Compounder Fund: Veeva Systems Investment Thesis - 01 Sep 2020

Data as of 29 August 2020

Veeva Systems (NYSE: VEEV) is one of the 40 companies in Compounder Fund’s initial portfolio. This article describes our investment thesis for the company.

Company description

The process to develop medical devices and drugs is highly complex and time consuming for the life sciences industry, which includes pharmaceutical, biotechnology, and medical device companies. For instance, clinical studies for drug development can take anywhere from six months to several years. Proper documentation is also necessary all the way from drug development to commercialisation and there are easily hundreds if not thousands of documents involved. Veeva, which is based and listed in the US, provides cloud-based software to help pharma, biotech, and medical device companies better handle all that complexity.

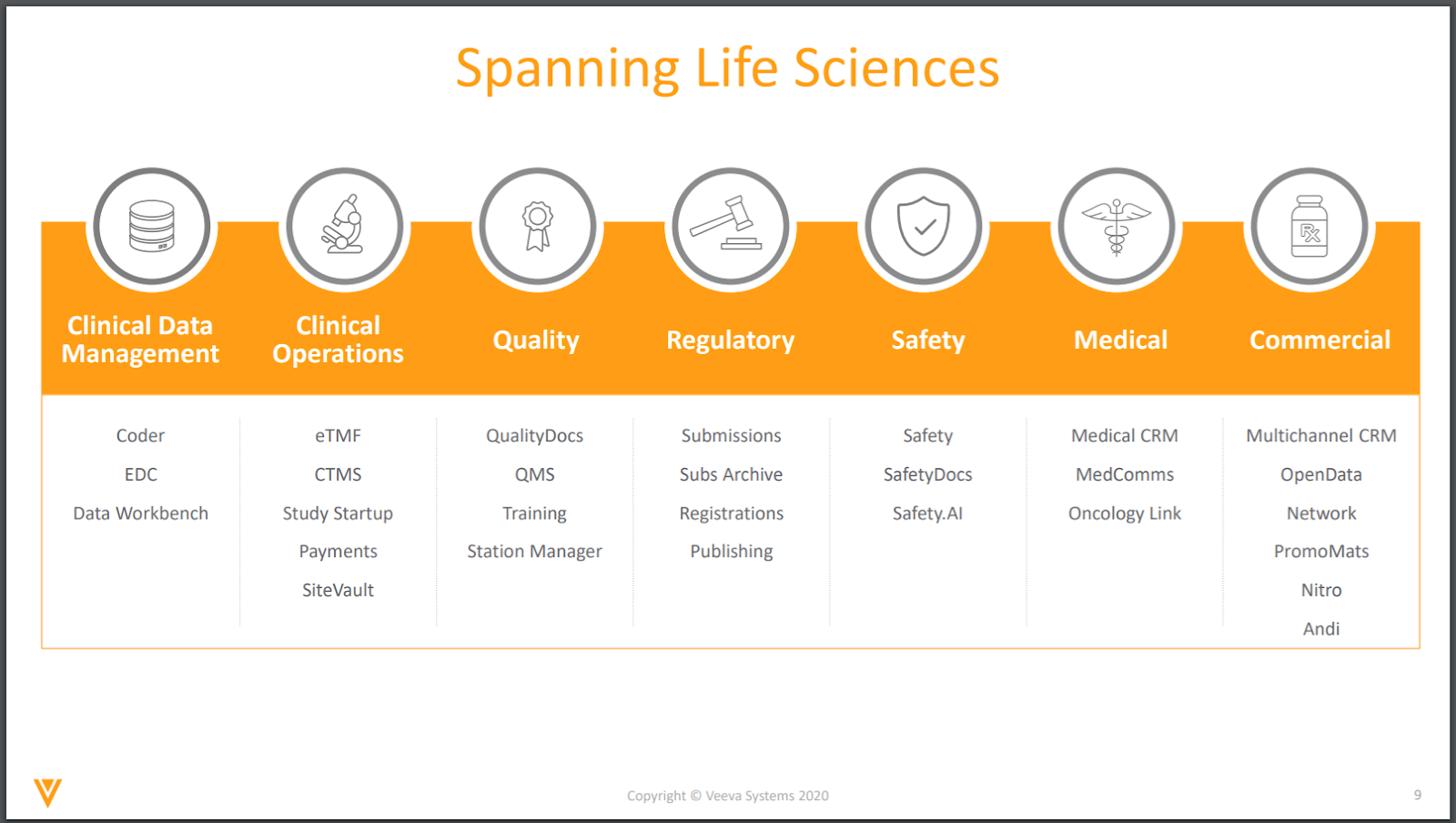

Here’s a graphic from Veeva showing the software products it has that support the commercial and research & development (R&D) activities of the life sciences industry:

Source: Veeva January 2020 investor presentation

There are a lot of software products that Veeva has, but the company groups them into three categories:

- Veeva Commercial Cloud supports a life sciences company’s sales & marketing activities. Some of the products within Veeva Commercial Cloud include a commercial data warehouse, customer relationship management (CRM) apps, data management apps, and key opinion leader data.

- Veeva Vault houses software that helps life sciences companies to manage content and data from R&D through to commercialisation.

- Veeva Data Cloud is a new service introduced in March 2020 that is scheduled for commercial launch in December 2020. Veeva Data Cloud is a patient and prescriber data service and will initially focus on patient and prescriber data solutions for the US specialty drugs distribution market. Veeva Data Cloud will be built on existing technology from Crossix, a privacy-safe patient data and analytics company that Veeva acquired in late 2019. In August 2020, Veeva revealed that it is already working with three adopters of Veeva Data Cloud.

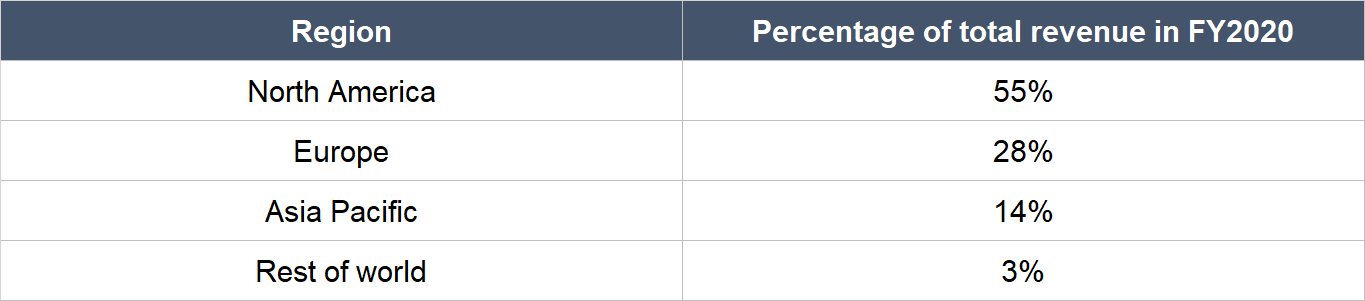

In FY2020 (the fiscal year ended 31 January 2020), 49% of Veeva’s total revenue of US$1.10 billion came from Veeva Commercial Cloud while the remaining 51% came from Veeva Vault. The table below gives an overview of the geographical breakdown of Veeva’s revenue in FY2020:

Source: Veeva FY2020 annual report

At the end of FY2020, Veeva had 861 customers in total. These customers range from the largest pharma and biotech companies in the world (such as Bayer, Eli Lilly, Novartis, and more) to small players in the same space (such as Alkermes, Ironwood Pharmaceuticals, and more).

In recent years, Veeva has started selling content and data management software services to companies outside of the life sciences industries. Veeva is targeting three regulated industries: Consumer goods, chemicals, and cosmetics (with a focus on consumer goods and cosmetics). We don’t have data on the exact split for Veeva in terms of revenue from life sciences and outside life sciences. But the lion’s share of the company’s revenue is still derived from the life sciences industry.

Investment thesis

We have laid out our investment framework in Compounder Fund’s website and will use the framework to describe our investment thesis for Veeva.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

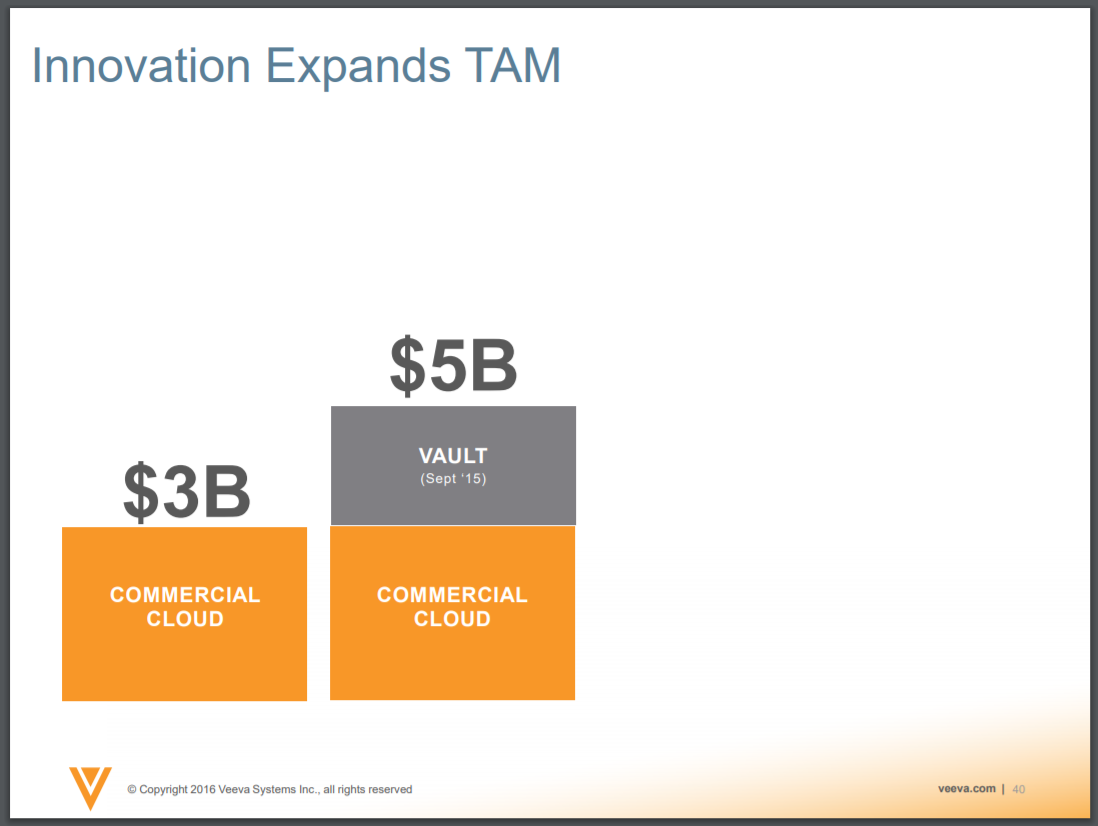

The total market opportunity for Veeva is currently over US$10 billion, which is nearly 10 times the company’s current revenue of US$1.28 billion in the last 12 months. The chart below shows the breakdown of Veeva’s market opportunity:

Source: Veeva January 2020 investor presentation

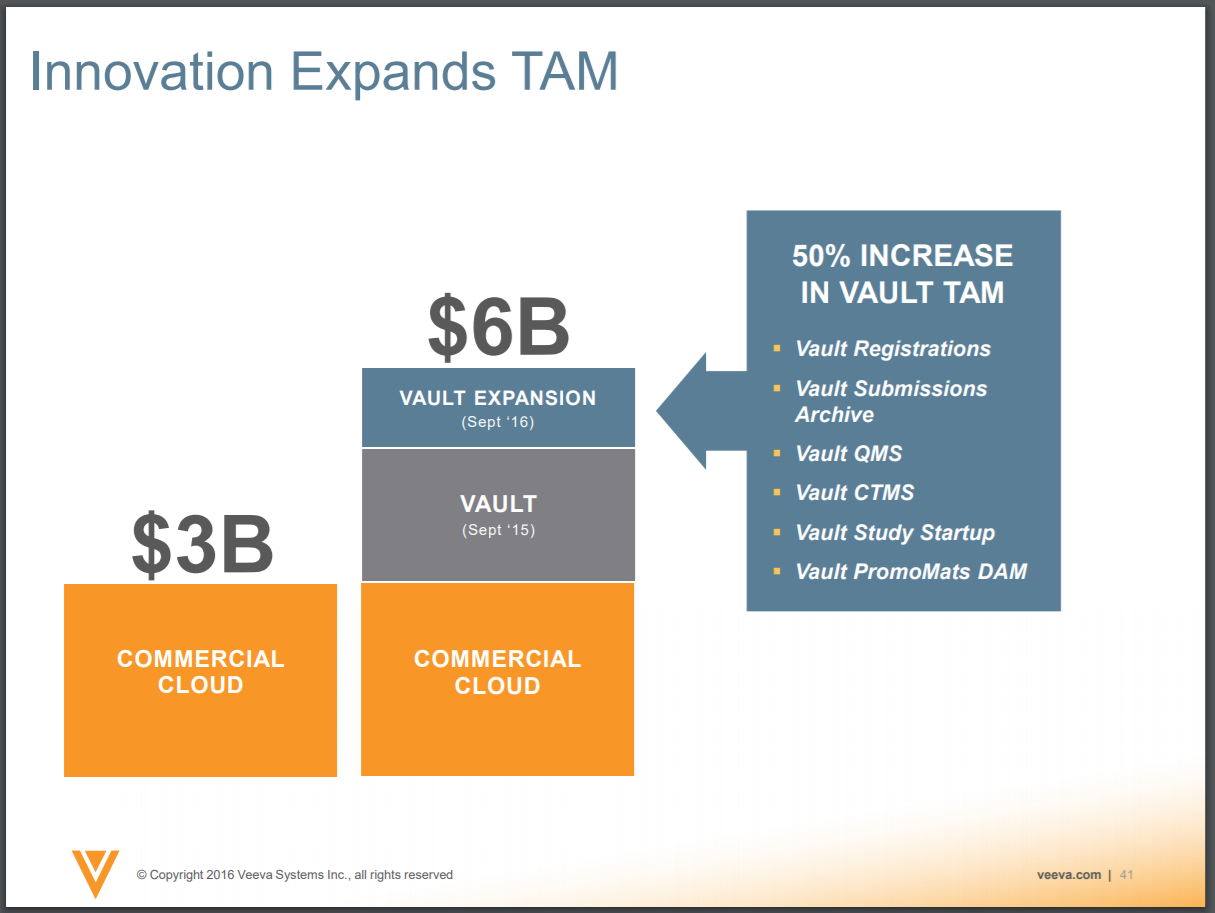

We also think it’s likely that Veeva’s market opportunity will grow over time. In Veeva’s September 2016 Investor Day presentation, management shared the charts below, which illustrate the company’s market opportunity back then. Management showed that Veeva’s market had expanded from US$5 billion in September 2015 to US$6 billion in September 2016 because of software innovation at the company. (More on Veeva’s innovation later!)

Source: Veeva September 2016 investor presentation

2. A strong balance sheet with minimal or a reasonable amount of debt

As of 31 July 2020, Veeva held zero debt and US$1.50 billion in cash and short-term investments. That’s a rock-solid balance sheet.

For the sake of conservatism, we also note that Veeva had US$57.3 million in lease liabilities. But that’s a tiny sum compared to the cash and short-term investments that the company had on hand.

3. A management team with integrity, capability, and an innovative mindset

On integrity

Leading Veeva as CEO is Peter Gassner, 55. Gassner is a co-founder of the company, and has served as Veeva’s CEO since the company’s founding in 2007. From 1995 to 2003, he was Chief Architect and General Manager at PeopleSoft. And from 2003 to 2005, Gassner was Senior Vice President of Technology at salesforce.com, one of the pioneering software-as-a-service companies (salesforce.com is also one of the companies in Compounder Fund’s portfolio). In our view, the relatively young age of Gassner, his years of experience in leadership roles in other tech companies, and his long tenure with Veeva, are positives.

The other important leaders in Veeva, most of whom have multi-year tenures and relatively young ages (both are good things in our eyes), include:

Source: Veeva proxy statements

(We note that in August 2019, Tim Cabral made the decision to retire as Veeva’s CFO and become an advisor to the company once a successor is appointed. On 8 June 2020, Veeva announced that Brent Bowman will become Veeva’s CFO after a 90-day transition period. During these 90 days, Cabral will remain as CFO. Bowman has held senior financial positions in a number of technology companies, including [24]7.ai, Intel, Altera, and Sun Microsystems, so he seems like a safe pair of hands to us.)

Veeva’s compensation structure for management makes us think that Compounder Fund’s interests as a shareholder of the company are well-aligned with management’s. Here are the key points:

- From Veeva’s IPO in October 2013 to FY2019, the company (1) was paying its key leaders cash compensation that were below market rates; (2) never offered any short-term cash-incentives to management; and (3) placed heavy emphasis on long-term stock awards, in the form of stock options and restricted stock units that vest over multiple years.

- In FY2019, all of the aforementioned leaders of Veeva were paid the same base salary of US$322,917, and nothing else – they were not given any equity awards. Management instead derived more compensation from vesting of stock awards that were given in previous years. The base salaries paid in FY2019 to Veeva’s management are rounding errors when compared with the company’s profit and free cash flow of US$229.8 million and US$301.0 million, respectively, for the same year.

- A new compensation structure was implemented in March 2019 for Veeva’s management – except for the CEO – for FY2020 and beyond. There are positives and a negative with the changes, though we think the pros outweigh the con. The positives: (1) The base salary for the company’s key leaders will be US$325,000; and (2) there will be long-term equity incentives in the form of stock options that will form the majority of each leader’s annual compensation and that vest over four years. The negative: There will now be a short-term incentive program made up of restricted stock awards that will vest over one year.

- The aforementioned changes to Veeva’s compensation structure are already in place, but will not be fully implemented until FY2021. But for perspective, Veeva’s key leaders – this includes Schwenger, Cabral, Mateo, and Zuppas, but excludes Gassner – received total compensation for FY2020 that ranged from US$1.9 million to US$8.1 million. For each leader, the long-term equity incentives made up the majority of their total compensation.

- In FY2018, Gassner was given US$87.8 million in stock options, which started vesting in February 2020 and will only finish vesting in February 2025, provided that Gassner continues to serve as CEO. Gassner will not be receiving any other long-term incentive awards until at least 2023. In FY2020, his total compensation was only his base salary of US$325,000 – there were no stock-related awards given to him.

We also note that Gassner controlled 16.68 million Veeva shares as of 31 March 2020. These shares are worth around US$4.57 billion at Veeva’s share price of US$274 as of 29 August 2020. This high stake lends further weight to our view that Veeva’s key leaders are in the same boat as Compounder Fund.

We want to highlight too that nearly all of Gassner’s shares (99.1%) are of the Class B variety. Veeva has two share classes: (1) Class B, which are not traded and hold 10 votes per share; and (2) Class A, which are publicly traded and hold 1 vote per share. As a result of holding Veeva Class B shares, Gassner alone controlled 51.8% of the company’s voting power as of 31 March 2020. In fact, all of Veeva’s senior leaders and directors combined controlled 57.9% of Veeva’s voting rights. This concentration of Veeva’s voting power in the hands of management (in particular Gassner) means that we need to be comfortable with the company’s current leadership. We are.

On capability

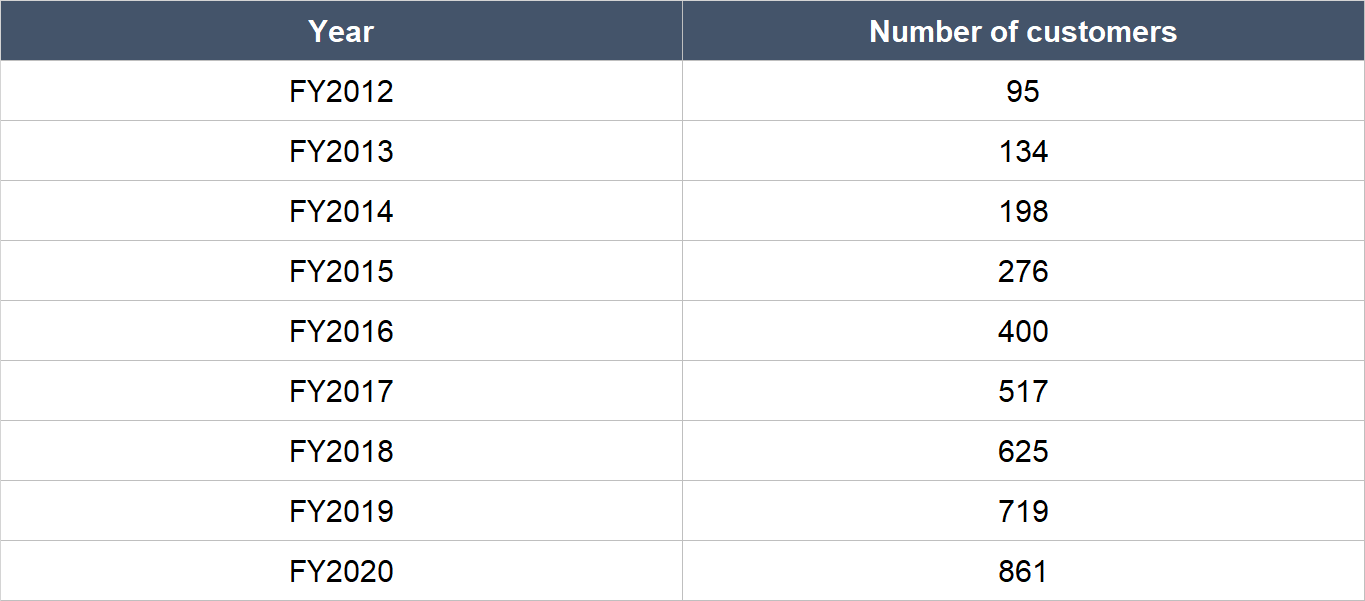

Over the years, Veeva’s management has done a great job in growing the company’s customer count (up 31.7% per year from 95 in FY2012 to 861 in FY2020). This is illustrated in the table below:

Source: Veeva annual reports

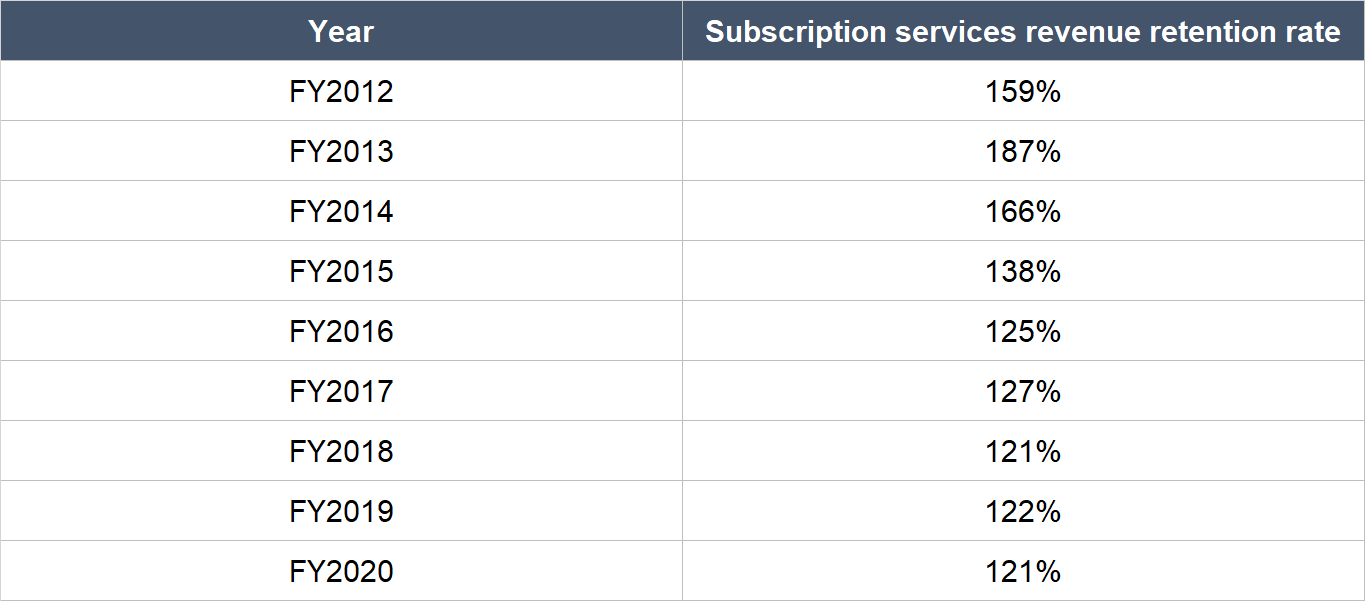

But there’s more. Management has also been adept at driving more spending over time from the company’s customer base. This can be seen in Veeva’s strong subscription services revenue retention rate. It essentially measures the change in subscription revenue from all of Veeva’s customers a year ago compared to today; it includes the positive effects of upsells as well as the negative effects from customers who leave or downgrade. Anything more than 100% indicates that Veeva’s customers, as a group, are spending more. The table below shows Veeva’s subscription services revenue retention rate over the past few years. There has been a noticeable downward trend in the metric, but the figure of 121% in FY2020 is still remarkable.

Source: Veeva annual reports

Impressively, Veeva has produced subscription services revenue retention rates of significantly more than 100% for many years because the company has succeeded at (1) getting its customers to adopt more products over time, and/or (2) winning more users at a customer for the same product; the strong subscription services revenue retention rates did not come from Veeva raising prices for its software solutions.

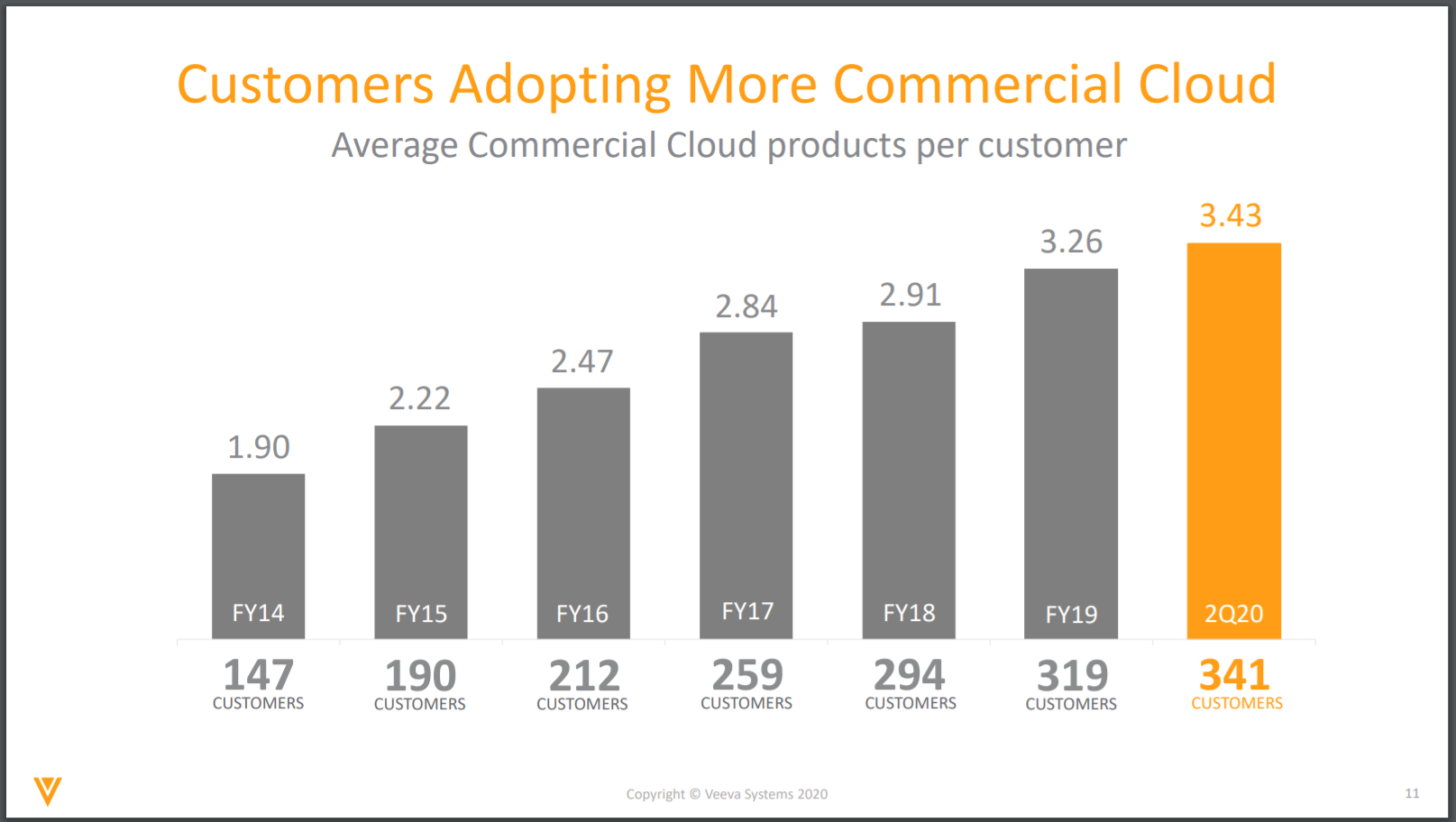

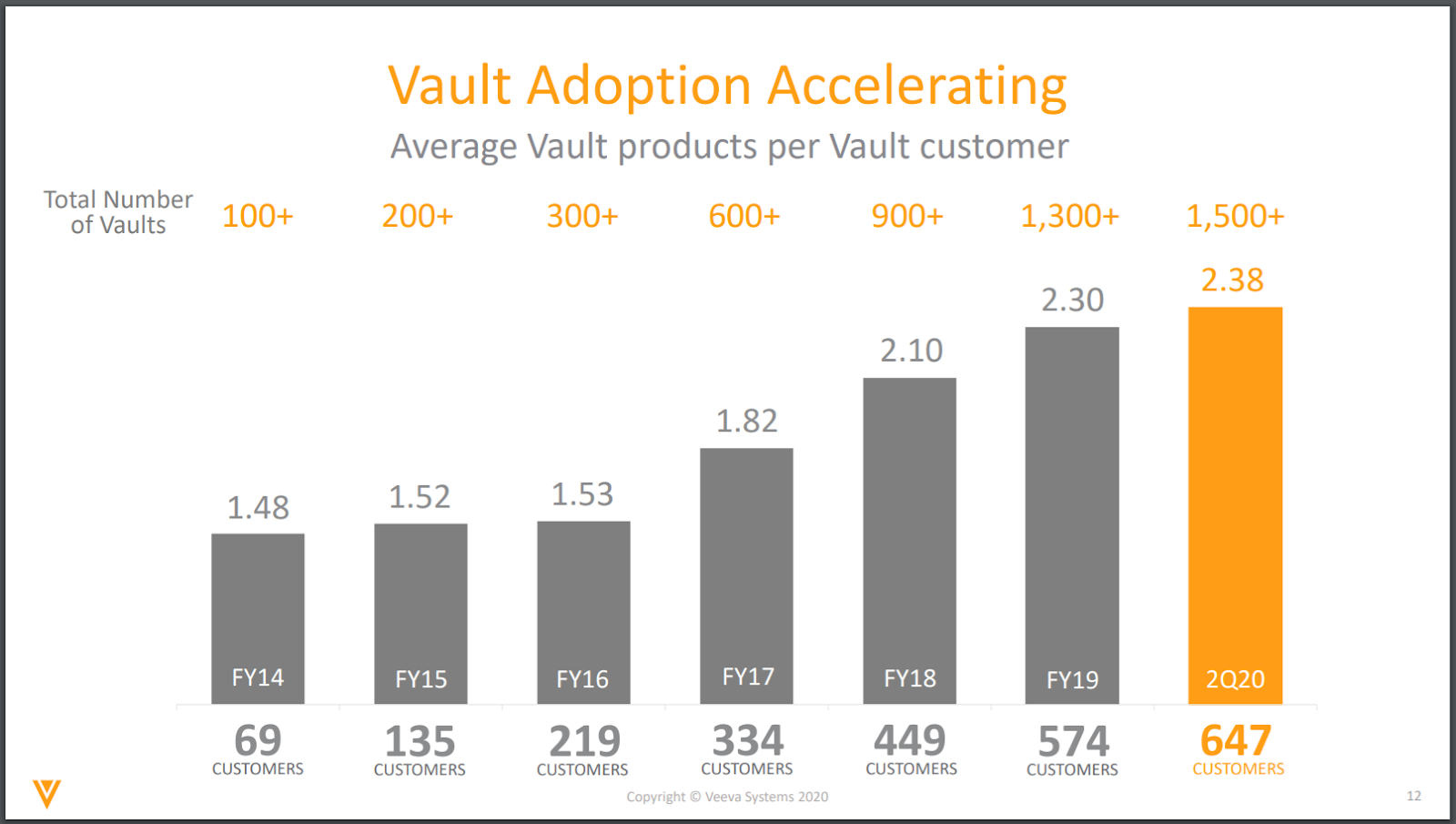

For another perspective, we can look at the growth in the average number of products that a Veeva Commercial Cloud and Veeva Vault customer is using:

Source: Veeva January 2020 investor presentation

During the second quarter of FY2021, Veeva added a record 357 net new employees. At a time when the US economy is suffering because of COVID-19 (US GDP fell by 9.1% year-on-year in the second quarter of 2020), Veeva is going on the offensive. We think this is a smart move by Veeva’s leadership and to us, it’s another positive sign on management’s capability.

There is a key area where Veeva’s management falls short though: The company’s culture. Veeva has a 3.6-star rating on Glassdoor, and only 62% of reviewers will recommend the company to friends. Gassner has an approval rating as CEO of only 76%. Veeva has managed to post impressive business results despite its relatively poor culture, but we’re keeping an eye on things here.

On innovation

Peter Gassner co-founded Veeva in 2007 with the view that “industry-specific cloud solutions could best address the operating challenges and regulatory requirements of life sciences companies.” He saw the market opportunity and grasped it with both arms, leading Veeva to become the first company to introduce a cloud-based CRM app – Veeva CRM – that caters to the global life sciences industry. It was not an easy ride for Gassner. Here’s a comment he gave in a 2017 interview with TechCrunch:

“Starting Veeva, I had the idea or vision you could make very industry-specific software in the cloud and it would be bigger than anyone would have thought. In 2007, [most] people thought that was incorrect.”

To us, the founding stories of Veeva are a great sign of an innovative management team. Over time, Gassner and his team have also continued to lead successful product-innovation at Veeva. There are three examples we want to point to.

First, Veeva Vault was introduced in 2011, and has grown rapidly from around 5% of Veeva’s revenue in FY2014 to 51% of total revenue in FY2020.

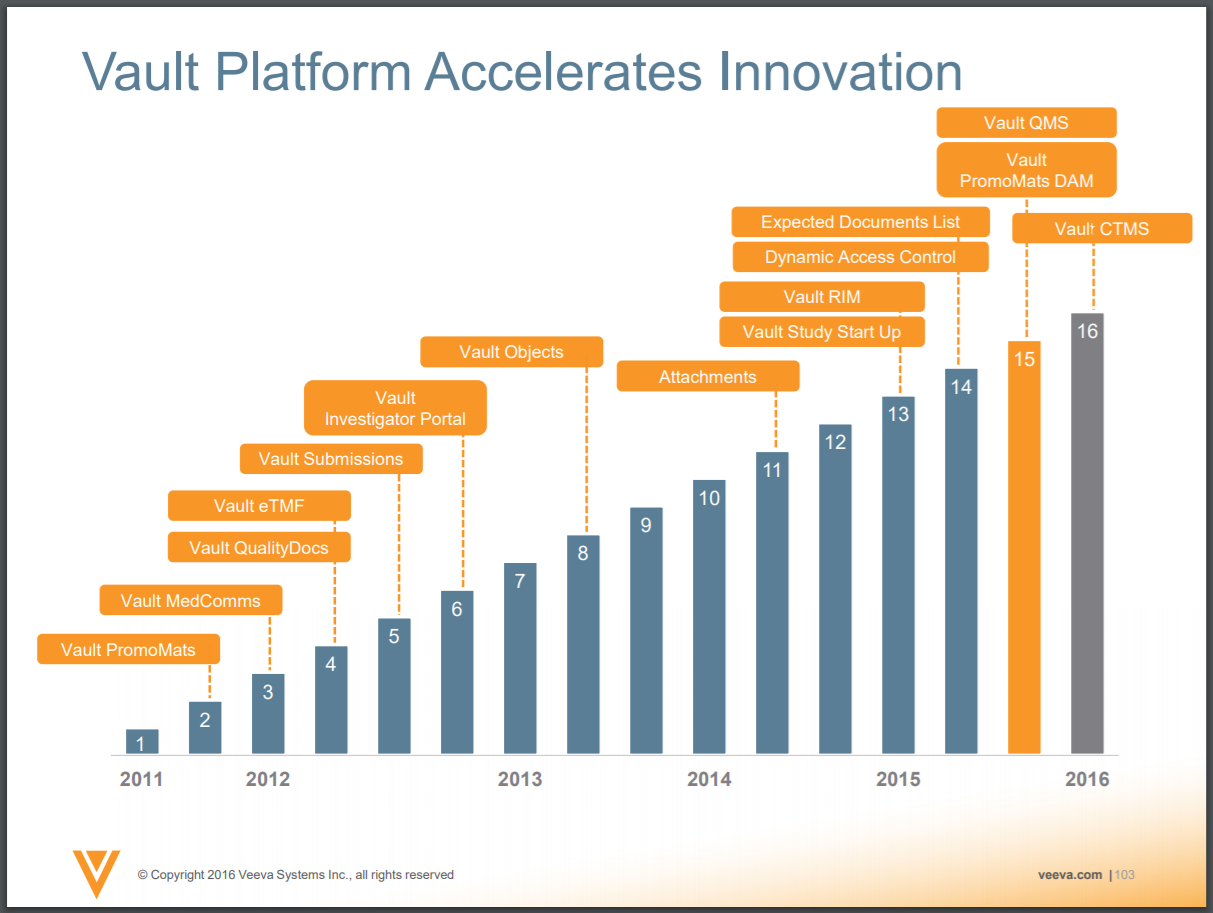

Second, Veeva has been relentless in creating new products. Here’s a chart showing the growth in the number of applications within Veeva Vault from 2011 to 2016:

Source: Veeva September 2016 investor presentation

Third, the company is now selling content and data management cloud-based software to regulated industries outside of life sciences, as mentioned earlier. It’s early days for this recent foray, but the signs are promising. Here are comments from Gassner in Veeva’s recent earnings conference calls:

“[FY2020 fourth quarter]

Outside life sciences for CPG [consumer packaged goods], chemicals and cosmetics, we had a number of expansions and added some big wins with new companies, including a top 10 CPG company, who will adopt QualityOne, and a top 10 cosmetics company to standardizing on RegulatoryOne. In reflecting on the year for this business and looking ahead, we set the right course in the Veeva Way. We kept our focus on customer success and doing the right things for our early adopters, which is helping establish Veeva as a trusted provider in these new industries.”“[FY2021 first quarter]

Now to our work outside life sciences in cosmetics and consumer goods. These industries have experienced major impacts from COVID-19. Cosmetic companies have seen a significant drop in demand, while CPG companies selling essential products have benefited from consumer stockpiling and have seen higher demand for certain product. Our team continues to execute well. This quarter, a new top 10 CPG company selected QualityOne for an initial deployment. Since the onset of the pandemic, this customer has experienced a rapid spike in demand.To secure their supply chain, they needed to quickly establish and track testing and auditing information for their suppliers. Our team was able to deliver a supplier quality management system within three weeks. So our outside of life sciences business is experiencing some disruption due to COVID-19, I’m very proud of how they have continued to build Veeva’s reputation for customer success and as a trusted partner within these new industries.”

“[FY2021 second quarter]

The industries we serve continue to be impacted by the pandemic, but I’m encouraged by the success we’re having with existing customers who continue to expand their use of Veeva. For instance, a top CPG company will replace an established incumbent with our quality applications across all their business units. Additionally, we continue to make progress with new customers. A top 20 agrochemicals business has selected regulatory solutions as their enterprise standard. Overall, the team had a strong quarter and is executing well.”

One particular new product-innovation at Veeva that we’re watching is MyVeeva, the company’s first consumer-facing software product. It was first announced in May this year. Here’s Gassner talking about MyVeeva in Veeva’s last two earnings conference calls:

“[FY2021 first quarter]

Just two weeks ago, at our R&D Customer Summit, we announced MyVeeva for clinical trials. This is our first patient-facing application. It will help patients through the clinical trial process from managing medications and appointments to participating in remote doctor visits. MyVeeva will enable clinical research sites around the world to eliminate paper and deliver a better patient experience. The product is planned for release in Q4 and will be free for clinical research sites. MyVeeva has the potential to remove most of the paper from the clinical trial process and transform the patient site and sponsor experience.”“[FY2021 second quarter]

One of the newer areas that’s created a lot of excitement is MyVeeva. MyVeeva is the overall brand of our two consumer-facing applications, one targeted to patients in clinical trials and one for doctors.This is important new territory for Veeva and for the industry as we provide better ways for our customers to serve patients and doctors online. I talked about MyVeeva for clinical trials on our last earnings call. And this quarter, I will give an update on MyVeeva for Doctors. We announced MyVeeva for Doctors at Veeva Commercial Summit in June. MyVeeva for Doctors, a website and mobile application, can make it easier for doctors to connect with life sciences. It will provide a single place where doctors can go to get information, services and contact directly from life sciences companies in a standard, easy-to-use format.

Today, there is no single place for doctors to go for this. MyVeeva for Doctors has the potential to be a game changer. This product will be available at the end of the year for the U.S. market, and we’re currently in discussions with a handful of potential early adopters.”

We also want to point out the presence of Gordon Ritter as Veeva’s Chairman. Ritter is a founder of Emergence Capital, a venture capital firm that is one of the earliest backers of salesforce.com (Ritter was a driving force behind Emergence Capital’s decision to invest in the company). Emergence Capital is also one of the early investors in Veeva. We think having Ritter as a director allows Veeva’s management to tap on a valuable source of knowledge. Ritter has been a director of Veeva since 2008 and he controlled 1.635 million Veeva shares as of 31 March 2020, a stake that’s worth around US$448 million at the 29 August 2020 share price.

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

Veeva generates the lion’s share of its revenue through subscriptions to its software services, which are recurring in nature. In FY2020, 81% of Veeva’s total revenue of US$1.10 billion came from subscriptions. The majority of the company’s subscriptions with customers are for a term of one year. The remaining 19% of Veeva’s revenue in FY2020 was from professional services, where the company earns fees from helping its customers implement and optimise the use of its software suite.

There’s some form of customer concentration in Veeva – 36% of its revenue in FY2020 came from its top 10 customers. This is a risk. But we’re comforted by the high likelihood that Veeva’s software services are mission-critical in nature for the company’s customers. For instance, the distribution of marketing and promotional material for the life sciences industry is highly regulated. This is where Veeva CRM can help through one of its applications, which enables the management, delivery, and tracking of emails from life sciences sales representatives to healthcare professionals, while maintaining regulatory compliance. In another example, the US FDA (Food & Drug Administration) requires life sciences companies to maintain full audit trails for the handling of electronic records; in fact, changes in data cannot overwrite previous records. Veeva Vault’s suite of apps helps life sciences companies meet the strict regulatory requirements for documentation.

5. A proven ability to grow

The table below shows Veeva’s important financial figures from FY2011 to FY2020. We like what we’re seeing:

Source: Veeva annual reports and IPO prospectus

A few key points about Veeva’s financials:

- Revenue has compounded impressively at 49.8% per year from FY2011 to FY2020. The rate of growth has slowed in recent years, but was still really strong at 28.7% per year from FY2015 to FY2020, and at 28.1% in FY2020.

- Net profit has surged tremendously since FY2011. Growth from FY2015 to FY2020 has been excellent at 49.6% annually; in FY2020, profit was up by a solid 31.0% too.

- Operating cash flow has consistently been positive for the timeframe I’m looking at, and has also increased significantly over time. The annual growth rate for operating cash flow from FY2015 to FY2020 was impressive, at 45.3%; in FY2020, operating cash flow climbed 40.7%.

- Free cash flow has also (1) been consistently positive for the time period we’re studying, and (2) stepped up strongly. Veeva’s free cash flow was up by 60.5% per year from FY2015 to FY2020, and was up by 43.9% in FY2020 – these are eye-catching numbers.

- The company’s balance sheet remained robust throughout the timeframe under study, with zero debt the entire way.

- At first glance, Veeva’s diluted share count appeared to increase sharply by 111.4% from FY2014 to FY2015. (We only started counting from FY2014 since Veeva was listed in October 2013, which is in the second half of FY2014.) But the number we’re using is the weighted average diluted share count. Right after Veeva got listed, it had a share count of around 122 million. Moreover, Veeva’s weighted average diluted share count showed a negligible growth rate of just 1.9% per year from FY2015 to FY2020.

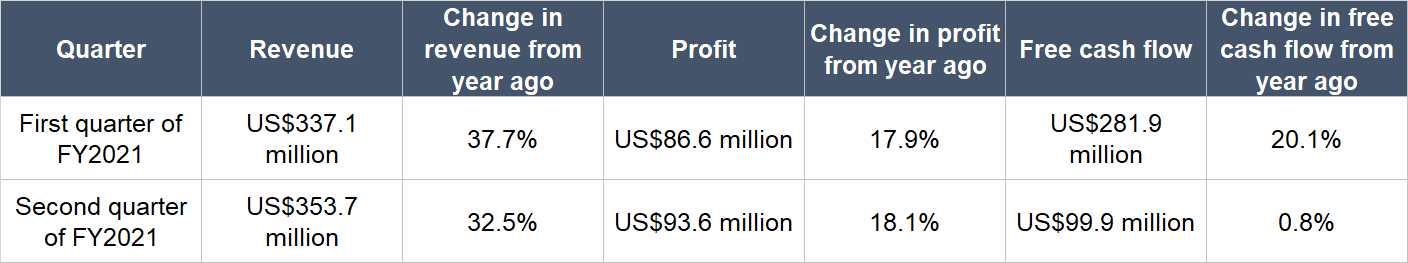

As mentioned earlier, the US economy has been hit hard by COVID in 2020. Some of Veeva’s customers – both within and outside the life sciences industry – have been negatively impacted. But this has not stopped Veeva from posting impressive growth in FY2021 so far, as you can see from the table below. Veeva’s management also commented in the company’s FY2021 second-quarter earnings call that its customers are seeing conditions improve:

“Our life sciences customers reported that the second quarter was as expected with fewer patient visits, delayed procedures and the reversal of Q1 stockpiling. They see some areas improving and are more optimistic as they look to the second half. More clinical trials are starting back up as clinical research sites reopen. Of the studies that were disrupted, roughly half have now restarted.”

Source: Veeva earnings updates

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

There are two reasons why we think Veeva excels in this criterion.

First, the company has done very well in producing free cash flow from its business for a long time. Its free cash flow margin (free cash flow as a percentage of revenue) has also increased steadily from an already strong level of 18.5% in the year of its IPO. In FY2020, Veeva’s free cash flow margin was an incredible 39.2%. In the first half of FY2021, the free cash flow margin was 55.3% (we do expect the margin to fall over the course of the fiscal year). As a cloud-based software company, we don’t see any reason why Veeva cannot maintain a fat free cash flow margin in the future.

Source: Veeva annual reports

Second, there’s still plenty of room to grow for Veeva. Over time, we expect Veeva to significantly increase both its customer count and the average number of products used per customer. These assumptions mean that Veeva should see robust growth in revenue in the years ahead. If the free cash flow margin stays fat – and we don’t see any reason why it shouldn’t, as we mentioned earlier – that will mean even more free cash flow for Veeva in the future.

Valuation

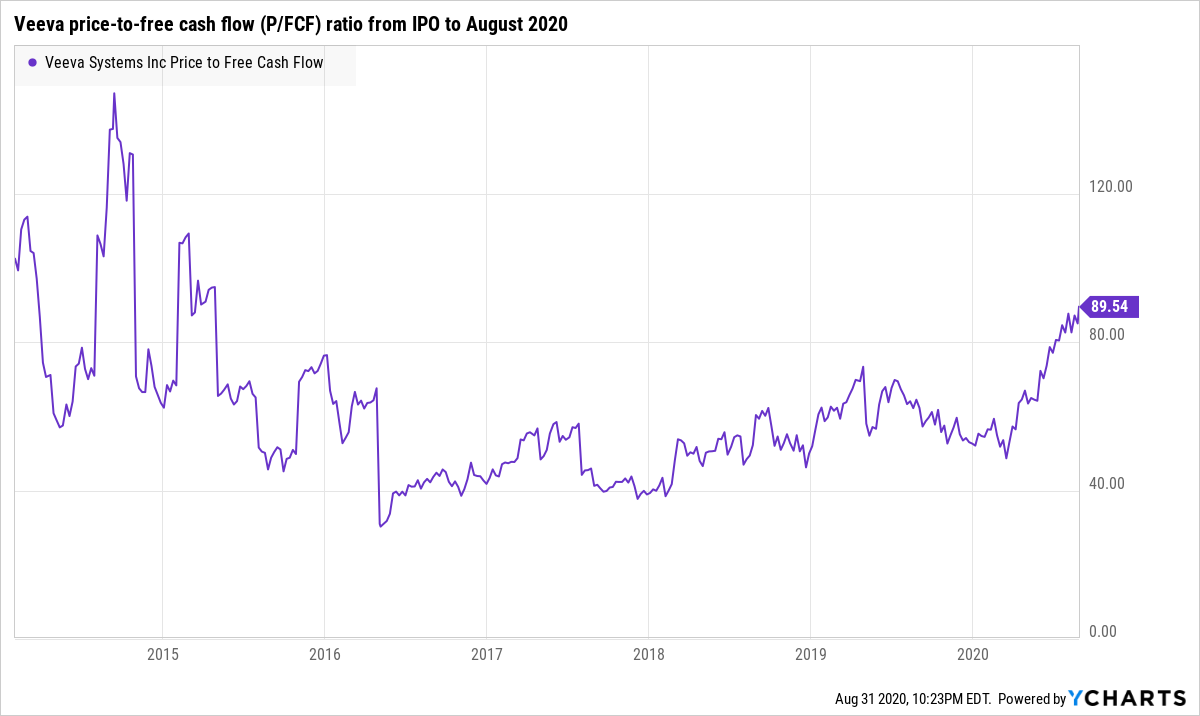

We like to keep things simple in the valuation process. In Veeva’s case, we think the price-to-free cash flow (P/FCF) ratio is an appropriate metric to value the company. This is because the SaaS company has a strong history of producing positive and growing free cash flow.

We completed our purchases of Veeva shares with Compounder Fund’s initial capital in late July 2020. Our average purchase price was US$263 per Veeva share. At our average price and on the day we completed our purchases, Veeva shares had a trailing P/FCF ratio of around 87. This is a pretty darn high valuation – we recognise this. And although the chart below shows that Veeva’s P/FCF ratio had been much higher in the past, the P/FCF ratio has averaged at 56, significantly lower than our purchase-valuation.

But there are strong positives in Veeva’s favour too. The company has: (1) Revenue that is low compared to a large and possibly fast-growing market; (2) a software product that is mission-critical for users; (3) a large and rapidly expanding customer base; and (4) sticky customers who have been willing to significantly increase their spending with the company over time. We believe that with these traits, there’s a high chance that Veeva will continue posting excellent revenue growth – and in turn, excellent free cash flow growth – in time to come.

For perspective, Veeva carried a trailing P/FCF ratio of around 91 at the 29 August 2020 share price of US$274.

The risks involved

We see seven big risks with Veeva. In no particular order…

First, we think there’s key-man risk with the company. Peter Gassner – and his co-founder Matt Wallach – were the ones with the vision. And over time, we think Gassner has been instrumental in leading Veeva to success. Wallach relinquished an active management role at the company in 2019. Should Gassner leave for any reason, we will be concerned.

Second, there’s customer-concentration, as we already mentioned.

Veeva’s relationship with salesforce.com is the third risk we’re watching. The two companies have a long-standing contract that ends on 1 September 2025. Based on the agreement, salesforce.com provides hosting infrastructure and data centers for portions of Veeva’s CRM applications. There is also a non-compete arrangement, where salesforce.com will not compete directly with Veeva’s CRM applications within the pharma or biotech industry. In return, Veeva has to pay salesforce.com a fee of at least US$500 million by the end of the contract. This agreement is important as parts of Veeva Commercial Cloud are built on salesforce.com’s Salesforce1 platform. (Veeva Vault is built on Veeva’s own proprietary platform.)

Based on the change in language used in Veeva’s annual reports for FY2020, FY2019, and FY2018 to describe Veeva’s partnership with saleforce.com, there appears to be a deterioration in the two companies’ relationship in recent years. We’re watching what happens if and when Veeva’s contract with salesforce.com is terminated. Veeva has already clocked 13 years of experience in providing CRM software that is focused on the life sciences industry. This gives us confidence that Veeva will be able to stand on its own even if salesforce.com pulls the plug on the existing CRM-partnership. But only time will tell.

The fourth risk we have an eye on relates to legal wrangles between Veeva and IQVIA. Veeva named IQVIA as its most significant competitor in the CRM software market for the life sciences industry in its FY2020 annual report. It’s worth noting that IQVIA’s CRM software is also built on the Salesforce1 Platform. IQVIA competes against certain applications within Veeva Vault too. For some background, here are excerpts from a February 2020 announcement by Veeva:

“Veeva Systems (NYSE: VEEV) today announced it is gaining widespread customer support for its antitrust lawsuit against IQVIA (NYSE: IQV). Six of the largest global pharmaceutical companies were among more than 70 depositions gathered as part of the fact discovery phase of the case. As its initial lawsuit successfully advances, Veeva filed a motion this week to expand its legal action to include additional Veeva software applications that IQVIA is excluding customers from using with IQVIA data…

…IQVIA has a long history of abusing its monopoly position to limit customers and competition. Since 2014, IQVIA has prevented companies from using OneKey reference data with Veeva’s master data management software, Veeva Network Customer Master. Over the past two years, IQVIA also began restricting the use of all IQVIA data with Veeva Nitro, a next-generation commercial data warehouse, Veeva Andi, an artificial intelligence (AI) application, and other Veeva software applications.

After three years of trying to work with IQVIA in good faith toward a resolution regarding Veeva’s master data management software to no avail, Veeva filed its first antitrust lawsuit in 2017 to end IQVIA’s long history of anti-competitive behavior. IQVIA’s motion to dismiss that case failed and fact discovery is now substantially complete. Trial is expected to take place in late 2021. [Because of COVID-19, the trial is now expected to happen near the end of 2022.]”

Despite IQVIA’s fiercely anti-competitive behaviour in the past few years, Veeva has still managed to grow its business significantly. Veeva’s management commented in the company’s FY2020 fourth-quarter earnings conference call:

“IQVIA is our primary competitor, as you know, there’s certainly regional competitors that we have, but they’re the ones that are primary in terms of global kind of scope there. IQVIA has continued to be aggressive in terms of how they approach the market in of pricing and bundling. Some of their projects have been a bit more services oriented, instead of standard product. And I think over the short-term that sort of thing could work out. I think over the long-term custom projects are not great.

From Veeva’s perspective, we had really great success last year. I’m really proud of what we’ve accomplished. Peter highlighted that we had 63 net new CRM customers, compared with the year before, where it was 46. So we’ve grown and we’ve actually expanded our share last year. And of those wins, most of them came — most of them were head to head with IQVIA, and many of them were IQVIA replacements. So I’m really proud of what we’ve accomplished. That’s the results. The results, I think, speak for themselves in terms of what we’re doing, where — we think our strategy is the right one, which is focus on product innovation and focus on customer success. So we’re innovating within core CRM in many different ways.”

It’s hard to predict the result of the legal battle between the two companies. But even if IQVIA wins, our bet is that Veeva will still be able to continue growing for two reasons. First, Veeva was able to grow even though IQVIA had already been behaving aggressively for some time. Second, IQVIA’s Technology & Analytics Solutions (TAS) business segment competes with Veeva, and the segment’s growth has been relatively poor compared with Veeva. In 2019, and the first half of 2020, IQVIA’s TAS segment experienced year-on-year revenue growth of just 8.4%, and 2.3%, respectively. We can’t tell for sure how much of the TAS segment’s revenue comes from products that directly compete with Veeva’s offerings, but we’re encouraged by the numbers we’re seeing. Again, it’s only with time that we can know if Veeva can hold its own against IQVIA even if Veeva loses the lawsuit.

The fifth important risk we’re seeing relates to competition in general. As Veeva expands, it’s likely that Veeva Commercial Cloud and Veeva Vault could increasingly butt heads with services from tech giants such as Oracle, Microsoft, and Amazon (Compounder Fund also owns Microsoft and Amazon shares). These companies have substantially stronger financial might than Veeva.

Veeva’s high valuation is the sixth risk. The high valuation adds pressure on the company to continue executing well; any missteps could result in a painful fall in its stock price. This is a risk we’re comfortable taking.

Lastly, we’re still watching potential impacts to Veeva’s growth from COVID-19. The outbreak of the respiratory virus has resulted in severe negative impacts to the global economy because of measures to fight the disease, such as the closing of businesses and the restriction of human movement. We think that the mission-critical nature of Veeva’s service means that its business is less likely to be harmed significantly by any coronavirus-driven recession. Veeva has so far continued to grow its business admirably (revenue growth was 35% in the first half of FY2021) but there could still be headwinds in the future.

Summary and allocation commentary

In summary, Veeva has:

- A valuable cloud-based CRM and content and data management software platform that is mission-critical for companies in the life sciences industry;

- High levels of recurring revenue;

- Outstanding revenue growth rates;

- Positive and growing operating cash flow and free cash flow, and fat free cash flow margins;

- A large, mostly untapped addressable market that could potentially grow in the years ahead;

- An impressive track record of winning customers and increasing their spending; and

- Capable and innovative leaders who are in the same boat as the company’s other shareholders

Veeva does have a rich valuation, so we’re taking on valuation risk. There are also other risks to note, such as the company’s complicated relationship with salesforce.com, and its legal battles with IQVIA. COVID-19 could also eventually place a dampener on Veeva’s growth.

After weighing the pros and cons, we initiated a 2.5% position – a medium-sized allocation – in Veeva with Compounder Fund’s initial capital. We appreciate all the positives that we see in Veeva, but our enthusiasm is also tempered by the company’s high valuation and the uncertainties associated with the Veeva-salesforce.com relationship.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share.