Compounder Fund: Adobe Investment Thesis - 24 Oct 2020

Data as of 22 October 2020

Adobe Inc (NASDAQ: ADBE) is one of the 40 companies in Compounder Fund’s initial portfolio. This article describes our investment thesis for the company.

Company description

Adobe was founded in 1982 by ex-Xerox employees, Charles Geschke and John Warnock. In its early days, Adobe’s business was in developing software for printing. The Adobe of today is much different: It is one of the largest and most diversified software companies in the world.

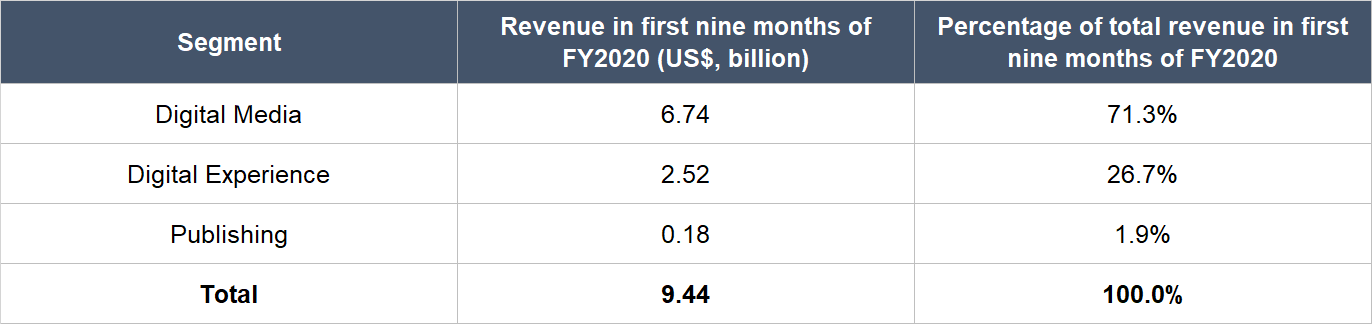

There are currently three business segments in Adobe: Digital Media; Digital Experience; and Publishing. The table below shows Adobe’s revenue breakdown by segment for the first nine months of FY2020 (the fiscal year ending late-November or early-December 2020).

Source: Adobe quarterly earnings update

Publishing is by far Adobe’s smallest segment and it houses the company’s legacy products. The key segments for Adobe are Digital Media and Digital Experience.

Digital Media itself consists of two sub-segments: Adobe Creative Cloud, and Adobe Document Cloud. They brought in revenues of US$5.65 billion and US$1.09 billion, respectively, in the first nine months of FY2020.

Adobe Creative Cloud, as its name suggests, is a cloud-based software subscription offering. Its products, which can be used on both computers and mobile devices, include Photoshop, Illustrator, Premiere Pro, Lightroom, InDesign, Adobe XD, and more. Users rely on Adobe Creative Cloud’s products for content creation, design, video and animation production, mobile app and gaming development, and document creation and collaboration. In fact, much of the printed and online information you see, read, and interact with everyday are created using Adobe Creative Cloud’s products.

Meanwhile, Adobe Document Cloud, which is also a cloud-based software subscription offering, is built around Adobe’s Acrobat family of products. Adobe Document Cloud’s products include Adobe Acrobat DC (the industry standard for PDF creation and conversion), Adobe Acrobat Reader, and other cloud-based document services such as Adobe Sign and Adobe Scan. Adobe Document Cloud enables its users to create, review, approve, sign, and track documents. (For some trivia, the PDF acronym stands for Portable Document Format, an apt name given the purpose and use of PDFs.)

The Digital Experience segment consists of a suite of cloud-based software products – named Adobe Experience Cloud – that are designed to help businesses optimise their customers’ digital experiences. These products provide their users with real-time data and insights, deliver content and personalisation, enable customer journey management, and provide platforms for commerce and advertising management. The table below shows the current key product groupings in Adobe Experience Cloud:

- Data and Insights: Delivers real-time customer profiles and insights and includes products such as Adobe Analytics, Adobe Audience Manager, Customer Journey Analytics, and more:

- Content and Commerce: Solutions for businesses to manage, deliver, test, target, and optimise content delivery and consumers’ shopping experiences; the products include Adobe Experience Manager, Adobe Target, and Magento Commerce.

- Customer Journey Management: This grouping includes products such as Adobe Campaign, Marketo Engage, and Journey Orchestration, and they help businesses manage, personalise, and run customer campaigns and journeys.

Helping to power Adobe’s entire suite of cloud-based software products is the company’s proprietary artificial intelligence (AI) and machine learning framework, Adobe Sensei. It helps users of Adobe’s software products to improve their efficiency significantly by automating and providing intelligent suggestions for many aspects of their work. (You can head to Adobe Sensei’s website to see first-hand what it is capable of.)

Geographically speaking, Adobe is somewhat diversified. The table below shows the geographical revenue breakdown for Adobe in the first nine months of FY2020:

Source: Adobe quarterly earnings update

Investment thesis

We have laid out our investment framework in Compounder Fund’s website. We will use the framework to describe our investment thesis for Adobe.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

In a November 2019 investor presentation, Adobe said that it believes its total addressable market in 2022 would be US$128 billion. For perspective, Adobe’s revenue in the 12 months ended 28 August 2020 was US$12.4 billion, just 10% of the market opportunity in 2022. The company’s total addressable market can be broken down into a few areas.

Adobe believes that its Adobe Creative Cloud business will have a total addressable market of US$31 billion in 2022, up from US$29 billion in 2021. This is derived from the estimate that creative professionals, communicators, and everyday hobbyists will be spending US$15 billion, US$12 billion, and US$4 billion, respectively, on creative software by 2022. Adobe Creative Cloud’s revenue of US$7.39 billion in the 12 months ended 28 August 2020 is less than 25% of its estimated 2022 market opportunity.

Source: Adobe investor presentation

Coming to Adobe Document Cloud, its total addressable market in 2022 is expected to nearly double from US$7.5 billion in 2021 to US$13 billion. In comparison, Adobe Document Cloud exited the third quarter of FY2020 with trailing revenue of US$1.43 billion, which is less than 11% of the business’s addressable market in 2022.

Source: Adobe investor presentation

The biggest growth opportunity for Adobe lies with Adobe Experience Cloud. The company estimates that the total addressable market for Adobe Experience Cloud will grow by 18% from US$71 billion in 2021 to reach US$84 billion by 2022. This is significantly higher than Adobe Experience Cloud’s revenue of US$2.84 billion in the 12 months ended 28 August 2020.

Source: Adobe investor presentation

The great thing about investing in innovative companies (and we think Adobe is a great example – more on this later!) is that their market opportunities tend to expand over time. For instance, with Adobe, it estimated that its market opportunity would be US$83 billion by 2020 during a March 2018 investor presentation. In the years ahead, we won’t be surprised to see Adobe grow the size of its addressable market from the current 2022-estimate of US$128 billion. The company has access to vast amounts of data. For instance, as of November 2019, (1) Adobe Experience Cloud served around 15 billion web pages and delivered around 3.3 billion offers on a daily basis, (2) Adobe Creative Cloud had more than 200 million mobile IDs created; and (3) Adobe Document Cloud had more than 100 million mobile IDs created in the past two years. We believe that the high level of usage of Adobe’s products, and the huge amounts of associated-data generated, would enable the company’s AI and machine learning framework, Adobe Sensei, to become smarter over time. This could then lead to new capabilities for the company.

2. A strong balance sheet with minimal or a reasonable amount of debt

Adobe exited the third quarter of FY2020 with US$5.26 billion in cash and short-term investments, and total debt of US$4.12 billion. This is a strong balance sheet with a net-cash position of US$1.15 billion. For the sake of conservatism, we also note that Adobe had operating lease liabilities of US$610 million. But even when the operating lease liabilities are added to the total debt (sum of US$4.73 billion), it’s still lower than Adobe’s cash and short-term investments.

As importantly, Adobe has been generating strong free cash flow for years, as we will show later.

3. A management team with integrity, capability, and an innovative mindset

On integrity

Adobe is led by Shantanu Narayen, 56, who serves as CEO and chairman of the board. He joined Adobe in 1998 as vice president and general manager of the company’s engineering technology group. He was promoted to president and COO in 2005, and assumed the CEO role in 2007. We appreciate Narayen’s long-tenure with Adobe. The table shows the company’s other key leaders; they are mostly still young (in a business sense) and have been working in Adobe for at least three years each:

Source: Adobe proxy statement and website

Warren Buffett once said: “We look for three things when we hire people. We look for intelligence, we look for initiative or energy and we look for integrity. And if they have don’t have the latter, the first two will kill you because if you’re going to get someone without integrity, you want them lazy and dumb.” We agree. In Adobe’s case, we think that the compensation structure for its management team demonstrates a high level of integrity. Here are a few key points:

- Narayen’s total compensation in FY2019 was estimated to be US$39.15 million. This is a princely sum, but it looks reasonable to us when compared to the scale of Adobe’s business; in FY2019, the company generated profit and free cash flow of US$2.95 billion and US$3.98 billion, respectively.

- 94.6% of Narayen’s total compensation in FY2019 came from stock-based awards that had two components. The first component scales according to Adobe’s total shareholder return over a three-year period relative to other companies in the NASDAQ 100 index. The second component consists of restricted stock units (RSUs) that vest over four years; we want to highlight that in FY2019, Adobe increased the vesting period for the RSUs awarded to management from three years to four years.

- In FY2019, the total compensation for Murphy, Belsky, Lamkin, and Parasnis were all very reasonable, ranging from US$7.42 million to US$7.58 million each. In addition, the sheer majority (87.1% to 89.0%) of their total compensation came from stock-based awards with similar traits to Narayen’s.

- From the points above on the compensation of Adobe’s key leaders, it’s clear to us that nearly all of their total compensation depends on the long-term growth of Adobe’s stock price, which is in turn driven by the company’s business performance. So we think the interests of Adobe’s management team are neatly aligned with the company’s other shareholders.

And for even further alignment of interests, Adobe has one of the heaviest stock-ownership-requirements for senior management that we have seen among US-listed companies. As CEO, Narayen is required to own Adobe shares that are worth at least 20 times his base salary (US$1 million in FY2019). Narayen has much more at stake though. As of 12 February 2020, he controlled 415,271 Adobe shares. At the 22 October 2020 share price of US$496, Narayen’s Adobe shares are worth a sizeable US$206 million.

Adobe’s founders, Charles Geschke and John Warnock, collectively controlled nearly 570,000 of the company’s shares as of 12 February 2020. They are currently on Adobe’s board of directors.

On capability and innovation

We rate Shantanu Narayen highly in terms of his ability to execute and innovative efforts at Adobe.

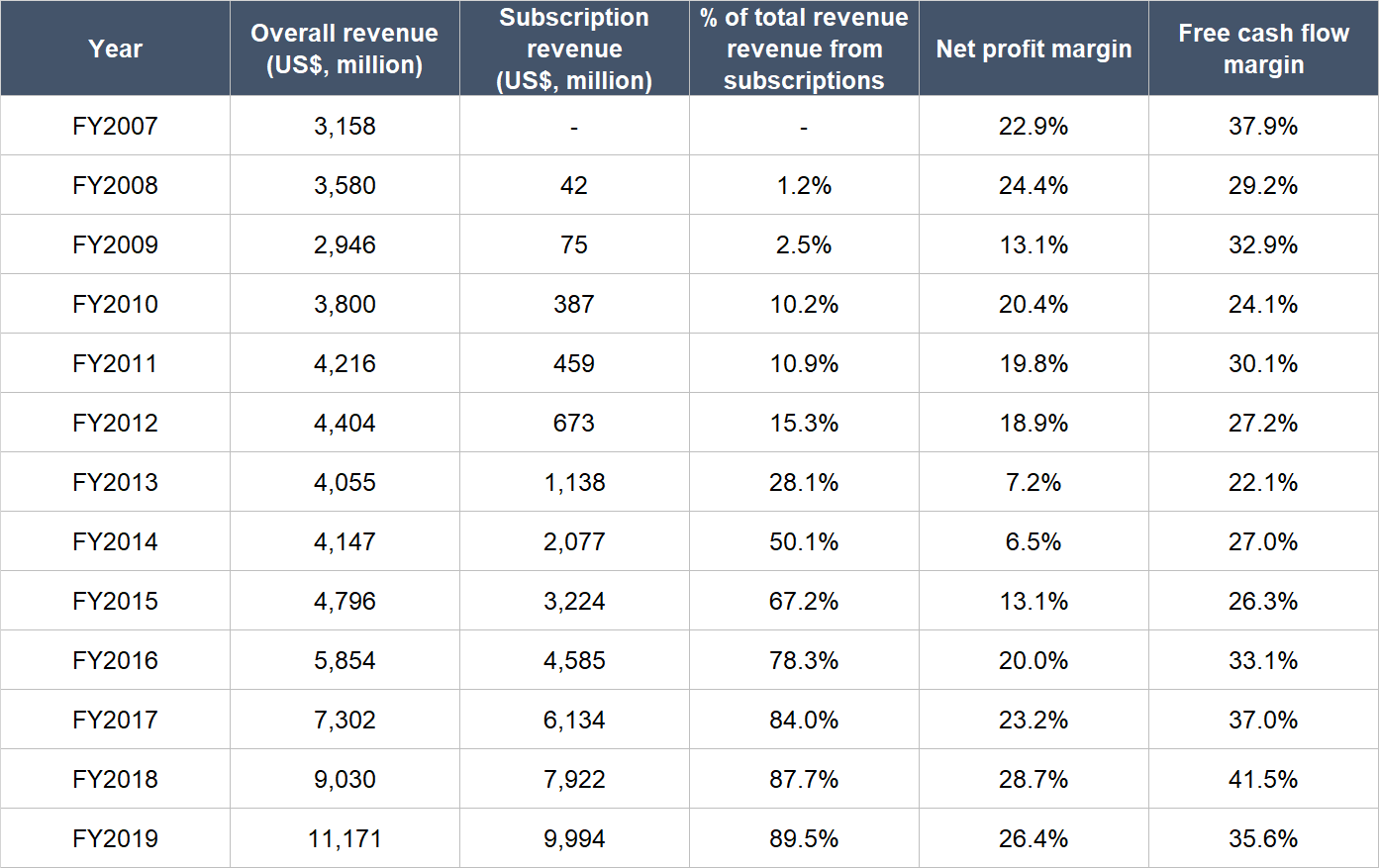

One of Narayen’s most impressive feats is leading Adobe’s shift from the legacy model of selling one-time software licenses to a software-as-a-service (SaaS) model. As mentioned earlier, Narayen took over the hot seat in 2007. Around 2010, Adobe started placing a heavier emphasis on building a subscription-based business model. Narayen and his team thought that having a focus on subscriptions could allow Adobe to capture new customers as well as grow its level of recurring revenue, thus making the business more predictable. The table below shows the changes in Adobe’s overall revenue, subscription revenue, and profit and free cash flow margins since 2007.

Source: Adobe annual reports

The shift in Adobe’s strategy to a cloud-based software subscription model really started paying off in FY2014 onwards. The annualised growth in Adobe’s overall revenue from FY2007 to FY2010 was merely 6.4%; from FY2010 to FY2014, the growth rate was just 2.2% per year. But from FY2014 to FY2019, Adobe’s overall revenue jumped by 21.9% annually. And it’s the growth in Adobe’s subscription business that carried the day – over the three timeframes, Adobe’s annualised subscription revenue growth was 203.5% (FY2008 to FY2010), 52.2% (FY2010 to FY2014), and 36.9% (FY2014 to FY2019).

But it was not an easy transition for Adobe to navigate. Customers were initially unhappy – a petition launched near the time of Adobe’s pivot to the SaaS model to protest against the change ended up with more than 50,000 signatures. Adobe’s profit margin also suffered in the process, falling from a fat 20.4% in FY2010 to just 6.5% in FY2014. We give Narayen and his team a lot of credit for sticking to their guns. The SaaS model is just inherently better than Adobe’s traditional way of selling software. Customers don’t have to worry about upgrading legacy software; they can use the same software on multiple devices; and cloud-based software allows for easier collaboration. For Adobe, it does not have to worry about having to support legacy software, since the software that’s delivered over the cloud – and what customers are using – will be the latest version.

Narayen and his team have also led Adobe to constantly introduce new features and products. A great example is the 2016 introduction of the Adobe Sensei AI and machine learning framework that now underpins all of Adobe’s software. In another instance, Adobe introduced the Open Data Initiative in late 2018 together with Microsoft and SAP. Through the Open Data Initiative, Adobe Experience Cloud can exchange data freely with other third-party software providers, in the process enabling a broad industry ecosystem to emerge and allow users of Adobe Experience Cloud to quickly develop their own applications to interact with consumers. Here’s a timeline showing the various new product/features that Adobe has launched for its Digital Media business segment over the past few years:

Source: Adobe investor presentation

Another positive trait we found about Narayen and his team is the excellent culture at Adobe that they have built. Glassdoor, a website that allows employees to anonymously rate their companies, placed Adobe in the 39th position in its “2020 Best Places to Work List” for large US companies. Currently, 85% of Adobe-raters on Glassdoor will recommend the company to a friend, while Narayen has a 96% approval-rating as CEO, far higher than the average Glassdoor CEO rating of 69% in 2019. Comparably, a platform that compares company culture and market compensation based on contributions from real employees, also named Adobe as one of the top 50 large US companies (those with more than 500 employees) in its “Best Companies For Diversity 2019” list. Here’re some other examples of the numerous accolades Adobe has won in the past few years in recognition of its innovative spirit and great culture:

- Named as one of Fast Company’s “Most Innovative Companies for AI” in 2018

- Ranked No.10 on Forbes and Just Capital’s “The JUST 100” list for 2020; “The JUST 100” is a group of “companies leading the new era of responsible capitalism”

- Given the No.2 position by Fortune in 2019 for the “World’s Most Admired Software Companies”

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

As already mentioned, 89.5% of Adobe’s revenue in FY2019 came from subscriptions. In the first nine months of FY2020, the selfsame percentage was 92.1%. It’s clear to us that Adobe’s business is built nearly entirely on subscriptions, which are recurring in nature.

But just having a subscription model does not equate to having recurring revenues. If your business has a high churn rate (the rate of customers leaving), you’re constantly filling a leaky bucket – that’s not recurring income.

As far as we know, Adobe does not reveal subscriber-retention numbers for its business. But there are good reasons for us to believe that Adobe does not have any problems with retention:

- The company has produced excellent revenue growth and strong free cash flow margins since FY2014, as we’ll show later.

- In 2014, Adobe Experience Cloud’s average annualised recurring revenue (ARR) from its top 100 customers was around US$3 million; in 2019, the selfsame figure had doubled to around US$6 million.

- The chart below illustrates the excellent growth in the ARR for Adobe Creative Cloud (the purple bars) and Adobe Document Cloud (the light blue bars) from the first quarter of FY2016 to the third quarter of FY2019.

Source: Adobe investor presentation

5. A proven ability to grow

The table below shows Adobe’s key financials since FY2007, the year Shantanu Narayen was promoted to CEO.

Source: Adobe annual reports

From FY2007 to FY2014, Adobe did not produce much growth, although there were still some positive traits: (1) Revenue, operating cash flow, and free cash flow were all stable; (2) the company was consistently profitable, although the bottom line had been volatile; (3) the balance sheet always had more cash and short-term investments than debt; (4) there’s been no dilution, since Adobe’s diluted share count declined from 598.8 million to 508.5 million; and (5) subscription revenue was a particular bright spot, as it increased significantly from just US$42 million in FY2008 to US$2.08 billion in FY2014.

In the period from FY2014 to FY2019, Adobe’s revenue increased by 21.9% per year. Operating cash flow and free cash flow were both consistently positive and had grown by 28.0% and 28.8% annually. The free cash flow margin (free cash flow as a percentage of revenue) for the period averaged at an impressive 33.4%. Subscription revenue quintupled, representing a compound annual growth rate of 36.9%, and net profit surged by 61.5% per year. Adobe’s net profit growth from FY2014 to FY2019 was so high because net profit in the base-year was low; nonetheless, Adobe’s net profit still showed a healthy increase of 13.9% in FY2019. Adobe’s balance sheet remained strong from FY2014 to FY2019, with FY2018 being the only year with more debt than cash and short-term investments; in FY2018, Adobe used up a big slug of cash by acquiring Marketo (a provider of B2B marketing engagement software) and Magento (a commerce platform company) for US$4.74 billion and US$1.64 billion, respectively. Adobe also continued to reduce its diluted share count from FY2014 to FY2019 at a rate of 0.7% per year.

COVID-19 was designated as a pandemic by the World Health Organisation in March 2020. Since its emergence, the virus has negatively impacted parts of Adobe’s business and continues to do so. But this has not stopped Adobe from producing overall growth in its business. During the company’s FY2020 third-quarter earnings conference call, Narayen said (emphasis is ours):

“The ongoing pandemic continues to result in a challenging environment everywhere around the world. People are seeking new ways to communicate, learn and conduct business virtually. Content creation and consumption are exploding in a world where connecting visually has become even more essential. Students are adapting to learning remotely instead of in a classroom. Entire industries, from media and entertainment to pharma, retail, automotive and financial services, have had to pivot overnight to digital operations to engage with customers and ensure business continuity. Electronic workflows and signatures are the only way to efficiently complete business transactions. The world has changed in a way that none of us could have ever foreseen.

This reality has created new tailwinds for Adobe. Our mission to change the world through digital experiences has never been more critical. Our strategy of unleashing creativity for all, accelerating document productivity and powering digital businesses is more relevant than ever and driving our strong performance across every geography and audience.”

The table below shows the healthy growth in Adobe’s revenue, net profit, operating cash flow, and free cash flow in the first three quarters of FY2020.

Source: Adobe quarterly earnings update

We want to highlight that Adobe began to discontinue its Adobe Advertising Cloud offering (housed under the Digital Experience business segment) in the second quarter of FY2020. This makes Adobe’s growth in the second and third quarters of FY2020 even more impressive. For perspective, subscription revenue from the Digital Experience segment was US$729 million in FY2020’s third quarter, up 7% year-on-year; if Adobe Advertising Cloud was excluded, subscription revenue from the Digital Experience segment would have grown by 14% year-on-year in the quarter instead.

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

We believe that Adobe excels in this criterion for two reasons.

First, the company has been consistently generating positive free cash flow for a long period of time. As mentioned earlier, Adobe’s average free cash flow margin from FY2014 to FY2019 was an excellent 33.4%. In the first nine months of FY2020, Adobe’s free cash flow margin was 38.3%.

Second, Adobe’s current revenue is small compared to its market opportunity. And importantly, we believe that (a) Adobe’s innovative edge can allow it to expand its market opportunity over time, and (b) the company can win its fair share of the growing pie. This would mean that Adobe’s revenue growth is likely to be strong in the years ahead – and higher revenue would bring higher free cash flow, since we don’t see any reason for Adobe’s free cash flow margin to suffer precipitous declines.

Valuation

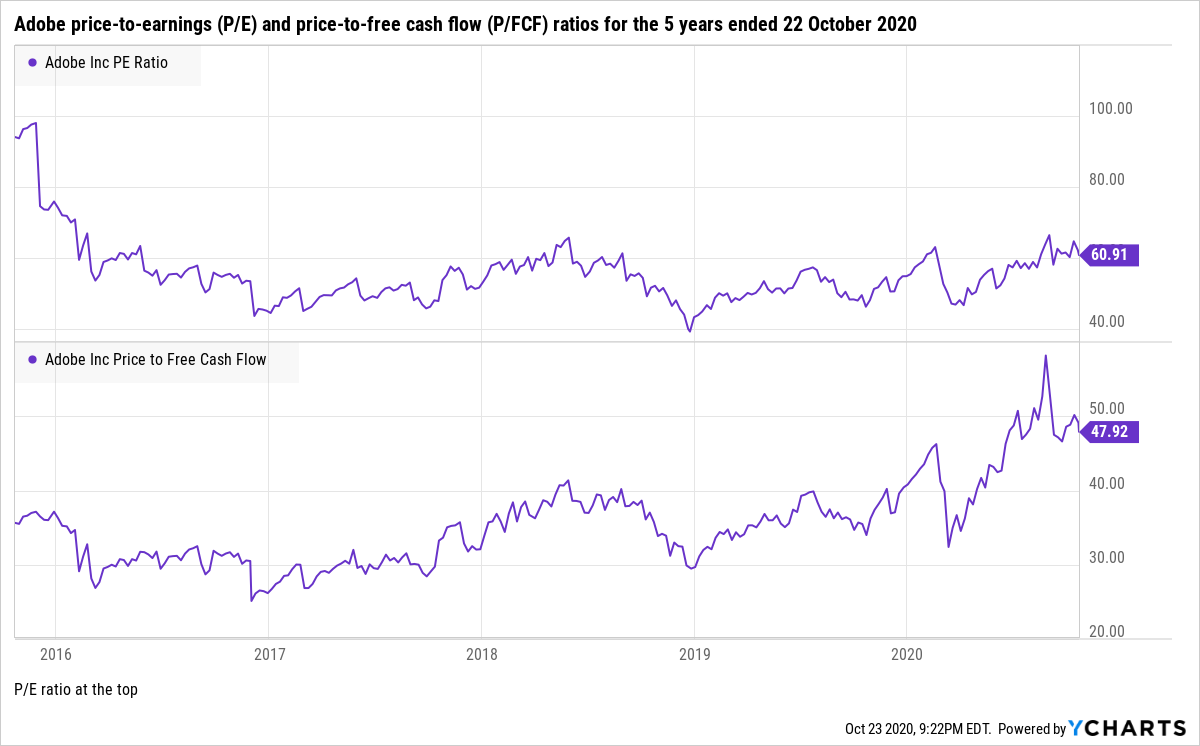

We completed our purchases of Adobe shares with Compounder Fund’s initial capital in late July 2020. Our average purchase price was US$443 per Adobe share. At our average price and on the day we completed our purchases, Adobe shares had trailing price-to-earnings (P/E) and price-to-free cash flow (P/FCF) ratios of 58 and 49, respectively.

Keeping things simple in the valuation process is what we like to do. In Adobe’s case, we think the P/E and P/FCF ratios are appropriate metrics to gauge the value of the company. This is because Adobe has a long history of generating both earnings and free cash flow. The chart below illustrates Adobe’s P/E and P/FCF ratios in the five years ended 22 October 2020.

The valuation ratios we had paid for Adobe are on the wrong side of 30. But the company’s P/E and P/FCF ratios have also been high for a long time. Moreover, Adobe has strong recurring revenue streams and excellent growth prospects. Because of these, we think Adobe’s optically high valuation ratios are still sensible if we look beneath the surface.

The risks involved

There are four main risks we see with Adobe.

Competition: As a diversified software services company, Adobe faces a tonne of competition. In its latest annual report, Adobe named a number of large technology companies as competitors. For Adobe Creative Cloud, its large competitors include Apple, Autodesk, and MIcrosoft. For Adobe Document Cloud, there’s DocuSign, Google, and Microsoft. Then for Adobe Experience Cloud, there’s Google, salesforce.com, SAP, and Shopify. There were many smaller ones that were named too. The point is, Adobe has no shortage of strong competitors in all that it is doing. We’re comforted by the fact that Adobe has been posting solid growth since FY2014 after its transition to a SaaS model. Moreover, it helps that Adobe has an impressive breadth of software capabilities, especially for Adobe Creative Cloud. But we’re still keeping an eye on Adobe’s competitive landscape.

Key-man risk: As with most of Compounder Fund’s holdings, a large part of our investment thesis is built around a strong management team. We believe that Shantanu Narayen is a talented leader who has been the central figure for Adobe’s success over the past few years. Should he leave the company for whatever reason, we’ll be keeping a close eye on the leadership transition. The good thing is Narayen is relatively young at 56, so he should still have plenty of gas left in the tank to continue leading Adobe.

Global recession: The emergence of COVID-19 has accelerated the adoption of online services. Adobe has so far managed to post healthy overall growth even in the face of the pandemic. But the growth has been uneven. In the second and third quarters of FY2020, the Digital Media segment saw year-on-year revenue growth of 18.1% and 19.1% respectively; for perspective, Digital Media revenue grew by 21.8% in FY2019. The Digital Experience segment, on the other hand, experienced year-on-year revenue growth of merely 5.4% and 2.1% in the second and third quarters of FY2020 after seeing its revenue jump by 31.2% in FY2019. We recognise that the aforementioned wind-down of the Advertising Cloud business had played a role in the current slowdown in growth for the Digital Experience business. But if there’s a prolonged global economic recession because of COVID-19, we suspect that important chunks of Adobe’s business – the ones dealing with digital marketing and creative work – could be hurt.

Valuation risk: Lastly, even though we are comfortable paying a premium valuation for Adobe, the high valuation poses a risk. If there are any hiccups in Adobe’s growth – even if they are temporary in nature – there could be painful falls in the share price. This is a risk we’re comfortable taking as long-term investors.

Summary and allocation commentary

To summarise, Adobe has:

- A largely untapped addressable market that is highly likely to grow over time because of the company’s innovative spirit

- A robust balance sheet with cash and investments that outweigh debt

- Shantanu Narayen as CEO; in our view, Narayen is an excellent and innovative leader who has demonstrated a high level of integrity and who is also a key figure in the company’s successful transition to a subscription-based revenue model

- Recurring revenue streams from subscriptions and customers who appear happy to renew their subscriptions with the company

- A solid track record of growing revenue, profit, and free cash flow while lowering its share count through share buybacks

- A high likelihood of generating a strong and growing stream of free cash flow in the future

Yes, there are risks involved with Adobe. The key ones we’re watching are Adobe’s tough competitive landscape; key-man risk; the threat of a global recession potentially dragging down Adobe’s business; and the company’s high valuation ratios. But on balance, we believe that Adobe still warrants a place in Compounder Fund’s portfolio. The positive traits of the company are highly attractive. To control the risks, we think that a 2.5% allocation – a medium-sized position – with Compounder Fund’s initial capital makes sense.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share. Of all the companies mentioned in this article, Compounder Fund also currently owns shares in Alphabet (parent of Google), Apple, DocuSign, Microsoft, salesforce.com, and Shopify.