Compounder Fund: Afterpay Investment Thesis - 26 Mar 2021

Data as of 25 March 2021

Afterpay Limited (ASX: APT), which is based and listed in Australia, is one of the three companies in Compounder Fund’s portfolio that we invested in for the first time in January 2021. This article describes our investment thesis for the company.

Company description

Founded in Australia in 2015 by Nicholas Molnar and Anthony Eisen, Afterpay has in a few short years become an important player in the “buy now, pay later” (BNPL) industry.

Here’s Afterpay’s business model:

- A merchant integrates Afterpay onto its website.

- When a customer buys a product from the merchant, the Afterpay BNPL option is presented along with other payment options.

- If the customer chooses Afterpay for the first time, he/she can create an account very quickly by providing simple payment details. Returning users simply have to login to Afterpay.

- If approved by Afterpay, the customer can then use Afterpay to pay for the purchase in four equal instalments every two weeks. The customer does not have to pay any interest or extra fees for using Afterpay to pay for the purchase.

- Afterpay pays upfront the price of the product to the merchant, minus a Merchant Fee (which is a small percentage of the product’s price). In other words, Afterpay takes on the risk of non-payment by customers, since it has to pay the merchant upfront, but collects payments from the customer over a few installments.

- If the customer is late in repaying Afterpay, he/she will be charged late fees. In Australia, the late fee for purchases below A$40 are a maximum one-time A$10 fee; for purchases above A$40, the total late fees are capped at 25% of the order value or A$68, whichever is lesser. In the USA, the late fee is capped at 25% of the order value. Afterpay’s service is paused as soon as a customer misses a payment.

- Afterpay does not require credit checks for customers. To manage risk, it relies on its own proprietary algorithms for payment-approvals. Afterpay also only allows new customers to start with low spending limits and the limits are increased only with positive payment behaviour over time.

Source: Afterpay IPO Prospectus

The company is currently active in Australia, Canada, New Zealand, the USA, and parts of Europe (France, Italy, Spain, and the United Kingdom). France, Italy, Spain, and Canada are relatively newer geographies for Afterpay. In the fiscal year ended 30 June 2020 (FY2020), Afterpay earned A$519.2 million in total income (the company calls its revenue “income”), of which 60.4% came from Afterpay’s BNPL platform in Australia and New Zealand. Afterpay’s BNPL platforms in the USA and UK accounted for 31.3% and 5.1%, respectively, of the company’s total income.. The remaining 3.2% of Afterpay’s total income in FY2020 (A$16.5 million) came from the legacy business of Touchcorp and it’s not something we’re focused on. Touchcorp merged with Afterpay in June 2017 and there will be more on the merger later.

Of Afterpay’s A$502.7 million in total income from its BNPL platform in FY2020, only 13.7% came from late fees. In other words, the lion’s share of Afterpay’s overall total income in FY2020 came from Merchant Fees.

In FY2017, 72% of purchases made with Afterpay were for apparel and beauty products. This has fallen to 42% in FY2020, meaning that product-concentration at Afterpay has improved over time. The remaining spending on Afterpay’s platform in FY2020 was for the catch-all “Other” category.

Investment thesis

We have laid out our investment framework in Compounder Fund’s website. We will use the framework to describe our investment thesis for Afterpay.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

To understand Afterpay’s market opportunity, we had some help from the IPO prospectus of Affirm, an Afterpay competitor, that was first filed in November 2020. The prospectus contained the following useful information:

- According to Worldpay’s 2020 Global Payments report, BNPL’s share of the e-commerce payments market is expected to rise substantially over the next few years. In North America, BNPL’s market share is expected to triple to 3% by 2023; in Europe, Middle East, and Africa (EMEA), BNPL’s penetration rate is expected to increase from 6% to 10% over the same period.

- eMarketer has a forecast for global online sales to jump by more than 70% from US$3.4 trillion in 2019 to US$5.8 trillion by 2023; meanwhile, e-commerce is still only 14% of total retail sales.

- Millennials and Gen Z will drive the adoption of BNPL. People in these age groups (according to the Pew Research Centre, Millennials are those born between 1981 and 1996, while Gen Z are those born from 1997 onwards) are increasingly losing trust in legacy financial and payment institutions and are looking to mission-driven technology companies for financial products. Around 25% of Millennials in the USA do not even have credit cards. The views of Millennials and Gen Z are not without merit. Traditional credit cards can be harmful for consumers. In 2019, credit card users paid US$121 billion in credit card interest, US$11 billion in overdraft fees, and US$3 billion in late fees, according to studies from LendingTree, the Center for Responsible Lending, and NerdWallet, respectively. The chart below, from Afterpay, shows the ascendence of debit cards, relative to credit cards, in recent years.

Source: Afterpay FY2020 earnings presentation

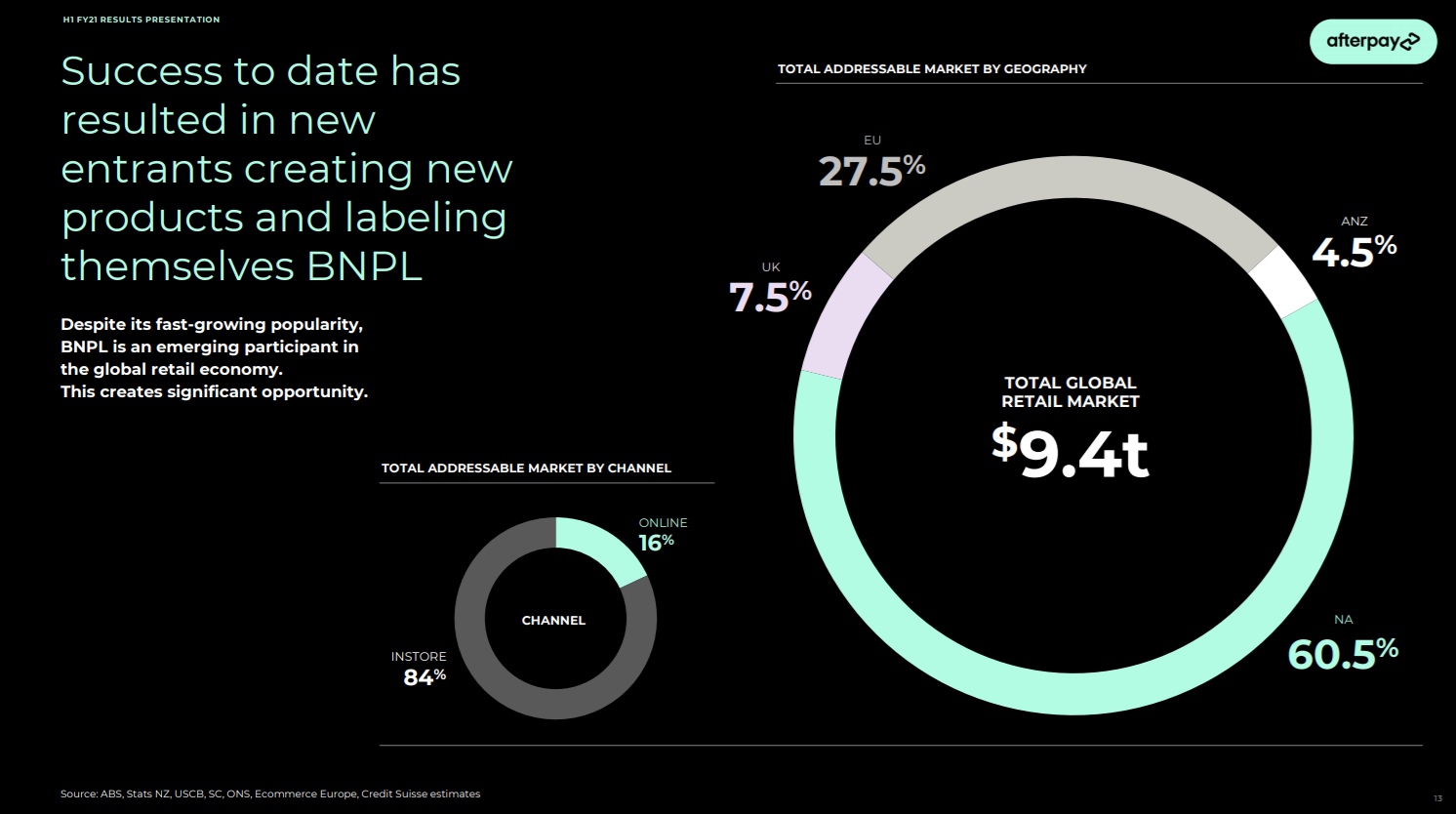

For context, Afterpay only processed underlying sales (the total amount of transactions happening on its platform) of A$16.1 billion in the 12 months ended 31 December 2020, which resulted in A$716.1 million in total income. These are tiny when compared to the data on the BNPL industry from Affirm’s IPO prospectus that we discussed above. But there’s more. Afterpay’s service can be used in physical retail stores – it’s not just for online transactions. This means that Afterpay’s BNPL opportunity goes beyond online payments and stretches into total global retail spending, which is in the multi-trillions of dollars.

Source: Afterpay FY2021 first-half earnings presentation

We think that Afterpay stands a good chance of being able to grow significantly within the burgeoning BNPL space. A few key things we want to highlight:

- We think that Afterpay’s service represents a much better experience for consumers compared to traditional credit cards. As mentioned earlier: (1) Afterpay has a maximum cap on its late fee of 25% of the purchase price; (2) usage of the company’s service is stopped the moment a consumer misses a payment, hence preventing the consumer from racking up debt; and (3) Afterpay provides a controlled environment for consumers to spend (as of 31 December 2020, the average order value and average amount outstanding at Afterpay is just A$155 and A$205, respectively.) In contrast, credit cards carry very high interest rates (around 20% in Australia), have high credit limits, and the service typically does not stop when you miss a payment, giving consumers the “opportunity” to rack up debt. Put another way, the traditional credit card business wins when consumers are heavier in debt. This is in contrast to Afterpay, whose interests are more aligned with those of consumers – the company wins when consumers spend responsibly. In FY2020, around 90% of Afterpay users used the service with a debit card.

- Afterpay’s service provides value for merchants. In the quarter ended 30 June 2020, Afterpay sent 14.5 million referrals per month to merchants who adopted the company’s platform. A July 2020 survey of merchants on Afterpay found that 83% of them saw improved conversion and fewer cart abandons, 72% saw an increase in their average order value, and 66% saw better customer satisfaction. Afterpay’s management also estimates that, on average, merchants who adopt Afterpay enjoy growth of 20% or more in average order value, conversion, and shopper-frequency.

- Afterpay already has sizeable active merchant and customer bases of 74,700 and 13.1 million, respectively. We think that the payments business that Afterpay operates exhibits network effects, where more merchants leads to more customers, which leads to even more merchants and so on. It will become increasingly difficult over time for new entrants to compete with Afterpay as the company continues to scale its platform.

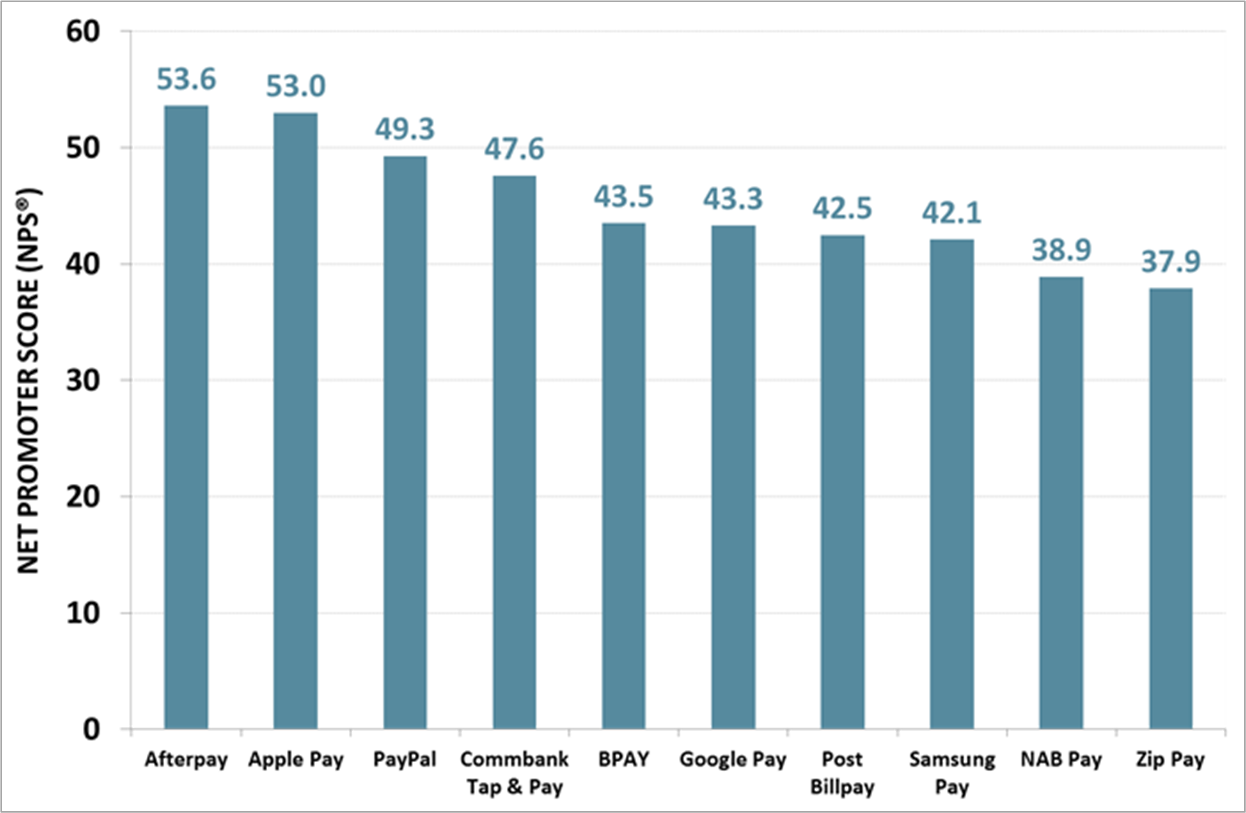

- Consumers love Afterpay. In June 2019, Afterpay clocked in a Net Promoter Score of 53.6 in Australia – the highest among digital payment solutions, as shown in the chart below – according to research firm Roy Morgan. (The Net Promoter Score, or NPS, ranges from -100 to +100 and it measures the willingness of customers to recommend a company’s product or service to others and can be a gauge of customer loyalty and satisfaction.) Financial and general news media outlets in Australia have also mentioned that Afterpay has become a verb (see here and here), much like how people would say “I’m Googling this” instead of “I’m going to search for this on Google.” Being a verb could help Afterpay bring down its customer acquisition costs because the company is likely to be the default payments option in the minds of many consumers.

Source: Roy Morgan

We first heard of the term “optionality” from The Motley Fool’s co-founder, David Gardner. It’s a term he coined to describe the trait a company has of being able to evolve and find entirely new ways to grow. We prize companies that exhibit optionality and we think Afterpay has this quality. The company could offer other types of financial services beyond payments to its large captive audience of active customers. There are already early signs of Afterpay doing this. The company will be officially launching its standalone Afterpay Money app in the first quarter of FY2022 with a pilot introduction slated for the fourth quarter of FY2021. Afterpay Money will allow Australians to manage all of their payments (including Afterpay payments) and savings seamlessly in one app.

2. A strong balance sheet with minimal or a reasonable amount of debt

Afterpay ended 2020 with A$458.8 million in cash and A$122.1 million in total debt. This is a strong balance sheet with a net cash position of A$336.7 million.

Afterpay also requires ample liquidity to fund growth given its business model (it assumes credit risk by paying merchants upfront and subsequently collecting payments from customers in instalments). As of 31 December 2020, Afterpay has funding capacity for more than A$26 billion in annualised underlying sales, which is above the actual annualised run rate of A$23 billion in the second quarter of FY2021 (the quarter ended 31 December 2020). This should be more than enough for Afterpay to fund short-term growth. If and when the company exceeds this level of underlying sales, it will be a happy problem for the company to raise more capital. It could borrow more or it could also issue more shares.

Issuing new shares could result in dilution, but we think the dilutive impacts would likely be mild. For instance, Afterpay issued around 11.87 million new shares at A$66 each in July 2020 to raise net proceeds of A$769.8 million. The capital raised was substantial, but doing so only resulted in negligible dilution as the new shares issued was less than 5% of the Afterpay’s existing shares (the company’s share count was 267.625 million at the end of June 2020).

3. A management team with integrity, capability, and an innovative mindset

On integrity

Afterpay is led by its co-founders and co-CEOs, Anthony Eisen and Nicholas Molnar, who are just 49 and 31 years old, respectively. We appreciate their relatively young ages (which means they likely have many years ahead of them to run Afterpay) and both of them have been effectively leading the company since its founding, though sometimes not as CEO. Prior to founding Afterpay, Eisen had a 20-plus year career in finance and investing. Meanwhile, Molnar created online jeweller Ice.com and grew it to become Australia’s largest online-only jewellery and watch retailer.

We think the integrity of Eisen and Molnar shines through in the way they are compensated at Afterpay. Some key things we want to highlight:

- Afterpay put in place a new executive remuneration framework in FY2020. The new framework sees Afterpay’s senior leaders having four components to their remuneration: (1) A base salary and superannuation, which is Australia’s retirement savings plan; (2) restricted stock units that vest over three years; (3) a short-term cash incentive that depends on the company’s performance in financial, customer, merchants, innovation, and people measures; and (4) a long-term incentive in the form of stock options, with the amount dependent on Afterpay’s growth in underlying sales and net transaction margin over a three-year performance period. (The net transaction margin is the amount earned by the group after stripping away its cost of sales and impairment of receivables.)

- Through the multi-year vesting period of the restricted stock units and the multi-year performance period of the long-term stock options incentive, at least some of the total compensation of Afterpay’s leaders depend on multi-year growth in the company’s business performance (technically, the restricted stock units depend on multi-year changes in Afterpay’s stock price, but a company’s long-term stock price movement is largely governed by its underlying business performance).

- Both Eisen and Molnar have decided to forgo any restricted stock units as well as short-term cash incentives for their remuneration. They believe that their shareholdings in Afterpay “already encourage a focus on long-term sustainable decision making.”

- In FY2020, Eisen and Molnar’s base salaries were A$450,000 each, while the maximum long-term stock options incentive they could each earn have a value of A$1.5 million. These are reasonable sums, in our opinion, given that Afterpay’s total income in the same year was A$519.2 million. We also like that the long-term component of their remuneration significantly outweighed the short-term component.

- Both Eisen and Molnar volunteered to reduce their base salary by 20% for three months from May 2020 as a show of solidarity, given the economic uncertainties brought on by COVID-19.

When discussing Eisen and Molnar’s remuneration, we alluded to the idea that they have significant skin in the game when it comes to growing Afterpay’s business for the long-term. They definitely do. For further context, they currently hold 19.456 million Afterpay shares each, based on their latest regulatory filings. At the 25 March 2021 share price of A$105, Eisen and Molnar’s Afterpay shares are collectively worth A$4.10 billion. The duo also have 165,203 options each that remain unexercised.

On capability and ability to innovate

We rate Eisen and Molnar highly when it comes to execution and innovation. There are a few things we want to discuss.

First, we appreciate the unique way that Eisen and Molnar view the world (see chart below). They have a core belief that consumers can be served much better than legacy payment solutions. This belief is why Afterpay does not charge interest and caps its late fees, so that its customers do not end up with snowballing debt. Afterpay also has a hardship program to assist customers who have difficulty paying their instalments. Instead of coming down hard on late payers, Afterpay freezes late fees for customers in hardship, and offers a range of short and long-term solutions. Afterpay makes it simple for customers to access the hardship program by not requiring any documentary evidence from them. We think that Afterpay’s commitment to its cause is one of the key reasons why consumers love the service.

Source: Afterpay FY2020 annual general meeting presentation

The second thing we want to share is related to the first, and that is the proportion of Afterpay’s business that comes from merchant fees versus late fees. Earlier, we mentioned that of Afterpay’s A$502.7 million in total income from its BNPL platform in FY2020, only 13.7% came from late fees. This proportion has improved over time – it was 21.1% in FY2017 – and clocked in at just 8.6% in the first half of FY2021. And strikingly, as the chart below illustrates, Afterpay tops the class by a huge margin for this proportion when compared to other BNPL providers.

Source: Afterpay FY2020 earnings presentation

Third, the table below illustrates the tremendous growth that Afterpay has experienced over the past few years in its underlying sales, number of active customers, and number of active merchants. The table also shows the stable take-rate (merchant fees as a percentage of underlying sales) that Afterpay has enjoyed. These are all key numbers that can give us clues on the health of Afterpay’s BNPL service.

Source: Afterpay earnings presentations and annual reports

The fourth thing is Afterpay’s incredible track record when it comes to expanding into new geographical markets. Afterpay was founded in Australia and started operations in its home country in the first half of 2015. In FY2018, Afterpay expanded into the US and then in FY2019, it entered the UK. Both these expansions have been raging successes so far.

Afterpay took just two years to achieve more than five million active US customers. In the quarter ended 31 December 2020, the USA became the largest country for Afterpay in terms of underlying sales. There are now more than 8 million active Afterpay customers in the USA, which is more than half of the 13.1 million total active customers that the company has. Meanwhile, in the UK, the company exceeded 1 million active customers in its first full year of operations and Afterpay (called Clearpay in the country) is the most popular BNPL service there. The chart below shows the UK consumer ratings for Clearpay and other BNPL providers in December 2020.

Source: Afterpay earnings presentations

The following chart shows the explosive growth in Afterpay’s number of active customers in the USA and UK from their respective launch dates to 31 December 2020 (see the black and blue lines).

Source: Afterpay FY2021 first-half earnings presentation

And sticking with geographic expansion, as mentioned earlier, Afterpay has a few newer markets in Canada, France, Italy, and Spain. Afterpay entered Canada in August 2020 and France, Italy, and Spain this month. The entry to the European countries has its roots in Afterpay’s August 2020 announcement of an agreement to acquire Pagantis SAU, a BNPL service provider that’s active there. The deal closed early this month. The market opportunity in Southern Europe is large, with ecommerce sales across Spain, Italy, and France exceeding US$177 billion. These countries also have significant debit card usage, which ties in well with Afterpay’s focus on debit rather than credit cards.

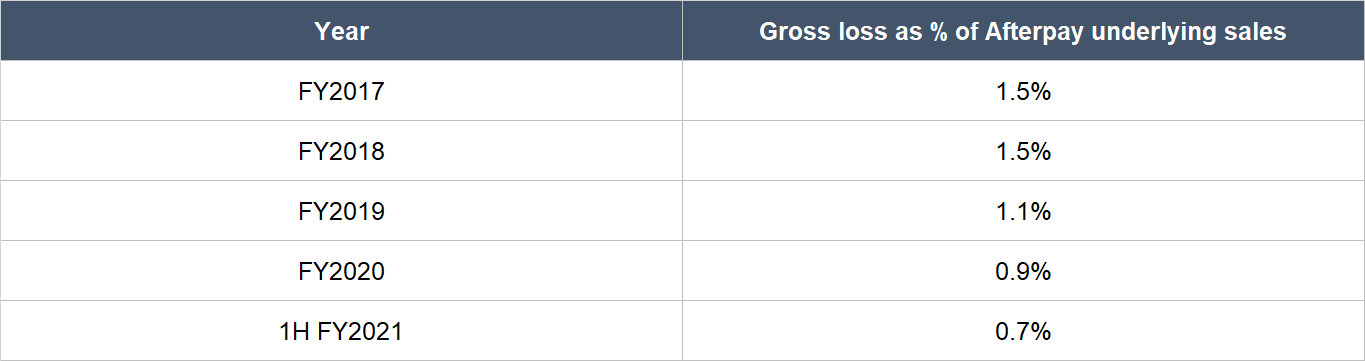

Fifth, Afterpay has done an admirable job in controlling risk. Evidence comes from the company’s industry-leading low ratio of bad loans to underlying sales (Afterpay uses the term “gross loss” to describe bad loans). In the first half of FY2021, Afterpay’s gross loss was just 0.7% of underlying sales, which means that only 0.7% of all the transactions that Afterpay processed in the period were from customers who failed to pay up. The table below shows that Afterpay’s gross loss as a percentage of underlying sales has also improved steadily over time from an already impressive 1.5% in FY2017.

Source: Afterpay annual reports and earnings presentation

Sixth, Eisen and Molnar have built a payments platform that customers are happy to use repeatedly. Even as the number of active customers for Afterpay in Australia increased over the years, the percentage of orders in each month that come from repeat customers has grown over time to reach 98% in June 2020, as the first chart below illustrates. Similar dynamics can be seen for the USA and UK markets too. Afterpay’s customer counts for both markets have grown impressively since their respective launch dates; at the same time, the percentage of orders from repeat customers have increased to 88% in the USA and 90% in the UK in December 2020 (see second and third charts below).

Source: Afterpay earnings presentations

The seventh thing we want to discuss is Afterpay’s product innovation. For instance, in FY2020, Afterpay launched a virtual card in the US with Apple Pay and Google Pay, giving customers more payment options to access Afterpay’s BNPL solution. In another example, Afterpay launched the first-of-its-kind mass market loyalty program in the US in July 2020. Named Pulse, the program aims to reward customers who use Afterpay in a responsible way, further incentivising timely repayment. To be eligible for Pulse, customers need to have a good payments record and its benefits include increased payment flexibility and access to exclusive discounts, promotions, and new product launches. Before Pulse, there was no way for debit card users to earn rewards or benefits (remember that around 90% of Afterpay’s active customers around the world use debit cards). In yet another instance, there’s Afterpay Money which we discussed earlier, the one-stop app for users to manage all their payments and savings.

Eighth, we think Eisen and Molnar have made smart decisions when it comes to acquisitions. We already mentioned the Pagantis deal which was announced in August 2020. By acquiring Pagantis, it gave Afterpay a quick way to expand into other parts of Europe outside of the UK. There is also the merger of Afterpay and Touchcorp that we touched on briefly in the “Company Description” section of this article. Afterpay’s payments technology was developed by Touchcorp, which was also an Australia-listed company. Prior to the merger, Touchcorp was responsible for maintaining Afterpay’s payments technology and processing Afterpay’s transactions. By merging with Touchcorp, Afterpay removed key-supplier-risk from its business and gained full control over its product’s technological development.

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

We shared earlier that a high proportion of purchases (88% to 98%) made through Afterpay are currently from repeat customers. This is a strong sign that Afterpay enjoys recurring revenue from customer-behaviour.

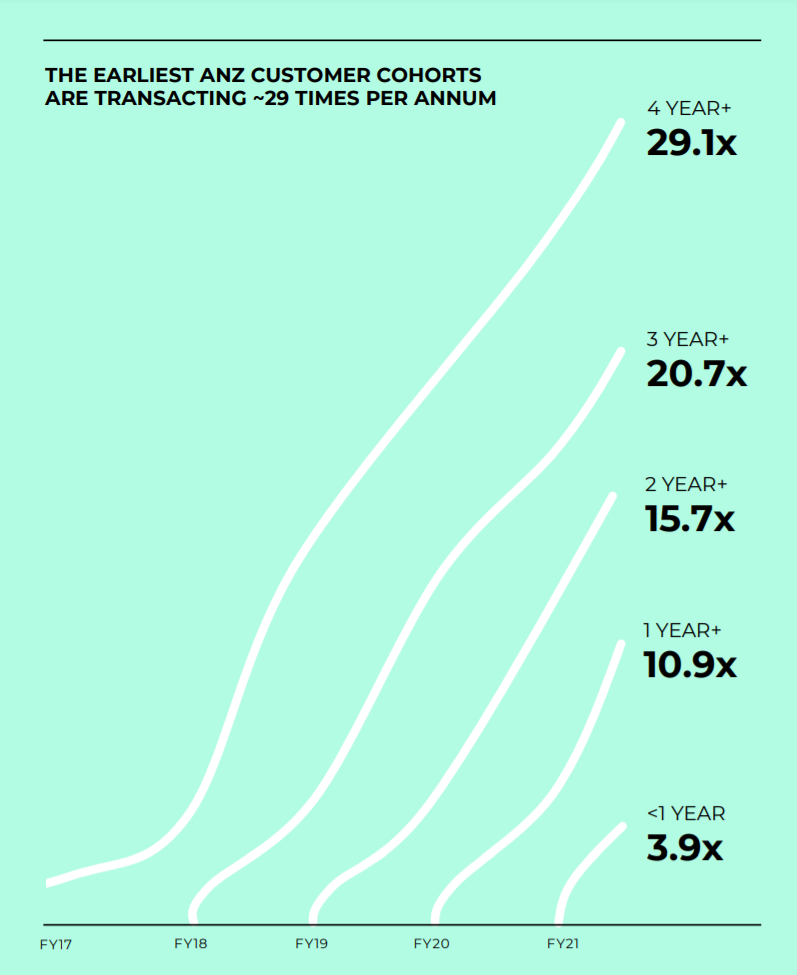

There is one other perspective we want to highlight. The chart below shows the frequency of transactions as of 31 December 2020 for Afterpay’s various customer-cohorts in Australia, sorted by year. The earliest customer-cohort (those who joined in FY2017), are currently transacting 29 times per year; those who joined in FY2020 are only making 11 transactions per year. In addition, the curves for each customer cohort slopes upward, meaning the transaction-frequency for each cohort increases with time. We think this demonstrates that Afterpay’s customers are happy to transact more as the years go by, which also means recurring revenue.

Source: Afterpay FY2021 first-half earnings presentation

5. A proven ability to grow

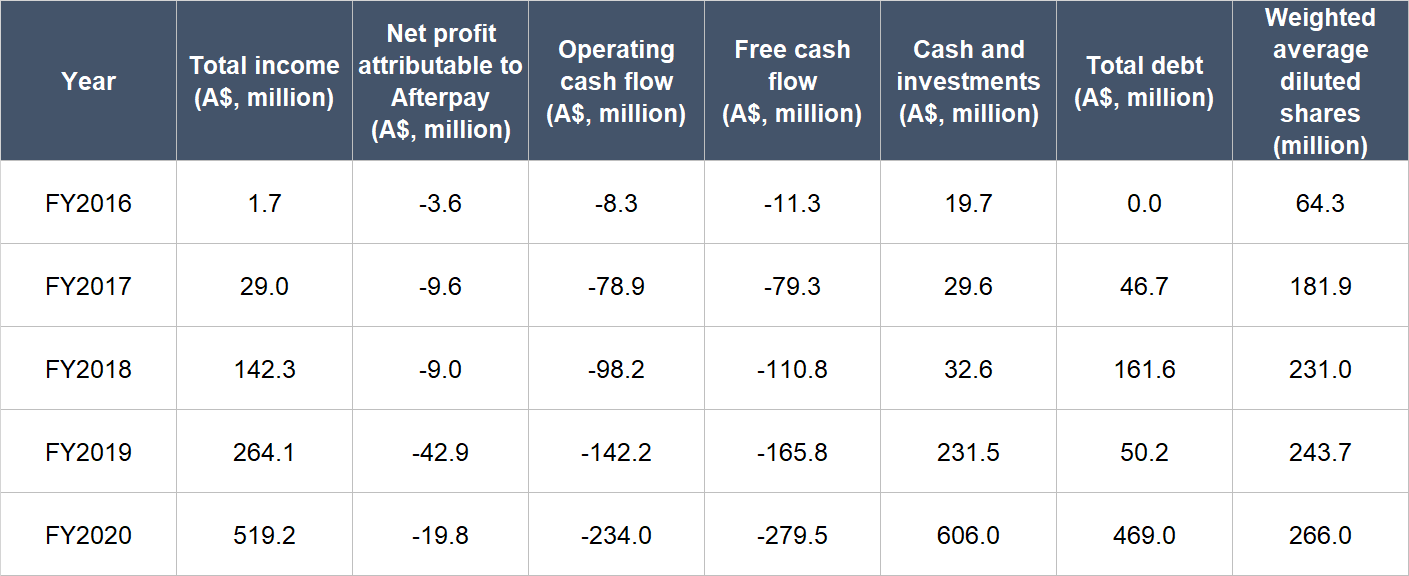

Afterpay only started business operations in the first half of 2015, so there’s not much history for us to look at. But we like what we see. The table below shows Afterpay’s key financials from FY2016 to FY2020.

Souce: Afterpay annual reports

A few key things to highlight from Afterpay’s financials:

- From FY2017 (when Afterpay had more meaningful total income) to FY2020, total income compounded at an impressive 161.5% per year. The growth rate in FY2020 was slower at 96.6%, but that’s not too shabby at all.

- Net profit attributable to shareholders was negative throughout the timeframe under study, but the margin (net profit as a percentage of total income) is trending in the right direction. FY2020’s net profit margin was -3.8%, an improvement from -6.3% and -16.2% in FY2018 and FY2019, respectively.

- Operating cash flow and free cash flow were also negative throughout from FY2017 to FY2020, but the margins for both financial figures are trending in the right direction. For perspective, Afterpay’s operating cash flow margin (operating cash flow as a percentage of total income) improved in each year from FY2017 to FY2020, stepping up from -271.7% to -45.1%. The picture’s the same with the free cash flow margin (free cash flow as a percentage of total income) – there was improvement in each year, and the metric stepped up from -273.3% to -53.8%. We’re comfortable with the cash burn at Afterpay for now, as it’s still in a high-growth phase and would need to spend capital to grow its base of merchants as well as customers.

- The balance sheet had more debt than cash & investments in FY2017 and FY2018 but the situation has since reversed.

- We’re more concerned with changes in Afterpay’s share count after its merger with Touchcorp that happened in June 2017. At the end of FY2017 (which is a date of 30 June 2017), Afterpay had a share count of 212.41 million – this is different from our table, because we used the weighted average diluted share count. What the 212.41 million share count at end-FY2017 means is that Afterpay’s dilution from then to FY2020 is only around 8% per year, which is far lower than Afterpay’s top-line growth. So we don’t think dilution has been a problem at all at the company. For more context, Afterpay’s weighted average diluted share count increased by 9.1% in FY2020, while revenue growth in the same year was 96.6%.

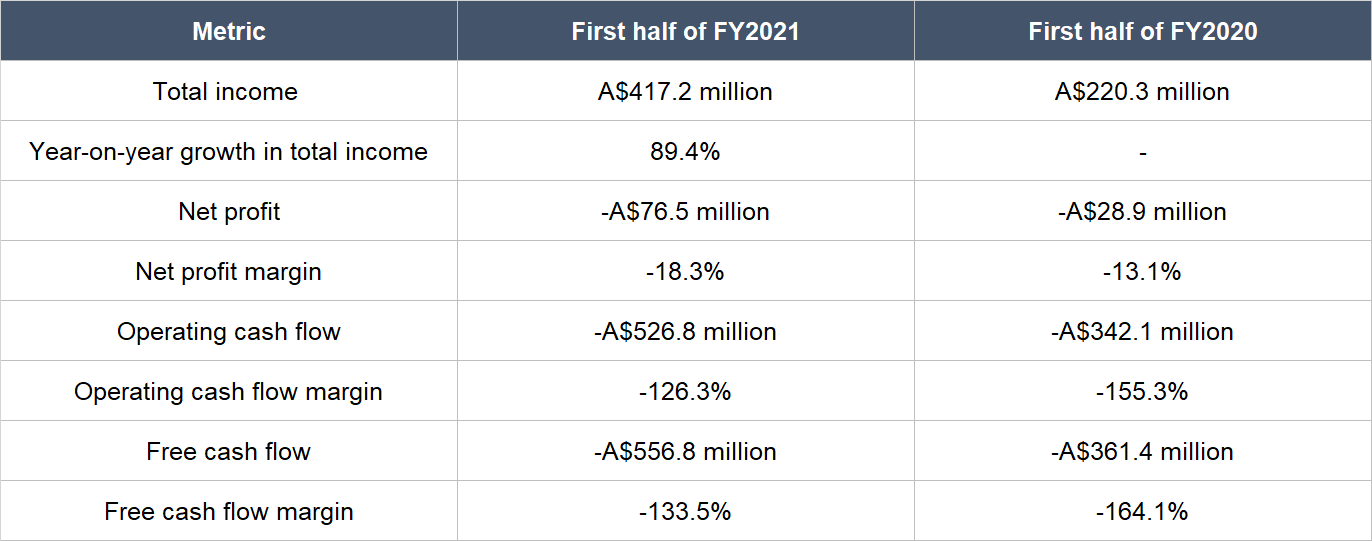

Afterpay continued putting up great numbers in the first half of FY2021. The table below shows the changes in Afterpay’s total income, net profit, operating cash flow, and free cash flow for the period compared to a year ago. The positives are: (1) Total income growth of 89.4% year-on-year, and (2) improvements in the operating cash flow and free cash flow margins. The negative is that the net profit margin did not improve.

Source: Afterpay FY2021 first-half earnings

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

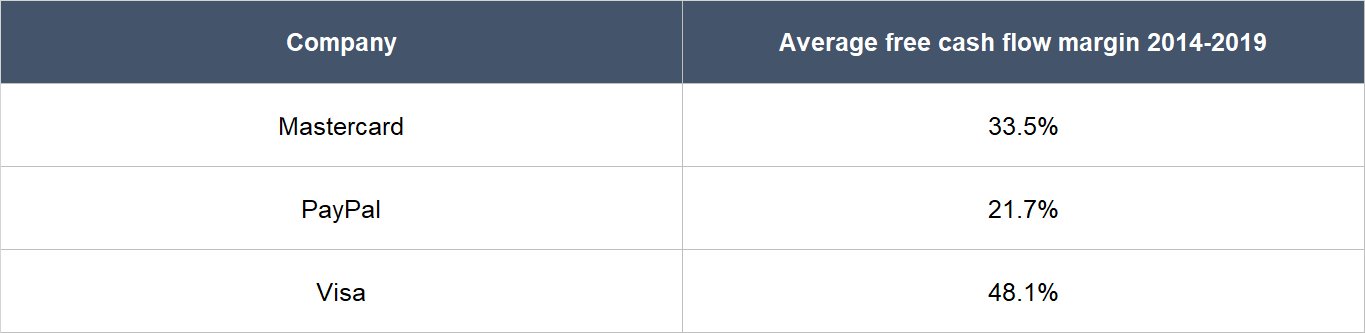

Although Afterpay is still burning cash heavily, we believe that its business is likely to generate strong free cash flow in the future. The company is, at the core, a technology-driven payment services provider. More established digital payments companies such as Mastercard, PayPal, and Visa, all have fat free cash flow margins, as shown below.

Source: Annual reports of Mastercard, PayPal, and Visa

Granted, there’s a difference between Afterpay and Mastercard/PayPal/Visa in that Afterpay takes on credit risk by virtue of its business model of paying merchants upfront and collecting instalment payments from customers later. A closer analogue to Afterpay would be American Express, which is a digital payments company that also takes on credit risk. American Express too, has solid free cash flow margins – the average from 2014 to 2019 was 26.4%.

Valuation

We completed our initial purchases of Afterpay shares in early January 2021. Our average purchase price was A$114 per share. At our average price and on the day we completed our purchases, Afterpay’s shares had a trailing price-to-sales (P/S) ratio of around 58. We like to keep things simple in the valuation process. In Afterpay’s case, we think the P/S ratio is currently an appropriate metric to gauge the value of the company, since the company does not have any history yet of generating profit or free cash flow.

There’s no need to consult any historical valuation chart to know that the P/S ratio of 58 is high – and that’s a risk. For perspective, if we assume that Afterpay has a 20% free cash flow margin today, then the company would have a price-to-free cash flow ratio of 290 (58 divided by 20%). But we think Afterpay has years of rapid growth ahead of it, given (1) the currently low penetration rate of BNPL solutions in the overall payments space, (2) that consumers love the company’s BNPL service, and (3) the potential formation of a strong network effect at Afterpay, which becomes harder to break over time. This makes us comfortable with paying up for Afterpay’s shares, since we think the company has a good chance of being able to grow into its valuation.

For perspective, Afterpay carried a P/S ratio of around 42 at its 25 March 2021 share price of US$105.

The risks involved

We see a few important risks to our Afterpay investment. In no order of merit, they are:

1. Competition. There are many financial services companies that are focused on BNPL with two prominent ones being the recently-listed Affirm and the privately-held Klarna. Meanwhile, other payment giants are interested to introduce, or have recently launched, their own BNPL products, such as Visa and PayPal. More mature financial institutions – the banks – are also trying to muscle into the territory. In a nutshell, competition in the BNPL market is intense. For now, we’re comforted by the popularity of Afterpay’s service and the impressive growth the company has achieved in terms of underlying sales and active customers and merchants – to us, these are signs that Afterpay is holding the fort. But we will still be keeping an eye on competitive developments in the space.

2. Key-man risk. We rate Eisen and Molnar highly and think that are the key architects of Afterpay’s success thus far. Should one or both of them leave, for any reason, we’ll be watching the leadership transition. The good thing is that both of them are relatively young, as we mentioned earlier, so they should still have plenty of gas left in the tank to continue leading Afterpay.

3. Funding risk. Afterpay’s current business model requires it to pay merchants upfront before it collects instalment payments from consumers. This also means that its growth in the near future will likely be dependent, in part, on access to cheap capital. Since its founding, Afterpay has successfully tapped on both the debt and equity markets to raise capital for growth. But both markets may not be as kind in the future. If they turn hostile, Afterpay’s growth may be stunted.

4. Valuation risk. We think Afterpay’s business is likely to grow at a rapid clip for many years and so it deserves its premium valuation. But if there are any hiccups in Afterpay’s growth – even if they are temporary – there could be a painful fall in the company’s share price. This is a risk we’re comfortable taking as long-term investors.

Summary and allocation commentary

To sum up, Afterpay has many qualities we look for in an investment opportunity. It has:

- A huge addressable market in the growing BNPL space and it stands a good chance of being able to take advantage of this rising trend because of its well-loved product and the potential formation of a powerful network effect

- A robust balance sheet with more cash than debt

- Capable co-founders who are still leading it, and who have demonstrated integrity and a fabulous track record of innovation and execution

- A customer base that tends to make repeat purchases through its payment platform, hence resulting in recurring revenue

- A history of excellent revenue growth

- A high chance of being able to generate positive and strong free cash flow in the future

There are risks to note, such as intense competition; key man risk; the chance that access to capital to fund growth may be cut off; and a high valuation.

After weighing the pros and cons, we decided to initiate a position of around 1% in Afterpay in January 2021. We appreciate all the strengths we see in Afterpay’s business, but our enthusiasm is tempered by its high valuation, cash-burn, and current dependence on the kindness of capital markets to fund its growth.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share. Of all the other companies mentioned, Compounder Fund also owns shares in Alphabet (parent of Google), Mastercard, PayPal, and Visa. Holdings are subject to change at any time.