Compounder Fund: Tencent Investment Thesis - 08 Apr 2021

Data as of 6 April 2021

Tencent Holdings (SEHK: 0700), which is based in China and primarily listed in Hong Kong, is one of the 40 companies in Compounder Fund’s initial portfolio. This article describes our investment thesis for the company.

Company description

Tencent is a Chinese technology juggernaut with four business segments: Value-added Services (VAS); FinTech and Business Services; Online advertising; and Others. In 2020, Tencent earned RMB482.1 billion in revenue and a segmental breakdown is shown in the table below:

Source: Tencent earnings update

Let’s start with the VAS segment. It can be further divided into the two subsegments of Online Games and Social Networks. The duo pulled in revenue of RMB156.1 billion and RMB108.1 billion, respectively, in 2020.

Tencent is the world’s largest online gaming company by revenue. It develops original games in-house and also publishes third-party games. In China, Tencent is the clear market leader in both the smartphone games market (54% share in the first half of 2020) and the PC games market (60% share in 2019), according to Analysys and iResearch. In fact, Tencent has business partnerships or equity investments in eight of the top 10 gaming companies in the world. Some of Tencent’s investments in gaming companies include: A 100% stake in Riot Games, which owns League of Legends, one of the most popular multiplayer online battle arena games in the world; a 66.24% stake in Supercell, a Finnish company that launched the popular mobile games Clash of Clans and Brawl Stars; and a 40% interest in Epic Games, the maker of the hit battle royale game, Fortnite. Epic Games has another important property: Unreal Engine, which is a complete suite of tools for third-parties to create all kinds of games. But because Unreal Engine makes the creation of detailed and expansive virtual environments easier, it can also be used to design and build film and TV content, automobiles, buildings, and even cities.

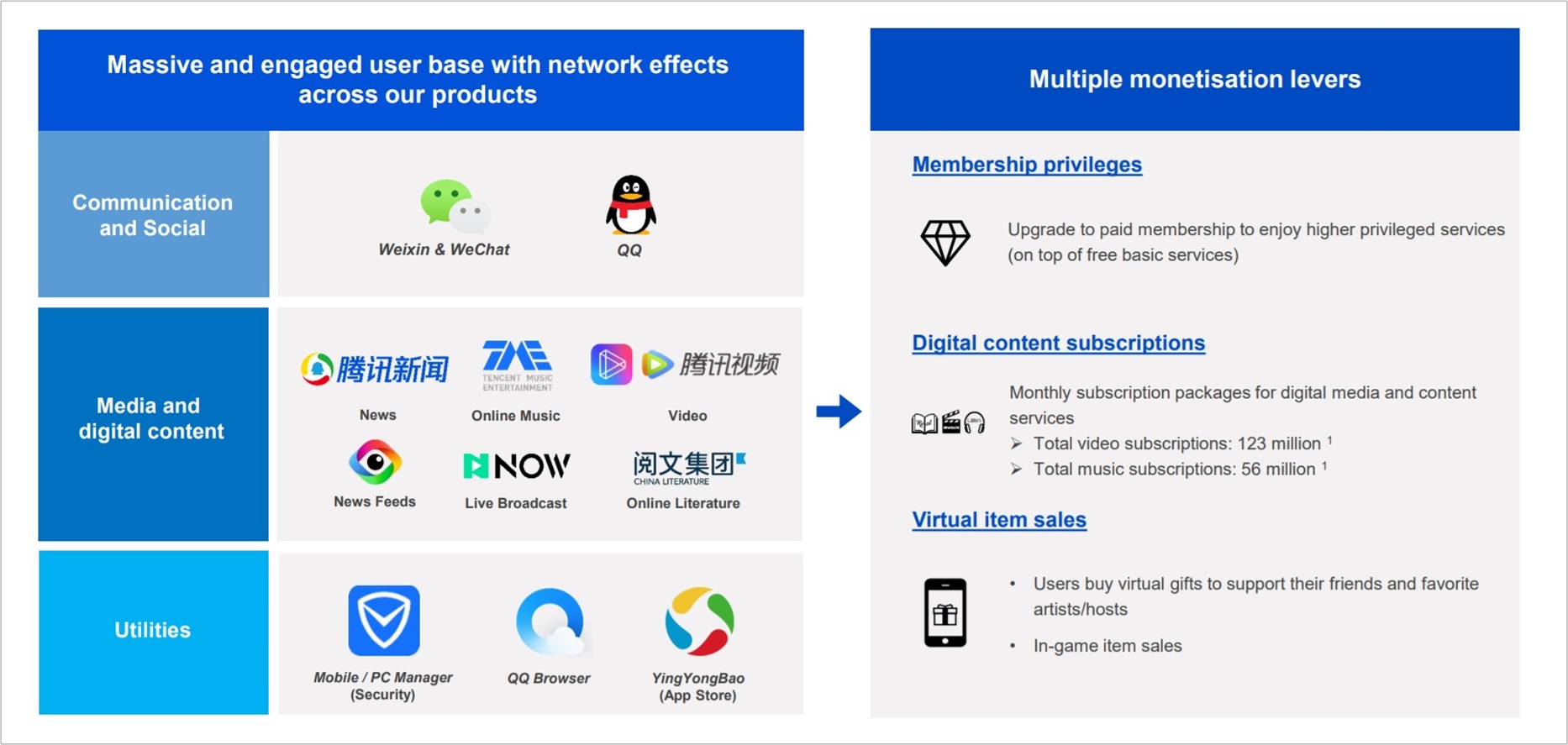

In the Social Networks subsegment, Tencent’s crown jewel is WeChat (known in China as Weixin), which boasted 1.225 billion monthly active users at the end of 2020. WeChat is a super app with functions that include peer-to-peer messaging, video calls, business communications, digital payments, e-commerce, and more. Put another way, users can conduct nearly all their daily digital activities without ever having to leave WeChat. According to China Internet Watch, WeChat users spent an average of 77 minutes per day on the app as of August 2019. QQ is another important messaging app in Tencent’s VAS sub-segment. At the end of 2020, QQ had 594.9 million monthly active users on smart devices. The chart below illustrates Tencent’s various properties in the Social Networks subsegment and the different ways these properties are monetised. In essence, the Social Networks subsegment earns revenues from membership subscriptions, content subscriptions, and the sale of virtual items.

Source: Tencent Corporate Overview presentation

Let’s now move on to the Fintech and Business Services segment. Tencent’s fintech arm consists of Weixin/WeChat Pay, where the company earns a small cut of each payment transaction that the service processes. Weixin/WeChat Pay also generates revenue from fees for cash withdrawals and credit card repayment charges. Tencent’s fintech arm has other financial services too, including wealth management (LiCaiTong), online lending (WeiLiDai), and insurance (WeSure); for these financial services, Tencent provides the platform to connect users with financial institution partners and collects commissions and fees. The Business Services arm includes Tencent Cloud (cloud computing infrastructure services) and other technology solutions.

The Online Advertising segment encompasses digital advertising revenues that Tencent earns from selling advertising space on its digital properties. Some examples of these properties include Weixin Moments (a feature similar to that of Facebook’s Timeline), Tencent Video, and Tencent News. The digital advertising formats that are supported by Tencent include digital banner ads, in-feed video ads, and video pre-roll ads.

Lastly, there’s the Others revenue segment, which comprises revenues from a hodgepodge of other relatively minor businesses such as the production and distribution of film and television programmes for third parties, merchandise sales, and more.

Tencent is very much a China-centric company. In 2019, more than 95% of its RMB 377.3 billion in revenue came from China and there’s no reason to believe that the percentage had changed much in 2020.

So if we put everything together, Tencent is almost synonymous with the entire internet experience in China as it provides everything from online games, digital media, and social networks, to digital payments, digital wealth management, enterprise cloud infrastructure services, and more. But that’s not all: Tencent also has a massive portfolio of investments in other companies, both privately held and publicly listed.

The Chinese tech conglomerate does not provide an updated list of all of its investments, as far as we know. But on an earnings conference call in August 2020, Tencent’s management said that the company’s investment portfolio has more than 700 companies. Investment writer Packy McCormick, the creator of the excellent Not Boring Substack, has a public spreadsheet that tracks some of Tencent’s major investments. McCormick’s list is not exhaustive, but it gives a great view of the breadth and quality of Tencent’s investment portfolio. Some notable investments include: A 20% stake in Meituan (a dominant e-commerce platform in China for services); a 5% stake in Tesla (a leading global electric vehicle manufacturer); a 5% stake in Activision Blizzard (one of the world’s largest computer gaming companies); a 12% stake in Snap (the owner of Snapchat, a camera app that allows users to communicate with videos and images); an 18% stake in JD.com (an ecommerce juggernaut in China); and a 25% stake in Sea (Southeast Asia’s leading ecommerce company and a global computer gaming giant).

As of 31 December 2020, the value of Tencent’s portfolio of investments in publicly listed companies was a staggering RMB 1.2 trillion (around US$180 billion). For perspective, this portfolio was worth ‘only’ RMB 420 billion (around US$63 billion) at the end of 2019. The RMB1.2 trillion portfolio at the end of 2020 does not include Tencent’s investments in private companies, where it has also deployed vast amounts of capital. All of Tencent’s investments – in both public as well as private companies – make it a true behemoth in the technology space.

Investment thesis

We have laid out our investment framework on Compounder Fund’s website. We will use the framework to describe our investment thesis for Tencent.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

As mentioned above, Tencent’s business operations – not including its investments in other companies – span a wide array of different markets. The company is involved with online gaming, social networks, digital payments, insurance, online lending services, video streaming, digital advertising, cloud infrastructure services, and more. With its fingers in so many pies, Tencent is not fishing in a small pond. But Tencent’s revenue of RMB482.1 billion (around US$72 billion) in 2020 is also massive, so is there still room for significant growth for the company? Turns out there is. Let’s touch on three of Tecent’s core businesses – online gaming, mobile payments, and digital advertising – as well as the company’s optionality.

China’s gaming market is expected to grow at a compounded annual rate of 14% from 2021 to 2026, with mobile games and cloud gaming being two of the key drivers. For perspective, Statista pegged China’s online gaming market to be RMB288 billion in 2019 and Tencent’s Online Games subsegment had revenue of ‘merely’ RMB156.1 billion in 2020. We think Tencent is in a prime position to capitalise on the gaming market’s growth. The ubiquity of WeChat in China means that Tencent has very strong game-distribution capabilities. The company also has an incredible long-term track record of growing its Online Games business (more on this later) and it had a list of at least 22 games at the end of 2020 that are slated for release in the future.

Meanwhile, China’s mobile payments market is expected to surge from RMB468 trillion in 2018 to RMB1,800 trillion in 2025, according to Research in China. Based on data from iResearch, WeChat Pay’s share of China’s mobile payments market had increased from just 10% in the third quarter of 2014 to 38.8% in June 2020 (Ant Group’s Alipay had the largest share at 55.6%). In the fourth quarter of 2019, WeChat Pay exceeded more than 1 billion daily average transactions, had more than 800 million monthly active users, and had more than 50 million monthly active merchants. With WeChat Pay’s current market position – and the service’s ability to leverage the WeChat network – we think it’s likely that Tencent will continue to benefit from the growth of China’s mobile payments market.

Moving on, China’s digital advertising market is expected to increase from US$71.7 billion in 2019 (around RMB478 billion) to US$120.9 billion (around RMB806 billion) in 2024, according to eMarketer. In 2020, Tencent’s Online Advertising segment pulled in revenue of ‘only’ RMB82.3 billion. Once again, we think the ubiquity of WeChat will allow Tencent to win a large share of this growing pie, since advertisers will flock to where users are – and WeChat has plenty of users.

We first heard of the term “optionality” from The Motley Fool’s co-founder, David Gardner. It’s a term he coined to describe the trait a company has of being able to evolve and find entirely new ways to grow. We prize companies that exhibit optionality and we think Tencent has this quality in spades. As already mentioned, Tencent has so many different irons in the fire in terms of its operational businesses. And with the huge user base of WeChat, new services that are launched by Tencent could very quickly find a large audience. WeChat also makes Tencent attractive to any company that it wishes to invest in, because Tencent could offer easy access to WeChat’s user base to its investee companies (for example, Meituan’s services are integrated with WeChat). The more companies Tencent gets to invest in, the more valuable its investment portfolio could become, and the more learning and collaboration opportunities Tencent gets with other technology companies.

One of the potential growth opportunities for Tencent that we’re the most intrigued with is the Metaverse. In an excellent January 2020 essay, venture capitalist and media-business analyst Matthew Ball described the Metaverse as having the following qualities:

“The Metaverse, we think, will…

1. Be persistent – which is to say, it never “resets” or “pauses” or “ends”, it just continues indefinitely

2. Be synchronous and live – even though pre-scheduled and self-contained events will happen, just as they do in “real life”, the Metaverse will be a living experience that exists consistently for everyone and in real time

3. Have no real cap to concurrent participations with an individual sense of “presence” – everyone can be a part of the Metaverse and participate in a specific event/place/activity together, at the same time and with individual agency

4. Be a fully functioning economy – individuals and businesses will be able to create, own, invest, sell, and be rewarded for an incredibly wide range of “work” that produces “value” that is recognized by others

5. Be an experience that spans both the digital and physical worlds, private and public networks/experiences, and open and closed platforms

6. Offer unprecedented interoperability of data, digital items/assets, content, and so on across each of these experiences – your “Counter-Strike” gun skin, for example, could also be used to decorate a gun in Fortnite, or be gifted to a friend on/through Facebook. Similarly, a car designed for Rocket League (or even for Porsche’s website) could be brought over to work in Roblox. Today, the digital world basically acts as though it were a mall where though every store used its own currency, required proprietary ID cards, had proprietary units of measurement for things like shoes or calories, and different dress codes, etc.

7. Be populated by “content” and “experiences” created and operated by an incredibly wide range of contributors, some of whom are independent individuals, while others might be informally organized groups or commercially-focused enterprises”

Put simply, the Metaverse is something like a pervasive virtual world that is interlinked with the real world. And the economic opportunities may be immense. In the same essay we referenced just above, Ball wrote:

“Even if the Metaverse falls short of the fantastical visions captured by science fiction authors, it is likely to produce trillions in value as a new computing platform or content medium. But in its full vision, the Metaverse becomes the gateway to most digital experiences, a key component of all physical ones, and the next great labor platform.”

To be clear, we think any Metaverse-related growth opportunities for Tencent are still very hazy at the moment. But if the Metaverse does become an important cog in the global economy, then we think Tencent is one of the handful of technology companies we currently know of that stand a good chance of being a force in the arena. This is because Tencent has a number of things going for it. The company has: (1) Games with expansive virtual worlds, such as Fornite; (2) a superapp – WeChat – that digitally connects a massive user base of people in the physical world; (3) the Unreal Engine – through its investment in Epic Games – that could power the buildout of massive and pervasive virtual environments; and (4) knowledge about augmented reality technology through its investment in Snap.

2. A strong balance sheet with minimal or a reasonable amount of debt

Tencent’s balance sheet is in great shape. The company exited 2020 with RMB253.0 billion in cash and deposits and RMB248.4 billion in total debt. It helps too that Tencent has a long history of generating strong free cash flow and this is something we will discuss later.

Meanwhile, we mentioned earlier that Tencent has a portfolio of shares in publicly listed companies that are worth RMB1.2 trillion. These investments are often strategic in nature, so Tencent is invested in them for the long haul. But those shares are also financial assets that can be turned into cash quickly if needed.

3. A management team with integrity, capability, and an innovative mindset

On integrity

Tencent was founded in November 1998 and held its initial public offering on Hong Kong’s stock market in June 2004. We think the 49-year old Ma Huateng, who’s also known as Pony Ma, is the most important leader in Tencent. He is not only a co-founder of the company, but he has also been its Chairman and CEO since its listing, at least. We appreciate the fact that Pony Ma is relatively young and yet already has at least 17 years of experience leading Tencent as CEO. Two of his most important lieutenants are Martin Lau Chi Ping and Allen Zhang Xiao Long, who both joined in 2005. Martin Lau, who’s 47, is Tencent’s president and has been a primary figure in the company’s investment process for many years. Allen Zhang is 51 and he was the leader of the internal Tencent team that created WeChat in 2011; he is currently the head of the entire WeChat business.

There is very little public information available on how Tencent’s key leaders are compensated. But we’re comforted by two things. First, we started looking from 2014 onwards and there were no material related party transactions that occurred between the company and its key leaders from then to 2019 (Tencent’s annual report for 2020 is yet to be published). Second, we think that the total compensation of Tencent’s key leaders have been very reasonable. The table below shows Pony Ma and Martin Lau’s overall remuneration from 2014 to 2019. For the period we’re observing, their remuneration levels for each year were tiny when compared to Tencent’s free cash flow. Moreover, the annual growth in Pony Ma’s remuneration for 2014-2019 (11.1%) is significantly slower than the annual growth in Tencent’s revenue and free cash flow over the same period (36.7% and 28.6%, respectively); for Martin Lau, his remuneration increased by 37.7% per year for the period, which is somewhat in line with the company’s growth.

Source: Tencent annual reports

We also want to positively highlight that Pony Ma has massive skin in the game. He currently owns 804.86 million Tencent shares, which are worth HK$526.4 billion (around US$68.4 billion) at the company’s share price of HK$654 as of 6 April 2021.

On capability and ability to innovate

We rate Pony Ma and his team highly on this front and there are a few things we want to discuss.

The first is the history of Pony Ma and Tencent. In 2016, author Wu Xiaobo published 腾讯传 (which can be translated as Tencent’s Story), a Mandarin book that covered the early life of Tencent’s leader and the founding of the company. There’s a wonderful English summary of 腾讯传 written by Julian Wu and the following are some highlights we’ve gleaned that showcases the integrity, ingenuity, and tenacity of Pony Ma:

- From a young age, Pony Ma was already demonstrating computer science wizardry. In school, he regularly won informal student hacking contests, and even built graphical user interfaces (GUIs) before they had gained popularity in China. While at an internship at a Chinese technology company, he built a stock market analysis tool as a side project and managed to sell it for RMB50,000, which was three times his annual salary back then.

- Tencent was founded by Pony Ma in 1998 with four others – Zhang Zhidong, Xu Chenye, Chen Yidan, and Zeng Liqing (Xu Chenye is still with Tencent today, as Chief Information Officer). Back then, one of Tencent’s core products was an internet messaging tool called OICQ. OICQ was copied from another product called ICQ that the American internet company AOL acquired in 1998. OICQ managed to grow its user base relatively quickly, but it generated no revenue. Moreover, Tencent was sued in 1999 by AOL for allegedly stealing ICQ’s intellectual property. The timing of the lawsuit was horrible because Tencent was running out of money. Near the brink of collapse, Tencent received a US$2.2 million investment at the last minute from IDG, a venture capital firm, and Yingke, an investment led by the son of the Hong Kong tycoon Li Ka Shing. Pony Ma’s honest and dependable character helped to convince IDG to invest.

- AOL eventually forced Tencent to rename OICQ. The new moniker – QQ – came about because Tencent’s employees heard OCIQ’s users calling it QQ in public. They thought the name was cute and so it stuck. In 2002, Tencent finally figured out how to monetise QQ. By then, QQ’s user base was around or had already exceeded 100 million. The monetising feature – QQ Show – was to sell virtual items to QQ’s users to doll up their avatars. Within six months of QQ Show’s launch, there were five million users paying RMB5 a month. Tencent followed up with a VIP membership that cost RMB10 per month; the membership gave perks and made members feel special.

- In 2005, Tencent acquired Foxmail to build its own enterprise email service, QQ Mail, to better attract enterprise customers (back then, QQ was seen as a tool for casual chats and not for serious business conversations). Foxmail was developed by Allen Zhang Xiao Long in 1996 and Tencent gained his genius with the acquisition of Foxmail.

- In 2010, a messaging app called Kik Messenger appeared that won 1 million users within 15 days. Kik Messenger allowed users to send and receive messages from their phonebook contacts through mobile data. Allen Zhang was inspired and persuaded Pony Ma to let him build a similar product. Shortly after, Zhang and his team launched WeChat. Around the same time, Xiaomi (a Chinese tech giant that’s well known today for its smartphones and other smart devices) also launched a similar messaging app called MiChat. WeChat and MiChat were duking it out when WeChat gained the decisive upper hand with the introduction of the “find people nearby” feature. By 2012, WeChat had reached 100 million users and it was the fastest social media app to achieve that milestone.

The second thing we want to discuss is related to the first, and it is about Allen Zhang’s unique view on product development at WeChat. Here are some highlights on the topic that we found from a 2019 speech of his:

- On the right objective to have when building a product: “I noticed that in various industries when a product manager graduates and starts working, the company will misguide them. Because the company’s objective is to increase traffic and make money, hence everyone’s KPI is also to increase traffic and make money. This means the product manager’s work objective is not to create the best product, but to use whatever means necessary to obtain traffic. We don’t support this way. What we advocate more is to use WeChat to create good products for our users.”

- On the right type of product-usage to aim for: “For example, these two years, the goal of apps across the industry has been to try their best to keep users in their app as long as possible. This goes against my beliefs. A user only has limited time in a day, so this goal of maximizing user time in-app is secondary. The primary goal for technology should be helping humankind increase efficiency… A few years ago, we had a version of WeChat with a statement encouraging users to put down their phones and meet their friends more in-person. This view has never changed. WeChat will never make user in-app time our objective. Instead, we are more concerned with when our users communicate, post a picture, read an article, make a payment, or find a Mini Program, that they can do it as quickly and efficiently as possible – this is what makes the best tool.”

- On the importance of sharing the value that’s created: “Things that benefit oneself but not others do not last. Mini Programs’ mission is to allow creators to cultivate value and also benefit from it. Just because we have a lot of user traffic doesn’t mean we should occupy it ourselves. If we didn’t decentralize it, Tencent could monopolize the platform with its own Mini Programs, but there would be no external developers. Sure, Tencent would benefit in the short term, but the platform ecosystem would not.”

- More on the right objective to have when building a product: “WeChat has never said that its objective is to increase the number of users. If we wanted to, we could have done it a few years ago and reached the one billion DAU milestone even earlier. But that’s not how it is. Our number of users grows organically. In my view, what we should consider is what kind of services we want to provide to our users – this is a more important question…. With these constant and rapid changes, we don’t really need to be concerned about how many more users we can get. We are focused on how to meet future needs. So, finding what kind of needs users will have in the future is our objective as we sit at one billion users.”

- On the North Star for making product decisions: “Sometimes when we look back on the changes brought about by WeChat over the years, we feel a sense of accomplishment. A lot of time, people will ask me, how are we different from others? I think that one difference is this: when we’re thinking of a problem or what to do, we often ask ourselves, what’s the meaning of doing this? Of course, I know many teams won’t ask about meaning when they do things, they only ask, “What is our KPI?” Honestly, since the beginning, the WeChat team has never worked towards KPI before. This doesn’t impede us from constantly improving. Just like Mini Programs, if we had used KPI, we wouldn’t know what KPI to set because there was no such thing. If we had set a KPI, everyone wouldn’t know what to do. Everyone in our team has developed a habit of ensuring every feature and every service has a meaning or a dream behind it. If a feature is made for just gaining traffic, and it doesn’t provide value to users, then it’ll have problems, it won’t last. We think about the meaning behind every detail of everything we do. This is a reason we’ve been able to make it to this day, and it helped us make many right decisions.”

It’s even more amazing to look back on WeChat now – with its 1.225 billion users – and realise that Allen Zhang built the product in 2010 in just two months with a team of just 10 people. We think WeChat’s massive success so far has a lot to do with Allen Zhang’s unique – and in our view, right – thoughts on product development. This credit can in turn be traced to Pony Ma because as Tencent’s Chairman and CEO, he sets the tone from the top. Indeed, Pony Ma never set any explicit financial targets for WeChat in its formative years, and this gave Allen Zhang and his team the freedom to do what was right for the long-term benefit of the product.

The way Pony Ma fostered the development of WeChat is the third thing we want to discuss. A few years ago, researchers from the London Business School interviewed Allen Zhang and other senior Tencent executives on the creation of WeChat. In November 2019, they published an article about what they learnt. Here’s an excerpt from the piece that’s relevant to our discussion:

“WeChat was the brainchild of Allen Zhang, a legend in China’s tech sector. Zhang created Foxmail in the late 1990s, and when his company was bought by Tencent in 2005 he led the development of QQ Mail, which became one of China’s top mail service providers.

In 2010, with mobile messaging starting to take off, Zhang formed a skunkworks operation: 10 people working in a ‘little dark room’ in Guangzhou, one-and-a half-hour’s drive from Tencent’s head office. This was a controversial move. Zhang’s team was in competition with another internal team who were also creating mobile messaging applications.

The new offering competed directly with Tencent’s existing Mobile QQ (originally a desktop messenger service and the cornerstone of its social networking and gaming services at the time). And the notion of a free messaging service was not popular with the giant mobile operators, as they were making good money from SMS services.

Pony Ma, Tencent’s CEO, allowed Zhang’s team to proceed in an internal ‘horse race’ with the other unit.”

We are impressed with Pony Ma’s willingness to internally create a competitor to what was the mobile version of Tencent’s core business at the time, QQ. Being willing to disrupt one’s money-tree is not a common trait to find in a business leader. It is also immensely valuable in our eyes, as it means that any company with such a leader would have a business that is better-shielded from disruptive competition.

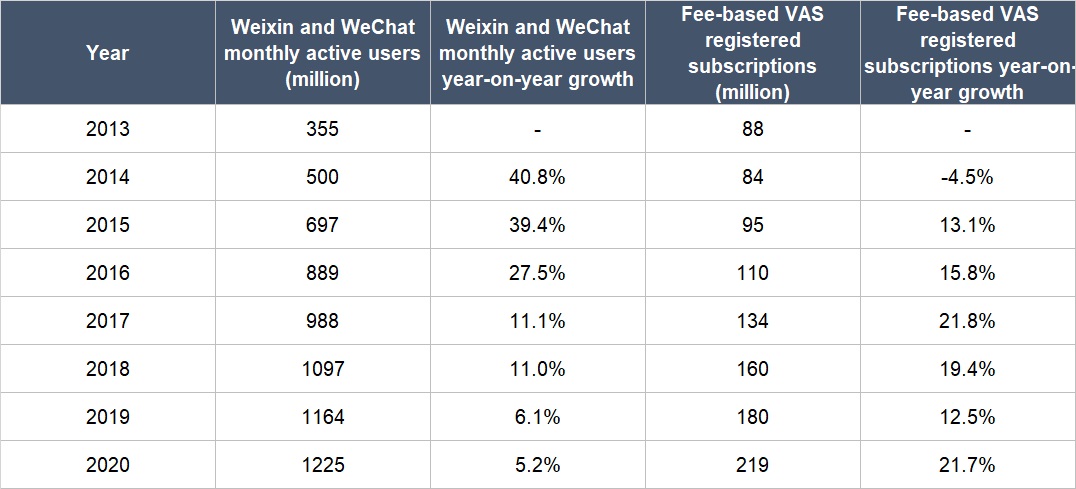

And sticking with WeChat, the superapp’s growth is the fourth thing we want to discuss. The table below shows the user base of WeChat from 2013 to 2020, along with the increase in the number of subscribers for Tencent’s VAS segment over the same period. The growth in WeChat users was driven by the introduction of new features over time, such as WeChat Pay in 2013, WeChat Official Accounts (where organisations can set up official accounts within WeChat to connect with the public) before mid-2014, and Mini-programs (an app-within-an-app feature in WeChat) in 2017.

Source: Tencent website

The fifth thing we want to talk about is Tencent’s excellent track record with its investment activities. Earlier, we mentioned the size of the company’s massive investment portfolio. It’s hard to stitch together a comprehensive history of Tencent’s investment returns. But for perspective, here are some of the deals that Martin Lau and Pony Ma have brokered for the company:

- Tencent bought a 40% stake in Epic Games in 2012 with the whole company valued at US$825 million. Last month, it was reported that Epic Games could fetch a valuation of US$28 billion in its latest fundraising round. If Tencent’s ownership remains the same after the latest round, we’re looking at a return of more than 3,300%.

- Tencent took a 15% stake in JD.com in March 2014. Tencent remains a major shareholder in JD.com today with a roughly 18% stake, according to data from Tikr. From the end of March 2014 to 6 April 2021, JD.com’s share price has increased by 300%.

- Tencent had invested in Sea Ltd as early as 2014 and today still owns around 20% of the company. Since its listing in October 2017 in the US stock market, Sea Ltd’s share price has increased by more than 1,400%.

Lastly, with games being an important business for Tencent, it’s worth noting that revenue from the company’s Online Games subsegment had grown by 25.4% annually over the past seven years, rising from RMB32.0 billion in 2013 to RMB156.1 billion in 2020. Tencent has a special sauce with game production and as an example, the company’s games were in the first, second, and sixth spots (Honor of Kings, Peacekeeper Elite, and League of Legends) among the top 10 games by revenue in 2020.

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

Due to the types of services that Tencent provides, we believe that most of the company’s revenue is recurring in nature. Here’s why:

- The Online Games subsegment (32.4% of Tencent’s total revenue in 2020) earns revenue from monthly subscriptions and sales of virtual items

- The Social Networks subsegment (22.4% of Tencent’s total revenue in 2020) also earns revenue from monthly subscriptions and sales of virtual items

- The fintech business earns revenue from (1) taking a small cut of the transactions that it processes; and (2) commissions from financial institution partners for introducing users. These revenue streams are likely recurring because the transactions and introductions are happening all the time.

- Tencent’s cloud computing arm provides cloud computing infrastructure services, and these are likely to be services its customers require constantly. Tencent’s cloud computing arm belongs to the Fintech and Business Services segment, which accounted for 26.6% of Tencent’s revenue in 2020.

- Revenue from the Online Advertising segment (17.1% of Tencent’s total revenue in 2020) should recur as advertisers want to connect with consumers through the internet; there will be no shortage of business for the segment so long as WeChat and Tencent’s other social networks continue to keep users engaged

5. A proven ability to grow

The table below shows Tencent’s key financials from 2010 to 2020. We chose 2010 as the starting point because WeChat was launched in 2011.

Source: Tencent annual reports and earnings update

A few key things to highlight from Tencent’s historical financials:

- Revenue had compounded at impressive annual rates of 37.7% and 36.2% for 2010-2020 and 2015-2020, respectively. In 2020, Tencent’s revenue growth slowed, but was still excellent at 27.8%.

- Profit to shareholders was positive throughout and had also grown impressively over the timeframe we’re studying. For 2010-2020, 2015-2020, and 2020, the growth rates were 34.8%, 40.9%, and 71.3% per year. We note that Tencent’s profit to shareholders includes gains/losses that are related to its investment portfolio, as required by IFRS (International Financial Reporting Standards). So we think it’s better to focus on the company’s cash flows.

- Operating cash flow was positive throughout the time period we are observing and had compounded at 31.7% per year from 2010 to 2020 and at 33.7% per year from 2015 to 2020. In 2020, operating cash flow was up by 30.6%. These performances are not too shabby at all!

- The dynamics for Tencent’s free cash flow are similar to its operating cash flow. The financial number was positive for each year for 2010-2020 and the compound annual growth rate was 28.5%. The growth rates for 2015-2020 and 2020 were excellent as well at 30.7% per year and 34.8%, respectively. We also want to highlight Tencent’s consistently high free cash flow margins (free cash flow as a percentage of revenue): The averages for 2010-2020 and 2015-2020 were 30.8% and 26.9%, respectively.

- There have been years where Tencent’s balance sheet had more cash than debt (in 2018 and 2019). But the company was never placed in undue financial risk because it was generating so much free cash flow.

- Dilution had not been a problem for Tencent. The company’s weighted average diluted share count increased at a glacial pace of only 0.4% per year from 2010 to 2020; in 2020, the selfsame number inched up by just 1.0%.

- Even though 2020 was a tough year for China’s economy because of COVID-19 – the country’s GDP growth was only 2.3% in the year, the slowest pace seen since 1976 – Tencent had basically shrugged off the pandemic and produced growth rates that were inline with its historical averages..

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

There are two reasons why we think Tencent excels in this criterion.First, there’s still significant room to grow for the company as we had discussed earlier. The company’s core markets of online gaming, mobile payments, and digital advertising are all poised for growth and we think it is well-positioned to capture these opportunities. There are many more markets Tencent is involved with, which means the company could have many possible paths to grow in the future.

Second, Tencent has excelled at generating free cash flow for a long time. We already shared that the company’s average free cash flow margins were 30.8% for 2010-2020 and 26.9% for 2015-2020 – these are excellent margins. Even in the face of COVID-19 in 2020, Tencent’s free cash flow margin was 25.6%. We don’t see why Tencent’s free cash flow margins would weaken in the years ahead, especially when we consider that the company is operating in the high-margin technology space.

Valuation

We like to keep things simple in the valuation process. In Tencent’s case, we think the price-to-free cash flow (P/FCF) ratio is the appropriate metric to gauge the value of the company. This is because Tencent has been extremely adept at producing free cash flow for many years.

We completed our purchases of Tencent shares with Compounder Fund’s initial capital in late July 2020. Our average purchase price was HK$530 per Tencent share. At our average price and on the day we completed our purchases, the company’s shares had a trailing P/FCF ratio of around 43 (using Tencent’s weighted average diluted share count at that point in time). This looked like a reasonable valuation to us for a company that (1) has multiple paths to grow, (2) strong long-term compounded growth in revenue and free cash flow, (3) a powerful super app – WeChat – with a massive monthly active userbase of 1.225 billion, and (4) excellent free cash flow margins that are routinely in excess of 25%. The chart below shows Tencent’s market capitalisation to free cash flow ratio for the last five years and this is a very close proxy to the P/FCF ratio that we calculated earlier. From the chart, it’s also clear that a P/FCF ratio of 43 is nowhere near being egregiously high when compared to history.

Source: Tikr

For perspective, Tencent carried a P/FCF ratio of around 43 at its 6 April 2021 share price of HK$654.

The risks involved

We see four main risks with our investment in Tencent.

First, there’s risk associated with the ownership structure of the company. Tencent is a China-based internet company that is listed in Hong Kong. This also means that it is using a variable interest entities (VIE) shareholder structure to get around China’s laws that restrict foreign ownership in internet companies that are based in the country. Under the VIE structure, Tencent’s shareholders do not own the China business directly. Instead, the shareholders own entities domiciled in the Cayman Islands that receive economic benefits from the China business through a series of contracts.

If the Chinese government should one day deem the contracts to be invalid in the future, owners of Tencent’s Hong Kong-listed shares – such as Compounder Fund – could see their stakes be wiped out. We think the chance of China messing around with the VIE structure is very low, since there are many huge Chinese tech companies listed outside of China that are listed with it (including Alibaba). The economic fallout in the country could be severe if the government decides to rock the boat. But it is still a risk that’s on the top of our minds.

Second, we think that the level of regulatory risk faced by Tencent – by virtue of its status as a technology company that’s based in China – is much higher compared to what its Western counterparts would have to face with their respective governments. The Chinese government may intervene in a heavy-handed way to regulate China-based technology companies in the name of national interests. The changes could be sudden and could hurt a company’s business. Tencent had a taste of this in 2018 when the Chinese government abruptly stopped approving new online games in March because it was worried about China’s youth becoming addicted to games. The approval process was restarted only in December 2018. Tencent managed to appease the authorities by implementing measures to control gaming time among youths, such as using facial recognition technology to detect the age of its gamers. But the hiatus in game approvals caused growth in Tencent’s VAS segment to slow down significantly in 2018.

Earlier this year, the Chinese government issued new anti-monopoly guidelines that targeted major Chinese technology companies, Tencent included. Large Chinese technology companies have recently been in the crosshairs of the country’s regulators for antitrust issues. We’re watching as the situation develops. For now, Tencent’s management seems confident of being able to deal with it. Here’s Martin Lau on the topic during Tencent’s 2020 fourth-quarter earnings conference call:

“We are very self-restrained in terms of monetization and our business practices. And I think a lot of people comment that there’s one way that you can actually turbocharge your revenue. I think we sometimes get criticism on being too much in self-control. But that’s something that we’ll continue to do, and we think it’s going to be beneficial for us in the current environment.

We embrace open platform. And we provide our open platform to a lot of industry partners and help them to grow. We embrace competition, right, but in a fair way. We embrace fair competition even within our own company, right? And because we think that fair competition actually makes the teams better.

And when the teams are better, they provide good products and innovation that create a lot of user value. And finally, we engage in partnerships while respecting our partners’ independence, and this has been our principle in our investments, in our business partnerships, and we’ll continue with that. So with all these existing practices, and we continue to put through our efforts in exercising them right now. I think over time, we would be able to comply with the rules and regulations and also present ourselves as a healthy force in the industry and also fulfil the expectation of the society as a whole.”

Third, we think that there’s significant key-man risk. We see the presence of Pony Ma’s leadership as one of Tencent’s key competitive edges. His vision, capability in execution, and ability to attract and retain key talent have been the building blocks for Tencent’s success. Ma is still young at just 49 years old today so he likely still has plenty of gas left in the tank to continue leading Tencent. But if he leaves the company for any reason, we’ll be keeping an eye on the leadership transition.

Lastly, there’s the risk of WeChat losing relevance in the digital lives of China’s citizens. Although we think the chance of something like this happening is small, the negative impact to Tencent’s business could be severe. China’s technology sector is immensely competitive and there could be a much better social and messaging app than WeChat appearing in the country in the future. Already, Tencent has been locking horns in recent years with Bytedance, the owner of the short-form video social app Douyin in China (known as TikTok internationally). Douyin could be a formidable competitor, given that it was launched only in 2016 but had already amassed 600 million daily users by September 2020.

Summary and allocation commentary

To sum up, Tencent has all the qualities we’re looking out for in an investment opportunity. It has:

- Huge growth opportunities because of its exposure to many different markets including online gaming, mobile payments, and digital advertising; we believe Tencent is also a great example of a company with optionality – because of WeChat’s status as a dominant superapp – and one of the future potential opportunities we’re excited about with the company is its possible participation in the Metaverse

- A robust balance sheet that has more cash than debt, and a prodigious ability to generate free cash flow

- In Pony Ma, a leader who has not only demonstrated integrity, but also a wonderful long-term track record of execution and innovation

- High levels of recurring revenue due to the nature of its various businesses

- An excellent history of growing its revenue, profit, and free cash flow at a rapid clip while not diluting shareholders

- A high likelihood of generating strong and growing free cash flow in the years ahead given the myriad of growth opportunities it has and its history of producing high free cash flow margins.

But an investment in Tencent also carries risks. The important ones, in our view, are Tencent’s ownership structure (shareholders do not own the actual operating businesses); the possibility that changes in China’s laws in the future could hurt the company’s business; key-man risk; and the possibility that WeChat could be leapfrogged by other social apps, given China’s intensely competitive business environment.

After considering the pros and cons, we initiated a 4.0% position in Tencent – a large-sized allocation – with Compounder Fund’s initial capital. We appreciate all of Tencent’s strengths and its valuation looks more than reasonable to us for a company that we think can compound its revenue by 20% or more annually in the years ahead.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share. Of all the companies mentioned in this article, Compounder Fund also currently owns shares in Activision Blizzard, Meituan, Sea Ltd, and Tesla. Holdings are subject to change at any time.