Compounder Fund: Amazon Investment Thesis - 09 Aug 2020

Data as of 7 August 2020

Amazon.com (NASDAQ: AMZN) is one of the 40 companies in Compounder Fund’s initial portfolio. This article describes our investment thesis for the company.

Company description

Jeff Bezos founded Amazon in 1994. A year later, the company started business by selling just books online. Over time, Amazon expanded its online retail business that now provides an incredible variety of product-categories for consumers. In 2006, the company launched its cloud computing business, AWS (Amazon Web Services), which has since grown into the largest cloud computing service provider in the world.

Amazon currently has three business segments: North America, International, and AWS. The North America and International segments consist of Amazon’s online retail as well as other retail-related subscription businesses. The AWS segment, as its name suggests, houses AWS, which offers computing power, database storage, content delivery, and other services to organisations.

The table immediately below shows the revenues and operating profits from Amazon’s three segments in 2019. Although Amazon’s retail operations make up the lion’s share of revenue, it is AWS that is currently generating more operating profit for the company.

Source: Amazon annual report

For a geographical perspective, the US was the source of 69% of Amazon’s total revenue of US$280.5 billion in 2019. Germany, the UK, and Japan are the other countries that Amazon reports as individual revenue sources, but the US is the only market that accounted for more than 10% of the company’s revenue.

Investment thesis

We have laid out our investment framework in Compounder Fund’s website. We will use the framework to describe our investment thesis for Amazon.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

On the surface, Amazon’s massive revenue (US$321.8 billion in the 12 months ended 30 June 2020) makes it seem like the company has exhausted its room for growth. But if you dig deeper, a different picture emerges.

First, let us consider Amazon’s online retail business. The St Louis Federal Reserve’s data show that online retail sales in the US was just 11.8% of the country’s total retail sales in the first quarter of 2020. Moreover, total retail sales in the US (excluding food services) in the 12 months ended June 2020 was over US$5.4 trillion. Amazon’s current revenue is merely a drop in the ocean. For more context, Walmart, a bricks-and-mortar retailer in the US, earned US$535 billion in revenue over the last 12 months. Bezos himself said in a legal testimonial statement in July 2020 that “Amazon accounts for less than 1% of the [US]$25 trillion global retail market and less than 4% of retail in the U.S.”

The chart below shows ecommerce sales as a percentage of total retail sales in the US for each quarter going back to 1999’s fourth-quarter. From then to today, the percentage has increased from just 0.6% to 11.8%. Ecommerce activity has clearly been growing in the US over a long period of time, and there’s still plenty of room for growth.

Source: St Louis Federal Reserve

Next, let us look at the cloud computing landscape. AWS on its own, can be considered a huge business too with revenue of US$40 billion in the 12 months ended 30 June 2020. But again, the runway for growth is long. According to a forecast from Gartner that was released in November 2019, the public cloud computing market is expected to grow by nearly 16% per year from US$197 billion in 2018 to US$355 billion in 2022.

Then, there’s Amazon’s digital advertising business which is reported within the North America and International business segments. In the 12 months ended 30 June 2020, Amazon’s advertising business brought in revenue of around US$16.5 billion, up 42% from a year ago. The market opportunity here is huge and fast-growing; global digital advertising spend was US$283 billion in 2018, and is expected to grow to US$518 billion in 2023, according to eMarketer.

The thing about Amazon is that we will not be surprised to see the company expand into new markets in the future. After all, Amazon “seeks to be Earth’s most customer-centric company.” This audacious statement also means that any industry is fair game for Amazon if it sees an opportunity to improve the customer experience. It helps that Amazon is highly innovative (more on this when we discuss Amazon’s management), and we think the company embodies a concept called optionality. Motley Fool co-founder David Gardner describes optionality as a company having multiple paths to grow.

Here are a few of Amazon’s irons-in-the-fire that we think hold high growth-potential:

- Amazon is making inroads in physical retail. Amazon Go is the company’s bricks-and-mortar retail store that requires no checkout. Customers walk into an Amazon Go store, grab what they want, and simply leave. Amazon Go is powered by technologies such as computer vision, sensor fusion, and deep learning, and the company brands them collectively as Just Walk Out Technology. Amazon reported in the first quarter of 2020 that it had 25 Amazon Go stores across the US, and that it has begun to offer Just Walk Out Technology to other retailers. In August 2017, the company also acquired Whole Foods Market, an organic grocer, for US$13.2 billion. Whole Foods Market has around 500 physical stores today in North America and the UK.

- In early 2018, Amazon set up a non-profit entity together with US banking giant J.P. Morgan Chase, and Warren Buffett’s Berkshire Hathaway. The non-profit was named Haven in early 2019 and is meant to tackle rising healthcare costs in the US. In September 2018, Amazon acquired online pharmacy and drug delivery outfit PillPack for US$753 million. Then in September 2019, Amazon launched Amazon Care, its telemedicine and in-person healthcare platform. As far as we know, Amazon Care is currently only available for Amazon’s employees in Seattle. Shortly after in October, Amazon acquired Health Navigator, a digital healthcare startup, and grouped it under the Amazon Care platform. In the second quarter of 2020, Amazon announced that it is collaborating with medical care group Crossover Health to introduce the Amazon Neighborhood Health Centres initiative, which consists of medical facilities for Amazon employees and their families. All these moves by Amazon suggest that it’s working hard to crack the US$3.5 trillion US healthcare market.

- Amazon has been flexing its financial muscle in video streaming. The company’s original-content budget for 2019 for its Prime Video streaming service is estimated to be around US$6 billion. In April 2020, Amazon inked a new three-year streaming deal with the US’s National Football League that is worth more than US$65 million per year. The streaming market is rapidly growing. And although Netflix is a formidable – and larger – presence in the space (Compounder Fund also owns Netflix shares), there is likely enough room for more than one winner.

- In Amazon’s 2018 annual report, it mentioned for the first time “transportation and logistics services” companies as its competitors; the same group was again mentioned as one of Amazon’s competitors in its 2019 annual report. Amazon started leasing delivery planes for the first time in 2016. By early-June 2020, the company’s fleet had expanded to over 70 planes, with 11 more planes scheduled for delivery in 2021.The company also has plans to develop a number of new air cargo hubs in the US in areas that include Lakeland Linder International Airport in Florida, San Bernardino International Airport, and Cincinnati/Northern Kentucky International Airport.

2. A strong balance sheet with minimal or a reasonable amount of debt

Amazon meets this criterion. As of 30 June 2020, the company’s balance sheet held US$33.1 billion in debt and US$42.8 billion in lease liabilities against US$71.4 billion in cash and marketable securities.

There’s more debt than cash, but Amazon has been adept at generating cash flow. This is something we will discuss later.

3. A management team with integrity, capability, and an innovative mindset

On integrity

Jeff Bezos, 56, has been leading the charge at Amazon since he founded the company. Today, he’s Amazon’s president, CEO, and chairman. We believe that Bezos’s compensation plan with Amazon shows that he’s a leader with (a) integrity, and (b) interests that are aligned with the company’s other shareholders such as Compounder Fund. There are a few key points to note:

- Bezos’s cash compensation in Amazon was merely US$81,840 in 2019. His annual cash compensation has never exceeded that amount at his request, because he already has a large stake in Amazon. His total compensation in 2019 was US$1.68 million if business-related security expenses were included. But even then, the sum is more than reasonable when compared to the scale of Amazon’s business.

- Bezos has never received any form of stock-based compensation from Amazon, because he believes he is already “appropriately incentivised” due to, again, his large ownership stake in the company.

- As of 18 February 2020, Bezos controlled 55.6 million Amazon shares (11.2% of the existing shares) that are worth around US$178 billion at the share price of US$3,167 (as of 7 August 2020). In my opinion, Bezos’s huge monetary stake in the company puts him in the same boat as other Amazon shareholders.

On capability and innovation

There’s so much to discuss about Bezos’s accomplishments with Amazon and his ability to lead innovation at the company. But for the sake of brevity, we want to focus on only a few key points.

First is Amazon’s tremendous track record of growth. There will be more details later, but consider that Amazon’s revenue has increased from just US$148 million in 1997 to US$280.5 billion in 2019. Over the same period, operating cash flow was up from less than US$1 million to US$38.5 billion.

Second is Amazon’s willingness to think long-term, and experiment and fail. We want to highlight Amazon’s long-term thinking through something Bezos said in a 2011 interview with Wired (emphasis is ours). Reading Bezos’s words directly will give you a window into his genius. Here are Bezos’s words in 2011:

“Our first shareholder letter, in 1997, was entitled, “It’s all about the long term.” If everything you do needs to work on a three-year time horizon, then you’re competing against a lot of people.

But if you’re willing to invest on a seven-year time horizon, you’re now competing against a fraction of those people, because very few companies are willing to do that. Just by lengthening the time horizon, you can engage in endeavors that you could never otherwise pursue. At Amazon we like things to work in five to seven years. We’re willing to plant seeds, let them grow—and we’re very stubborn. We say we’re stubborn on vision and flexible on details.”

Amazon has the courage to constantly seek new ground. Often, the trail turns cold. A sample of Amazon’s long string of failures include: The Fire Phone (Amazon’s smartphone); Amazon Wallet (Amazon’s digital payments service); Amazon Local Register (a device to help mobile devices process credit cards); and Destinations (Amazon’s hotel-booking website). But sometimes the trail leads to gold. Bezos has written about this topic. Here’s a relevant excerpt from Amazon’s 2015 shareholders’ letter (emphases are ours):

“One area where I think we are especially distinctive is failure. I believe we are the best place in the world to fail (we have plenty of practice!), and failure and invention are inseparable twins. To invent you have to experiment, and if you know in advance that it’s going to work, it’s not an experiment. Most large organizations embrace the idea of invention, but are not willing to suffer the string of failed experiments necessary to get there.

Outsized returns often come from betting against conventional wisdom, and conventional wisdom is usually right. Given a ten percent chance of a 100 times payoff, you should take that bet every time. But you’re still going to be wrong nine times out of ten. We all know that if you swing for the fences, you’re going to strike out a lot, but you’re also going to hit some home runs.

The difference between baseball and business, however, is that baseball has a truncated outcome distribution. When you swing, no matter how well you connect with the ball, the most runs you can get is four. In business, every once in a while, when you step up to the plate, you can score 1,000 runs. This long-tailed distribution of returns is why it’s important to be bold. Big winners pay for so many experiments.”

The following is another relevant passage on the company’s willingness to experiment, from Bezos’ 2018 shareholders’ letter (emphasis is ours):

“Sometimes (often actually) in business, you do know where you’re going, and when you do, you can be efficient. Put in place a plan and execute. In contrast, wandering in business is not efficient … but it’s also not random. It’s guided – by hunch, gut, intuition, curiosity, and powered by a deep conviction that the prize for customers is big enough that it’s worth being a little messy and tangential to find our way there.

Wandering is an essential counter-balance to efficiency. You need to employ both. The outsized discoveries – the “non-linear” ones – are highly likely to require wandering.

AWS’s millions of customers range from startups to large enterprises, government entities to nonprofits, each looking to build better solutions for their end users. We spend a lot of time thinking about what those organizations want and what the people inside them – developers, dev managers, ops managers, CIOs, chief digital officers, chief information security officers, etc. – want.

Much of what we build at AWS is based on listening to customers. It’s critical to ask customers what they want, listen carefully to their answers, and figure out a plan to provide it thoughtfully and quickly (speed matters in business!). No business could thrive without that kind of customer obsession. But it’s also not enough. The biggest needle movers will be things that customers don’t know to ask for. We must invent on their behalf. We have to tap into our own inner imagination about what’s possible.

AWS itself – as a whole – is an example. No one asked for AWS. No one. Turns out the world was in fact ready and hungry for an offering like AWS but didn’t know it. We had a hunch, followed our curiosity, took the necessary financial risks, and began building – reworking, experimenting, and iterating countless times as we proceeded.”

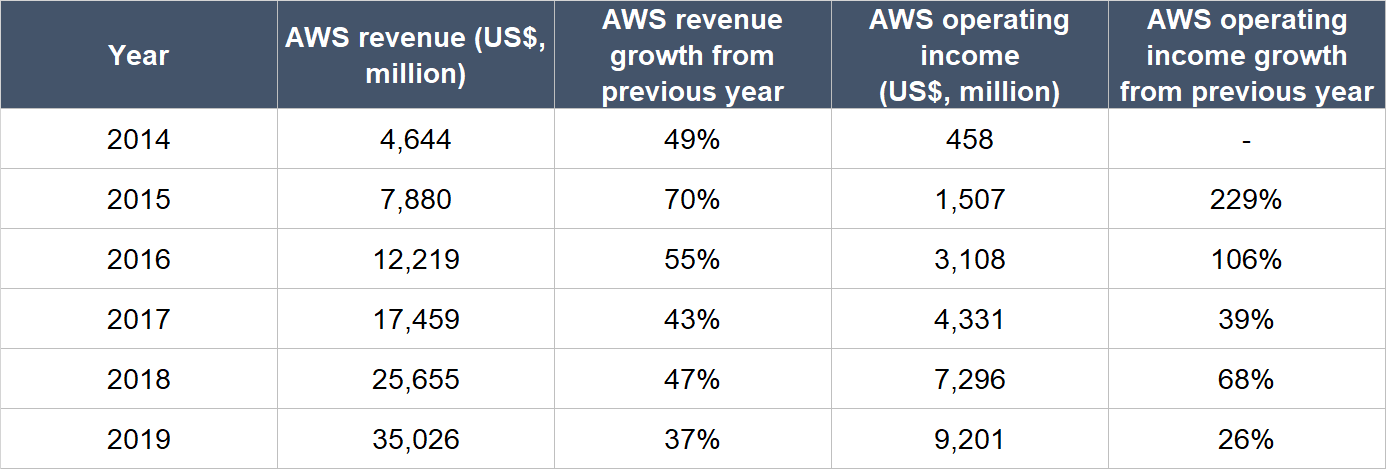

One instance for Amazon of the trail leading to gold is, of course, AWS. It has been a smashing success. When AWS was 10 years old, it was bigger than Amazon was at the same age and was growing at a faster rate. The table below shows AWS’s outstanding revenue and operating income growth since 2014. Bear in mind that AWS has grown despite Amazon having voluntarily lowered the service’s price a total of 67 times from its launch in 2006 to September 2018.

Source: Amazon annual reports

The third key point we want to discuss about Amazon’s management is Jeff Bezos’s unique obsession over the customer experience. In fact, we think it is an unreplicable competitive advantage, because it stems from Bezos’s own unique way of thinking. You can’t clone Jeff Bezos – at least not with current science!

In his 2003 shareholders’ letter, Bezos illustrated his willingness to dent Amazon’s short-term sales for longer-term benefits (emphasis is ours):

“Another example is our Instant Order Update feature, which reminds you that you’ve already bought a particular item. Customers lead busy lives and cannot always remember if they’ve already purchased a particular item, say a DVD or CD they bought a year earlier. When we launched Instant Order Update, we were able to measure with statistical significance that the feature slightly reduced sales. Good for customers? Definitely. Good for shareowners? Yes, in the long run.”

We mentioned earlier that AWS has dropped prices over the years for the benefit of customers. Back in his 2005 shareholders’ letter, Bezos already gave an excellent window on his thinking behind his obsession on lowering prices for customers. He thinks it can build strong customer loyalty that is not easily measurable but that is real. Most importantly, he thinks this loyalty translates into higher future free cash flows for Amazon. We agree. Here’s what Bezos wrote (emphases are ours):

“As our shareholders know, we have made a decision to continuously and significantly lower prices for customers year after year as our efficiency and scale make it possible. This is an example of a very important decision that cannot be made in a math-based way.

In fact, when we lower prices, we go against the math that we can do, which always says that the smart move is to raise prices. We have significant data related to price elasticity. With fair accuracy, we can predict that a price reduction of a certain percentage will result in an increase in units sold of a certain percentage.

With rare exceptions, the volume increase in the short term is never enough to pay for the price decrease. However, our quantitative understanding of elasticity is short-term. We can estimate what a price reduction will do this week and this quarter. But we cannot numerically estimate the effect that consistently lowering prices will have on our business over five years or ten years or more.

Our judgment is that relentlessly returning efficiency improvements and scale economies to customers in the form of lower prices creates a virtuous cycle that leads over the long term to a much larger dollar amount of free cash flow, and thereby to a much more valuable Amazon.com. We’ve made similar judgments around Free Super Saver Shipping and Amazon Prime, both of which are expensive in the short term and—we believe—important and valuable in the long term.”

The fourth point involves the unique corporate structure Jeff Bezos has built in Amazon. Tech entrepreneur Zack Kanter wrote an amazing blog post in March 2019 that describes Amazon’s brilliant culture. Here’re the key passages (italics are his):

“In 2002, Jeff Bezos had the most important insight he would ever have: in the world of infinite shelf space – and platforms to fill them – the limiting reagent for Amazon’s growth would not be its website traffic, or its ability to fulfill orders, or the number of SKUs available to sell; it would be its own bureaucracy.

As Walt Kelly put it, “we have met the enemy, and it is us.” In order to thrive at ‘internet scale,’ Amazon would need to open itself up at every facet to outside feedback loops. At all costs, Amazon would have to become just one of many customers for each of its internal services.

And so, as told by former Amazon engineer Steve Yegge, Jeff Bezos issued an edict: 1) All teams will henceforth expose their data and functionality through interfaces, 2) teams must communicate with each other through these interfaces, 3) all interfaces, without exception, must be designed from the ground up to be exposed to developers in the outside world, and 4) anyone who doesn’t do this will be fired.

This principle, this practice, this pattern, would enable Amazon to become the sprawling maze of complexity that it would eventually become without collapsing under its own weight, effectively future-proofing itself from the bloat and bureaucracy that inevitably dragged down any massive company’s growth.”

Bezos’s edict that Kanter mentioned allows Amazon to innovate rapidly. That’s because any service or technology that Amazon builds for internal uses can very quickly be pushed to external customers when the time is right. In fact, that was how AWS came to be: It was first developed to meet Amazon’s own computing needs before it was eventually shipped to the public.

The fifth and last point concerns Amazon’s admirable actions during the current COVID-19 crisis. Here’s what Bezos said in Amazon’s earnings updates for the first and second quarters of 2020:

“[First quarter of 2020]

The service we provide has never been more critical, and the people doing the frontline work — our employees and all the contractors throughout our supply chain — are counting on us to keep them safe as they do that work. We’re not going to let them down. Providing for customers and protecting employees as this crisis continues for more months is going to take skill, humility, invention, and money.

If you’re a shareowner in Amazon, you may want to take a seat, because we’re not thinking small. Under normal circumstances, in this coming Q2, we’d expect to make some [US]$4 billion or more in operating profit. But these aren’t normal circumstances. Instead, we expect to spend the entirety of that [US]$4 billion, and perhaps a bit more, on COVID-related expenses getting products to customers and keeping employees safe. This includes investments in personal protective equipment, enhanced cleaning of our facilities, less efficient process paths that better allow for effective social distancing, higher wages for hourly teams, and hundreds of millions to develop our own COVID-19 testing capabilities. There is a lot of uncertainty in the world right now, and the best investment we can make is in the safety and well-being of our hundreds of thousands of employees. I’m confident that our long-term oriented shareowners will understand and embrace our approach, and that in fact they would expect no less.

[Second quarter of 2020]

As expected, we spent over [US]$4 billion on incremental COVID-19-related costs in the quarter to help keep employees safe and deliver products to customers in this time of high demand — purchasing personal protective equipment, increasing cleaning of our facilities, following new safety process paths, adding new backup family care benefits, and paying a special thank you bonus of over $500 million to front-line employees and delivery partners. We’ve created over 175,000 new jobs since March and are in the process of bringing 125,000 of these employees into regular, fulltime positions. And third-party sales again grew faster this quarter than Amazon’s first-party sales. Lastly, even in this unpredictable time, we injected significant money into the economy this quarter, investing over [US]$9 billion in capital projects, including fulfillment, transportation, and AWS.”

We think it’s really smart for Amazon to go on the offensive and re-invest heavily into its business during this time of uncertainty – indeed, we expect no less. Re-investing heavily in this current juncture should enable Amazon to come out of the COVID-19 pandemic even stronger.

After a really long discussion on Amazon’s leadership (and that’s after we tried to be as brief as possible!), we want to make it very clear: Compounder Fund’s investment in Amazon is also very much a long-term bet on Jeff Bezos.

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

Amazon’s business contains highly recurrent revenue streams. There are a few key things to note:

- According to Statista, there were 206.1 million unique visitors to Amazon’s US sites in the month of December 2018. These are visitors who are likely using Amazon’s online retail sites to purchase products regularly.

- Amazon also has subscription businesses, most notably Amazon Prime. Subscribers to Amazon Prime gain access to free shipping (from two days to two hours depending on the products), the Prime Video streaming service, and more. Amazon Prime typically charges subscribers US$12.99 per month or US$119 per year. In Amazon’s 2019 fourth-quarter earnings update, Bezos revealed that Amazon Prime had more than 150 million paying subscribers around the world.

- AWS provides cloud computing services, and that is likely to be something its customers require all the time, or frequently. AWS also sometimes enters into significant long-term contracts of up to three years.

We also want to point out that it’s highly unlikely that Amazon has any customer concentration. The company’s retail websites welcome hundreds of millions of visitors each month, and AWS also has “millions of customers” ranging from startups to large enterprises, and government entities to nonprofits.

5. A proven ability to grow

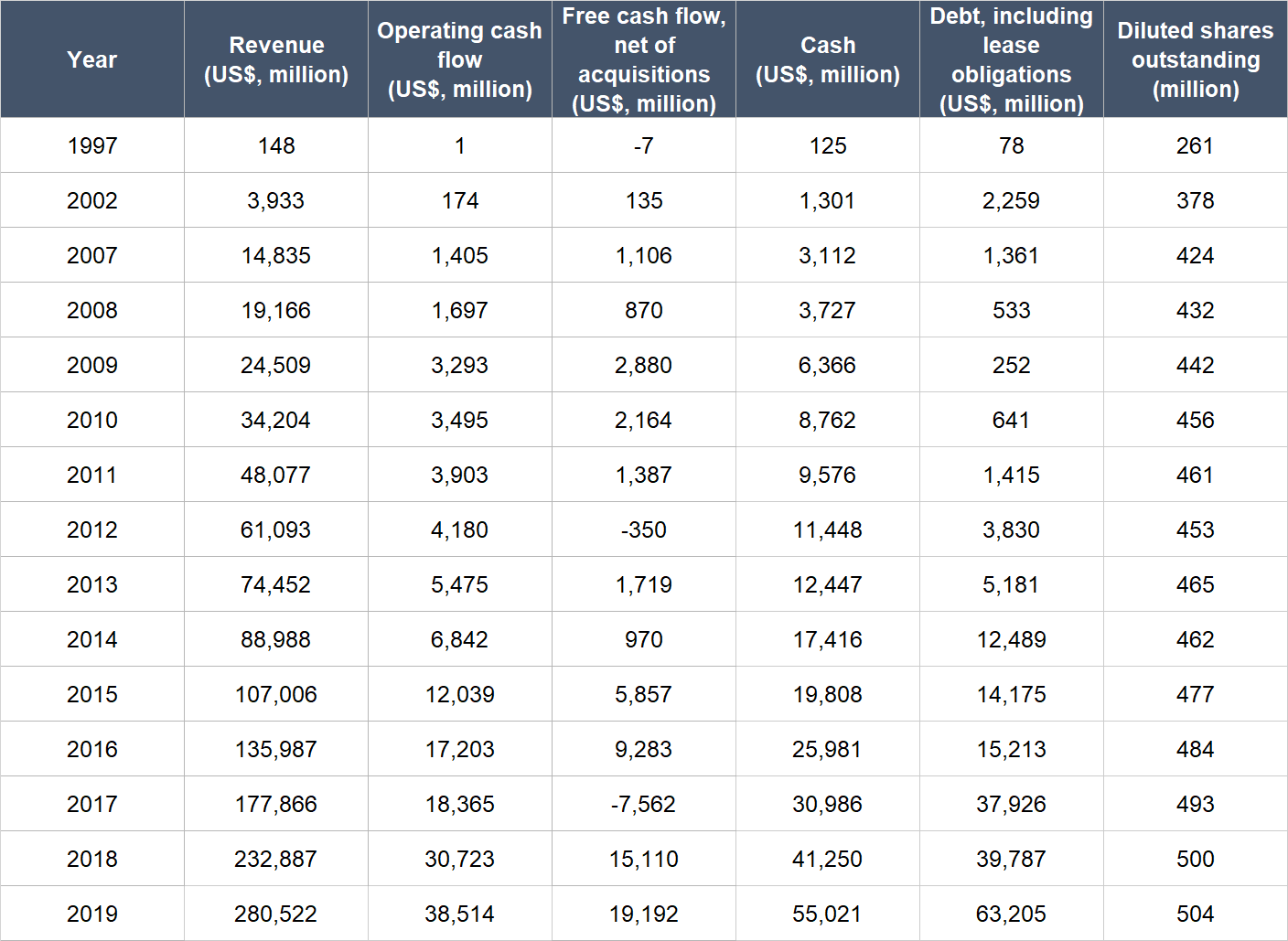

The table below shows Amazon’s important financial figures from 1997 to 2019:

Source: Amazon annual reports

A few points to note about Amazon’s financials:

- Revenue has compounded at an amazing rate of 40.9% from 1997 to 2019; over the last five years from 2014 to 2019, Amazon’s topline growth was still excellent at 25.8%. The company also managed to produce strong revenue growth of 29% in 2008 and 28% in 2009; those were the years when the global economy was rocked by the Great Financial Crisis.

- Operating cash flow has increased markedly for the entire time frame we’re looking at. The compound annual growth rates from 2007 to 2019, and from 2014 to 2019, were robust at 31.7% and 41.3%, respectively. Moreover, just like Amazon’s revenue, the company’s operating cash flow had strong growth in 2008 and 2009.

- Free cash flow, net of acquisitions, has mostly been positive and has also stepped up significantly from 1997 to 2019. But it’s worth noting that Amazon has spurts of heavy reinvestments into its business which depresses its free cash flow from time to time. We also want to point out that 2017 was an anomaly because of the huge US$13.2 billion Whole Foods Market acquisition we mentioned earlier.

- The balance sheet was in a net cash position in most years, and even when net debt was positive, it looks trivial compared to the company’s cash flows.

- Amazon has been diluting its shareholders, but the dilution has happened at a glacial pace of 3% annually since 1997. From 2007 to 2019, the annual increase in the diluted share count has been just 1.5%, which is negligible given the rate at which Amazon’s business is growing.

In the first half of 2020, Amazon has continued to post excellent revenue growth and churn out strong free cash flow. These are shown in the table below. Bear in mind too that Amazon had managed to generate plenty of free cash flow even after it had (1) invested more than US$4 billion voluntarily in the second quarter of 2020 on COVID-19 related initiatives to keep employees safe and ensure that products are delivered to customers, and (2) paid a US$500 million one-time bonus.

Source: Amazon earnings update

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

Jeff Bezos has attached his 1997 shareholders’ letter to every subsequent shareholders’ letter he has written. In the 1997 letter, Bezos wrote:

“When forced to choose between optimizing the appearance of our GAAP accounting and maximizing the present value of future cash flows, we’ll take the cash flows.”

In Amazon’s 2019 annual report, the company stated that its “financial focus is on long-term, sustainable growth in free cash flows.”

The two comments above – from Bezos’ 1997 shareholders’ letter and from Amazon’s latest annual report – highlights the emphasis that the online retail giant places on free cash flow. We like this focus. And crucially, Amazon has walked the talk. Its free cash flow has grown over time as we mentioned earlier, and hit US$19.2 billion in 2019 and US$25.6 billion over the last 12 months.

Valuation

We like to keep things simple in the valuation process. Given Amazon’s penchant for free cash flow (which is absolutely correct!), we think the price-to-free cash flow (P/FCF) ratio is a suitable gauge for the company’s value when free cash flow is abundant. When free cash flow is light because Amazon is reinvesting into its business, the price-to-sales (P/S) ratio will be useful.

With US$25.6 billion in free cash flow (US$50 in free cash flow per share) right now, Amazon has a P/FCF ratio of around 61 at Compounder Fund’s average purchase price of US$3,063. This is a high valuation. But Amazon is still growing rapidly – revenue was up 40% in the second quarter of 2020, which is incredible and all the more impressive given (1) the company’s already massive revenue base, and (2) the difficult economic conditions in the US because of COVID-19 (US GDP was down 9.6% in the second quarter of 2020 compared to a year ago).

There are two more important points that make us happy to pay up for Amazon’s shares:

- Amazon still has tremendous growth opportunities in its core markets of e-commerce and cloud computing, and relatively nascent market of digital advertising. But we think it will be folly to assume that these three markets will be Amazon’s only playgrounds five to 10 years from now – the company’s penchant for wandering means it is likely that Amazon finds new growth opportunities in the years ahead.

- Amazon is one of those rare companies that are creating tailwinds rather than merely riding on them. The company is one of the vanguards of the e-commerce and cloud computing industries. The innovator status Amazon has is valuable.

The risks involved

Key-man risk is an important concern we have with Amazon. We think that Jeff Bezos is an incredible and fair businessman. If he ever leaves the company for whatever reason, his successor will have giant shoes to fill – and we will be watching the situation closely.

We also recognise that there’s political risk involved with Amazon. Earlier this month, Bezos had to testify before US lawmakers, who are currently investigating the company on antitrust issues, alongside the CEOs of three other US tech giants, Alphabet, Apple, and Facebook (Compounder Fund owns shares in them too). Lawmakers in the US, such as Elizabeth Warren, have even gone as far as to propose plans to break up large tech companies in the country, including Amazon. We’re not worried about a break up, because it might even unlock value for Amazon’s shareholders. For example, it’s possible that an independent AWS could win more customers compared to its current status. It was reported in 2017 that Walmart had told its technology vendors not to use AWS. Nonetheless, we’re keeping an eye on politicians’ moves toward Amazon.

Lastly, there’s valuation risk. Amazon is priced for strong long-term growth. We’re confident that the company can continue growing at high rates for many years into the future, but there’s always the risk that the wheels fall off the bus. If Amazon’s growth slows materially in the years ahead, the high valuation will turn around and bite us. It’s something we have to live with, but we’re comfortable with that.

Summary and allocation commentary

In our view, Jeff Bezos is one of the best business leaders the world has seen. We have good company. Warren Buffett called Bezos “the most remarkable business person of our age” in a 2017 interview. Charlie Munger, Buffett’s long-time right-hand man, also said around the same time that Bezos “is a different species.”

Amazon has Bezos as its leader, and that in itself is an incredible competitive advantage for the company – no one else has Jeff Bezos. Besides excelling in the management-criteria within Compounder Fund’s investment framework, Amazon also shines in all the other areas:

- The company is operating in large and growing markets including online retail, cloud computing, and digital advertising. Moreover, it is constantly on the hunt for new opportunities.

- Amazon’s balance sheet carries a fair amount of debt, but is still robust when the debt is compared to its cash flows.

- The nature of Amazon’s business means there are high levels of recurring revenues.

- The company has an amazing long-term track record of growth – its business even managed to soar during the Great Financial Crisis, and has continued growing at a rapid clip even in the current COVID-19 pandemic.

- Amazon has a strong focus on generating free cash flow, and has proven to be adept at doing so.

The company’s valuation – based on the P/FCF ratio – is on the high side on the surface, and that’s a risk. Other important risks we’re watching with Amazon include key-man risk and scrutiny from politicians. But Amazon is a very high quality business, in our view, which means the high valuation currently could be short-term expensive but long-term cheap. Moreover, we see Amazon as a company with (1) huge addressable markets and (2) a high probability of being able to grow at a rapid clip for many years in the future. As a result, we’re happy to have Amazon be one of the larger positions in Compounder Fund’s portfolio – we initiated a 4.0% position in Amazon with Compounder Fund’s initial capital.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share.