Compounder Fund: Haidilao Investment Thesis - 25 Dec 2020

Data as of 23 December 2020

Haidilao (SEHK: 6862), which is listed in Hong Kong and based in China, is one of the 40 companies in Compounder Fund’s initial portfolio. This article describes our investment thesis for the company.

Company description

Hotpot is a popular meal among the Chinese. It involves people – often friends and family – sitting around a big pot of flavourful boiling broth and cooking food items by dipping them into the broth.

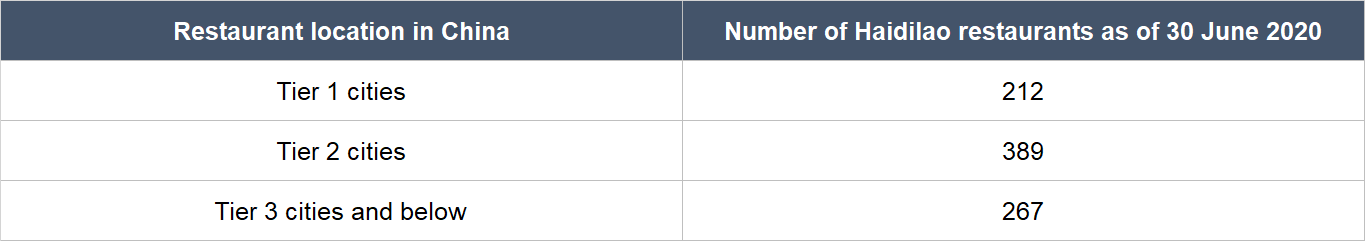

Haidilao’s business is simple – it runs its namesake chain of hotpot restaurants. As of 30 June 2020, the company had 868 restaurants in China and another 67 in other countries and territories around the world, including Australia, Hong Kong, Japan, Singapore, Taiwan, the United Kingdom, the United States, and more. Haidilao’s 868 restaurants in China are located across 164 cities from various tiers with a pretty even mix, as illustrated in the table below:

Source: Haidilao 2020 interim report

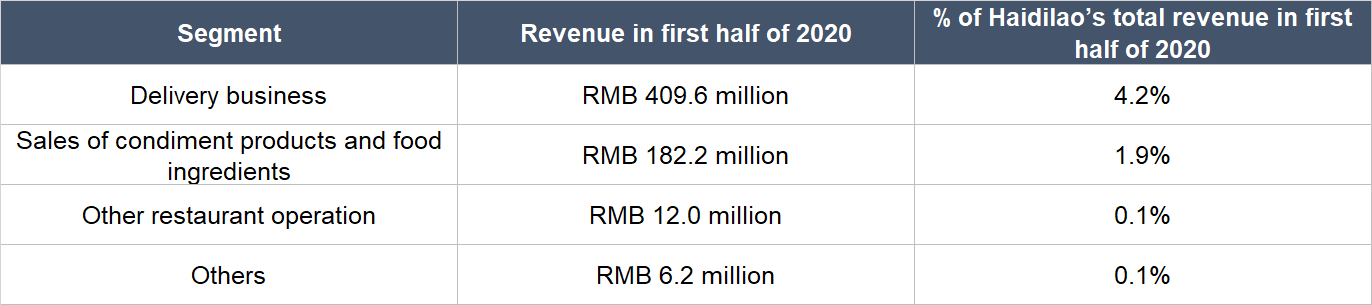

In the first half of 2020, Haidilao earned RMB 9.76 billion in revenue, of which 93.7% (RMB 9.15 billion) came from its namesake hotpot restaurant business. The remaining 6.3% of Haidilao’s revenue came from four other segments that are shown in the table below. And since most of Haidilao’s restaurants are in China, it’s no surprise that the country accounted for the lion’s share of the company’s revenue in the first half of 2020 (89.8%).

Source: Haidilao 2020 interim report

Hotpot restaurants are a dime a dozen in China – there were 601,000 hotpot restaurants in the country in 2017 – and in some, or maybe even all, of the other markets that Haidilao is in, such as Singapore. What sets Haidilao apart from its peers is the service that it provides to guests. Here’s an instructive passage on Haidilao’s service standards that was shared in the company’s 2018 IPO prospectus (Haidilao was listed in September 2018):

“Service is the foundation of our brand — it is what differentiates Haidilao and contributes to our success today. The service quality we aim for is above and beyond the basics of cleanliness, taste and speed of service. We strive to provide services that go beyond those expected for a restaurant, which make our guests feel taken care of. We are a pioneer in the industry to offer services that have now become iconic to Haidilao and followed by our peers. For example, many Haidilao restaurants are equipped with a seated waiting area with free board games, fruit, snacks and tea or other beverages. We also offer complimentary manicures and shoe polish at the waiting area. After guests are seated, our servers pay special attention to our guests’ individual needs, and offer them services to make them feel being taken care of, such as handing out aprons and cell phone covers, hairbands for guests with long hair and eyeglass cleaning cloths for those wearing glasses.”

Haidilao’s restaurants had an average spending of RMB 112.80 per guest in the first half of 2020, which places its restaurants in the mid-to-high-end category. For context, the average level of spending per customer in mid-to-high-end hotpot restaurants in China is RMB 60 to RMB 200.

Investment thesis

We have laid out our investment framework in Compounder Fund’s website. We will use the framework to describe our investment thesis for Haidilao.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

Haidilao served 216 million diners in the 12 months ended 30 June 2020 and earned revenue of RMB 24.62 billion (around US$3.69 billion). In 2017, Haidilao was the largest Chinese cuisine restaurant operator in China in terms of revenue. These data may make the company seem like it’s already a huge restaurant business, without much more room for growth. But a different picture emerges when we dig in.

According to Haidilao’s IPO prospectus, the entire restaurant market in China was a staggering RMB 3.96 trillion in 2017, up 10.7% annually from RMB 2.64 trillion in 2013. The restaurant market in China can be split into three main groups: Chinese cuisine restaurants; Western cuisine restaurants; and restaurants that serve other cuisines. Chinese cuisine represented 80.5% of the total restaurant market in China in 2017, or around RMB 3.19 trillion. The Chinese cuisine market can be further sliced into many different categories, with hotpot style restaurants being the largest group, taking up a 13.7% share. The hotpot restaurant market also exhibited healthy growth of 11.6% per year from RMB 281.3 billion in 2013 to RMB 436.2 billion in 2017. Even if we use the strictest way to define Haidilao’s market – the hotpot cuisine market – its size in 2017 is still nearly 18 times Haidilao’s current revenue of RMB 24.62 billion.

We don’t have more recent data on China’s restaurant industry. But we think it’s highly likely that it is considerably larger today compared to 2017. This is because of the nature of China’s strong economic growth. In 2018 and 2019, China’s GDP increased by 6.75% and 6.11%, respectively, according to the World Bank. China’s economy is on pace to record growth of 2% in 2020, even though the country has been grappling with the COVID-19 pandemic since late last year. Meanwhile, the Chinese economy is now increasingly led by consumers – the contribution from consumption to China’s economic growth had climbed from 45% in 2007 to 76% in 2018. This means that China’s overall economic growth from 2018 to 2020 is very likely to have been driven mostly by consumers. So, we think that Haidilao still has plenty of market share in China to gobble up.

There are also plenty of growth opportunities for Haidilao internationally. We mentioned earlier that 10.2% of the company’s revenue in the first half of 2020 came from countries and regions outside of China. Even though China is the world’s second largest economy, its GDP in 2019 was only 16% of the world, based on World Bank data – this gives perspective on the relative size of the international restaurant industry compared to China’s. Haidilao’s international business has seen its revenue compound at 70.2% annually from RMB 307 million 2015 to RMB 2.57 billion in 2019, but it’s still a drop in the ocean compared to the size of the global restaurant market.

2. A strong balance sheet with minimal or a reasonable amount of debt

As of 30 June 2020, Haidilao’s balance sheet held RMB 4.66 billion in cash and investments and had RMB 3.40 billion in total debt. That’s a strong balance sheet.

For the sake of conservatism, we note that Haidilao also had RMB5.99 billion in lease liabilities. As a restaurant operator, Haidilao’s business has suffered so far in 2020 (based on the latest earnings update for the first half of the year) because of COVID-19. The good thing for Haidilao is that 85.7% of its total lease liabilities of US$5.99 billion are long-term in nature, with payment typically due only from 30 June 2021 onwards.

3. A management team with integrity, capability, and an innovative mindset

On integrity

Haidilao was founded in 1994 by Zhang Yong, Shu Ping (now Zhang’s wife), Shi Yong Hong, and Li Haiyan (now Shi’s wife) with their personal savings of just RMB 8,000. The company started life as an operator of a single humble hotpot restaurant in Jianyang, Sichuan Province in China, and Zhang has been its key leader since its founding.

Today, the 49 year-old Zhang holds the position of Executive Chairman and he and his wife, who’s currently a non-executive director, collectively controlled 68.2% of Haidilao’s shares as of 30 June 2020. At Haidilao’s 23 December 2020 share price of HK$61.50, Zhang and Shu’s 3.61 billion shares are worth a total of HK$222.2 billion (around US$28.9 billion). We think this huge stake helps to align Zhang’s interests with those of Haidilao’s other shareholders. Shi remains an executive director of Haidilao and he has a 16% stake in the company as of 30 June 2020 together with his wife.

Haidilao’s compensation structure for Zhang also seems sensible to us. Zhang’s total compensation in 2019 increased by 159.5% from RMB 14.1 million to RMB 36.6 million. This is significantly higher than the 42.4% increase in Haidilao’s profit to RMB 2.34 billion in the same year. But Zhang’s compensation in 2019 is a rounding error compared to Haidilao’s profit.

Haidilao has a history of conducting related-party transactions (RPTs) that involve huge sums. For example, all of Haidilao’s top five suppliers in 2017 were organisations that are controlled by or linked to members of Haidilao’s management team, including Zhang, Shu, and Shi; Haidilao’s total expenditure with the five connected suppliers in 2017 was RMB 4.93 billion, which was 46.3% of the company’s revenue of RMB 10.64 billion in the year. The picture in 2019 was similar, with three of Haidilao’s top five suppliers in the year being organisations with ties to the company’s co-founders. Haidilao spent a total of RMB 5.18 billion with its top five suppliers in 2019, and this was 19.5% of Haidilao’s revenue of RMB 26.56 billion for the year.

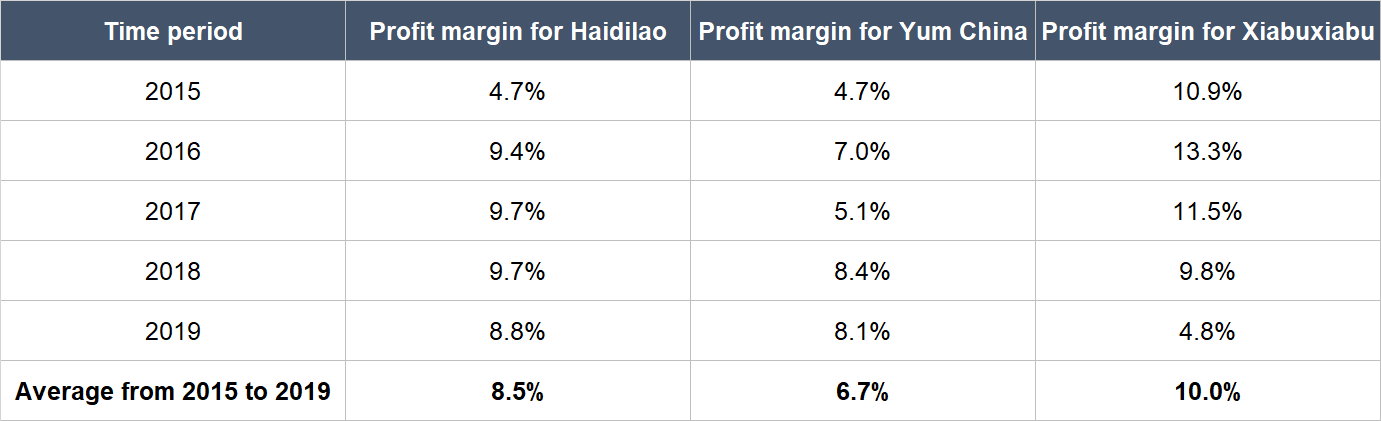

We are typically wary of companies that have significant RPTs. This is because the presence of high levels of RPTs in a company means that management could be using the company to enrich entities that are linked to them. But in Haidilao’s case, we’re not worried for two reasons. First, Haidilao’s profit margin from 2015 to 2019 had averaged at 8.5%, which is comparable with other public-listed restaurant companies that operate mostly in China and that do not run a franchise model (a restaurant company with a franchise model will have very high profit margins, since selling franchise licenses is a very high-margin business). The restaurant companies we are comparing Haidilao’s profit margins with are: Yum China, which operates brands such as KFC, Taco Bell, and Little Sheep (a competitor of Haidilao); and Xiabuxiabu, a company that runs hotpot restaurants across China.

Source: Companies’ annual reports

The second reason is related to one of Haidilao’s largest suppliers, Yihai International. A key supplier of soup bases and condiments to Haidilao, Yihai is also a public-listed company in Hong Kong’s stock market. Yihai’s major shareholders include Zhang Yong and Shu Ping and the couple collectively controlled 373 million Yihai shares (35.6% of the company) as of 30 June 2020. At Yihai’s 23 December 2020 share price of HK$109, Zhang and Shu’s shares are worth nearly HK$41 billion (around US$5.3 billion). This is a huge sum of money, which makes the company an important economic asset for Zhang and Shu. But at the same time, the value pales in comparison to the couple’s stake in Haidilao. So we think that Zhang and Shu’s economic interests are still well-aligned with those of Haidilao’s other shareholders. And to be clear, we’re not trying to say that Zhang and Shu’s interests are not aligned with those of Yihai’s other shareholders – instead, we’re trying to convey our view that the couple’s multi-billion-dollar stake in Yihai is not a cause of concern for Haidilao’s other shareholders.

On capability

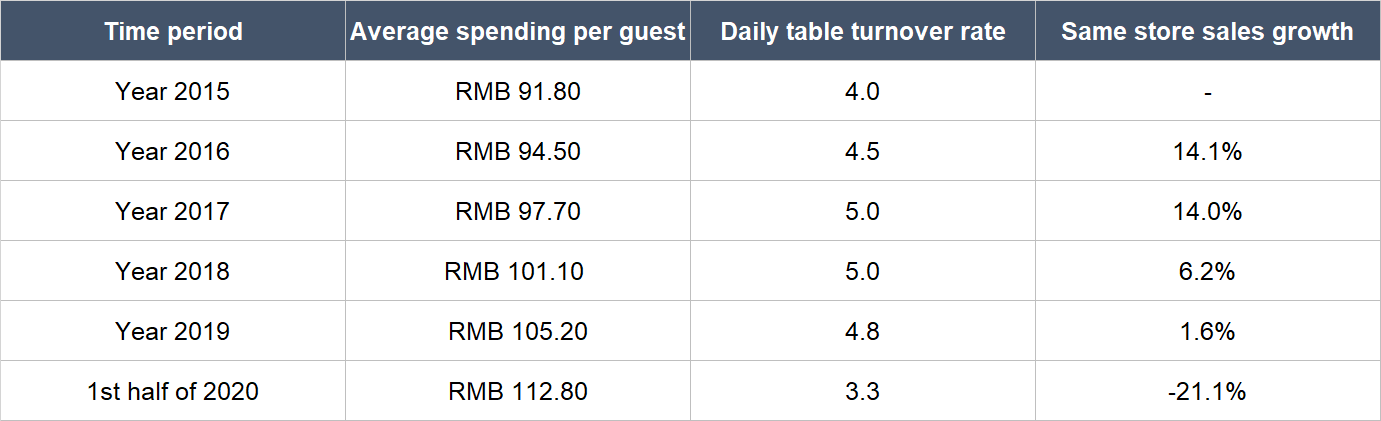

There are a few key numbers from Haidilao that can tell us how well the restaurant company is doing: (1) Average spending per guest; (2) daily table turnover rate; and (3) same store sales growth. The first two numbers are pretty self-explanatory but the last needs some explaining. Same store sales growth represents the change in period-over-period revenue for a company’s restaurants that are in operation for 300 days or more (for comparisons between years) or 150 days or more (for comparisons between half-yearly periods). So what same store sales growth measures is essentially the growth in revenue for Haidilao from its existing stores. The table below shows Haidilao’s average spending per guest, daily table turnover rate, and same store sales growth from 2015 to the first half of 2020.

Source: Haidilao IPO prospectus, annual reports, and 2020 interim report

Haidilao’s management has done a pretty good job at growing the three key numbers from 2015 to 2019. The deceleration in same store sales growth in that period (from 14.1% in 2015 to just 1.6% in 2019) does give us some concern, so we’re keeping an eye on the situation. Haidilao’s table turnover and same store sales growth declined significantly in the first half of 2020 because of COVID-19 – this is through no fault of the company, so we’re not reading too much into this. Besides, Haidilao’s management has seen improvement in the operating performance of the company’s restaurants since 30 June 2020.

We think Zhang Yong and his team also deserves credit for the impressive unit-economics of Haidilao’s restaurants. During 2015, 2016, 2017 and the first six months of 2018, Haidilao’s restaurants typically achieved monthly breakeven within one to three months. A majority of Haidilao’s restaurants that were opened in 2015 and 2016 also had outstanding cash investment payback periods of between six and 13 months. In contrast, other major Chinese cuisine brands tended to need three to six months to achieve monthly breakeven, and 15 to 20 months to achieve cash investment payback.

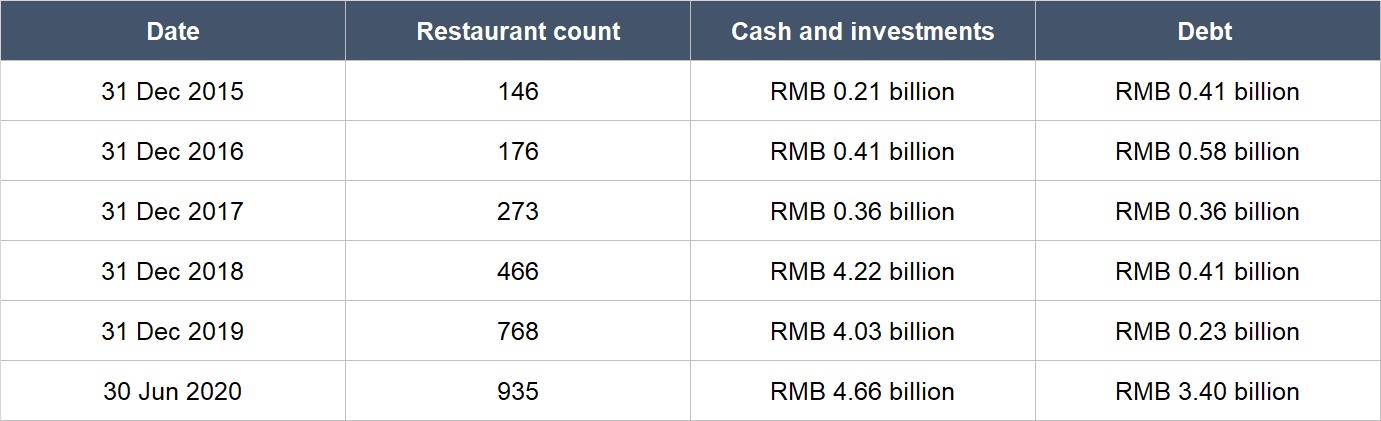

Another noteworthy accomplishment by Haidilao’s leadership is producing staggering growth in the company’s restaurant count while not causing undue financial strain on its balance sheet. The table below shows Haidilao’s restaurant count, cash and investments, and debt going back to 2015:

Source: Haidilao annual reports and 2020 interim report

On innovation

We rate Zhang Yong extremely highly when it comes to innovation. For instance, in October 2018, Haidilao opened its first smart restaurant. The restaurant, located in Beijing, has features such as: Robots with arms to prepare dishes; robot waiters to serve food; automated assembly lines that can prepare standard as well as customised soup bases; a waiting area with interactive games that guests who are waiting for tables (Haidilao’s restaurants often have long waiting times) can participate in through scanning a QR code; a multimedia visual and audio experience for diners in the dining areas of the restaurants, and more. But this is not why we think Zhang is brilliant. Rather, it is the way he runs the company that has impressed us.

“You Can’t Copy Haidilao” is a Mandarin book (the original Mandarin title is “海底捞,你学不会”) written by Huang Tie Ying, a professor at Beijing University. The book, published in 2011, is written from Huang’s point of view and it discusses the highly unusual way that Zhang manages Haidilao. It helped us to understand that while Zhang is not perfect, he has an immense kindness and love toward his fellow man and an unwavering belief in the good of humankind. He had infused these qualities into Haidilao and it had helped him to develop employees who deliver extraordinary service to customers from the heart. And it is this genuine commitment to exemplary service from Haidilao’s frontline service staff that had propelled the company’s growth. In the Appendix section of this article, you can find Mandarin-to-English translations of some of our favourite passages from the book.

We invested in Haidilao before we came across Huang’s book. But we already saw strong signs that Zhang was unique. For instance, Haidilao’s IPO prospectus mentioned:

- Haidilao has industry-leading compensation for employees among all Chinese cuisine restaurants in China.

- Quoting directly from the prospectus: “We seek to give employees greater autonomy to provide better service than our peers. We encourage our restaurant staff to execute their own ideas on how to discover and satisfy the needs of our guests, which originates from our belief that people can be creative when given relatively high degrees of freedom.” The quoted passage is highly similar to what was described in “Translation: On providing incredible service” and “Translation: On extreme trust” in the Appendix section of this article.

- Haidilao’s restaurant managers are primarily evaluated based on customer satisfaction.

- Nearly all of Haidilao’s restaurant managers started working for the company in non-managerial positions (such as waiters, bussers or janitors) and steadily rose through the ranks.

- Restaurant managers share in the profits of the restaurants they manage, but that’s not at all – they enjoy an even larger share of the profits from restaurants that are managed by their first and second-generation mentees.

We cannot confirm if the Haidilao described in “You Can’t Copy Haidilao” is still the same today. But there are also no strong reasons for us to believe that the current Haidilao has warped. The hotpot business is not complicated. You do not require a chef in the shop, so nearly anyone can run a hotpot restaurant. It also means that competition is tough. But Zhang has grown Haidilao’s revenue to RMB 26.56 billion (around US$3.98 billion) in 2019, up 46.6% annually from 2015. Net income, including minority interests, was up 54.6% per year over the same period to RMB 2.35 billion. The company is today a truly massive and global business – when Huang wrote his book, Haidilao was only in China.

We live in Singapore, so we’ve dined in Haidilao’s restaurants and those of its competitors on many occasions. As much as its competitors try to copy the form of Haidilao’s service, they can’t seem to get its substance. And we think there’s only a tiny sliver of a chance that Haidilao’s competitors can ever truly imitate the company. Haidilao’s substance comes directly from Zhang’s worldview, and it is something that is unlikely to be replicable, since no two humans are ever identical. This means that Haidilao has a near unreplicable competitive advantage.

Haidilao’s competitors have copied the company’s service standards. But in our view, Haidilao’s daring empowerment of its restaurant staff, along with management’s clever preference for evaluating restaurant managers primarily based on customer satisfaction, means that Haidilao is likely to always be the first in creating new ways to delight customers. This is important. In our investment thesis on iPhone maker Apple, we quoted passages from a 2018 article that business-writer-extraordinaire Ben Thompson wrote for his newsletter Stratechery. Here are the excerpts that are relevant for our current discussion on Haidilao:

“Bezos’s letter, though, reveals another advantage of focusing on customers: it makes it impossible to overshoot. When I wrote that piece five years ago, I was thinking of the opportunity provided by a focus on the user experience as if it were an asymptote: one could get ever closer to the ultimate user experience, but never achieve it:

In fact, though, consumer expectations are not static: they are, as Bezos’ memorably states, “divinely discontent”. What is amazing today is table stakes tomorrow, and, perhaps surprisingly, that makes for a tremendous business opportunity: if your company is predicated on delivering the best possible experience for consumers, then your company will never achieve its goal.

“

We think a somewhat similar dynamic exists for Haidilao too. There will always be room for improvement for a restaurant company to please its customers on the service-front. And if Haidilao is very likely going to continue to be better than its peers at delighting customers with excellent and innovative service standards, then it can always remain one step ahead of its competitors.

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

We think it’s sensible to conclude that restaurant companies such as Haidilao enjoy recurring revenues simply due to the nature of their business: Customers keep coming back for food.

5. A proven ability to grow

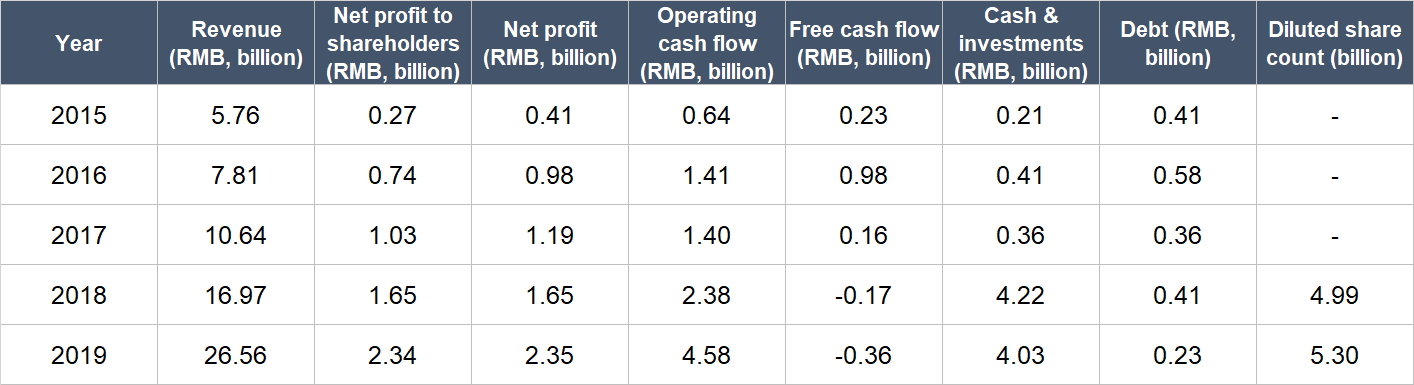

There isn’t much historical financial data to study for Haidilao, since the company was listed only in September 2018. But we do like what we see:

Source: Haidilao annual reports

A few key points about Haidilao’s financials shown in the table above:

- Revenue had grown in each year from 2015 to 2019 and had compounded at an impressive annual rate of 46.6%. The growth rate in 2019 was strong at 56.5%.

- Net profit to shareholders increased in each year too from 2015 to 2019 and grew at an even more impressive pace of 71.2% per year. The increase in 2019 was still outstanding at 42.4%.

- Haidilao had significant minority interests in 2015, 2016, and 2017. This is why the company’s net profit to shareholders for those three years were materially different from net profit. Haidilao’s annual net profit growth rate from 2015 to 2019 was 54.6%, which is still excellent, but is lower than the 71.2% seen for net profit to shareholders. In 2019, Haidilao’s net profit increased by 42.3%, which is very similar to the increase in net profit to shareholders.

- From 2015 to 2019, operating cash flow was consistently positive, grew each year, and climbed at a robust annual pace of 63.4%. In 2019, the increase in operating cash flow came in at 92.1% – not too shabby.

- Because of a sharp increase in capital expenditure over the timeframe under study, Haidilao’s free cash flow is a different picture from its operating cash flow. There’s no consistent track record of growth from 2015 to 2019 and has in fact turned negative in more recent years. But we’re not concerned by this. Earlier, we showed that the company has been opening restaurants at a rapid clip from 2015 to 2019 and its restaurants have excellent unit-economics. So we think that the company’s capital expenditures – which are investments into the business – would eventually be seen as money well-spent on hindsight.

- Haidilao’s balance sheet had more debt than cash and investments in 2015 and 2016, but the net-debt amount was never outrageous. Since then, Haidilao has kept its balance sheet strong with more cash and investments than debt.

- At first glance, Haidilao’s diluted share count appeared to increase by 6.2% from 2018 to 2019. This is already an acceptable rate of dilution given the company’s growth. But a look beneath the hood reveals an even better picture. The number we’re using is the weighted average diluted share count. Right after Haidilao got listed in September 2018, it had a share count of 5.3 billion, which is exactly the same as what the share count was in 2019, meaning there’s been no dilution at all.

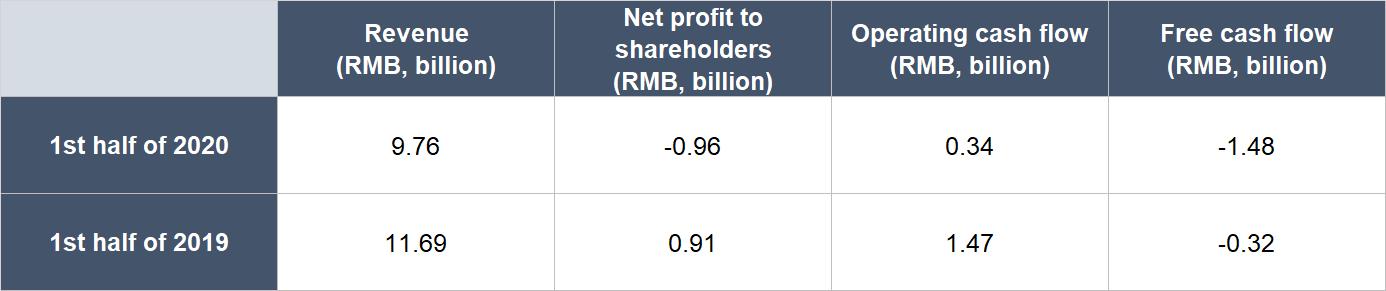

Haidilao’s business performance in the first half of 2020 was hurt badly by COVID-19, as we had already mentioned. Here’s a table showing the year-on-year changes in Haidilao’s revenue, net profit to shareholders, operating cash flow, and free cash flow in the first half of 2020:

Source: Haidilao 2020 interim report

We see COVID-19 as merely a temporary problem for Haidilao. In fact, there’s also the possibility that the company could emerge stronger after the pandemic blows over. According to Haidilao’s IPO prospectus, the restaurant market in China is highly fragmented and is dominated by standalone restaurants. This means that consolidation in the restaurant market is likely at the moment, since standalone restaurants could find it difficult to survive during the current pandemic. Talented employees and good restaurant locations could thus be in higher supply for Haidilao.

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

Haidilao currently does not produce much free cash flow. But given the excellent unit-economics for the company’s restaurants, and the company’s low penetration rate in the China restaurant market (the international penetration rate is even lower), we think it is likely that Haidilao could produce a strong stream of free cash flow in the future.

Valuation

We like to keep things simple in the valuation process. In the case of Haidilao, we think the price-to-earnings (P/E) ratio is an appropriate gauge for the company’s value. Haidilao already has a multi-year history of generating profits, but it is not generating much free cash flow at the moment as it invests to expand its restaurant network.

We completed our purchases of Haidilao shares with Compounder Fund’s initial capital in late July 2020. Our average purchase price was HK$35 per Haidilao share. At our average price and on the day we completed our purchases, the company’s shares had a trailing P/E ratio of around 71, based on its full-year results for 2019 (Haidilao’s results for the first half of 2020 were released only in late August 2020). This is clearly a high valuation, and it’s worth noting that Haidilao’s earnings back then were not temporarily depressed because of COVID-19.

But we’re comfortable with paying up for Haidilao. The company has a history of producing excellent revenue growth and we see no reason why its revenue cannot continue to grow at a rapid clip in the years ahead. This topline growth should also lead to commensurate increases in Haidilao’s bottomline and free cash flow over time too.

For perspective, Haidilaio carried an absurd P/E ratio of around 620 at the 23 December 2020 share price of HK$61.50. But this is because the company’s profit is currently weighed down by COVID-19.

The risks involved

We see five main risks with our Haidilao investment.

Firstly, there’s key-man risk. We see Zhang Yong as the instrumental figure in guiding Haidilao to where it is today and he will be equally important for the company’s future growth. We believe that Haidilao’s key strength – its ability to delight customers – is a product of Zhang’s genuine care and concern for his people, and his unique worldview. These are nearly unreplicable. If Zhang steps away from Haidilao for any reason, we will be concerned.

The second risk is related to the company’s decelerating same store sales growth from 2015 to 2019. We’re keeping an eye on Haidilao’s same store sales growth in the coming years as this figure can give us clues on whether the company is facing intensifying competition and/or saturation in its market.

Third, we’re looking at COVID-19. The pandemic has caused difficulties for many restaurant companies, Haidilao included. Right now, with the successful development of vaccines for the virus, there’s light at the end of the tunnel. But if the COVID-19 situation worsens or doesn’t improve from here for a prolonged period, Haidilao’s business could be in pain for a considerable length of time.

Fourth is Haidilao’s current lack of free cash flow. We explained why this is currently the case and we’re not worried about it. But it’s still a risk until we see Haidilao actually start consistently producing robust free cash flow.

The fifth risk we see is Haidilao’s high valuation. We’re comfortable paying up for Haidilao, because it has tremendous growth prospects and an excellent leader in Zhang Yong. But if there are any hiccups in the company’s growth – even if they are temporary in nature – there could be painful falls in the share price. This is a risk we have no worries taking on as long-term investors.

Lastly, there’s the risk that Haidilao’s restaurants become embroiled in massive food-safety scandals. The company is serious about food safety, but we don’t think it’s possible to completely eliminate the chances of such issues flaring up. Haidilao has experienced hygiene problems in the past. For instance, a Beijing newspaper reported in August 2017 that rats were caught on video in two of the company’s restaurants in Beijing, and a worker was found to be fixing a blocked sewage pipe with a soup ladle.

Summary and allocation commentary

To summarise, Haidilao ticks all our boxes:

- The company holds a negligible share of a massive restaurant market in China, and it has an even more negligible share of an even larger restaurant market worldwide.

- The balance sheet is strong with more cash and investments than debt. Although there are sizeable lease liabilities, they don’t come due before 30 June 2021, so liquidity is not a problem.

- We admire Zhang Yong’s unusual but brilliant way of managing Haidilao, with a focus on empowering even rank-and-file employees and evaluating employees in a way that makes sense for the long-term growth of the company.

- Haidilao has recurring revenues, since customers will keep coming back for food.

- The company has a multi-year history of producing excellent revenue and profit growth. Free cash flow is currently lacking, but we don’t see any reason for concern yet.

- We think the hotpot hotshot’s free cash flow has a high chance of growing significantly in the years ahead.

Haidilao does have a high valuation, and that’s a risk. The other risks to our Haidilao investment includes key-man risk; the possibility that the company has already saturated its market and/or is facing tougher competition; the potential for long-term harm to its business if the COVID-19 pandemic drags on; the company’s current lack of free cash flow; and the chance of food hygiene problems flaring up in the company’s restaurants in the future.

After weighing the pros and cons, we decided to initiate a 2.0% position – a medium-sized allocation – in Haidilao with Compounder Fund’s initial capital. We appreciate all the positives we see in Haidilao. But at the same time, our enthusiasm is tempered by the combination of the company’s high valuation and decelerating same store sales growth in the past few years.

Appendix (translations)

Translation: On providing incredible service

Even someone who has worked in Haidilao for only a day would know an aphorism of Zhang Yong’s: “Customers are won table by table.”

Why do we have to win customers table by table? Because every customer in a hotpot restaurant is there for a different reason. Some are couples on a date, some are there for a family gathering, while some are having business dinners. What every customer needs will be different, so how you move each customer’s heart will not be the same.

Zhang Yong has performed every single task that’s required in a hotpot restaurant… He knows that customers have a wide variety of requests. If you strictly follow standard operating procedures, the best result you can hope for is for your customers to not fault you. But you will never be able to exceed their expectations and delight them. For example, no restaurant’s operating procedure will include a free shoe-shining service.

In the early days after Zhang Yong opened his first hotpot restaurant, there was a familiar face who visited. Zhang Yong realised that the shoes of this old friend were very dirty, and so he arranged for an employee to clean his friend’s shoes. Zhang Yong’s little act moved his friend deeply. Ever since, Haidilao has provided free shoe-cleaning services at its restaurants.

A lady who stayed above a Haidilao restaurant once ate there and praised its chilli sauce. The next day, Zhang Yong brought a bottle of the sauce to her and told her that Haidilao would be happy to send her a bottle any time she wants to have it.

These are the roots of Haidilao’s extreme service standards.

But these differentiated services can only come from the creativity of every employee’s minds.

Having processes and systems are critical when running chain restaurants… Processes and systems can ensure quality control, but human creativity is suppressed at the same time. This is because processes and systems overlook a human’s most valuable asset – the brain…

… The goal of providing world-class service is to satisfy customers. Since each customer has different preferences in the process of consuming a hotpot meal, it’s not possible to fully rely on SOPs to achieve 100% satisfaction….

…If some customers do not enjoy a free bowl of soya milk and sour plum soup, can we give them a bowl of chicken egg porridge instead? Even if we normally charge for this porridge, an elderly person with weak teeth who receives it for free may remember this considerate act for life!

A customer craves ice cream – can the restaurant’s waiters leave their station to purchase the ice cream from a neighbouring shop? A customer realises he has overordered – can he return a plate of vegetables? A customer wants to enjoy more variety – can she order half-portions? A customer really likes the dining aprons that the restaurant provides guests – can the customer bring one home for her child?

When faced with these requests that are not included in SOP manuals, most restaurants will just say “No.” But at Haidilao, the waiters are required to exercise their creativity: “Why not?”

I grabbed a few stories from Haidilao’s internal employee magazine to highlight the company’s incredible service standards…

…Zhang Yao Lan from Haidilao’s third Shanghai restaurant says:

“Business was exceptional on a Saturday night. At 7:30pm, the Yu family visited the 3rd room… They ordered quail eggs and as I helped them cook the eggs in the hotpot, I noticed that Aunty Yu ate all the radish strips that came with the eggs.

I figured that Aunty Yu loves radish strips. So I called the kitchen to prepare a plate of radish strips and I added my own special concoction of sauces. The Yu family were really surprised when I served the radish and asked if they had ordered the dish. I said that it’s a gift from me because I guessed that Aunty Yu likes eating radish strips and that I hope they like it…

…They were really happy and praised me as they dug into the dish. They even asked how the dish was made… The following month, the Yu family came three times, and even brought their friends (with surnames of Cai and Yang) to Haidilao. See, how magical a plate of radish strips is – it has helped me to win so many customers!”

Translation: On winning over the hearts of employees (and more on providing incredible service)

Zhang Yong was once a waiter. So he understands that every employee is critical in ensuring the delivery of truly outstanding service. Haidilao’s employees are given the freedom to exercise their creativity and even make small mistakes – Haidiao can really touch the hearts of customers only if the company gets the short end of the stick at times.

But this is easier said than done. Haidilao’s employees have travelled far from home and they come from villages that are mired in poverty. They have little education, have not seen much of the world, and are often looked down upon, resulting in an inferiority complex. How can Haidilao motivate such employees to develop the initiative to provide excellent service for customers?

Zhang Yong said: “The hotpot business requires very little skill… Anyone can do it after some light training if they are willing. The key though, is the willingness. Waitressing is a physically demanding job with low social status and benefits. Most waiters don’t perform well because they have no other choice other than to take up the role. So to ensure that waiters can excel in their role, the focus should not be on the training methods. Instead, it should be on how to develop the willingness in people to take up waitressing jobs. If your employees are willing to work diligently, you win!”

I asked Zhang Yong: “Can you find me a boss who does not want hard working employees? This is the Mount Everest for every boss in the world. But it’s rare for any leader to achieve this.”

Zhang Yong replied: “I think that humans have emotions. If you treat somebody well, he or she will treat you well in return. As long as I can find ways to let my employees think of Haidilao as their home and family, my employees will naturally care for our customers.”…

…How can Haidilao get its employees to think of the company as family?

To Zhang Yong, the answer is simple – treat your employees as family. If your employees are your siblings and they have travelled afar to Beijing to work for you, would you house them in underground basements that most people in Beijing are not willing to live in? Of course not. If you have the resources, you wouldn’t bear to let your family members stay in a place that’s humid and lacks proper ventilation. But for many restaurant owners in Beijing, they house their employees in underground basements while they themselves live above ground.

Haidilao’s employees get to stay in proper housing, with similar living conditions to the locals in Beijing. There are heaters and air conditioning, and Haidilao ensures that there’s no overcrowding. In addition, each hostel has to be within a 20-minute walking distance to the restaurants that the employees work in.

Why? This is because Beijing’s traffic system is complex. Restaurant staff members work long hours, and as young adults, they require ample sleep. Because Haidilao is picky about where its employees stay, there are only a few suitable locations that also happen to be desirable among the locals in Beijing. This has caused some haughty locals in the city to be unhappy.

There’s more. Haidilao also has specialised employees who take care of the hostels’ housekeeping needs. There’s free internet, TV, and phones too. Haidilao’s employees state that their hostels are akin to hotels with “stars”!

Getting employees to treat your company as family is not as simple as just repeating some mantra or educating them. Humans are intelligent – your actions will show what you truly mean. Haidilao’s employees come from poor villages. During Beijing’s cold weather season, Haidilao issues hot-water packets to keep these employees’ blankets warm. For some Haidilao restaurants, there are even employees in the hostels who come in the night to fill up the packets with hot water. Isn’t this something that only mothers will do?

If your siblings travel from your village to work in the city, you’ll naturally be worried that they won’t be familiar with traffic, that they will be looked down upon by city folks. Because of this, Haidilao’s training program also includes soft skills such as map reading, how to use flush toilets, how to navigate the transport system, how to use bank cards etc…

…If your siblings have travelled somewhere far to work, what would happen to their children’s education? Haidilao set up a boarding school in Jianyang, Sichuan, for the children of the company’s employees.

Haidilao does not just take care of its employees’ children, it also cares for its employees’ parents. Haidilao provides a monthly stipend (a few hundred RMB) to the parents of employees who hold the rank of foreman and upwards. Every parent would want a capable child. Homecoming opportunities for Haidilao’s employees are rare. But Haidilao’s monthly stipend gives the parents of these employees a regular opportunity to feel pride for their children. Chinese people are stingy, the villagers even more so. Despite feeling pride, the villagers would only say: “My child is fortunate to have found a good company where the boss treats them as brothers!” No wonder Haidilao’s employees all affectionately call Zhang Yong, “Big Brother Zhang.”

Translation: On extreme trust

What does it mean to respect people? Does it mean you have to bow to your boss or cheer for your superiors? This is not respect for people – this is only respect for status and power. Respecting people means trusting them.

If I trust your ethics, I would never guard myself against you. If I trust your ability, I would entrust important tasks to you. This is what it means to respect someone! When a person is trusted, a sense of responsibility would arise within. When an employee is trusted, he can treat the company as family.

At Haidilao, employees are not only treated better than at other restaurant companies – they are also trusted by the company.

To treat employees as family is to trust them like you trust your family members. You have to show through actions that you trust someone – words are not enough. The only sign of trust is to confer authority…

…So at Haidilao, any expenditure above RMB 1 million will require Zhang Yong’s approval. Anything lower than RMB 1 million is the responsibility of the vice president, finance director, and regional manager. Sectional managers and the heads of the Purchasing and Engineering departments have the authority to sign off on expenditures of up to RMB 300,000, while restaurant leaders can do so up to RMB 30,000. It’s rare to find private sector enterprises that have the confidence to delegate authority to such an extent.

What Haidilao’s peers find the most unbelievable about Zhang Yong is the trust he places in his frontline service staff. Even Haidilao’s ordinary frontline service staff have the power to give customers partial to full discounts without having to seek approval from their superiors. As long as a staff member thinks it’s appropriate to discount a dish or provide a free dish (or even an entirely free meal), he or she can do so. This authority means that all of Haidilao’s employees – regardless of rank – are effectively managers, because such authority is usually reserved only for managers at restaurants.

In the spring of 2009, I invited Zhang Yong to give a lecture to MBA students in Beijing University. A student asked: “If all your staff can give full discounts for meals, will there be cases where rogue employees provide free meals to their own family and friends?”

Zhang Yong asked the student instead: “If I give you this authority, will you do it?”

The entire class of more than 200 students fell silent. Indeed, with your hand on your heart: Will you bear to betray such trust in you?

The truth is, the vast majority of people know deep in their hearts that kindness needs to be repaid and they would not betray the trust that others have placed with them.

Having been a frontline service staff, Zhang Yong understands this logic: If he wants to utilise the minds of his employees, he needs to give them authority. This is because the satisfaction of customers actually rests entirely in the hands of his frontline service staff. It is after all his frontline service staff who interact with customers from the moment they step into the restaurant till the moment they leave. If a restaurant’s manager has to be consulted before a frontline service staff can solve any unhappiness a customer experiences, the process itself will only vex the customer further.

Humans are often worried when they’re waiting for a problem to be resolved. So the only way to solve customer-unhappiness at scale is to give frontline service staff the power to deal with problems. More importantly, it is the frontline service staff who best know the whims and fancies of customers. They are the ones who can touch the hearts of customers table by table.

Translation: On treating employees the right way

Zhang Yong has an unwritten rule within Haidilao. And because he is the unquestioned leader of the company, the people within Haidilao believe his words.

He said: “Anyone who has been a restaurant leader at Haidilao for at least a year will receive a “dowry” of RMB 80,000 if they leave the company for any reason.”

I asked: “Even if they’re being poached by competitors?”

Zhang Yong responded: “Yes”

“Why?” His answer completely took me by surprise.

Zhang Yong explained: “The work in Haidilao is incredibly tough. Anyone who can rise to the rank of restaurant leader and above has already contributed significantly to the company.”

In fact, many of Haidilao’s leaders clock in overtime for extended periods and this takes a significant toll on their physical and mental health. Many of them are riddled with health issues even at a young age. Haidilao’s procurement head, Yang Bin, once set a record in 2004 by working for 365 days straight.

Zhang Yong said: “Every Haidilao leader deserves credit for building Haidilao to what it is today. So we should give people what they deserve when they leave for any reason. If a sectional manager leaves, we provide a reward of RMB 200,000. If a leader with the title of regional manager or higher leaves, the gift will be a ‘hotpot restaurant’ – that’s around RMB 8 million in value.”

I asked, somewhat in disbelief: “If Yuan Hua Qiang [a leader in Haidilao with significant importance] is poached, you will reward him with RMB 8 million?”

“Yes, if Yuan Hua Qiang wants to leave today, Haidilao will reward him with RMB 8 million,” Zhang Yong said gently and plainly, while lowering his head as though deep in thought.

Even though I know Zhang Yong wants to win over every talented individual he encounters, this policy of his is highly unusual – not many will dare to implement it. It seems like if you’re not trying to be different and do what others won’t, you can’t ever win – but even if you do, it does not guarantee success! Zhang Yong walks the extreme path….

…Haidilao’s entrance to Beijing did not go smoothly. The company fell for a scam in its first real estate deal there and lost RMB 3 million. At that time, it was all the cash that Haidilao had.

“Did you manage to find the culprit?” I asked Zhang Yong.

“So what if we had found him? There was even a retired judge in the group of scammers. We simply were not aware that we had fallen into a trap.”

I continued to ask: “Did you scold anyone after you heard the news?”

Zhang Yong said: “How would I dare to scold anyone?! The Beijing manager was already so anxious that he could not eat for two days. In fact, I did not dare to call him in those few days. I only decided to contact him after I heard that they wanted to kidnap the culprit. I said, are we worth only RMB 3 million? Let’s start doing the real work.”

I followed up: “Did you really not blame him, or feel any pain?”

Zhang Yong replied: “Of course I felt the pain. The sum we lost was all our cash at that point in time. But I really did not blame him. Because if I was the one in Beijing, I would have fallen into the same trap!”

Dear bosses, after reading this, please ask yourself if you would think this way if you were to run into the same situation?

No wonder Haidilao has only ever had to pay its “dowry” to three people in its 10-plus years of operating history, despite having more than a hundred people who qualified for the reward if they had left.

But as a company grows, there will be all kinds of people in it. Haidilao is no exception. Last year, there was a restaurant leader who quit Haidilao to join a competitor who set up shop just opposite her Haidilao outlet. She also brought along her Haidilao restaurant’s kitchen manager, area manager, and other service staff leaders. When she came back to Haidilao to ask for her “dowry,” Zhang Yong refused.

Translation: On priorities

In his 2006 New Year’s address to employees, Zhang Yong said: “If you’re talking to me and your phone rings because your staff is calling you, then you and I will stop our conversation. Your priority should be handling your staff’s issue. If you’re talking to your staff and a customer needs help, you and your staff should end the conversation and focus on the customer’s needs. This is what our list of priorities should look like when I talk about placing customer satisfaction at the centre of what we do. As I grow older, I’ve come to gradually understand the broader meaning of the term “customer” – it includes our employees.

Translation: On evaluating a restaurant business

Zhang Yong has an extremely strange way of evaluating the performance of every Haidilao restaurant. A restaurant’s profit is not part of the assessment criteria that Haidilao’s HQ uses. To add to the weirdness, Zhang Yong does not have any annual company-wide profit target for Haidilao.

I asked him: “Why do you not assess profits?”

He responded: “Assessing profits is useless because profit is the result of the work we do. If our work is bad, it’s not possible to produce high profits. But if we do good work, it’s impossible for our profits to be low. Moreover, the company’s profit is the end result of all the work performed by various departments. Each department has a different function, so it’s tough to clearly define their contributions. There’s also an element of chance in the profit a restaurant earns. For example, no matter how hard a restaurant leader and his team works, a poorly-located restaurant can’t hope to outperform a restaurant with average-leadership but a superb location. But a restaurant leader and his team have no say in choosing a restaurant’s location. It’s not fair, nor scientific, to insist on assessing a restaurant’s performance based on its level of profit.”

I followed up: “The level of profit depends, at least to some extent, on costs. Each individual restaurant should at least be able to control its costs, right?”

Zhang Yong said:

“Yes that’s right. But in what areas can those below the rank of restaurant leader have the biggest effect? It’s in improving service standards and winning more customers! Lowering costs is not as important as creating more revenue.

As Haidilao started to introduce more SOPs, we also began to assess results more. Consequently, some sectional leaders started to include profit in their evaluation of individual restaurants. When this happened, incidents like the following occurred: Brooms for toilets continued to be used even when there were no longer any whiskers on them for sweeping; the watermelons that we gave to customers for free stopped being sweet; and towels with holes were given to customers to dry themselves after using the washroom.

Why? Because each restaurant has very little control over its own costs. The important cost items in a restaurant – its location, renovation, dishes, prices, and manpower needs – are set in HQ. Rank and file employees can only focus on the little things if you insist on evaluating profit. We noticed this phenomenon before it was too late and promptly stopped using the level of profit as a criterion for performance-assessment. In actual fact, any employee with even a modicum of business sense does care about costs and profits. Even if you merely conduct a basic accounting of profit, everyone is already paying attention to it. So if you make the level of profit a key criterion for performance assessment, it will only magnify people’s focus on profit…

…I asked Zhang Yong: “You do not even look at a restaurant’s revenue when assessing its performance?”

Zhang Yong said: “Yes, our performance criteria does not include profit. But that’s not all. We also do not include revenue as well as other KPIs that are commonly used by restaurant companies, such as spending per customer. This is because these criteria are results. If a business manager insists on waiting for these results to know if the business is doing well or poorly, wouldn’t the food already be cold by the time? Imagine that there’s a polluted river and instead of trying to fix the source of the pollution, you’re only busy filtering, testing, and removing filth downstream. What’s the point?”…

…Zhang Yong said: “Now we only have three criteria for evaluating the performance of each hotpot restaurant. First is the level of customer satisfaction; second is the level of positiveness in the work attitudes of the restaurant’s workers, and the third is the restaurant’s ability to nurture leaders.

I replied: “These are all qualitative criteria. How do you measure them?”

Zhang Yong answered: “Yes, they are all qualitative, so you can only measure them qualitatively. Teacher Huang, I don’t understand why these scientific management tools insist on scoring qualitative things. Let’s talk about customer satisfaction for instance. Do they expect every customer to fill up a survey form? Think about this. How many customers are willing to fill up your form after their meal? Wouldn’t customers’ unhappiness increase if they’re being made to fill up forms? Besides, how believable can a form be if you’re forcing it onto someone?

I asked: “How then do you evaluate customer satisfaction?”

He said: “We get the direct superiors of restaurant leaders – sectional managers – to conduct frequent yet random visits to the restaurants. The sectional manager and his assistant will communicate at length with the restaurant leader. In what areas have the level of customer satisfaction increased or decreased? Have frequent diners appeared more regularly this month, or less? Our sectional managers were all once frontline service staff who rose to their current roles. They have intimate knowledge when it comes to customer satisfaction.

It’s the same when it comes to employee’s work attitudes. Teacher Huang, if you’re the one doing the assessment, it won’t work. All you’ll see are people running about, with smiles on their faces. But if it’s me, I will be able to tell you: Look at that young chap there with hair that’s too long. This young girl has applied her makeup too sloppily. Some employees’ shoes are dirty. This service staff is standing there in a daze. These are all signs on the level of positivity that employees bring to work, aren’t they?! It’s the same when a restaurant leader assesses his team leaders and when his team leaders assess their teams.

I further probed: “So their rewards depend on these qualitative assessments?”

Zhang Yong replied: “It’s not just their rewards. Their promotions or demotions also depend on the three criteria. Think about this. How can most waiters have positive work attitudes if their restaurant leader is an unfair person? And how can customers be happy if they are served by waiters who are not positive at work? The revenue and profit numbers for such a restaurant will definitely be bad. There’s no need to wait for the numbers to be out to replace the restaurant leader or remind him that he needs to change his ways. And even if the numbers are good, it has nothing to do with the restaurant leader. We’ve had cases where we are unable to promote restaurant leaders who run very profitable restaurants. This is because they are unable to groom talent. The moment these restaurant leaders step away from their restaurants, problems occur. For these restaurant leaders, we may even demote them despite the high profits their restaurants are producing.”

Translation: What it means to truly care for employees

In 2006, Haidilao’s directors decided to establish a union. Unions are supposed to belong to employees, but Zhang Yong gave Haidiao’s union a unique mission. During the birth of the union, he said some important things:

“The 11 restaurants we have welcomed 3 million customers last year. The vast majority of these customers visited our restaurants because of the people working in Haidilao. This is proof of the excellent calibre of many of Haidilao’s employees. Since we have so many outstanding colleagues, shouldn’t we group them together, so that we can rely on them to influence even more people to remain at Haidilao and continue working hard (this is Zhang Yong’s purpose for setting up the union)? Because of this, I need the cream of the crop to join the union. The union should be an excellent organisation within Haidilao (Zhang Yong can really innovate!)…

…Every union member needs to understand this simple logic. We’re not caring for our employees simply to carry out the company’s orders. We’re doing so because we truly understand that we’re all human. And every human being needs to care and to be cared for. This care stems from a belief, and that is “all men are created equal.”

If our union members understand this point, then we’ll know that the union should not only be caring about the little things, such as taking care of employees when they have a small illness. What’s even more important is for the union to provide a platform for them to change their destiny. And to change their destiny is to win more diners for Haidilao with all their might. To open more restaurants so that there are more opportunities for career growth for the people of Haidilao to change their destiny. This is what it really means to care for employees.”

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share. Of all the companies mentioned in this article, Compounder Fund also currently owns shares in Apple. Holdings are subject to change at any time.