Compounder Fund: TSMC Investment Thesis - 27 Apr 2022

Data as of 25 April 2022

Taiwan Semiconductor Manufacturing Company (NYSE: TSM), or TSMC, is based in Taiwan and listed in both Taiwan and the USA. It is a company in Compounder Fund’s portfolio that we invested in for the first time in April 2022 (we bought the US-listed shares because of convenience). This article describes our investment thesis for the company.

Company description

A semiconductor chip is a miniaturised electronic circuit that is built on a small thin piece of semiconductor material, typically silicon. These chips, also known as integrated circuits, are the backbone of the modern digital world. They are the components that allow computers and electronic devices to perform the wonderful technological feats we take for granted today. In the 1960s and 70s, the legendary co-founder of Intel, Gordon Moore, gave the world Moore’s Law, his observation that the number of transistors in a chip (a transistor is essentially a tiny electrical switch) would double every two years. Moore’s Law has been a driving force in global technological innovation because a chip becomes faster and more powerful with more transistors on it. TSMC is a key player helping to power Moore’s Law today.

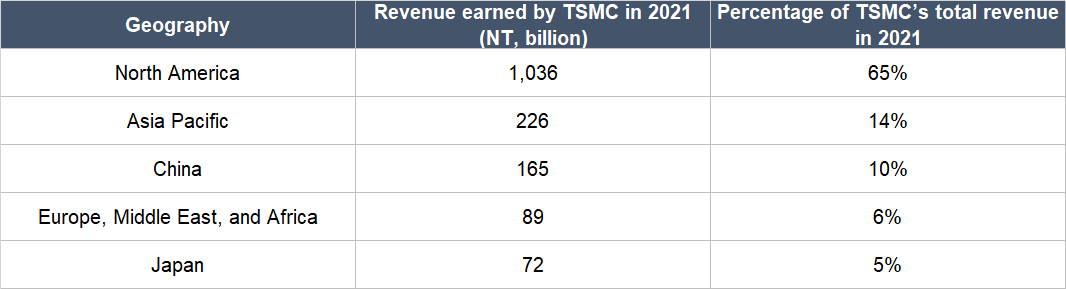

Given its name, it should not come as a surprise that TSMC’s business is about manufacturing semiconductor chips, mostly in Taiwan. The company has 12 active chip manufacturing plants and nine of them are in Taiwan; of the remaining three, two are in Mainland China while one is in the USA. But while TSMC’s manufacturing is concentrated in Taiwan, its customers are global. Based on where its customers are headquartered, 65% of its total revenue of NT$1.59 trillion (around US$56.8 billion; NT$1 translates to around US$0.034) in 2021 came from North America. The other geographical regions where TSMC’s customers are based are shown in Table 1 below:

Table 1; Source: TSMC 2021 annual report

Speaking of TSMC’s customers, the company’s chips were sold to 535 customers in 2021. These customers include fabless semiconductor companies (companies that design but do not manufacture semiconductor chips), integrated device manufacturers (companies that design and manufacture semiconductor chips), and consumer electronics companies. Among TSMC’s customers are some of the world’s largest companies, such as NVIDIA (fabless), Intel (integrated device manufacturer, or IDM), and Apple (consumer electronics). TSMC runs a pure-play foundry model, where it acts solely as a contract-manufacturer of semiconductor chips for its customers. Since its founding in 1987, TSMC has consistently stayed true to the pure-play foundry model and has strictly avoided designing, fabricating, or marketing its own-branded semiconductor chips.

There are a wide variety of semiconductor chips but they can be broadly grouped into three categories: Logic; memory; and DAO (discrete, analog, and other). Logic chips are used for computation and they can be seen as the “brains” that allow computers and electronic devices to process data. Memory chips, meanwhile, are for data storage, as their name suggests; compared to logic chips, memory chips are more of a commodity product. The last category, DAO, are chips that interact with the physical world, such as converting light or sound into electrical signals. TSMC’s focus is on logic chips although it has some exposure to chips in the DAO category.

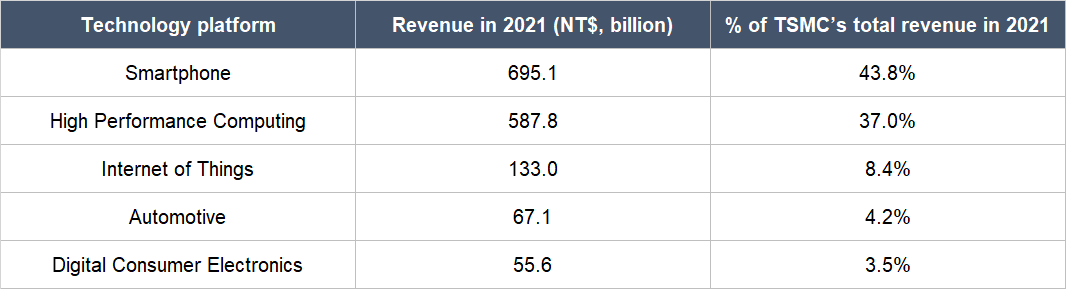

Within TSMC, the company categorises its chips in two ways: (1) By technology platform; and (2) by process technology. The first categorisation, technology platform, refers to the end markets where TSMC’s chips are found. TSMC has five main platforms, some with self-explanatory names:

- Smartphone

- High Performance Computing, which includes personal computers, tablets, game consoles, data icenter servers, and more

- Internet of Things, which encompasses a wide variety of connected devices; some examples include smart wearables, smart speakers, smart health devices, and smart industrial devices

- Automotive, which includes chips used for electric vehicles, advanced driver assistance systems, and smart cockpit/infotainment systems

- Digital Consumer Electronics.

A breakdown of TSMC’s revenue in 2021 by the technology platforms is found in Table 2. Smartphones and HPC accounted for the lion’s share of TSMC’s revenue for the year.

Table 2; Source: TSMC 2021 annual report

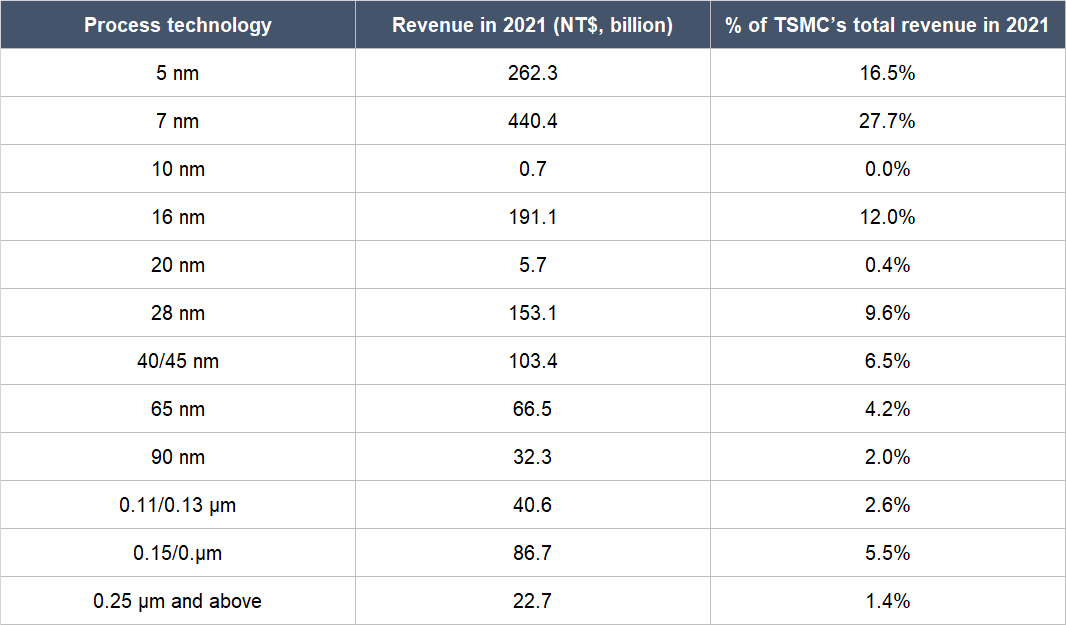

Process technology, the second way TSMC categorises its chips, refers to the node sizes of the chips. A node size, in layman terms, refers to the dimension of the transistors found in a chip. And how the semiconductor industry progresses is by steadily reducing the node size over time. The chips that TSMC is currently manufacturing at volume come in a range of node sizes, from 0.25 µm (0.25 micron) and above at the largest end, to just 5 nm (5 nanometres) at the smallest. For perspective on the node sizes, a human hair’s diameter is around 75 µm or 75,000 nm, and a 5 nm chip designed by Apple that goes into its laptops – the chip is manufactured by TSMC – contains up to 57 billion transistors. Table 3 below shows the revenue earned by TSMC from each process technology in 2021.

Table 3; Source: TSMC 2021 annual report

Earlier in this article, we mentioned that TSMC is a key player helping to power Moore’s Law today. This is because the most advanced chips in the world that can currently be produced at volume are 5 nm chips; and according to data from Capital Economics cited by a November 2021 CNBC article, TSMC accounts for 92% of the global manufacturing volume for these chips. TSMC’s dominance extends to other leading edge nodes. The Financial Times reported early last year that TSMC was responsible for between 80% and 90% of global revenue produced by foundries in 2020 for chips with node sizes of 10 nm to 5 nm; Samsung from Korea accounts for the rest. In 2021, 7 nm and 5 nm chips were the two most important process technologies for TSMC and they collectively accounted for 44.3% of the company’s total revenue. Put another way, leading edge chips are an important part of TSMC, and TSMC is the most important manufacturer of them in the world.

Investment thesis

We have laid out our investment framework in Compounder Fund’s website. We will use the framework to describe our investment thesis for TSMC.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

TSMC already has a significant 56% share of the global semiconductor foundry market in 2021. But TSMC expects the market’s growth to “outpace the high single-digit compound annual growth rate projected for the worldwide semiconductor market excluding memory from 2021 through 2026.” We think this projection for a high single-digit to mid-teens growth rate for the foundry market makes sense. This is because we see a high probability that significantly more data will be generated across the world in the years ahead and this data would need to be transmitted, stored, and analysed. In turn, there should be growing demand for semiconductor chips as they are required for the production, transmission, storage, and analysis of data.The Netherlands-based ASML is an important supplier to TSMC. In order for TSMC to manufacture leading edge chips, it needs EUV (extreme ultraviolet) lithography machines and ASML is the only company in the world that can build them. In our thesis for ASML published in May 2021, we discussed the explosion in data-quantity that is expected to happen:

“There are around 40 billion connected devices currently in use, with more being added every second. This number is expected to increase to 350 billion devices by 2030. Connected IoT devices are expected to create up to 175 ZB (zettabyte) of data per year by 2025. In other words, one zettabyte (1021 byte) equals a trillion gigabytes, and to download 175 ZB data with average current internet connection speed would take one person 1.8 billion years. This big data will need to become fast data to allow for ubiquitous computing as we move towards ‘edge’ computing, where processing is brought as close to the source of data as possible, rather than in the cloud.”

In our view, TSMC has a high chance of benefiting from the potential growth in demand for semiconductor chips. As we shared in the “Company description” section of this article, TSMC dominates the global production of the most advanced chips in the world today. This was not always the case.

When TSMC first went into business in 1987, its own process technology was at least two-and-a-half generations behind the leading edge chips at the time. But over the years, TSMC was relentless in improving its process technology. For perspective, the company shrank its most advanced node at volume production from 0.6 µm in 1994 (the year of its IPO in Taiwan) to 0.15 µm in 2000, 0.09 µm in 2005, 0.04 µm in 2010, and 0.016 µm in 2015. In 2018, TSMC became the first chip maker in the world to manufacture 7 nm (0.007 µm) chips at volume even as some of its foundry competitors – GlobalFoundries and UMC – decided to stop their 7 nm programs. 2018 was also the same year that Intel – then the world’s most advanced chip maker, a status it held for a long time – lost its manufacturing lead, after it failed to scale production of its 10 nm chips (Intel’s 10 nm chips are equivalent to TSMC’s 7 nm).

But TSMC is not content to simply coast. During TSMC’s 2021 first-quarter earnings call, management revealed that the company would be investing US$100 billion in capital expenditure over three years to meet growing customer demand, maintain the company’s technological leadership, and conduct research & development on even smaller nodes. But the already-massive capital expenditure plan was upgraded recently. In TSMC’s 2021 fourth-quarter earnings call, management said that the company’s capital expenditure for 2022 would be a staggering US$40 billion to US$44 billion. TSMC also expects to enter volume production of 3 nm chips in the second half of 2022 and this new node will be the most advanced in the world when it is introduced. In addition, TSMC is developing its 2 nm process technology, and expects to start production of such chips in 2025.

We believe there are three barriers that are hinderingTSMC’s competitors in their desire to catch up to the company’s current technological lead in manufacturing chips. We discussed the first two previously in this subsection of this article: TSMC’s relentless drive to improve its process technology, and the sheer amount of capital that the company is reinvesting into its business. The third is TSMC’s careful and consistent cultivation of customer trust over the years, a key pillar of which is the company’s steadfast adherence to its pure-play foundry model where it refuses to compete with its customers. This is a significant competitive advantage. In 2013, Apple signed a deal for TSMC to manufacture microprocessor chips – a partnership which still stands today – that goes into Apple’s iPad and iPhone products. Apple was using Samsung as an exclusive supplier of these chips in the early days of the iPhone (the iconic product was first launched in 2007). But as Samsung started producing its own mobile devices to compete with Apple’s products, the relationship between the two companies deteriorated. As a result – and also because of TSMC’s drive to improve its chip-making prowess – TSMC became the sole supplier of microprocessor chips for Apple’s mobile devices.

2. A strong balance sheet with minimal or a reasonable amount of debt

TSMC exited the first quarter of 2022 with NT$1.28 trillion (US$44.8 billion) in cash and short-term investments, and significantly lower debt of NT$0.79 trillion (US$27.7 billion).

Given TSMC’s huge capital expenditure plans, the strength of the company’s balance sheet is of paramount importance. With much higher cash and short-term investments than debt, we think TSMC’s balance sheet is in great shape.

It helps too that TSMC has a long history of generating strong operating cash flow and free cash flow, which we will discuss in the “A proven ability to grow” subsection of this article.

3. A management team with integrity, capability, and an innovative mindset

On integrity

TSMC was founded in 1987 by Dr. Morris Chang, a legendary figure in the semiconductor industry. Chang, who’s currently 91, led the company as CEO and Chairman of the board of directors from then to June 2005, when he stepped down as CEO but remained as Chairman. In June 2009, he returned to the CEO role, then relinquished the role again in November 2013, before retiring completely from the company in June 2018.

When Chang stepped away from TSMC in June 2018, Dr. Mark Liu and Dr. C.C. Wei became the company’s Chairman and CEO, respectively. Both men are long-time TSMC employees (Liu entered the company in 1993 while Wei joined in 1998) who steadily climbed through the ranks and were both co-CEOs of TSMC from November 2013 till Chang’s retirement. Both Liu and Wei are currently still in their respective roles of Chairman and CEO, and are thus the two most important leaders of TSMC. We appreciate the long tenures that they have and the fact that they were promoted to their current roles also speaks positively to TSMC’s culture, in our view.

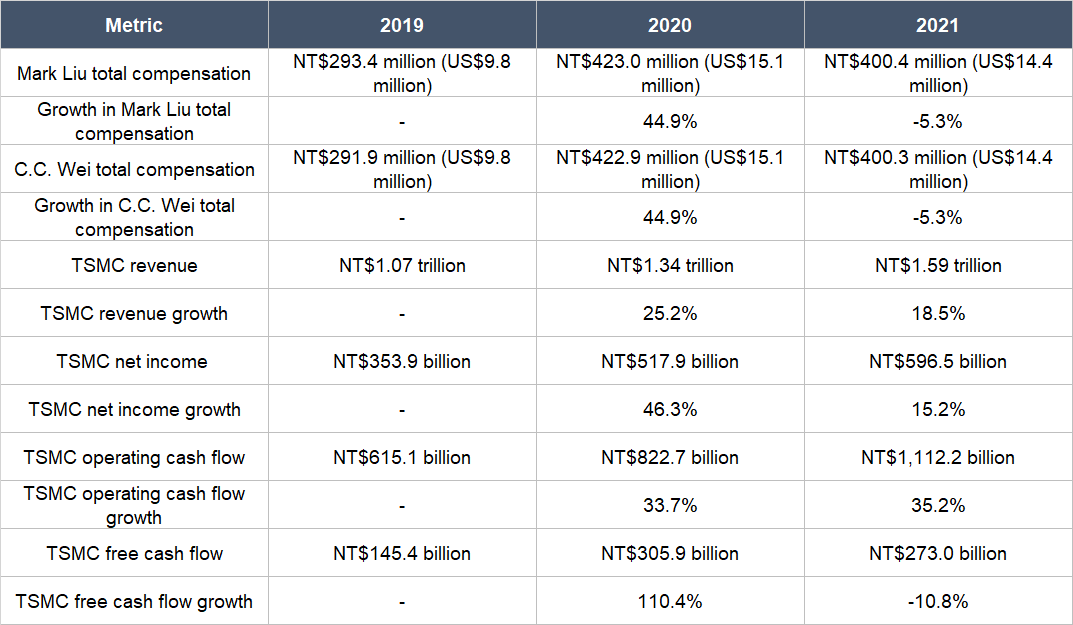

We don’t have much details on TSMC’s compensation structure for its senior leaders. But we know three things that are shown in Table 4 below: (1) Liu and Wei’s compensation in each year from 2019 to 2021 were substantial, but they were rounding errors when compared to TSMC’s net income, operating cash flow, and free cash flow; (2) the growth of Liu and Wei’s compensation in 2020 was accompanied by significant growth in TSMC’s revenue, profit, operating cash flow, and free cash flow; and (3) the two leaders’ compensation actually declined in 2021 even though TSMC continued to post strong growth. We think these are good signs of the integrity that TSMC’s management team possesses.

Table 4; Source: TSMC annual reports

Another positive sign, in our view, is the skin in the game that Liu and Wei have; as of 28 February 2022, they and their immediate family members held 12.913 million and 6.579 million of TSMC’s Taiwan-listed shares, respectively. With a price of NT$547 per Taiwan-listed TSMC share as of 25 April 2022, Liu and Wei’s respective stakes are worth over US$240 million and US$122 million.

On capability and innovation

We think TSMC’s management team is excellent when it comes to innovation and their ability to execute and there are a number of things we want to discuss.

First, Morris Chang created the pure-play foundry business model in the semiconductor industry with the establishment of TSMC. His professional career prior to founding TSMC was dedicated to the semiconductor industry. When Chang was working at other semiconductor companies, he noticed that there were many chip designers who wanted to establish their own semiconductor companies. But they found it difficult to do so because they couldn’t raise enough capital to build chip manufacturing plants. Back then (in the 1950s to the 1980s), the norm was for chip designers to own their own chip manufacturing plants and this required heavy capital expenditure. He thought that the creation of a pure-play foundry – a company that focused on being a contract manufacturer for chip designers – would solve this important pain-point for chip-design entrepreneurs.

Chang’s insight proved prescient as the birth of TSMC allowed innovation to flourish in the semiconductor industry. The number of fabless companies bloomed shortly after TSMC came to life – and continues to flourish – as chip designers could now bring their creations to life without worrying about the massive capital expenditure that come with constructing and outfitting chip manufacturing plants.

Second, shortly after Chang returned as CEO in June 2009, he boldly decided to increase TSMC’s capital expenditure for 2010. For context, the global economy in 2010 was still recovering from the aftermath of the Great Financial Crisis that erupted in 2008. But Chang was undeterred and wanted to double TSMC’s 2010 capital expenditure from 2009’s level of NT$87.8 billion (US$2.75 billion); TSMC’s actual capital expenditure for 2010 was NT$186.9 billion (US$6.42 billion). He saw the birth of smartphones a few years earlier (the first iPhone model was introduced by Apple in 2007) and thought this had the potential to unleash a massive increase in demand for leading edge chips. Interestingly, TSMC’s independent directors back then opposed Chang’s plan to increase the company’s capital expenditure and he had to strongarm them to agree with him.

It turned out that Chang was right to have TSMC invest heavily. Looking back today, smartphones have proliferated across the globe over the past decade and TSMC’s revenue grew at an annualised rate of 14.9% from 2009 to 2018. Chang’s foresight is even more remarkable when considering that TSMC’s independent directors in 2009 included Thomas Engibous, who was CEO of Texas Instruments from 1996 to 2004, and Chairman from 2004 to 2008. Texas Instruments was at the time – and still is – one of the largest semiconductor companies in the world.

Third, TSMC has consistently improved its process technology over a long period of time as we first shared in the “Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market” subsection. Table 5 below shows the chips with the smallest node that TSMC is able to manufacture at volume in each year going back to 1994.

Table 5; Source: TSMC annual reports (for perspective, 0.005 micron equals 5 nm)

Although much of the history shown in Table 5 took place with Chang at the helm, the company was able to introduce high-volume manufacturing for 5 nm chips with Mark Liu and C.C. Wei as its two most important leaders. Moreover, TSMC’s development of 3 nm chips looks promising. During TSMC’s 2022 first-quarter earnings conference call, an analyst mentioned that “we continue to hear a lot of good news and anecdotes about your N3E [referring to a more advanced version of TSMC’s 3 nm process technology] is actually progressing very, very well;” management concurred, responding that the “N3E result is quite good” and that there is “very strong demand on… N3 and N3E.”

When talking about TSMC’s process technology, it’s also worth noting that as the company consistently churned out smaller nodes over time, its competitors struggled. In the “Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market” subsection, we shared that 2018 was a year in which Intel lost its manufacturing lead to TSMC and GlobalFoundries and UMC both stopped developing their 7 nm process technology. In addition, we mentioned in the “Company description” section that TSMC dominates the global production of leading edge chips, leaving relative scraps for Samsung. Making TSMC’s management seem even more impressive is the emergence of news reports earlier this year that Samsung may have yield problems with the manufacturing of its 5 nm chips.

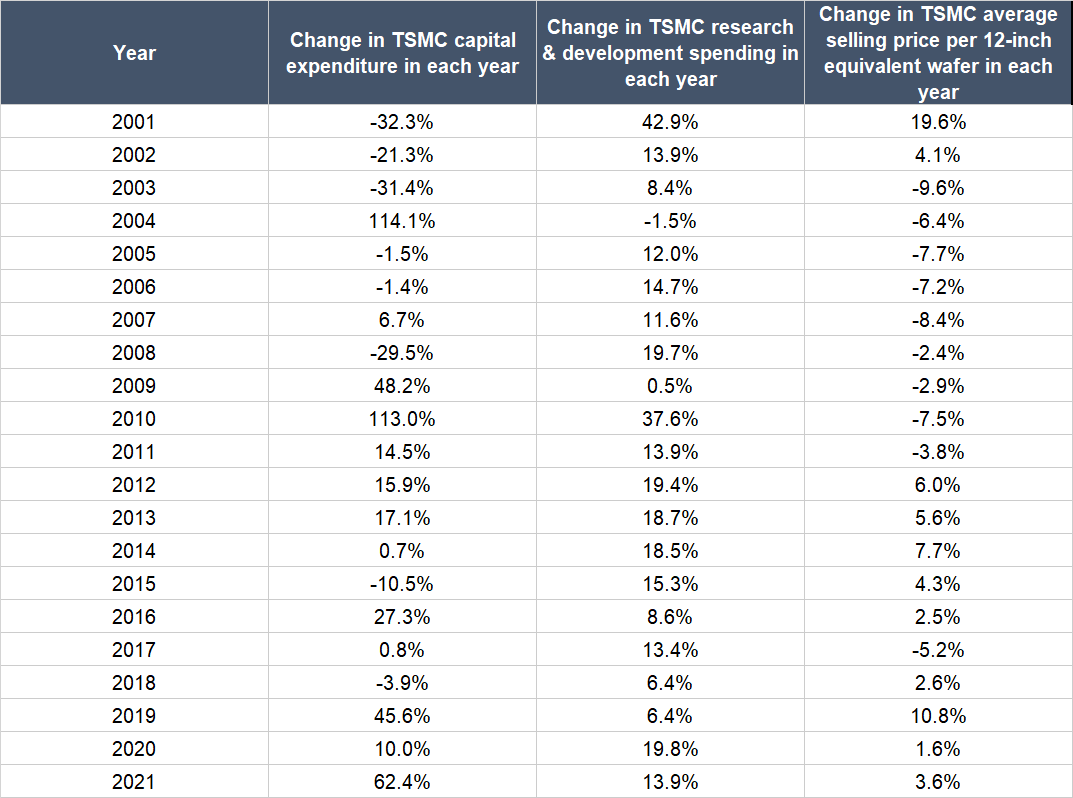

The fourth point we’re bringing up is related to the third, and it’s that Liu and Wei have so far appeared to be more-than-capable successors to Chang. When Chang first relinquished the CEO role in June 2005, it was Rick Tsai who stepped up to the plate. Tsai was a long-time employee of TSMC (he joined in 1989), and was the company’s Chief Operating Officer since August 2001. Despite having a few years under his belt working closely with Chang in a senior leadership role at TSMC before becoming CEO, Tsai’s performance as chief executive was not the best. From 2006 to 2008, the few full years where Tsai was CEO (reminder: Chang returned as CEO in June 2009), TSMC’s revenue increased by only 2.5% per year and net income declined from NT$127.0 billion to NT$99.9 billion. More importantly, during Tsai’s run as CEO, TSMC did not fare well on the three most important metrics that Chang looked at – while he was involved with the company – to determine the health of TSMC’s business. The three metrics are TSMC’s capital expenditure, research & development spending, and average selling price (ASP) for its chips. Table 6 lays out how these numbers have changed from 2001 to 2021.

Table 6; Source: TSMC annual reports

While TSMC’s research & development spending was growing at a healthy mid-to-high teens percentage range from 2006 to 2008, its capital expenditure did not. Moreover, the ASP for TSMC’s chips fell each year. In contrast, during Chang’s second run as CEO from June 2009 to November 2013, TSMC’s capital expenditure and research & development spending both saw strong increases (see 2010 to 2013 numbers) while the ASP started growing after initially declining. From 2014 onwards, TSMC’s capital expenditure, research & development spending, and ASP were mostly growing (note the big jumps in capital expenditure in 2019 and 2021). As a reminder, Liu and Wei became co-CEOs of TSMC in November 2013 before becoming Chairman and CEO, respectively, in June 2018. TSMC will also be investing heavily in capital expenditure in 2022 and beyond as we discussed in the “Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market” subsection.

Lastly, we applaud management’s insistence on having TSMC stay true to the pure-play foundry model. This is a competitive advantage for the company that we think is hard to replicate, since it comes from management’s world view. In the “Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market” subsection, we mentioned that Samsung – a TSMC competitor – lost plenty of business from Apple after the former started producing its own mobile devices. After Chang’s retirement, we’ve not seen any signs from Liu and Wei that they have even the slightest inclination of wanting to shift TSMC away from being a pure-play foundry.

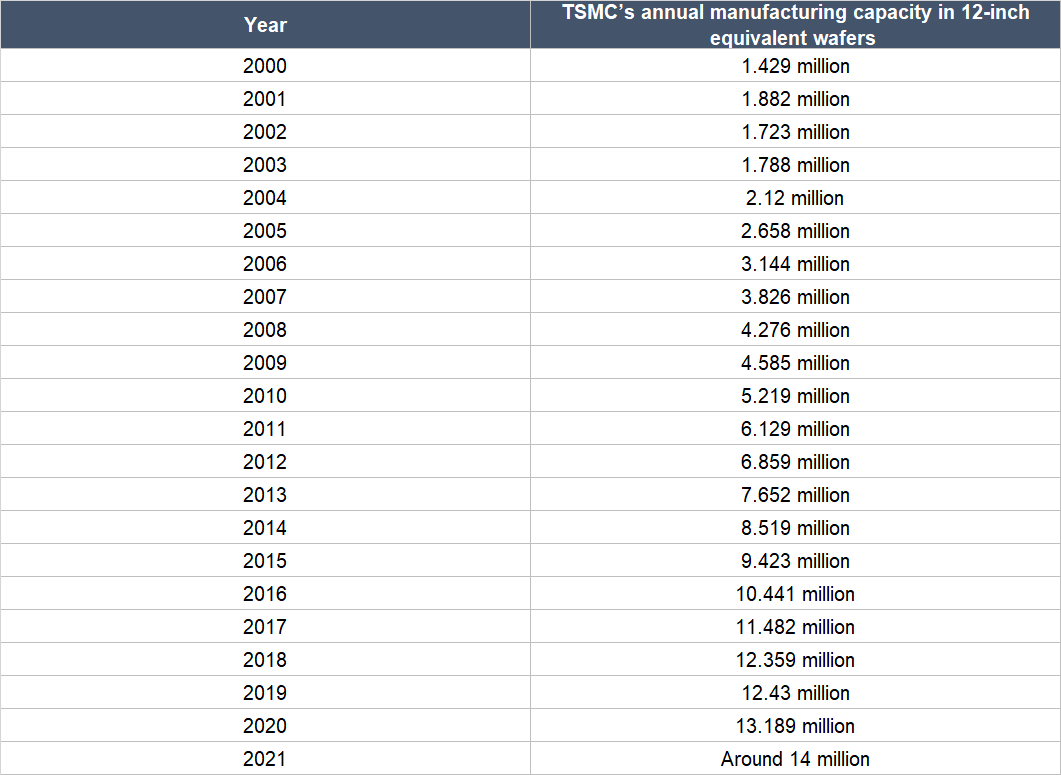

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

TSMC manufactures semiconductor chips and each time an electronic device is manufactured, chips are required. With the high probability that demand for electronic devices will grow over the long run, as well as TSMC’s current – and likely future – dominance in manufacturing leading edge chips (we discussed these in the “Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market” subsection), we think it’s likely that TSMC enjoys recurring revenue. Lending weight to our view is the long–term growth in TSMC’s wafer shipments that are shown in Table 7.

Table 7; Source: TSMC annual reports

But TSMC’s customers could still reduce their orders for chips with the company when conditions in the global economy or the semiconductor market changes. Global semiconductor revenues have historically been cyclical even though there’s also been a clear long-term upward trend. These traits can be seen in Figure 1 below, which shows monthly global semiconductor revenues (the blue line) and their year-on-year growth rates (the red line) from January 1996 to February 2022.

![]()

Figure 1; Source: Semiconductor Industry Association

This said, our eyes are fixed on the long-term opportunity for TSMC within the semiconductor market and we think the company does have strong recurring revenue over the long run. Moreover, TSMC has guided for annualised revenue growth of between 15% and 20% in US dollar terms from 2021 to 2026. In TSMC’s latest annual report (for 2021), Mark Liu and C.C. Wei also discussed their views – which we find to be sensible – on the company’s higher structural growth because of a few megatrends that are powering the semiconductor industry:

“We believe TSMC is entering a period of higher structural growth, as the multi-year megatrends of 5G and High Performance Computing (HPC)-related applications are expected to fuel massive demand for computation power, which expand the use of leading edge technologies. The structural increase in the long-term market demand profile will drive growth across our smartphone, HPC [High Performance Computing], IoT [Internet of Things] and Automotive platforms, and TSMC is working closely with our customers to plan our capacity, and accelerating our investments in both leading edge and specialty technologies to support their demand.”

We also think it’s possible that, going forward, there may be very little cyclicality in the areas of the global semiconductor market that TSMC is exposed to. During a February 2022 interview with Ben Thompson, founder of the business and technology newsletter Stratechery, Intel’s CEO Pat Gelsinger shared (emphasis is mine):

“The first thing I’d ask you, because there is a cyclical nature to the semi industry, when was the last time we had a logic surplus, not a memory surplus?…

…The last memory surplus was about three and a half years ago. The last logic surplus was over a decade ago. So, this idea, as I asserted at the investor event, was there’s an insatiable demand for computing and high performance. [As a reminder, logic chips are the mainstay of TSMC’s business.]”

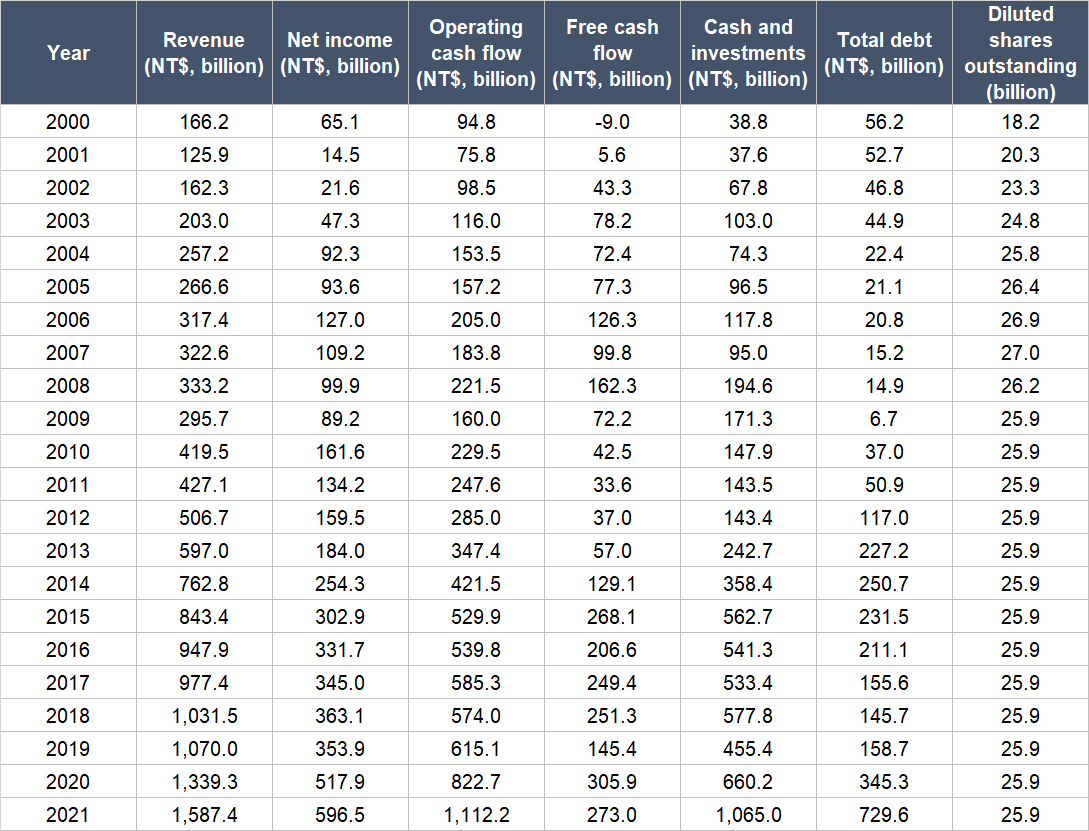

5. A proven ability to grow

Table 8 below shows TSMC’s key financials from 2000 to 2021. We chose 2000 as the starting point because we wanted to see how the company fared in the aftermaths of the early-2000s Dotcom Bubble and 2008/2009 Great Financial Crisis.

Table 8; Source: TSMC annual reports

A few key things to highlight from TSMC’s historical financials:

- Over the entire time period studied, revenue had, impressively, increased in most years and there’s also clear long-term growth. In particular, TSMC produced revenue growth in each year going back to 2010. The respective annual revenue growth rates for 2010-2021 and 2016-2021 were also healthy at 12.9% and 10.9%. We also note that TSMC’s revenue growth of 25.2% and 18.5% in 2020 and 2021, respectively, were significantly higher than the low single-digit growth rates seen in 2017 (3.1%), 2018 (5.5%), and 2019 (3.7%).

- The company’s net income had similar dynamics as its revenue: There’s growth in most years for the entire time period we’re looking at and there’s a clear upwards slope; annualised growth rates for 2010-2021 and 2016-2021 came in at 12.6% and 12.5%; and growth in 2017, 2018, 2019, 2020, and 2021 were at 4.0%, 5.2%, -2.5%, 46.3%, and 15.2%, respectively.

- TSMC has an impressive long-term track record of generating positive and growing operating cash flow. From 2000 to 2021, there was not a single year where operating cash flow was negative. The annualised growth rates for 2010-2021 and 2016-2021 were similar and healthy (15.4% vs 15.6%), while recent growth had been impressive, coming in at 33.7% in 2020 and 35.2% in 2021 compared to just 8.4% in 2017, -1.9% in 2018, and 7.2% in 2019.

- TSMC’s free cash flow had substantial upswings and downswings over the years, but the good things are (1) the important financial number was negative in only one year from 2000 to 2021, (2) the swings are the result of TSMC increasing its chip manufacturing capacity over the years, and (3) the average free cash flow margins for 2000-2021, 2010-2021, and 2016-2021 were all healthy at 21.5%, 17.4%, and 20.9%, respectively.

- Speaking of manufacturing capacity, TSMC’s balance sheet had more cash than debt in nearly each year for the entire time period we’re looking at (2000, 2001, and 2013 were the exceptions). This is impressive when we consider that TSMC had increased its manufacturing capacity by 10 times over the same period (see Table 9).

- Dilution was never really a problem for investors at TSMC. The company’s weighted average diluted share count did increase by 9.2% annually from 2000 to 2004. But since then, the share count had barely changed.

Table 9; Source: TSMC annual reports

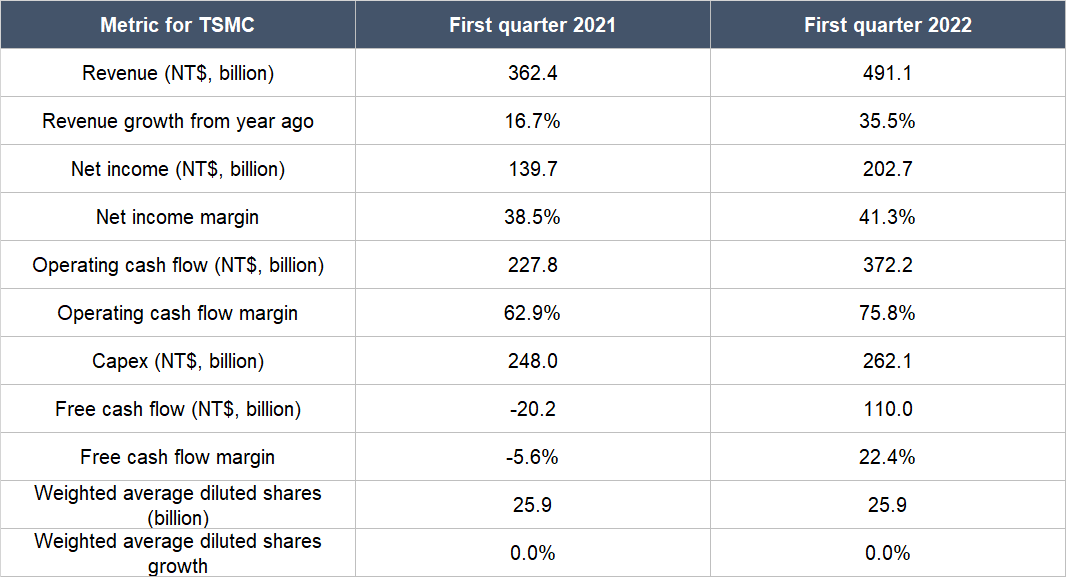

TSMC posted impressive year-on-year revenue growth of 35.5% for the first quarter of 2022, as illustrated in Table 10 below. The table also shows that TSMC’s net income, net income margin, operating cash flow, operating cash flow margin, free cash flow, and free cash flow margin all improved (some substantially) during the quarter. Another positive point is that TSMC’s weighted average diluted share count did not change.

Table 10; Source: TSMC quarterly earnings update

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

Over the past 21 years from 2000 to 2021, TSMC had produced positive free cash flow and achieved respectable free cash flow margins, as mentioned in the subsection just above. With the tailwinds enjoyed by the entire semiconductor industry, and TSMC’s commanding lead in the manufacture of leading edge chips, the company looks set, in our view, to continue growing its free cash flow over the long run.

This said, we do expect TSMC’s free cash flow in the next few years to be compressed because of the company’s aforementioned heavy capital expenditure plans. But we think management is making a wise investment, as the capital expenditure would allow TSMC to take advantage of the growth opportunities it sees as a result of the megatrends powering the semiconductor industry.

Valuation

We like to keep things simple in the valuation process. Given TSMC’s long history with generating net income and penchant for periodic heavy reinvestments into the business which depresses its free cash flow (to be clear, we see the reinvestments as absolutely correct moves by management!), we think the price-to-earnings (P/E) ratio is a suitable gauge for the company’s value.

We completed our initial purchases of TSMC’s US-listed shares in early April 2022. Our average purchase price was US$105 per share. At our average price and on the day we completed our purchases, TSMC’s shares had a trailing P/E ratio of around 26. (If you’re calculating the P/E ratio of TSMC, do note that each US-listed TSMC share is equivalent to five Taiwan-listed shares.)

Figure 2; Source: Tikr

We don’t think the P/E ratio of 26 is high when it is compared to the bright long-term growth prospects that TSMC’s business enjoys. But we do acknowledge that the P/E ratio is near the high-end of where the valuation multiple has been over the past five years (see Figure 2 above, which plots TSMC’s P/E ratio for the five years ended 26 April 2022).

For perspective, TSMC’s US-listed shares carried a P/E ratio of around 22 at the 25 April 2022 price of US$96.

The risks involved

There are a few risks that we think could chip away at our investment in TSMC. The most important, in our view, is related to geopolitics. Taiwan is where TSMC is based and it is the locus of the company’s chip manufacturing activities. Unfortunately, China and Taiwan have long had a fraught relationship and China has made no secret that it sees Taiwan as its territory, even though Taiwan governs itself autonomously. If China were to forcefully seek unification with Taiwan in the future, TSMC’s business and/or foreign investors could become a casualty. Adding a layer of complexity to TSMC’s geopolitical risk is the currently frosty relationship between the USA and China, with the two superpowers embroiled in a tech war at the moment. In the “Company description” section of this article, we shared that TSMC’s North America-based customers accounted for nearly two-thirds of its revenue in 2021. If tensions between the US and China were to escalate from here, TSMC could become collateral damage.

The other risks that we see are (in no particular order):

- Technology sovereignty and competitors catching up: Over the past few years, there has been an increasing focus by governments around the world to localise supply chains for the production of semiconductor chips. In particular, the governments of China and the USA have pledged, or are looking to spend, significant sums (in the tens of billions of dollars) to support their own semiconductor manufacturing companies. The capital that these companies could receive from their respective governments could weaken the capital-barrier TSMC has erected (the barrier was first discussed in the “Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market” subsection). But capital is not the only ingredient necessary for TSMC’s competitors to catch up to the company – the knowhow is critical too. As it currently stands, the US-based IDM Intel has its own foundry business that it set up last year, but it has contracted TSMC to manufacture its own leading edge chip designs with single-digit nanometer nodes. The extent of the collaboration appears to be deep enough for Intel’s CEO, Pat Gelsinger, to visit Taiwan twice in the space of four months (in December 2021 and April 2022). Meanwhile in China, the country’s largest chip manufacturer, Semiconductor Manufacturing International Corporation (SMIC), is a few generations behind TSMC in process technology; for perspective, SMIC’s most advanced node at the moment is 28 nm. Moreover, TSMC could also benefit from governments’ desires for technology sovereignty. For example, the company is currently developing a US$12 billion chip manufacturing plant in Arizona – with a target for production of 5 nm chips in 2024 – seemingly with financial support from the US government.

- Succession: We rate Mark Liu and C.C. Wei – TSMC’s current Chairman and CEO, respectively – very highly. But Liu is already 68 while Wei is 70. They may not have many more years left in the tank to serve TSMC. We have faith that the company’s board will be able to choose capable successors when Liu and/or Wei eventually steps down. But should either or both of them leave, TSMC will have big shoes to fill and we’ll be watching the leadership transition.

- Cyclicality in the semiconductor industry: We discussed the cyclicality of global semiconductor revenues in the “ Revenue streams that are recurring in nature, either through contracts or customer-behaviour” subsection. Although we think TSMC is currently enjoying a structural growth trend without much or any cyclicality, it’s not a certainty that this is the case. There’s a possibility of an oversupply of chips in the future, given that TSMC and many of its competitors are ramping up their manufacturing capacities at the moment (partly as a result of technology sovereignty). If there’s a long cyclical winter in the global semiconductor market in the future, TSMC’s business could also catch a prolonged cold.

- Customer-concentration: Although TSMC sold chips to 535 customers in 2021, there were two customers that collectively accounted for 36% of the company’s revenue. In particular, TSMC’s largest customer was responsible for 26% of its revenue for the year. This customer had been TSMC’s largest customer for a number of years, but the concentration had climbed over time; for perspective, the same customer accounted for 17% of TSMC’s total revenue in 2016. As far as we know, TSMC has never revealed its largest customer, but it has been widely reported that this customer is Apple. Given TSMC’s high level of customer concentration, the company would likely be dragged down if Apple’s business were to suffer.

- Supplier-concentration: Lithography is an essential step in the manufacturing of semiconductor chips. In the “Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market” subsection of this article, we wrote that “In order for TSMC to manufacture leading-edge chips, it needs EUV (extreme ultraviolet) lithography machines and ASML is the only company in the world that can build these machines.” (For more on lithography and EUV lithography machines, please check out our ASML investment thesis.) This means that TSMC is likely to have trouble producing leading edge chips, or growing its manufacturing capacity for these chips, if ASML runs into difficulties with its own business.

- Obsolescence of transistor-based chips: For decades, chips that contain transistors have been the bedrock of computers as we know them – and TSMC’s business has been growing on the back of the global demand for having more and more transistors per chip. But in recent years, researchers at companies such as IBM and Google have been building quantum computers with chips that are built very differently from the traditional transistor-based chip. In a well-publicised but somewhat controversial controlled experiment by Google in 2019, its quantum computer was shown to have significantly outperformed a state-of-the-art supercomputer that’s built with transistor-based chips. Should quantum computers with chips that are not based on transistors gain widespread adoption in the future, it could cause the obsolescence of transistor-based chips and the technological knowhow of TSMC. For now, quantum computing is still in its infancy and there’s also no widespread consensus yet on what’s the best way to build quantum computing chips (there’s been at least one successful experiment showing that quantum computing chips could possibly be built with traditional transistor-based chips). Nonetheless, we’re keeping an eye on things here because they represent a remote but existential risk to TSMC’s business.

- Valuation: TSMC’s P/E ratio is near a five-year high as we discussed in the “Valuation” section of this article. If there is indeed a downturn in the semiconductor market, there could be a painful fall in the company’s stock price as a result of falling earnings and a lower P/E ratio. But this is a risk we’re comfortable taking as long-term investors.

Summary and allocation commentary

To sum up, TSMC has:

- A growing opportunity in the global foundry market, and a commanding lead over its competitors in manufacturing leading edge chips

- A formidable balance sheet with significantly more cash and investments than debt

- A management team with (1) compensation and ownership that demonstrates integrity, and (2) an excellent long-term history of execution and innovation

- Customers that likely will keep coming back for more chips

- A long track record of healthy free cash flow margins and growth in revenue, net profit, and operating cash flow

- A high likelihood of producing a growing stream of free cash flow in the future

There are risks to note, such as the messy geopolitical tension between Taiwan/China and China/USA; leaders who may not be able to serve the company for a long time; the possibility that there could be a prolonged downcycle in the semiconductor market in the future; a heavy reliance on Apple for revenue and ASML for EUV lithography systems; the chance that transistor-based chips could become obsolete in a future where non-transistor-based computing chips become widely adopted; and a valuation multiple that is at the higher end compared to the past.

After considering the pros and cons, we decided to initiate a position of around 1.0% in TSMC in April 2022. We appreciate all the strengths we see in TSMC’s business, but our enthusiasm is tempered by the geopolitical risks confronting the company, the possibility of a downturn in the semiconductor market, and a P/E ratio that is near the high-end in relation to history.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share. Of all the other companies mentioned in this article, Compounder Fund also owns shares in Alphabet (parent of Google), Apple, and ASML. Holdings are subject to change at any time