Compounder Fund: Tesla Investment Thesis - 06 Jun 2021

Data as of 3 June 2021

Tesla Inc (NASDAQ: TSLA), which is based and listed in the USA, is one of the three companies in Compounder Fund’s portfolio that we invested in for the first time in January 2021. This article describes our investment thesis for the company.

Company description

Founded in 2003, Tesla today designs, manufactures, and sells electric vehicles, solar energy systems, and energy storage devices. It also provides driver-assist software for its vehicles. The company breaks its revenue down into two business segments: automotive; and energy generation and storage. In 2020, Tesla’s revenue was US$31.54 billion, of which 93.7% (or US$29.54 billion) came from the automotive segment. The energy generation and storage segment accounted for the remaining 6.3% (or US$1.99 billion).

Under the automotive segment, Tesla currently has four electric vehicle models in production, which are seductively named Model S, Model 3, Model X, and Model Y (in combination, they become “S3XY”). Model S and Model X are Tesla’s higher-end vehicles, with their starting prices being around US$78,000 and US$88,000, respectively, in the USA. Meanwhile, Model 3 and Model Y are Tesla’s more affordable vehicles, with respective starting prices in the USA of around US$38,000 and US$50,000. Tesla’s vehicles feature stylish interiors and exteriors, and offer a wide variety of in-vehicle entertainment options, including internet search, music services, passenger karaoke, and parked video streaming and gaming. In 2020, Tesla delivered 499,550 vehicles worldwide. 88.6% of the vehicles delivered (or 442,511) were Models 3 and Y. From these numbers, it’s clear that Tesla’s lower-end vehicles are its real money-makers.

Source: Unsplash; Description: Interior of a Tesla vehicle

Tesla is a vertically integrated automobile manufacturer, with control over both the production and distribution of its vehicles. The company currently has two main vehicle-production factories: the Fremont Factory in California, USA and the Gigafactory Shanghai in China. As of the first quarter of 2021, the Fremont Factory had an annual production capacity of 600,000 vehicles (500,000 Model 3/Y and 100,000 Model S/X) while the Gigafactory Shanghai had an annual production capacity of 450,000 (all for Model 3/Y). In terms of Tesla’s distribution, the company sells its vehicles through its own website and an international network of its self-owned stores.

Also worth noting is that Tesla has done – and is doing – extensive research and development on lithium-ion batteries. In Tesla’s September 2020 Battery Day event, CEO Elon Musk announced that the company has a blueprint to reduce the cost of its batteries by 56% over the next few years. This could mean lower production costs for the company’s electric vehicles and thus lower vehicle prices for end consumers. In turn, the accessibility of Tesla’s electric vehicles could improve compared to traditional ICE (internal combustion engine) vehicles. We will have more discussion on this later. According to Tesla’s latest annual report for 2020, the company currently depends on suppliers – with a key one being Panasonic from Japan – for its battery needs. But Tesla is also building its own battery manufacturing capabilities at the moment.

Besides batteries, Tesla is developing self-driving software too. Tesla’s vehicles are fitted with hardware that enables collection of field-data to train and improve its neural networks for its self-driving technology. The company has already collected – and is collecting – a large amount of field data for this purpose. Currently, Tesla has two software packages for its vehicles: Autopilot and Full Self-Driving (FSD). Autopilot, which comes standard on every new Tesla vehicle, has features such as auto steering on roads with clearly marked lanes, and traffic-aware cruise control where the software matches the speed of the car to that of surrounding traffic. FSD is even better, with features such as auto lane change, auto parking, auto summoning of the vehicle, and more. As Tesla’s vehicles are connected to the internet and some of the older models are also fitted with the necessary hardware, Tesla vehicle owners without the Autopilot or FSD software packages can also purchase them over the web. We want to emphasise that contrary to what their names suggest, Tesla’s two software packages are merely driver assist software. At all times, drivers in the vehicles with the software must still be alert and have their hands on the wheel. Tesla is still in the midst of developing software for fully-autonomous vehicles. We believe that when Tesla’s self-driving technology is fully-developed and widely available commercially, it will open up new market opportunities for the company. We will touch more on this later.

The last point to bring up about Tesla’s automotive business segment is that the company also earns revenue from the sale of zero-emission vehicle (ZEV) regulatory credits. According to the state of Vermont’s Department of Environmental Conservation, there are currently 12 states in the USA that have ZEV regulations. Under the regulatory programme, vehicle manufacturers are required to earn a certain number of ZEV credits every year and they are able to buy the credits or earn them based on the number and type of ZEVs they produce. This is a way for these states to promote the adoption of environmentally friendlier vehicles. As Tesla sells exclusively electric vehicles, which are considered to be ZEVs, it earns more ZEV credits than it needs. Tesla is able to sell its ZEV credits to other automobile manufacturers who may fall short of the regulatory requirements in the applicable states. In 2020, Tesla sold US$1.58 billion in regulatory credits that are related to ZEV and other environmental regulations. This is 5.0% of Tesla’s total revenue for the year, and 5.3% of its automotive segment’s revenue.

Coming to the energy generation and storage segment, this is where Tesla sells its solar energy systems as well as energy storage products, such as the Powerwall, Powerpack, and Megapack lithium-ion battery products. Tesla’s energy storage products allow for electrical energy produced from solar power and other energy sources to be deployed in periods of increased energy needs or lower production. The energy generation and storage segment counts homeowners, commercial facilities, and utilities as customers.

Currently, the two most important countries for Tesla are the USA and China. In 2020, the two countries accounted for 48.2% and 21.1% of Tesla’s total revenue for the year, respectively. The remaining 30.7% of Tesla’s revenue came from other geographies that the company collectively terms as “Other”.

Investment thesis

We have laid out our investment framework in Compounder Fund’s website. We will use the framework to describe our investment thesis for Tesla.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

As mentioned earlier, Tesla delivered 499,550 vehicles worldwide in 2020, which helped it to earn US$31.5 billion in total revenue for the year. Including numbers for the first quarter of 2021, Tesla’s trailing vehicle deliveries and revenue are 595,320 and US$35.94 billion, respectively. These numbers are a tiny fraction of the vast global automotive market.

According to BloombergNEF’s Electric Vehicle Outlook 2020 report, annual electric vehicle sales are expected to surge from 1.7 million vehicles in 2020 to 8.5 million in 2025, and 26 million in 2030. This is an annualised growth rate of over 30%. The high expected-growth-rate for electric vehicles is supported by their low penetration rate at the moment. In 2020, only 2.7% of total new vehicle sales globally were electric vehicles; this percentage is expected to rise to 10% in 2025 and 28% in 2030. From 2020 to 2030, BloombergNEF also predicts that the global electric vehicle fleet will rise from 8.5 million to 116 million. China is expected to be the biggest driver of this transformation, with the country projected to account for 54% of global electric vehicle sales in 2025. The rise of electric vehicle sales will be driven by a few factors, according to BloombergNEF:

- Lower pricing for electric vehicles due to technology-improvements in lowering the cost of batteries. For instance, lithium-ion battery prices fell by 87% from 2010 to 2019. BloombergNEF expects electric vehicles to reach up-front price-parity (without subsidies) with ICE vehicles in most vehicle segments by the mid-2020s.

- Policymakers are driving vehicle manufacturers toward the production of electric vehicles.

- Battery-technology improvements mean that charging times and energy densities are improving (the average battery energy density is rising by 4% to 5% annually).

- Vehicle manufacturers and vehicle fleet owners are increasing their investments in electric vehicles for their own climate goals, as well as to meet regulatory requirements.

We think BloombergNEF’s projections for high-growth in the electric vehicle market are sensible. Here are more supporting data:

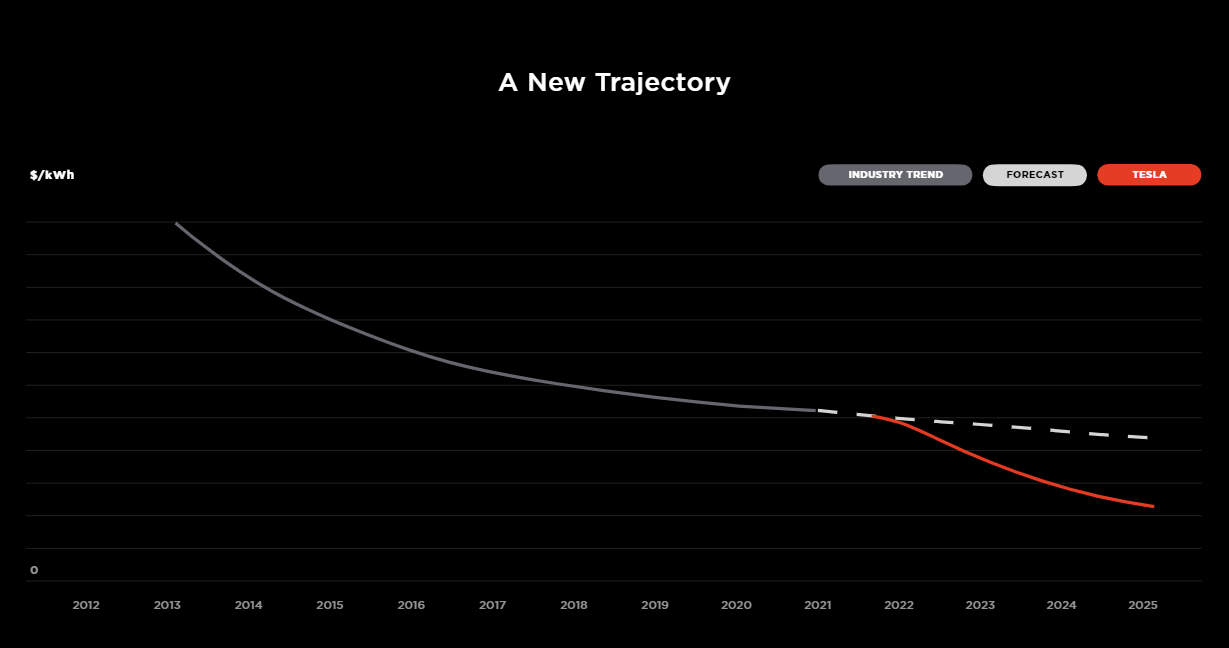

- As mentioned earlier, Tesla has a plan to more than halve battery prices. In fact, as the first chart below shows, the company’s plan is for battery prices to fall even faster than the long-term historical trend.

- Some jurisdictions are outright removing ICE vehicles over the long run. For instance, the state of California in the USA announced in 2020 that it will forbid the sale of ICE vehicles by 2035. In our home in Singapore, the government said in 2020 that the country will be progressively phasing out ICE vehicles by 2040.

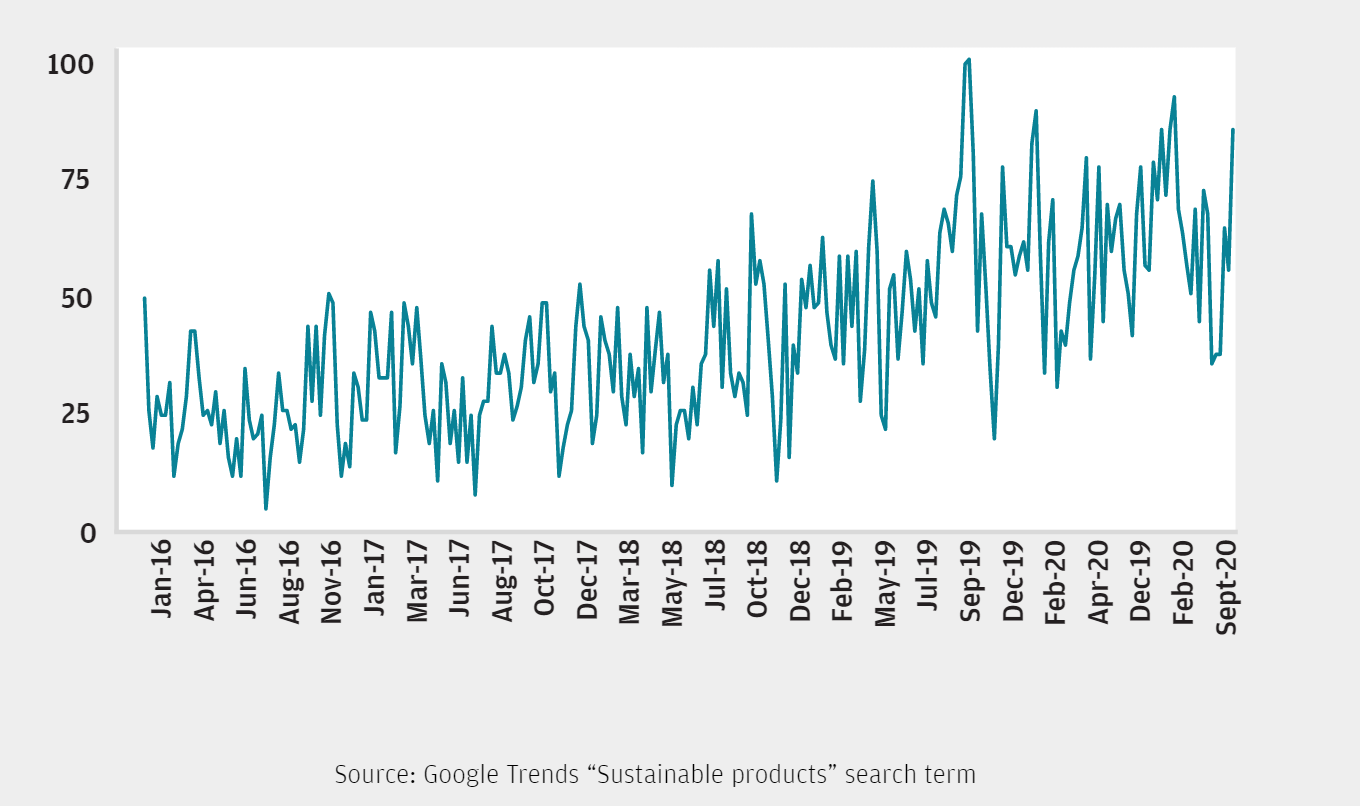

- Consumers are increasingly becoming environmentally conscious. For example, a study published by IBM and the National Retail Federation in 2020 found that 57% of consumers (a total of 18,980 individuals from 29 countries were surveyed, with age groups that range from Gen Z to Boomers) are “willing to change their purchasing habits to help reduce negative environmental impact.” In another instance, JP Morgan wrote in a March 2021 report that “there has been a recent rise in searches for “sustainable products,” “eco-friendly” and “environmentally friendly,” suggesting a shift in consumption preferences”. The second chart below, from JP Morgan’s report, shows the global increase over the past few years for the “sustainable products” search term. It also helps that electricity around the world is increasingly being generated by renewable energy sources. According to the Center for Climate and Energy Solutions, renewable energy was responsible for 26.2% of global electricity generation in 2018 and this percentage is expected to rise to 45% by 2040. This will increase the positive environmental impact of electric vehicles over ICE vehicles.

- Charging infrastructure is improving, which should make owning electric vehicles more convenient for consumers. For example, an October 2020 report from the National Renewable Energy Laboratory said that the number of electric vehicle charging stations in the USA had almost doubled from around 15,000 to nearly 30,000 between December 2015 and December 2019, with 13% growth in 2019. It’s worth noting too that Tesla has its own Supercharger network (mostly for its own vehicles) across the globe. The company’s Supercharger network contains more than 25,000 Superchargers in around 2,700 locations around the world, and can add up to 320 kilometres of range with a 15 minute charge. Tesla’s Supercharger locations have increased significantly over the years – for example, there were only 615 Supercharger locations in the first quarter of 2016, compared to around 2,700 today. Tesla’s Superchargers are typically found in well-travelled routes and near dense city centres. What’s more, when possible, Tesla also co-locates its Superchargers with its solar and energy storage systems to reduce costs and promote adoption of renewable energy.

Source: Tesla 2020 Battery Day

Source: JP Morgan

We think that Tesla can be a key beneficiary of the growth in demand for EVs for a few reasons.

First, Tesla has an extremely strong brand – and its strength will likely endure. Tesla’s vehicle deliveries have surged nearly seven-fold from 2016 to 2020 (from around 76,000 to almost 500,000) without any traditional advertising and with relatively little marketing spend. We think this is a great example of the strong brand that Tesla has. Another great example can be found in the 2020 version of J.D. Power’s Automotive Performance, Execution and Layout (APEAL) Study, which was published in July. Tesla had the best APEAL index score of 896 among automobile brands; for perspective, Porsche and BMW had scores of 881 and 869, respectively. J.D. Power, which is a global provider of consumer insights, has been conducting its APEAL study for 25 years and the 2020 version was the first time Tesla was featured. The APEAL study “measures an owner’s emotional attachment to their new vehicle.” In another instance, a customer-satisfaction-survey for automakers published by Consumer Reports in February 2021 showed that Tesla was ranked first. It’s worth keeping in mind that Tesla topped the consumer studies conducted by J.D. Power and Consumer Reports while spending little on marketing and nothing on traditional advertising.

We believe there are two important and related factors that have shaped Tesla’s strong brand. The larger-than-life personality of Tesla’s CEO and major shareholder, Elon Musk, is one. He has a bold vision – that he’s not shy from publicly sharing – of making humans a multiplanetary species through his privately-held rocket company, SpaceX. But before humans can colonise other planets, Musk’s in a race to increase the odds that Planet Earth can remain comfortably habitable for humans for a long time to come. This is why Tesla’s mission is not to build the best car or the best energy systems, but to “accelerate the world’s transition to sustainable energy.” We think this grand mission that Musk has ordained for Tesla helps build strong consumer appeal for its vehicles (it calls to consumers’ human-desire to want to do good). Another factor for Tesla’s strong brand – and also why the brand’s power will likely endure – also stems from Musk’s drive to promote adoption of sustainable energy in the world. Shifting the world to EVs makes Planet Earth healthier, but to do so, EVs need to provide a much better experience than traditional ICE vehicles. We believe this is why Tesla’s vehicles offer a fantastic overall user experience. And we don’t think Musk will ever relent when it comes to delivering a world-class experience for owners of Tesla vehicles – this is the critical pillar for our belief in the longevity of Tesla’s brand-power. In our investment thesis on iPhone maker Apple, we quoted passages from a 2018 article that business-writer-extraordinaire Ben Thompson wrote for his newsletter Stratechery. Here are the excerpts that are relevant for our current discussion on Tesla:

“Bezos’s letter, though, reveals another advantage of focusing on customers: it makes it impossible to overshoot. When I wrote that piece five years ago, I was thinking of the opportunity provided by a focus on the user experience as if it were an asymptote: one could get ever closer to the ultimate user experience, but never achieve it:

In fact, though, consumer expectations are not static: they are, as Bezos’ memorably states, “divinely discontent”. What is amazing today is table stakes tomorrow, and, perhaps surprisingly, that makes for a tremendous business opportunity: if your company is predicated on delivering the best possible experience for consumers, then your company will never achieve its goal.

”

We think a somewhat similar dynamic exists for Tesla too. There will always be room for improvement for a vehicle manufacturer to please its customers on the user-experience front. And if Tesla is very likely going to continue to be better than its peers at delighting consumers with its innovative vehicles, then it can always remain one step ahead of its competitors.

The second reason why we think Tesla can be a key beneficiary of the growth in demand for electric vehicles is that it is increasing its output. Because of the power of Tesla’s brand, we believe that the real bottleneck for Tesla is not a lack of demand, but its production capacity. The good news is that Tesla is increasing its output volume. We already discussed the significant growth in the company’s vehicle delivery numbers over the past few years. Tesla is also growing its output capacity in its existing Fremont Factory and Gigafactory Shanghai. For example, the Fremont Factory’s annual production capacity had increased from 490,000 vehicles in the first quarter of 2020 to 510,000 in the first quarter of 2021. Over the same period, the Gigafactory Shanghai’s annual production capacity increased from 200,000 vehicles to 450,000. Moreover, Tesla is currently constructing two more factories – one each in Texas, USA and Berlin, Germany – which will increase its capacity still further. Tesla also has plans in the future to introduce new vehicle models (the Cybertruck and the Tesla Semi) and a new version of an old model, its high-performance sports car, the Roadster.

Third, Tesla has access to cheap capital. In 2020 alone, Tesla raised US$12.27 billion through three secondary stock offerings that did not cause any significant dilution to existing shareholders. Tesla issued a total of 34.257 million new shares in the secondary stock offerings in 2020, while ending 2019 with slightly over 900 million shares – these numbers suggest that the dilution to existing shareholders was less than 4%. The ability to raise significant amounts of capital while not heavily diluting shareholders puts Tesla in a great position to continue building new factories (which require heavy capital investments) and increase its output.

Fourth, Tesla possesses better technology in batteries. This is related to the first reason, in that having better batteries makes for a better user experience in the electric vehicles manufactured by Tesla. Earlier, we showed a chart from Tesla’s September 2020 Battery Day event on how Tesla could bring down the costs for batteries at a much faster rate than the long-term historical trend. ARK Invest, an investment firm founded by Catherine Wood, has been a long-time investor in Tesla and it believes that Tesla’s battery technology is a few years ahead of its rivals.

So far we have only described Tesla’s growth opportunities in selling electric vehicles. But we also believe the company has optionality in spades. We first heard of the term “optionality” from The Motley Fool’s co-founder, David Gardner. It’s a term he coined to describe the trait a company has of being able to evolve and find entirely new ways to grow. There are three future growth opportunities for Tesla, beyond the sale of electric vehicles, that are obvious to us currently (although, we won’t be surprised if Tesla has new important business lines five to 10 years from now that are not even present today):

- First, Tesla could be selling subscription-based software packages for fully autonomous vehicles in the future. As we mentioned earlier, Tesla currently sells two driver assist software packages, namely, Autopilot and FSD. The price of the FSD package was raised to US$10,000 (for a one-off purchase) in late-2020. We believe that as Tesla’s driver assist software gets closer to Levels 4 and 5 on the scale of vehicle automation as defined by the Society of Automotive Engineers (Level 5 is when a vehicle is fully autonomous without any need for human intervention), Tesla will be able to sell its software package at a much higher price point. Tesla could even offer its software on a subscription basis – Musk has publicly stated that a FSD subscription plan is in the works. There is also the potential for Tesla to offer its autonomous driving software to other automakers. We don’t think this is a far-fetched idea at all. Tesla’s mission, as we already mentioned, is to “accelerate the world’s transition to sustainable energy.” Providing great software to other automakers to promote adoption of electric vehicles (of the fully autonomous variety) is very much in-line with Tesla’s mission.

- Second, if Tesla succeeds with developing autonomous driving technology, it could establish and operate an autonomous ride-hailing network in the future. Tesla has publicly said that this is something it is working on. The growth opportunity could be immense, since autonomous vehicles could be used for ferrying people and for logistics. For perspective, Uber, a provider of ride-hailing services, said in its 2019 IPO prospectus (the company held its initial public offering in May of the year) that its personal mobility market opportunity alone was estimated to be US$5.7 trillion across 175 countries.

- Third, the global solar energy market is also expected to shine in the next few years. According to ResearchAndMarkets, this market is projected to grow by 20% annually from US$52.5 billion in 2018 to US$223.3 billion in 2026. For perspective, Tesla’s energy generation and storage segment produced revenue of US$1.99 billion in 2020.

2. A strong balance sheet with minimal or a reasonable amount of debt

We think Tesla has a robust balance sheet. The company exited the first quarter of 2021 with US$17.14 billion in cash, and US$10.87 billion in total debt. This equates to plenty of short-term liquidity and a sizable net-cash position of US$6.27 billion.

It helps too that (1) Tesla has recently started to generate free cash flow, as we’ll discuss later, and (2) we mentioned earlier that Tesla has cheap access to capital due to the strong interest for its shares, so it’s in a good position to maintain the health of its balance sheet even when it’s investing heavily for growth.

3. A management team with integrity, capability, and an innovative mindset

On integrity

We think that Elon Musk, who has been Tesla’s CEO since October 2008, is a brilliant entrepreneur and business leader. He is revolutionising the automobile industry, is building reusable space-faring rockets, and wants to help humans to colonise Mars. But the Tesla CEO is also one of the most controversial business leaders in the world. He is a livewire when it comes to the things he posts on Twitter. To be clear, we do not agree with everything that Musk has said or did. But such is the price we have to pay to partner with genius, and on balance, we’re happy to be partners with Musk by being an investor in Tesla. Venture capitalist and finance writer Morgan Housel once wrote:

“A problem happens when you think someone is brilliantly different but not well-behaved, when in fact they’re not well-behaved because they’re brilliantly different. That’s not an excuse to be a jerk, or worse, because you’re smart. But no one should be shocked when people who think about the world in unique ways you like also think about the world in unique ways you don’t like.”

Musk has made many promises in the past on what Tesla would do, and these promises were often broken. But we’re willing to give him leeway. After all, he has to solve incredibly hard problems when it comes to building high-quality electric vehicles and developing self-driving software. There are two other reasons why we’re giving Musk leeway. First, Tesla has managed to grow its production capabilities significantly – we mentioned earlier that Tesla’s vehicle deliveries have surged almost seven-fold from 76,000 in 2016 to nearly 500,000 in 2020. Second, Musk did deliver on the long-term promise he made in an open-letter he penned in August 2006 titled “The Secret Tesla Motors Master Plan (just between you and me)”. At the end of the letter, Musk wrote:

“So, in short, the master plan is:

Build sports car

Use that money to build an affordable car

Use that money to build an even more affordable car

While doing above, also provide zero emission electric power generation options”

Tesla’s first vehicle was the high-performance sports-car, the Roadster, which was introduced in 2008. It then followed up with the cheaper Model S (in June 2012) and Model X (in September 2015), before launching the even cheaper Model 3 (in July 2017) and Model Y (om March 2020). We also mentioned earlier that of the nearly-500,000 vehicles that Tesla delivered in 2020, 88.6% were the lower-end Model 3 and Model Y. Moreover, Tesla has a business segment that is involved with generating solar power and building batteries for electric vehicles and other uses. The Tesla of today looks exactly like what Musk envisioned in 2006.

The compensation structure that Musk has at Tesla also gives us confidence in his integrity. Here are the key points:

- Musk has never received any base salary while being CEO of Tesla. In March 2018, Tesla implemented a 10-year remuneration programme for Musk – named the 2018 CEO Performance Award – that is based entirely on equity awards.

- Under the 2018 CEO Performance Award, Musk was granted 101.3 million stock option awards. The stock option awards consist of 12 equal vesting tranches, with each tranche’s vesting being determined by Tesla meeting market capitalisation milestones and operational milestones. The market capitalisation milestones begin at US$100 billion for the first vesting tranche and increases by increments of US$50 billion with each subsequent tranche. This means that Tesla’s market capitalisation needs to be US$650 billion for Musk to earn the full option grants. The market capitalisation milestones are also based on two averages for Tesla’s share price: A six-month average, and a 30-day average.

- Meanwhile, the operational milestones involve revenue and adjusted EBITDA (earnings before interest, taxes, depreciation, and amortisation) targets for Tesla. The revenue target starts at US$20 billion and goes up to US$175 billion. The adjusted EBITDA figure ranges from US$1.5 billion to US$14.0 billion. A market capitalisation milestone must be paired with either a revenue or adjusted EBITDA milestone in order for each vesting tranche of the option awards to vest.

- The stock option awards each have an exercise price of US$70.01 per Tesla share and once they are exercised, Musk must hold the shares for at least five years.

- If Tesla is unable to fulfill any of the market capitalisation or operational milestones, Musk will receive no remuneration from the company throughout the lifespan of the 2018 CEO Performance Award.

- The market capitalisation and operational milestones are aggressive. When the 2018 CEO Performance Award was established, Tesla had a market capitalisation of around US$50 billion and ended 2017 with revenue of US$11.8 billion.

- In summary, the 2018 CEO Performance Award will reward Musk richly only if there are large increases in the company’s market capitalisation, revenue, and adjusted EBITDA over many years. We would have preferred the following: (1) The use of Tesla’s share price instead of market capitalisation; (2) the use of revenue per share instead of just revenue; and (3) the use of free cash flow per share instead of adjusted EBITDA. But on balance, we still think that Tesla has one of the better remuneration structures that we’ve seen in public-listed companies.

We also want to highlight positively that Musk has significant skin in the game even before the stock options from the 2018 CEO Performance Award have fully vested. Based on his latest regulatory filing (made in February 2021), he controls 170.493 million Tesla shares and options to purchase 56.639 million Tesla shares that are exercisable within 60 days of 31 December 2020. Based on Tesla’s 3 June 2021 share price of US$573, Musk’s 170.493 million Tesla shares alone, excluding the 56.639 million options, are worth a staggering US$97.7 billion.

We note that there’s some controversy related to Musk’s involvement with Tesla in its earlier years. Although Musk is the public face of Tesla, the company was actually not founded by him. Instead, it was Martin Eberhard and Marc Tarpenning who established Tesla in 2003, with the former as CEO and the latter as CFO. Musk joined the company in 2004 as chairman after investing US$30 million in the company. In 2007, Eberhard resigned as CEO but remained on Tesla’s advisory board. In 2008, before Musk became CEO in October, both Eberhard and Tarpenning left Tesla completely. When they departed, both of Tesla’s founders said that they were forced out of the company; Eberhard even sued Tesla and Musk in 2009, although the lawsuit was dropped later in the same year. The acrimonious departure of Tesla’s founders is an unsavoury episode for Musk. But we don’t see it as anything close to being a red flag. This is because we think Musk has done a great job at growing Tesla’s business as CEO and he has a compensation plan that aligns his interests well with the company’s other shareholders.

On capability and ability to innovate

This is where we think Elon Musk excels. Tesla has a history of bringing successful new products to market. To fully appreciate the innovative spirit of Musk, we just have to look at the company’s product timeline since he became CEO in 2008. Back then, Tesla had only just shipped its first electric vehicle, and it was to none other than Musk himself. It was called the Roadster. But for a host of reasons, the Roadster was an impractical car for mass use. The vehicle was priced at more than US$100,000 and took 24 to 48 hours to charge fully from a standard home electrical outlet. In addition, charging infrastructure in the USA was not well-developed back then. In the 13 years since Musk became CEO, Tesla has done a fantastic job in improving all of the problem areas.

Now, Tesla has electric vehicles with much lower price points; home-charging times are dramatically faster (from around 5-10 miles per hour of charge when the Roadster was first introduced, to up to 44 miles per hour of charge today); and there are more than 25,000 Superchargers – that offer very fast charging speeds – spread across 2,700 locations in the world.

Source: Pixabay; Description: A Tesla charging station

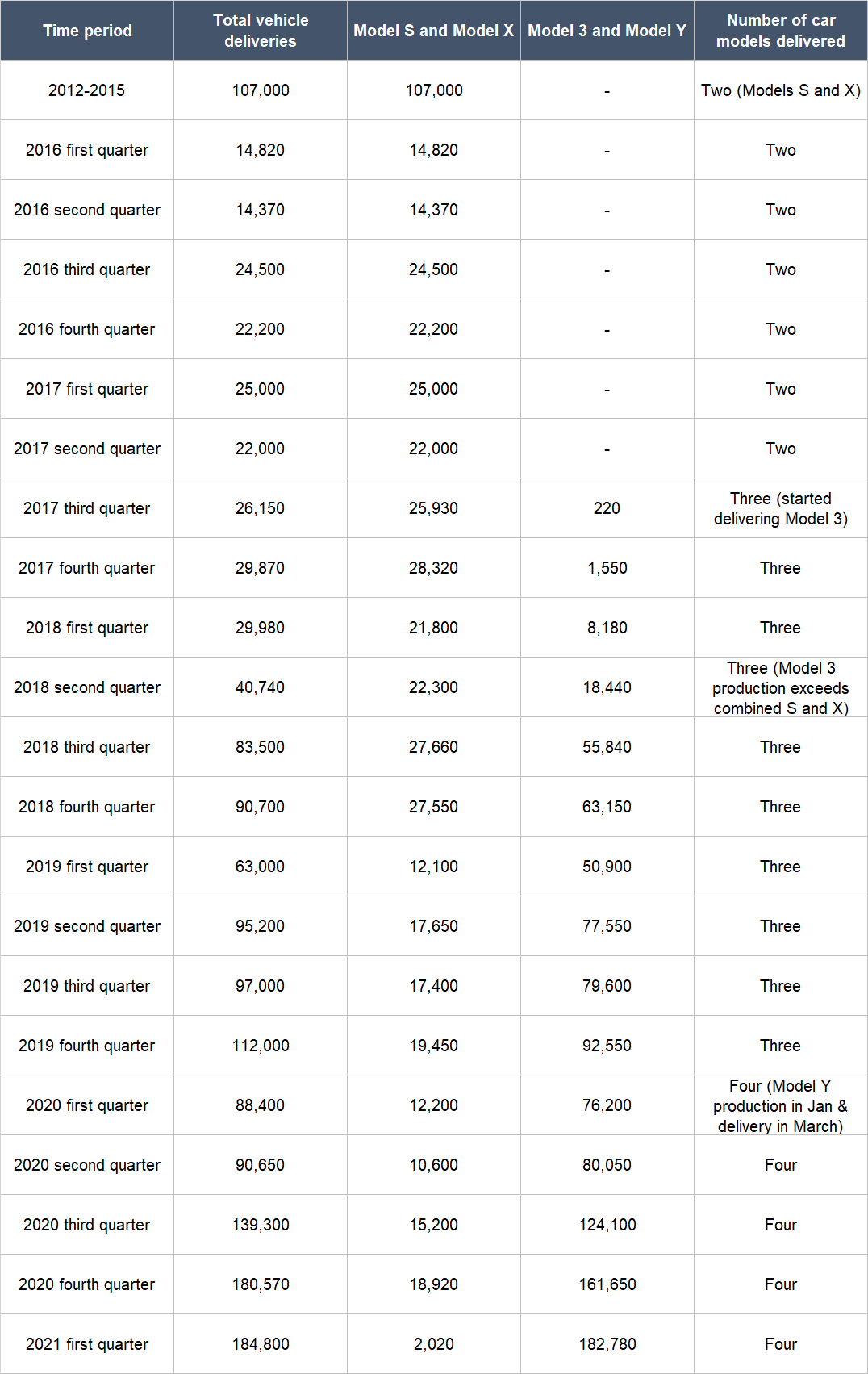

For more colour on the success Tesla has enjoyed in terms of introducing new products, the table below shows Tesla’s vehicle deliveries from 2012 to the first quarter of 2021. Notice (1) the growth in the number of deliveries for Models 3 and Y, which are the company’s cheaper vehicle models, and (2) Tesla’s solid record of increasing production and deliveries since 2015. It’s worth noting that when Tesla introduced the Roadster in 2008, it was the first company in the world to commercially produce a regulatory-compliant and highway-capable electric vehicle. What this means is that Tesla had to develop knowledge for mass production of electric vehicles largely on its own. With this background, it’s no surprise that Tesla uses innovative technology within its manufacturing facilities (here’s a good video tour of the Fremont Factory).

Source: Tesla press releases and 2015 annual report

Musk is also an innovator at heart – and he’s an incredibly impressive one. Before Tesla, Musk co-founded online bank X.com, which eventually merged with Confinity in March 2000 to form digital payments provider PayPal. Musk is also the co-founder of SpaceX (which builds rockets and spacecraft), The Boring Company (which creates safe, fast-to-dig, and low-cost transportation, utility, and freight tunnels), and NeuraLink (which is developing brain-machine interfaces). Despite becoming a centimillionaire when PayPal was sold to eBay in 2002, Musk was not content to coast on his wealth. Instead, he decided to pour most of his capital into new ventures (such as Tesla and SpaceX) and bring innovation to the way humans live and move. With Musk at the helm, we are confident that Tesla will continue to innovate.

Another thing about Musk that caught our eye is that he has a unique view of the world. This is something we prize. Earlier, in the “Revenues that are small in relation to… a fast-growing market” sub-section of this article, we discussed why we think Musk’s grand mission for Tesla “to accelerate the world’s transition to sustainable energy” can help the company to stay ahead of the pack. There’s something else about Musk’s worldview that we want to bring up: In 2014, Tesla openly released its patents related to electric vehicles and it has irrevocably pledged that it will not sue any party for using its patents “for so long as such party is acting in good faith.” When Musk made the decision to open up Tesla’s patent portfolio, he wrote:

“When I started out with my first company, Zip2, I thought patents were a good thing and worked hard to obtain them. And maybe they were good long ago, but too often these days they serve merely to stifle progress, entrench the positions of giant corporations and enrich those in the legal profession, rather than the actual inventors. After Zip2, when I realized that receiving a patent really just meant that you bought a lottery ticket to a lawsuit, I avoided them whenever possible.

At Tesla, however, we felt compelled to create patents out of concern that the big car companies would copy our technology and then use their massive manufacturing, sales and marketing power to overwhelm Tesla. We couldn’t have been more wrong. The unfortunate reality is the opposite: electric car programs (or programs for any vehicle that doesn’t burn hydrocarbons) at the major manufacturers are small to non-existent, constituting an average of far less than 1% of their total vehicle sales.

At best, the large automakers are producing electric cars with limited range in limited volume. Some produce no zero emission cars at all.

Given that annual new vehicle production is approaching 100 million per year and the global fleet is approximately 2 billion cars, it is impossible for Tesla to build electric cars fast enough to address the carbon crisis. By the same token, it means the market is enormous. Our true competition is not the small trickle of non-Tesla electric cars being produced, but rather the enormous flood of gasoline cars pouring out of the world’s factories every day.

We believe that Tesla, other companies making electric cars, and the world would all benefit from a common, rapidly-evolving technology platform.”

Part of the reason for Musk’s daring patent move was because he recognised the true nature of Tesla’s competition. It’s not just electric vehicles from other automakers – it is “the enormous flood of gasoline cars” being produced. In our opinion, having this expansive view on competition helps increase the odds that Tesla will always be the leader in producing delightful vehicles.

One area where Musk does not appear to have done too well is building a good corporate culture. There are criticisms of the company’s culture (see here for example) and currently, only 68% of Tesla raters on Glassdoor would recommend a friend to work at the company. Glassdoor is a platform that allows employees to rate their companies anonymously. The good thing is that Musk has an approval rating of 86% as CEO, which is higher than the average Glassdoor CEO rating of 69% in 2019.

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

Unlike many of the other companies we have invested in for Compounder Fund, Tesla does not have high levels of recurring revenues. It has provided lease arrangements for some of its vehicles as well as for its energy generation and storage products. But the lion’s share of the company’s revenue (83.0% in 2020 and 81.2% in 2019) still comes directly from the sale of electric vehicles, and these are transactions that are not repeated frequently. This is because a car tends to have a long useful lifespan and there’s often a high capital outlay involved when buying a car, from the perspective of an individual consumer.

But we did not see this as a deal breaker when we were evaluating Tesla as an investment opportunity. We are confident in the company’s ability to maintain and grow sales because of the strong demand for its vehicles. As we already showed, the company’s vehicle delivery numbers have increased significantly over the past few years.

Earlier, we also mentioned the potential for Tesla to sell subscriptions to its self-driving software packages in the future. If this comes to pass, Tesla will have a new source of stable recurring revenue.

5. A proven ability to grow

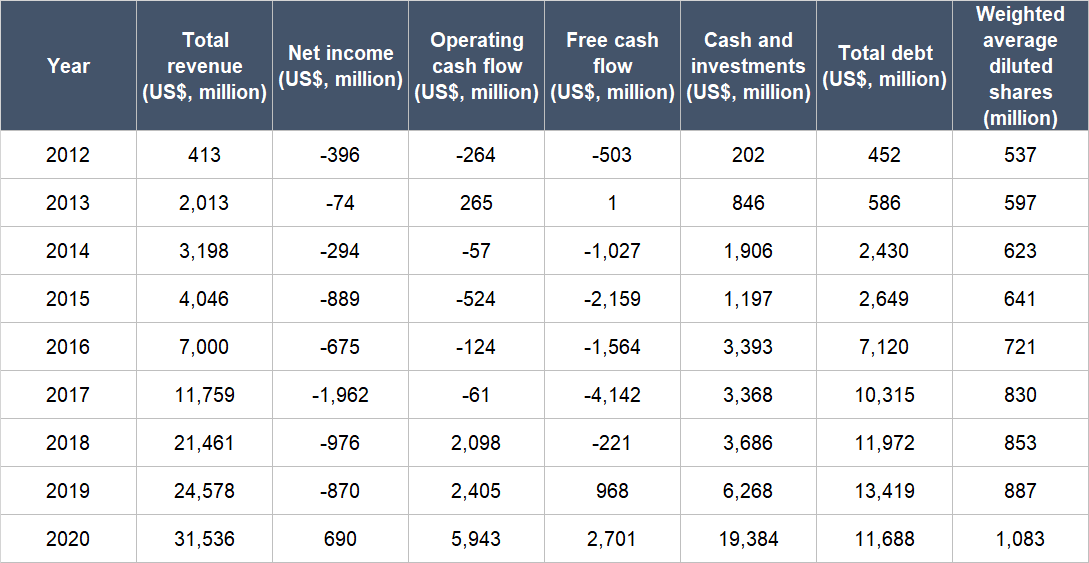

The table below shows Tesla’s key financial figures from 2012 to 2020 (we chose 2012 as the starting point because this was the year when Tesla introduced the Model S):

Source: Tesla annual reports

A few key things to highlight from Tesla’s historical financials::

- Revenue has compounded at an impressive annual rate of 71.9% from 2012 to 2020. Recent growth rates have been slower – 50.8% per year for 2015-2020 and 28.3% in 2020 – but were still strong.

- It’s worth highlighting Tesla’s healthy topline growth of 28.3% in 2020. This happened despite the company having to suspend operations at its manufacturing facilities across the world for a part of the first half of the year because of the COVID-19 pandemic.

- For the entire time frame we’re studying, Tesla was mostly loss-making. 2020 was a turning point for the company as it produced a profit for the whole year.

- 2018 was another banner year for Tesla as it started generating positive operating cash flow. Since then, the company’s operating cash flow has been substantial, a sign that its early and heavy investments into its business are starting to pay off.

- In terms of producing positive free cash flow (operating cash flow less capital expenditures), Tesla turned the corner in 2019. It’s worth noting too that 2020 saw Tesla’s free cash flow nearly triple from a year ago. We think that Tesla’s operating cash flow will likely increase going forward as its vehicle deliveries grow. But as mentioned earlier, Tesla is currently constructing two new factories (one in Texas and one in Berlin) and so its capital expenditures over the next few years should be substantial. Nonetheless, the free cash flow picture at Tesla is looking brighter than ever.

- From 2012 to 2020, Tesla’s weighted average diluted share count increased by 9.2% annually. The rate of dilution is even higher in more recent times – they were 11.1% for 2015-2020 and 22.1% in 2020. Tesla’s rate of dilution is much higher than what we typically like to see. But at the same time, as long as Tesla’s business grows at a much faster pace than its diluted share count, there will be a positive impact on shareholder value. And as mentioned earlier, Tesla’s annualised revenue growth for 2012-2020, 2015-2020, and 2020 were 71.9%, 50.8%, and 28.3%, respectively. The increase in Tesla’s weighted average diluted share count in 2020 (22.1%) was only slightly lower than its revenue growth. But the good thing is that Tesla’s free cash flow increased by 179% in 2020. We will be watching Tesla’s dilution in the future.

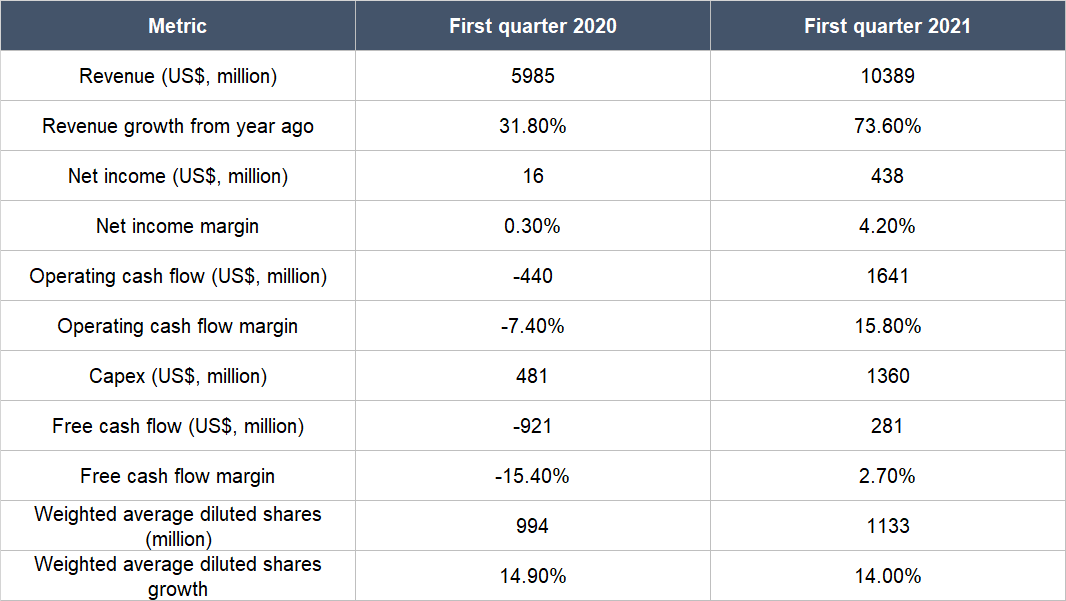

Tesla posted impressive year-on-year revenue growth of 73.6% for the first quarter of 2021, as illustrated in the table below. The table also shows that there were significant improvements in Tesla’s net income, net income margin (net income as a percentage of revenue), operating cash flow, operating cash flow margin (operating cash flow as a percentage of revenue), free cash flow, and free cash flow margin (free cash flow as a percentage of revenue) during the quarter. The company’s weighted average diluted share count again increased at a high rate of 14.0%. But the good thing is that this is dwarfed by Tesla’s revenue growth.

Source: Tesla quarterly earnings update

In the first quarter of 2021, the two major US automakers – Ford and General Motors – both suffered from a shortage of chips for the electronics in their vehicles. Tesla did as well. But that’s not all. During the quarter, Tesla couldn’t get critical engineers for its factory in China because of COVID-19 quarantine restrictions, and so its manufacturing operations in the country had difficulties scaling. With these issues as a backdrop, Tesla’s business performance in the first quarter of 2021 looks even more impressive.

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

Tesla began to generate positive free cash flow in 2019 and continued doing so in 2020 and in the first quarter of 2021. And it did so while spending billions on capital expenditures. We believe these are strong signs that Tesla can indeed generate strong free cash flow when its business is in a more mature phase.

Let’s not forget too that Tesla has other businesses besides manufacturing and selling electric vehicles. The most important one we are watching is its software business. The sale of software can generate very high free cash flow margins. If Tesla can bring fully-autonomous driving into reality, the sale of autonomous driving software could potentially be another massive cash generator for the company.

Valuation

We completed our initial purchases of Tesla shares in early January 2021. Our average purchase price was US$736 per share. At our average price and on the day we completed our purchases, Tesla’s shares had a trailing price-to-sales (P/S) ratio of around 28. We like to keep things simple in the valuation process. In Tesla’s case, we think the P/S ratio is currently an appropriate metric to gauge the value of the company, since the company does not have a long history yet of generating substantial free cash flow.

The P/S ratio of 28 is high and that’s a risk. For context, if we assume Tesla has a 15% free cash flow margin today, the P/S ratio translates to a price-to-free cash flow (P/FCF) ratio of more than 180 (28 divided by 15%). But we’re willing to pay a premium for a few reasons.

First, Tesla is growing its revenue at a rapid clip. And as mentioned earlier, we believe that the key constraint for Tesla’s sales is its factory output – and the company is increasing its production capacity as we speak. Second, we believe that Tesla can command higher margins than traditional automobile manufacturers. For perspective, Ford, General Motors, and Toyota produced average free cash flow margins of 7.8%, -6.5%, and 0.2%, respectively, over their last five completed fiscal years. We think Tesla can do much better. This is because it is vertically integrated from manufacturing to distribution (the company is even exploring the idea of buying its own chip-making plant to further its vertical integration) and it also has the potentially high-margin driving-software business.

For perspective, Tesla carried a P/S ratio of around 18 at its 3 June 2021 share price of US$573.

The risks involved

We see four main risks that can crash our Tesla investment:

- Key-man risk: We think that Tesla’s success has largely been the result of Elon Musk’s vision, drive, ability to market, attract talent and capital, and execute. He is still just 49 years old, so he should have ample stamina to lead the company for many years to come. But he has a certain reckless streak in his life (in 2000, Musk completely wrecked a US$1 million McLaren F1 sports car while trying to show off the vehicle to investor Peter Thiel) and is a controversial figure. We won’t be surprised too if Musk decides to step down from Tesla in the future to concentrate on his projects to bring humans to other planets. If Musk leaves Tesla, for whatever reason, we will be watching the leadership transition.

- Competition: We mentioned earlier that Tesla has a strong brand and its electric vehicles are well-loved by consumers. But competition is heating up for Tesla. Many legacy automakers are starting to pour serious resources into their electric vehicle and self-driving projects. For example, General Motors has a target to have 30 new global electric vehicle models by 2025 and will sell only electric vehicles by 2035. Ford will be investing US$22 billion in electric vehicles and another US$7 billion in self-driving technologies by 2025. Hyundai has committed to invest around US$55 billion in its electric vehicle and other projects, also by 2025. Tesla may have to contend with Apple in the future too. The tech giant, famous for the iPhone, has long been rumoured to be working on a self-driving car. There is likely to be more than one winner as the electric vehicle market grows and we think the same can also be said for self-driving cars (if and when one finally gets built). We think that Tesla has a high chance of being among the winners, but there’s a non-zero chance that its competitors could race ahead.

- Supplier concentration: As mentioned earlier, Panasonic is a key supplier of the batteries that Tesla needs. We can’t tell what percentage of Tesla’s battery-needs are fulfilled by Panasonic, but the number is likely to be very high at the moment. Panasonic has a close relationship with Tesla, to the extent that it is co-located with Tesla in the latter’s Gigafactory Nevada. Tesla is building its own battery-manufacturing capabilities at the moment, so its reliance on Panasonic should decline in the future. But for now, Tesla’s business is likely to suffer if Panasonic’s operations are disrupted.

- High-valuation: We think Tesla’s business deserves a premium valuation because it is likely to grow at a rapid clip for many years. But if the company’s growth falls short – even if it’s due to temporary problems – there could be a painful fall in its share price.

Summary and allocation commentary

To sum up Tesla, it has:

- The rapidly-growing electric vehicle market, and the potential to find growth in different areas in the future, such as providing software for autonomous vehicles.

- A strong balance sheet with a high net-cash position.

- Elon Musk in the driver’s seat and he’s a brilliant entrepreneur with a knack for solving hard problems – plus, he has a compensation plan that is well-aligned with the interests of other Tesla shareholders.

- A long-term track record of solid revenue growth and has shown an ability to generate significant free cash flow in recent times.

- A high likelihood of being able to produce strong free cash flow in the future.

There are risks to note with the company and the key ones we’re watching include key-man risk; an intensifying competitive landscape; supplier concentration; and a high valuation.

After weighing the pros and cons, we decided to initiate a position of around 0.5% in Tesla in January 2021, which can be considered to be a small-sized allocation. We appreciate the strengths in Tesla’s business, but we’re mindful of Tesla’s high valuation, especially when the company will require significant capital investments for its growth (building cars requires factories, which require capital).

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share. Of all the other companies mentioned in this article, Compounder Fund also owns shares in Apple and Paypal. Holdings are subject to change at any time.