Compounder Fund: Portfolio Update (October 2020) - 15 Oct 2020

Jeremy and I intend to share frequent but non-scheduled updates on how Compounder Fund’s portfolio looks like. The last time we shared an update on this was for Compounder Fund’s portfolio in early-August 2020.

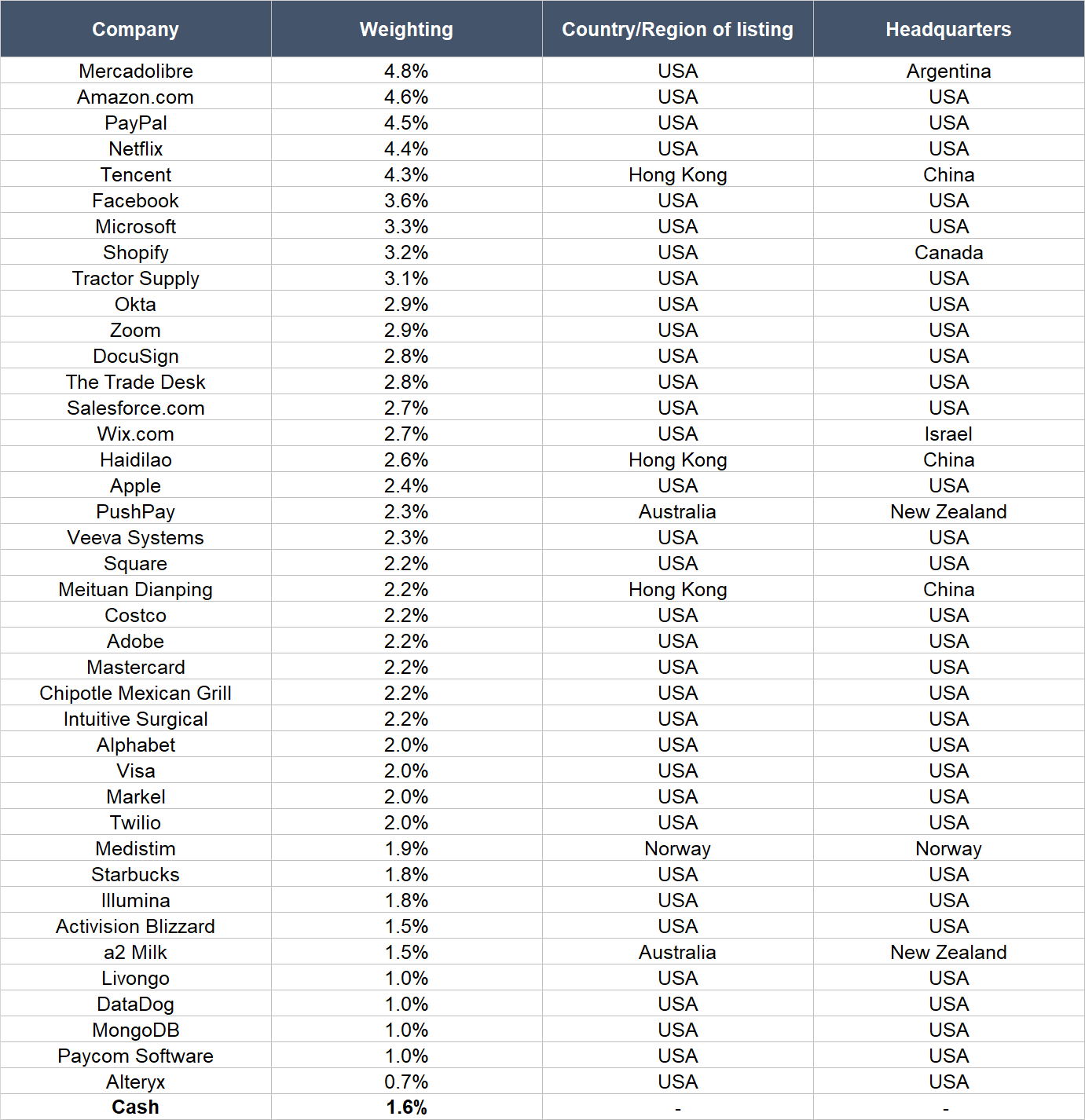

Since then, there have been no changes in terms of the companies in the portfolio – as of today, the portfolio contains the same 40 holdings. What has changed though, are the weightings of the 40 holdings. The changes in the weightings happened because of: (1) The stock price movements of the holdings since we made the investments; and (2) the deployment of new capital.

Compounder Fund is able to accept new subscriptions once every quarter with a dealing date that falls on the first business day of each calendar quarter. In the middle of September 2020, Jeremy and I successfully closed Compounder Fund’s first subscription window since the end of its initial offering period (IOP) on 13 July 2020.

The new capital raised during the subscription window was deployed quickly in the days after 1 October 2020, which is the window’s dealing date. Jeremy and I invested the new capital across 11 of Compounder Fund’s existing holdings. They are (in alphabetical order): Amazon.com; DocuSign; MercadoLibre; Netflix; Okta; PayPal; Shopify; Tencent; Tractor Supply; Wix.com; and Zoom.

In Compounder Fund’s Owner’s Manual, we mentioned that “if Compounder Fund receives new capital from investors, our preference when deploying the capital is to add to our winners and/or invest in new ideas.” Not all of the 11 stocks we added capital to have seen their stock prices rise strongly after we initially invested in them. But all 11 of them have executed brilliantly in recent times and produced wonderful results. They are winners, according to our definition. Here’s how Compounder Fund’s portfolio looks like as of 13 October 2020:

The standout change will be video conferencing app provider Zoom. In Compounder Fund’s initial portfolio that was shared in an investors’ letter I wrote titled, Compounder Fund Investors’ Letter: First Portfolio Update, Zoom’s weighting was just 1.0%. Today, it’s around 3%. In roughly equal measures, the increase in Zoom’s weighting has been due to an increase in its stock price since we first invested as well as the addition of new capital.

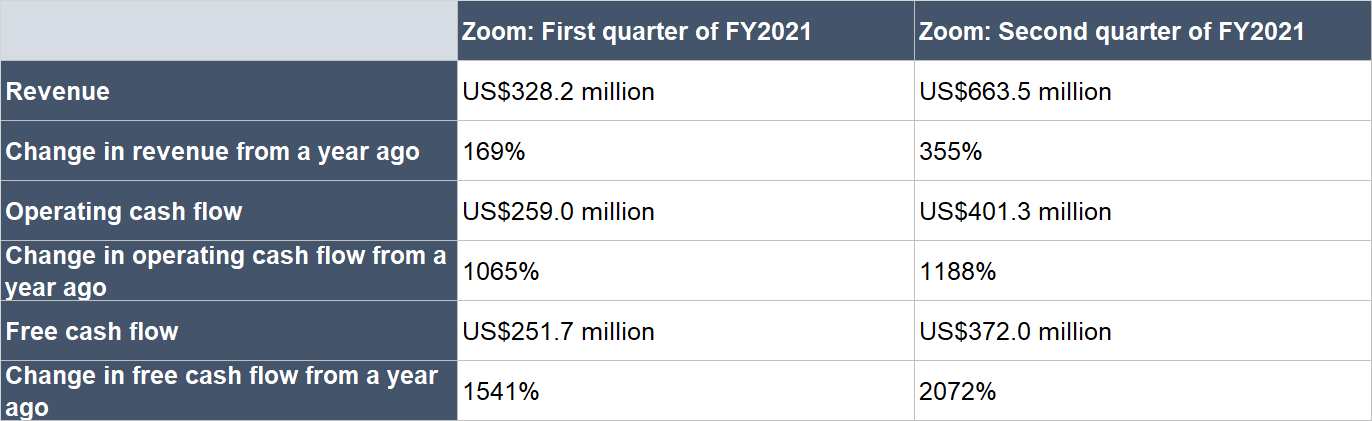

When we first invested in Zoom, the only results the company had reported for FY2021 (fiscal year ending late-January 2021) was for the first quarter. It was really good, with a 169% jump in revenue from a year ago and a huge 1,541% spike in free cash flow. But amazingly, Zoom’s business performance in the second quarter of FY2021 was even better, because of COVID-19-related tailwinds. The table below shows Zoom’s revenue, operating cash flow, and free cash flow in the first and second quarters of FY2021. Zoom’s excellent performance in the second quarter gave us even more confidence in the long-term growth of the company’s business in the future and so we decided to significantly increase its allocation within Compounder Fund’s portfolio.

Source: Zoom earnings updates

In our investment thesis for Zoom, we wrote the following:

“We completed our purchases of Zoom shares with Compounder Fund’s initial capital in late July 2020. Our average purchase price was US$258 per Zoom share. At our average price and on the day we completed our purchases, Zoom shares had trailing price-to-sales (P/S) and price-to-free cash flow (P/FCF) ratios of around 92 and 217, respectively…

…For perspective, Zoom carried P/S and P/FCF ratios of 103 and 197, respectively, at the 21 September 2020 share price of US$468.”

Notice that Zoom’s share price had increased significantly in around two months from late July to 21 September. But crucially, its valuation – measured by the P/S and P/FCF ratios – were similar. This is an effect of the company’s jaw-dropping growth in the second quarter of FY2021. In our view, the best time to add to a company’s shares is when its valuation (and not its share price) declines even when its business grows strongly. The next best time to add is when the valuation stays roughly the same even in the face of excellent growth – this is the case with Zoom.

We’re sharing all this information with the public and with the fund’s investors for two reasons. First, we believe deeply in investor education and want Compounder Fund’s return and actions to be a source for people to learn about investing. Second, we believe that this transparency will help investors of Compounder Fund develop comfort with our investing process over time, which is great; in turn, this will also free us from the time-consuming activity of dealing with questions on how we invest, and thus give us more to invest better for our investors.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share.