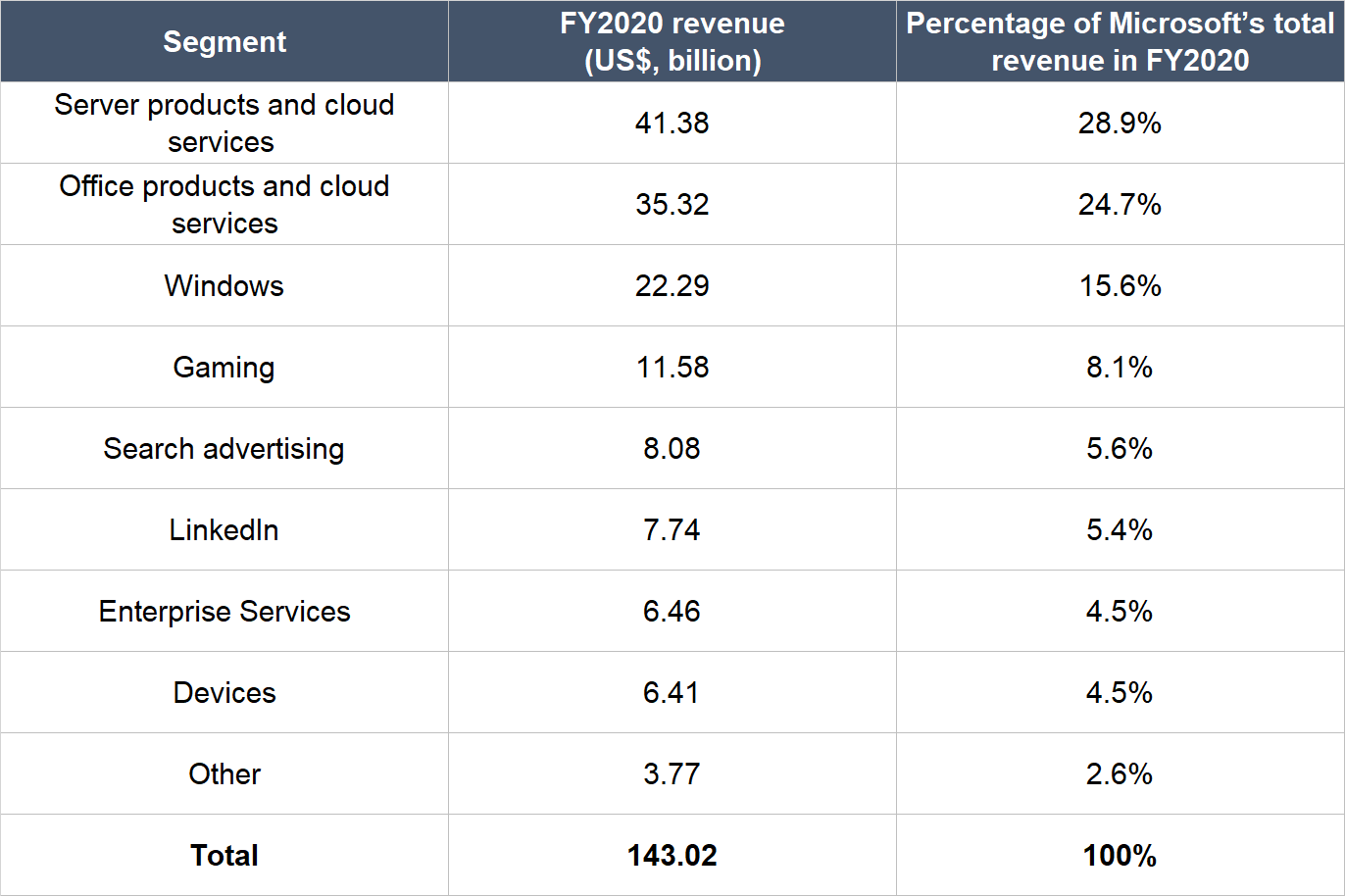

Here’s a more granular breakdown of Microsoft’s total revenue in FY2020 by product and service:

Source: Microsoft annual report

Microsoft groups all its cloud-related businesses under the Commercial Cloud banner. These businesses include Office 365 Commercial, Azure, the commercial portion of LinkedIn, Dynamics 365, and more (in the table just above, they are primarily included in Server products and cloud services, Office products and cloud services, and LinkedIn). In FY2020, Commercial Cloud’s revenue was US$51.7 billion, around 36% of Microsoft’s total revenue for the year.

Microsoft also has a fairly diversified business from a geographical perspective. In FY2020, 51% of the company’s revenue came from the USA while the remaining 49% originated from other countries across the world.

Investment thesis

We have laid out our investment framework in Compounder Fund’s website. We will use the framework to describe our investment thesis for Microsoft.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

As you saw in the “Company description” section of this article, Microsoft has a highly diversified business. In discussing Microsoft’s market opportunities, we will focus on three areas: (1) Azure, (2) Office 365, and (3) the video gaming business of Microsoft.

Azure

Azure is one of Microsoft’s fastest-growing products. Although Microsoft does not release revenue numbers for Azure, it does share the growth rates of the cloud computing business. The table below shows Azure’s impressive year-on-year revenue growth rates over the last few years.

Source: Microsoft quarterly earnings updates

Despite the heady growth Azure has experienced, we still see significant room for the cloud computing service to grow. The cloud computing market is expanding rapidly. According to market researcher Gartner, the cloud PaaS (platform-as-a-service) and cloud IaaS (infrastructure-as-a-service) markets are expected to collectively be US$132 billion in 2022, up 22% annually from US$59 billion in 2018. Azure currently participates in both the cloud PaaS and cloud IaaS markets. And importantly, Azure has been adept at winning market share. According to estimates from research outfit Canalys, Azure held 20% of the global cloud computing overall infrastructure market in the second quarter of 2020, up from 18% a year ago, and up from 13.5% in 2017.

In the global cloud computing overall infrastructure market, the top three players are, in descending order, AWS (Amazon Web Services), Azure, and Google Cloud. AWS has a commanding lead with its market share of 31% in the second quarter of 2020 according to Canalys; Google Cloud is a distant third with its market share of 6%. Azure is up against tough competition, no doubt. But we think a rising tide can lift some boats in this case, Azure included. The cloud computing infrastructure services providers with the largest scale are able to offer users lower costs and a better overall experience. Azure is one of the clear leaders in this space, and so should benefit from the growing need for cloud computing infrastructure services.

Office 365

According to Bitglass, Office 365 reigns supreme in the cloud productivity software market. In 2019, Office 365 had a 79% adoption rate compared to key rival Google G-Suite’s 33% adoption rate. The number of consumer subscribers to Office 365 has also grown from just 7 million in the first quarter of FY2015 to 42.7 million in the fourth quarter of FY2020.

The market opportunity for Office 365 is still growing fast. According to Adroit Market Research, the productivity software market is expected to grow at 16.5% annually from 2018 to hit US$96 billion by 2025. Office 365 looks set to benefit from this growing addressable market.

Games

Microsoft’s gaming business saw its revenue inch up by just 6% per year from US$9.2 billion in FY2016 to US$11.6 billion in FY2020. But the fourth quarter of FY2020 saw gaming revenue surge 64% from a year ago, with stay-at-home guidelines to combat the current COVID-19 pandemic boosting demand for Microsoft’s gaming products and services.

The opportunity ahead is intriguing to us. The global gaming market was US$109 billion in 2019, up 3% from US$106 billion in 2018, according to Nielsen’s SuperData Research Group. We won’t be surprised if Microsoft ends up pursuing a gaming-as-a-service strategy in the future. There are already early signs of this happening with Microsoft launching its game streaming service, Project xCloud, earlier this month. During Microsoft’s FY2020 fourth-quarter earnings conference call, CEO Satya Nadella also teased his ambitions for the company’s gaming business:

“This gaming TAM [total addressable market] is much more expansive than we participated in, even with all the success we have with Xbox. We think going forward, Xbox with the approach we are taking has much more of an ability to reach the 2+ billion gamers out there and we’re in the early days of building that out.”

2. A strong balance sheet with minimal or a reasonable amount of debt

Microsoft has a robust balance sheet that is flush with cash. As of 30 June 2020, it had US$136.5 billion in cash and short-term investments compared to US$63.3 billion in debt. This puts Microsoft in a net-cash position of around US$73.3 billion, which gives it massive financial firepower to continue investing in the business or return capital to shareholders through dividends and buybacks. It helps too that Microsoft has a great track record of generating free cash flow from its business for a long time, which we will discuss later.

Microsoft’s strong balance sheet is made all the more impressive given the fact that the company has been very aggressively buying back shares and paying dividends. For perspective, Microsoft has spent a total of US$95.4 billion and US$74.4 billion to buy back shares and pay dividends, respectively, from FY2015 to FY2020.

3. A management team with integrity, capability, and an innovative mindset

On integrity

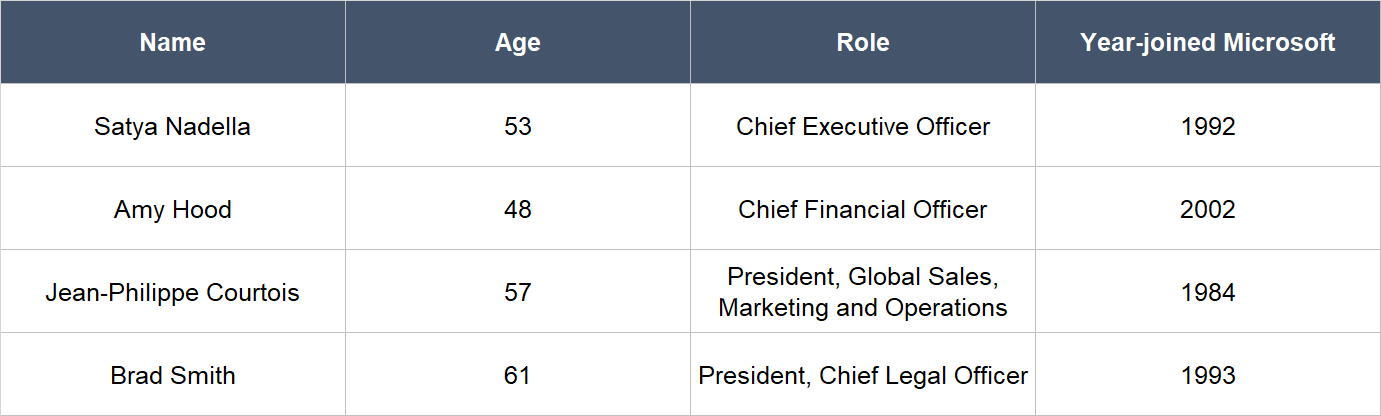

Microsoft is led by CEO Satya Nadella, who took over the hot seat in February 2014. The other key leaders in Microsoft include Amy Hood, Jean-Philippe Courtois, and Brad Smith. The table below shows more details on the four of them and there are two positive and striking things to note: (1) They are mostly all relatively young, and (2) each of them have long tenure with Microsoft.

Source: Microsoft website, FY2019 Def 14-A, and Wallmine website

We think that the compensation structure for Microsoft’s leadership demonstrates integrity. Here are a few key data points:

- In FY2019, Nadella was the highest paid executive in Microsoft and his total compensation was a princely US$42.9 million. But this is a rounding error when compared to Microsoft’s profit of US$39.2 billion in the same year.

- 69% of Nadella’s total compensation in FY2019 came from stock awards that vest over four years and performance stock awards (PSAs). The PSAs are based on (1) three-year growth in Microsoft’s business metrics that make sense to us, such as Commercial Cloud revenue and Commercial Cloud subscribers, among others, and (2) Microsoft’s three-year total shareholder return compared to the other components in the S&P 500. So what this means is that the lion’s share of Nadella’s compensation in FY2019 depended on the long-term growth of Microsoft’s stock price as well as important business metrics.

- 25% of Nadella’s total compensation in FY2019 came from cash incentives that are based on the company hitting certain sensible goals, both financial (in terms of revenue and operating income) and qualitative (in areas such as product & strategy, customers & stakeholders, and culture & organizational leadership).

- The total compensation for Hood, Courtois, and Smith in FY2019 was US$20.2 million, US$15.1 million, and US$17.4 million, respectively. Around 75% of each sum came from stock awards and PSAs with the same features as Nadella’s.

Moreover, there’s a high level of insider ownership at Microsoft, which strengthens our view that Microsoft’s leaders are in the same boat as the company’s other shareholders. As of 8 October 2019, Nadella owned 951,502 Microsoft shares and had an additional 1.457 million shares that vest over time. His directly-held stake alone is worth more than US$199 million at Microsoft’s 29 September 2020 share price of US$210 while his total stake is worth half a billion US dollars.

On capability and innovation

We rate Satya Nadella very highly on capability and innovation, and we think he has done a tremendous job at transitioning Microsoft from a company that mostly sells software licenses to one built for the cloud. There are a few things about Nadella’s tenure as Microsoft’s CEO that we want to discuss.

First is the transformation of Microsoft’s people culture under Nadella. In September 2017, Fast Company published an excellent feature on Microsoft’s CEO titled Satya Nadella Rewrites Microsoft’s Code. Here’re some relevant excerpts from the article:

“One of Nadella’s first acts after becoming CEO, in February 2014, was to ask the company’s top executives to read Marshall Rosenberg’s Nonviolent Communication, a treatise on empathic collaboration. The gesture signaled that Nadella planned to run the company differently from his well-known predecessors, Bill Gates and Steve Ballmer, and address Microsoft’s long-standing reputation as a hive of intense corporate infighting. (Programmer/cartoonist Manu Cornet crisply summed up the Microsoft culture in a 2011 org chart spoof that depicted the various operating groups pointing handguns at each other.) The reading assignment “was the first clear indication that Satya was going to focus on transforming not just the business strategy but the culture as well,” says Microsoft president and chief legal officer Brad Smith, a 24-year company veteran…

…When I ask Nadella for his own account of working with his predecessors, he’s blunt. “Bill’s not the kind of guy who walks into your office and says, ‘Hey, great job,’ ” he tells me. “It’s like, ‘Let me start by telling you the 20 things that are wrong with you today.’ ” Ballmer’s technique, Nadella adds, is similar. He chuckles at the images he’s conjured and emphasizes that he finds such directness “refreshing.” (Upon becoming CEO, Nadella even asked Gates, who remains a technology adviser to the company, to increase the hours he devotes to giving feedback to product teams.)

Nadella’s approach is gentler. He believes human beings are wired to have empathy, and that’s essential not only for creating harmony at work but also for making products that will resonate. “You have to be able to say, ‘Where is this person coming from?’” he says. “‘What makes them tick? Why are they excited or frustrated by something that is happening, whether it’s about computing or beyond computing?’”

His philosophy stems from one of the principal events of his personal life. In 1996, his first child, Zain, was born with severe cerebral palsy, permanently altering what had been a pretty carefree lifestyle for him and his wife, Anu. For two or three years, Nadella felt sorry for himself. And then—nudged along by Anu, who had given up her career as an architect to care for Zain—his perspective changed. “If anything,” he remembers thinking, “I should be doing everything to put myself in [Zain’s] shoes, given the privilege I have to be able to help him.” Nadella says that this empathy—though he cautions that the word is sometimes overused—”is a massive part of who I am today. . . . I distinctly remember who I was as a person before and after,” he says. “I won’t say I was narrow or selfish or anything, but there was something that was missing.””

Microsoft’s excellent Glassdoor reviews also provide clues on the fantastic people culture that Nadella appears to have built. Nadella has a 99% approval rating on Glassdoor as CEO – far higher than the average Glassdoor CEO rating of 69% – and 95% of Microsoft’s employees who rated the company will recommend their friends to work at the software giant. The very first comment on Glassdoor we saw read, “Brilliant colleagues, incredible culture and a purpose-led mission that delivers impact.”

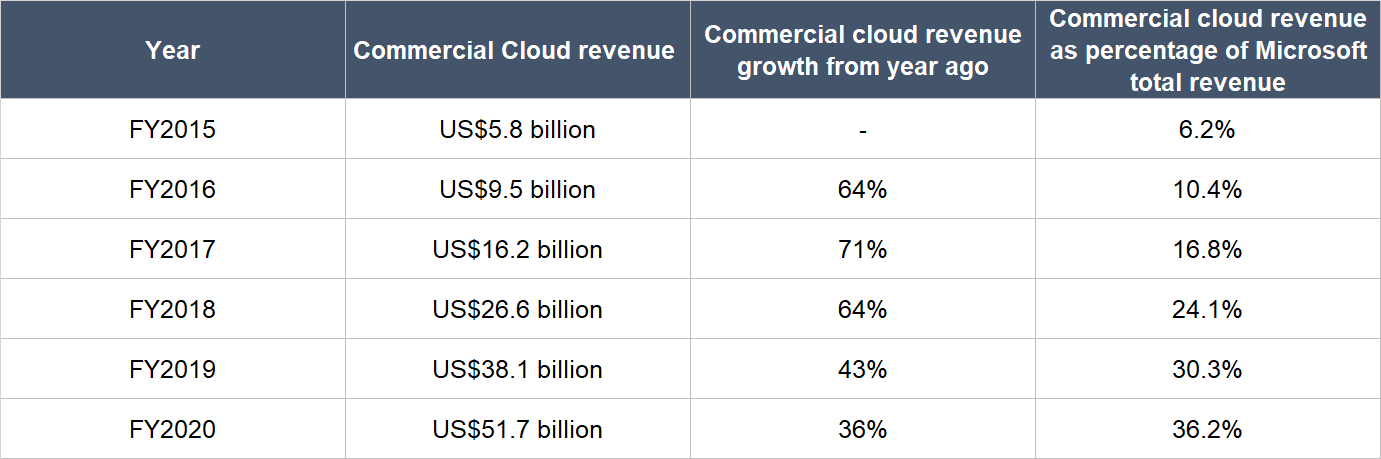

Second, on his first day as CEO of Microsoft, Nadelle sent an email to all of Microsoft’s employees. In it, he wrote that “our job is to ensure that Microsoft will thrive in a mobile and cloud-first world.” He’s doing great on this front. The table below shows the explosive growth in Microsoft’s Commercial Cloud revenue during Nadella’s tenure as CEO (Nadella became CEO in February 2014, which is in the second half of FY2014):

Source: Microsoft annual reports

And earlier in this article, we also discussed the following positive aspects about Microsoft’s cloud-related business: (1) Azure’s stunning growth in the past few years; (2) Azure’s impressive market-share gains; and (3) the big jump in consumer subscribers to the cloud-based Office 365 productivity software. Nadella does not seem keen to rest on his laurels. Microsoft’s Project xCloud games streaming service which we mentioned earlier, works on Android mobile devices. And at Microsoft’s recent Build 2020 conference, Nadella said the following about Azure:

“We’re innovating at every layer from edge to hybrid to data and AI. We’ve always led with hybrid computing. Azure Arc is the first control plane built for a multi-cloud, multi-edge world.”

Interestingly, Nadella’s decision to focus Microsoft on building for the cloud after he became CEO worried Microsoft’s directors: The cloud business had lower margins than Microsoft’s traditional software-sales business and the directors were not used to it. But Nadella’s decision proved to be right, and Microsoft is reaping the rewards. Nadella also has an audacious vision to make Azure the “world’s computer.” A key highlight of Azure’s progress happened in late 2019. The United States Department of Defence picked Azure over Amazon’s AWS to award a US$10 billion cloud computing contract. The contract, named JEDI (Joint Enterprise Defense Infrastructure), showed that Azure can compete with Amazon’s AWS and come out ahead.

Third, besides transforming Microsoft’s people culture, Nadella also drove a dramatic – and we think positive – change in the way Microsoft approached open-source software. Linux, an open-source coding system, was once described as “a cancer” by Steve Ballmer, Nadella’s predecessor as Microsoft CEO. But under Nadella, Microsoft is now a strong supporter of Linux and the company has been incorporating Linux into its own software. Here’s an excerpt from a July 2019 article from Wired that describes one instance of how it’s beneficial for Microsoft to be working with Linux:

“Thanks to a feature called Windows Subsystem for Linux, you can already run Linux applications in Windows. WSL essentially translates commands meant for the Linux kernel—the core part of the operating system that talks to hardware—into commands for the Windows kernel. But now Microsoft will build the Linux kernel into WSL, starting with a new version of the software set for a preview release in June…

… At first blush it may sound like a strange idea. But it makes perfect sense to programmers, especially web developers. Linux is the most common operating system for running web servers, but Windows is still king inside corporations. Making it easy to run Linux code in Windows is a boon for developers who need to use a Windows machine to write code that runs on Linux servers.”

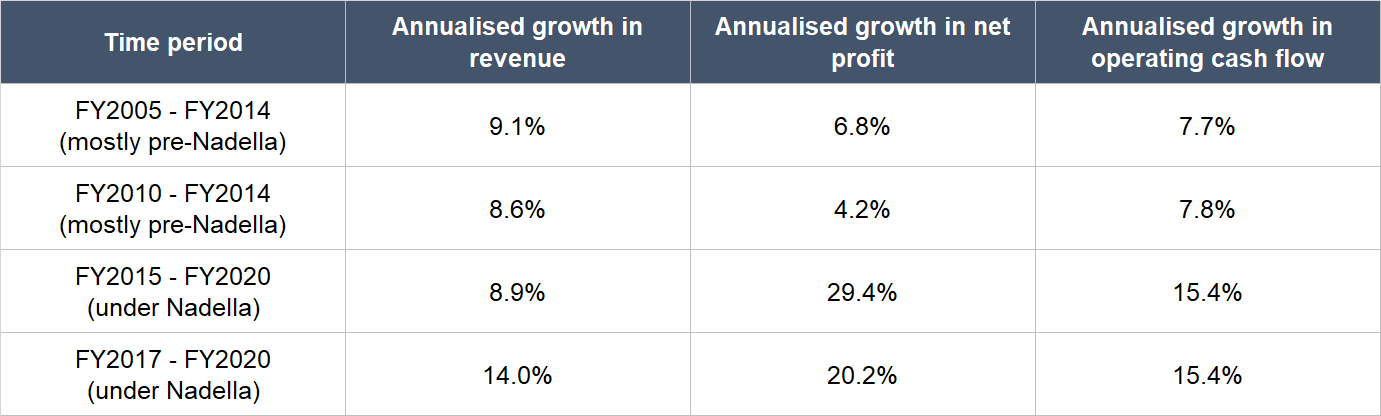

Fourth, we’re impressed by the way Nadella has accelerated growth at Microsoft despite taking over the company when its business was already massive. For perspective, Microsoft’s revenue in FY2013 (remember, Nadella took over in the second half of FY2014) was US$77.8 billion. The table below shows the annualised growth rates in Microsoft’s revenue, net profit, and operating cash flow for various time periods to highlight the differences between the pre-Nadella and current eras. Note the significantly faster revenue growth rate for the FY2017-FY2020 time period – we think the growth rate achieved in FY2017-FY2020 show the fruits of the company’s transformation under Nadella’s leadership, and so they are a good indicator of Microsoft’s revenue growth over the next few years.

Source: Microsoft annual reports

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

Microsoft has multiple revenue streams, as we have shown earlier. The company does not breakdown exactly how much of its revenue is recurring in nature. But what we know for sure is that the Commercial Cloud business, which accounted for 36.2% of Microsoft’s total revenue in FY2020, is recurring. This is because the business relies on subscription and/or usage-based models.

We also have a rough idea of how much of Microsoft’s Commercial Cloud business will return in the next fiscal year. Microsoft reports its remaining performance obligations (RPO), which consists of unearned revenue and amounts that will be invoiced and recognized in future periods. As of 30 June 2020, Microsoft’s RPO was US$111 billion, of which US$107 billion was related to its commercial business (this includes the Commercial Cloud business). Microsoft expects to recognise around 50% of the US$107 billion (roughly US$53 billion) as revenue over the next 12 months. This lends further weight to our view that the Commercial Cloud business is recurring in nature (for perspective, Commercial Cloud had revenue of US$51.7 billion in FY2020).

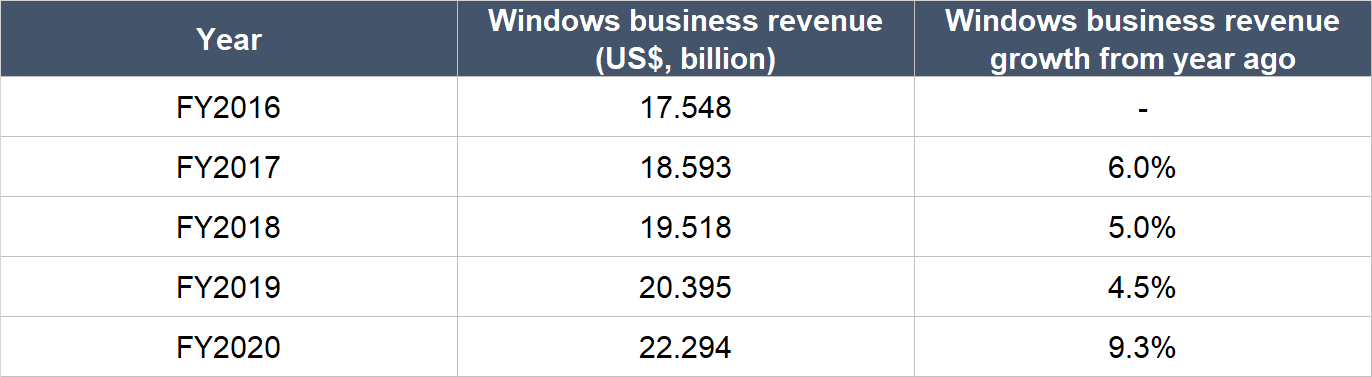

We believe that there are significant recurring revenues in other areas of Microsoft’s business too. For instance, we think that Microsoft also enjoys fairly predictable revenue streams through the licensing of its Windows operating system (OS) software. First, the Windows OS dominates the OS market for personal computers with a 77% share as of August 2020. Second, we think there’s a sticky customer base as Windows OS users tend to continue with the Windows OS once they have learnt how to use it. These traits mean that software developers will be keen to write software and programs that are compatible with the Windows OS, increasing the OS’s value proposition. All of these then in turn cause computer manufacturers to prefer to pre-install the Windows OS in personal computers over other OS-es, leading to stable demand for the Windows OS. Indeed, revenue from the Windows business has displayed steady growth over the past few years as the table below illustrates.

Source: Microsoft annual reports

In other examples of recurring revenues in Microsoft’s business:

- Microsoft has 42.7 million consumer subscribers to its Office 365 cloud-based productivity software

- The Gaming sub-segment has subscriptions and advertising services, both of which are recurring in nature

- The Search Advertising sub-segment is recurring because of customer behaviour, since companies have to continuously advertise to build awareness amongst their customers.

5. A proven ability to grow

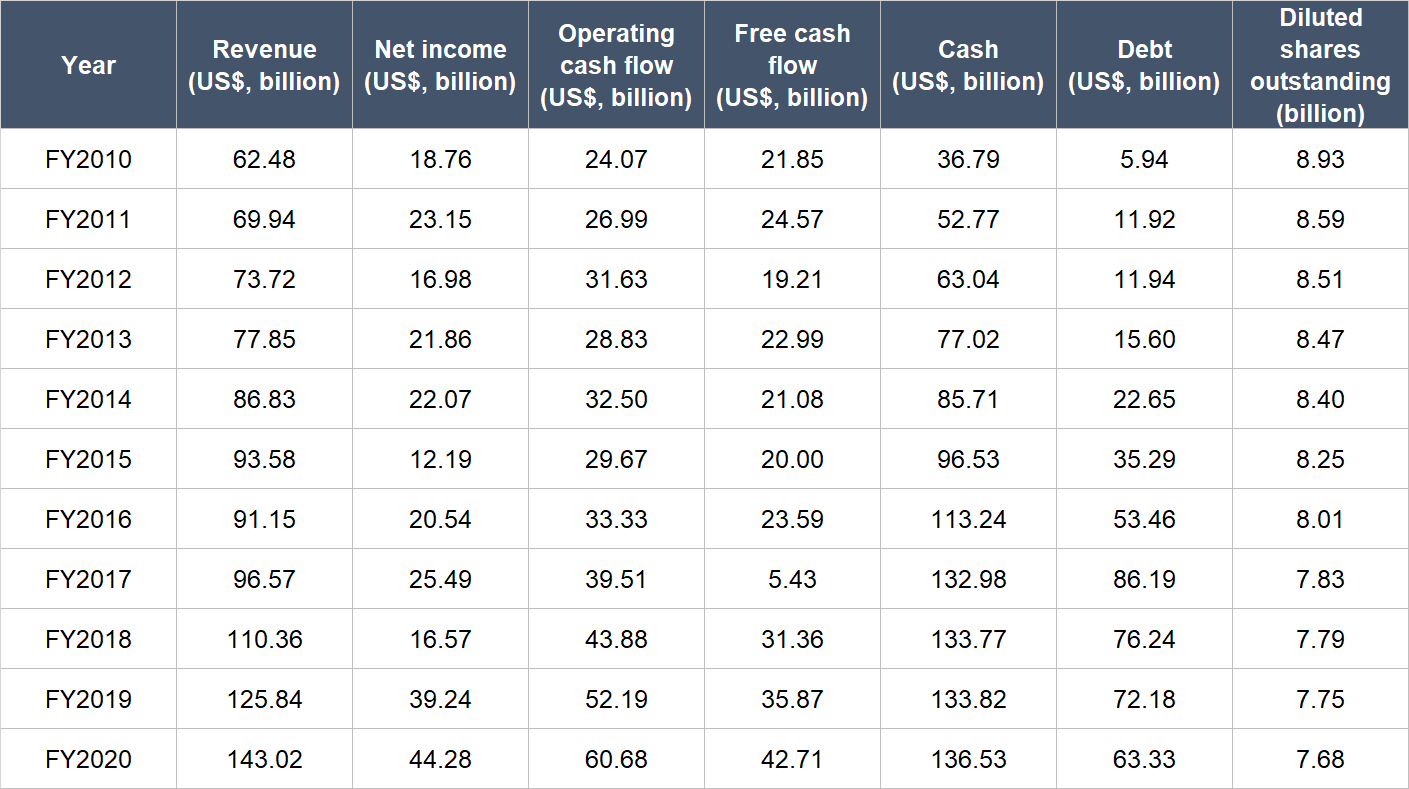

The table below shows Microsoft’s important financial numbers since FY2010. (We did not pick an earlier time period as the starting point because Microsoft’s business has gone through significant changes in the past few years, so more-recent data is better suited for us.)

Source: Microsoft annual reports

A few key things to highlight from Microsoft’s financials:

- For the entire time period under study, Microsoft’s revenue has grown in nearly every single year. FY2016 was the only year there was a decline and even then, the fall was just 2.6%. From FY2010 to FY2020, Microsoft’s revenue compounded steadily at 8.6% per year. More recently, from FY2017 to FY2020, the company’s revenue increased at a significantly faster annual rate of 14.0%. As we mentioned earlier in this article, we think that the revenue growth achieved in FY2017-FY2020 shows the fruits of Microsoft’s transformation under Satya Nadella’s leadership.

- Net income has been consistently positive, although growth has not been smooth. From FY2017 to FY2020, net income has compounded impressively at 20.2%. There was a sharp drop in net income in FY2018, but this was due to a one-off US$13.7 billion charge recorded in the fiscal year because of changes to US tax laws that were enacted in December 2017.

- Microsoft’s operating cash flow and free cash flow (net of capital expenditures and acquisitions) have both been consistently positive. There’s also a clear upward trend over the years for both metrics. The free cash flow in FY2017 was abnormally low because Microsoft acquired LinkedIn during the fiscal year (in December 2016 to be exact) for US$27 billion. From FY2010 to FY2020, operating cash flow compounded at 9.7% annually; the annualised growth rate had jumped to 15.4% for FY2017-FY2020. Meanwhile, free cash flow increased by 6.9% per year from FY2010 to FY2020. The growth rate in free cash flow from FY2017 to FY2020 was absurdly high at 98.8% per year, but that’s because of the low free cash flow in the base year. Shifting the base year to FY2016 will result in compound annual growth of 16.0% in free cash flow. We also want to highlight that Microsoft’s free cash flow has tracked its net income pretty closely.

- The balance sheet was rock-solid throughout the entire time frame we’re looking at with the amount of cash (including short-term investments) significantly outweighing the amount of debt. In fact, Microsoft’s net-cash position has increased from US$30.8 billion in FY2010 to US$73.2 billion in FY2020. We believe that Microsoft can afford to even be more aggressive with its share buybacks and acquisitions.

- Microsoft has not been diluting shareholders. Because of share buybacks, the number of shares declined by 1.5% per year from FY2010 to FY2020 and by 1.4% annually from FY2015 to FY2020. The buybacks have helped Microsoft’s existing shareholders to have a larger piece of the pie over time. For instance, the annual growth in Microsoft’s earnings per share for FY2017-FY2020 was 21.0%, compared to the net income growth rate of 20.2% per year.

The second half of FY2020 (1 January 2020 to 30 June 2020) was when COVID-19 started spreading across the world. Microsoft’s business performance in this period has been impressive, as shown in the table below. To a certain extent, the pandemic has benefited Microsoft, with Satya Nadella commenting in the FY2020 third-quarter earnings update that the company saw “two years’ worth of digital transformation in two months.”

Source: Microsoft quarterly earnings updates

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

Ultimately, we want our portfolio companies to be able to generate a growing stream of free cash flow in the future because we believe this is what makes companies become more valuable over time.

We believe Microsoft scores well in this criterion for two reasons. First, Microsoft’s revenue is likely to continue growing at a healthy clip in the years ahead. In particular, revenue from Azure and Microsoft’s other subscription businesses will likely grow significantly as companies shift towards cloud-based software and solutions. Second, Microsoft has a fantastic track record in generating free cash flow. The company’s average free cash flow margin (free cash flow as a percentage of revenue) for FY2015-FY2020 was an excellent 23.3%. We see no reason why Microsoft’s free cash flow margin will shrink in the future.

Valuation

We like to keep things simple in the valuation process. In Microsoft’s case, we think the price-to-earnings (P/E) and price-to-free cash flow (P/FCF) ratios are appropriate metrics to value the company, since it has a long history of producing solid and growing streams of profit and free cash flow.

We completed our purchases of Microsoft shares with Compounder Fund’s initial capital in late July 2020. Our average purchase price was US$205 per Microsoft share. At our average price and on the day we completed our purchases, Microsoft had trailing P/E and P/FCF ratios of 36 and 37, respectively. These ratios are on the wrong side of 30, and also high relative to their histories. The chart below shows Microsoft’s P/E and P/FCF ratios over the last five years.

But we believe that Microsoft deserves a higher multiple than what the market was paying for it back in late 2015. Microsoft has grown its Commercial Cloud business at rapid rates in the past few years, and this business currently makes up more than a third of the company’s overall revenue. Moreover, revenue from the Commercial Cloud business is nearly all recurring in nature. The growth of Commercial Cloud – not to mention the other subscription-based businesses – means that Microsoft is now a more robust and predictable business, and hence worth higher valuations. We also think that Microsoft will be able to compound its top-line in the low-teens rate, at the very least, in the next few years and this will be able to drive annual bottom-line and free cash flow growth in the high-teens range or more. For such growth, P/E and P/FCF ratios in the mid-30s do not seem high to us.

For perspective, Microsoft carried P/E and P/FCF ratios of 36 and 38 at the 29 September 2020 share price of US$210.

The risks involved

There are four key risks we are watching with Microsoft.

The first is key-man risk. Satya Nadella has been an immense transformative force at Microsoft. His foresight and ability to reinvent the company even when facing pressure from within has been instrumental to Microsoft’s recent successes. If there’s a change in leadership, it could impact Microsoft’s growth. The good thing is that Nadella is only 53 years old right now, so he likely still has plenty of years ahead of him to continue leading the company.

The second is competition. Microsoft’s products and services have a host of competitors, big and small. In its annual report for FY2020, Microsoft name-dropped a who’s who of the technology sector as competitors. The list includes Alphabet (parent of search engine Google), Amazon, Apple, Cisco Systems, Facebook, IBM, Oracle, salesforce.com, SAP, Slack, Zoom, and more. Notably, Microsoft’s Azure lags behind Amazon’s AWS in the cloud computing space, although we believe that the cloud computing market is big enough for multiple winners. Nonetheless, we are still keeping an eye on Microsoft’s competitive landscape.

The third is regulatory risk. Large technology companies in the USA have been under heavy scrutiny by the country’s regulators in recent years. For instance, in August this year, the CEOs of Alphabet, Amazon, Apple, and Facebook had to testify before US lawmakers on antitrust issues. Microsoft is currently not under the same level of scrutiny in the USA as its other large-tech peers, but the winds could change quickly, since the company had been fined by regulators in the more distant past.

Summary and allocation commentary

We initiated a 4% position in Microsoft – a large-sized allocation – with Compounder Fund’s initial capital. Microsoft is a software juggernaut that we believe has years of reliable growth ahead of it. Its balance sheet is rock-solid, and it has an incredible leader in Satya Nadella. There are other strong positives going for Microsoft, including: A sensible compensation structure for its leaders; a high level of recurring revenue; a good track record of growth in revenue, profit, and free cash flow; and a high likelihood of being able to generate growing free cash flow in the future.

There are risks to note for Microsoft, such as key-man risk, intense competition, and the potential danger of being subjected to heavier regulatory pressures.

But after weighing the pros and cons, we’re comfortable to have Microsoft be one of the larger positions in Compounder Fund’s initial portfolio. We think highly of the company’s reliable growth prospects and we think the valuation is reasonable.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share. Of all the companies mentioned in this article, Compounder Fund also currently owns shares in Amazon, Alphabet, Facebook, salesforce.com, and Zoom.