Compounder Fund: The a2 Milk Company Investment Thesis - 30 Aug 2020

Data as of 29 August 2020

The a2 Milk Company (ASX: A2M) is one of the 40 companies in Compounder Fund’s initial portfolio. This article describes our investment thesis for the company.

Company description

The a2 Milk Company (hereafter called a2 Milk) is one of the two companies we’ve invested in for Compounder Fund that are based in New Zealand. a2 Milk is listed on both the stock markets of New Zealand and Australia, but we bought a2 Milk’s Australia-listed shares for Compounder Fund because they are easier to access through the fund’s broker.

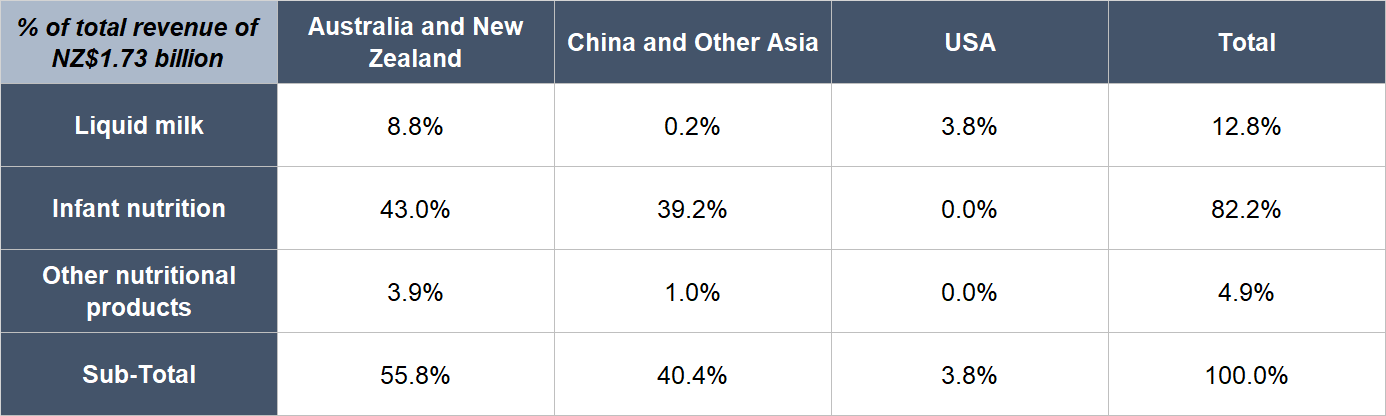

a2 Milk derives revenue from three main geographical regions: Australia and New Zealand; China and Other Asia (which is mostly China); and the USA. The company had sales from the UK in the past, but discontinued the business in the second half of 2019. In the fiscal year ended 30 June 2020 (FY2020), a2 Milk earned NZ$1.73 billion in revenue (around S$1.57 billion). Of this, 55.8% came from Australia and New Zealand, 40.4% from China and Other Asia, and 3.8% from the USA. a2 Milk’s UK revenue in FY2020 was merely NZ$1.4 million, a rounding error.

In terms of product categories, a2 Milk’s revenue comes from the sale of liquid milk, infant nutrition (mainly infant formula), and other nutritional products (such as whole milk powder and skim milk powder) under its a2 Milk brand. Around 12.9% of a2 Milk’s total revenue in FY2020 was from liquid milk products while 82.2% came from infant nutrition products. The remaining portion of revenue – 4.9% – comes from the sale of other nutritional products.

Here’s a table that shows a2 Milk’s revenue breakdown by geography and product-category in FY2020:

Source: a2 Milk FY2020 results presentation

The table above shows that a2 Milk’s revenue in China is derived almost entirely from infant nutrition products. a2 Milk sells these products in China via a few channels: Cross-border e-commerce; physical mother and baby stores and modern supermarkets; and domestic e-commerce sites.

An important detour

Before we move into a2 Milk’s investment thesis, we want to spend some time discussing the histories of cow’s milk and a2 Milk, and what’s unique about the milk in the company’s products. We’re doing so because these have implications on a2 Milk’s business prospects.

Today, conventional cow’s milk contains two main types of beta casein protein, the A1 protein and the A2 protein. (To avoid confusion, we’re using the capital “A” – as in “A1” and “A2” – only to describe the protein.) Beta casein is one of the most abundant proteins found in milk. What’s interesting is that cows originally produced milk that contained only the A2 beta casein protein. Here’s an excellent 2017 article from The Atlantic that describes how the A1 mutation potentially emerged:

“Historians believe that the A1 mutation originated in Europe somewhere around 8,000 years ago, but why it occurred is open to speculation. Some believe that farmers began breeding for higher output at this time, and favored the A1-dominant breeds like Holsteins known for producing more milk. Others speculate that the mutation was caused by forces more cosmetic than substantive; Holsteins are the classic black-and-white cows that dot pastures throughout the western world.

“It could have been something as simple as the first cow to have a black-and-white color by chance also carried the A1 version of the gene, and farmers then said, “we like the look of these,” said Keith Woodford, an honorary professor of farm management and agribusiness at New Zealand’s Lincoln University. A2-dominant breeds wound up in Asian and African countries, possibly because they were less in-demand and relegated to cultures that consumed less milk.”

The milk from a2 Milk looks and tastes like ordinary milk, but there’s something unique: The milk in the company’s products contain only the A2 beta casein protein. a2 Milk sources its milk from herds that naturally produce milk with only the A2 beta casein protein – there’s no genetic engineering or technological processes involved.

a2 Milk was co-founded in 2000 by the late Dr Corran McLachlan. In the 1990s, he conducted research on the effects of milk consumption and thought he found a link between the A1 beta casein protein and ailments such as heart disease and Type 1 diabetes. Inspired by his research, and with the belief that milk with only the A2 beta casein protein is better for human health, McLachlan co-founded A2 Corporation – the predecessor to a2 Milk – in 2000 to promote consumption of milk that contains only the A2 protein. McLachlan used genetic testing to identify cows that produced A2-only milk.

However, McLachlan’s findings on the harmful effects of A1 beta casein protein, and the positive effects of A2 beta casein protein, were and are still not universally accepted. There are scientific studies that support as well as undermine the theory that A1 beta casein protein found in milk can lead to diseases in humans.

On a2 Milk’s part, the company’s messaging to consumers today is focused on phrases such as “Many people say they can feel the difference [between A1 and A2 milk].” There’s nothing scientific in the message, and the company is not making any bombastic health-related claims when it comes to the consumption of A1 or A2 milk. Your mileage may vary, but we have no ethical views on the scientific legitimacy about the health effects of the A1 beta casein and A2 beta casein proteins. Our only ethical concern is whether there’s conclusive proof that A2 beta casein protein is severely harmful to human health – if there is, we’ll stay far from a2 Milk. So far, we’ve not seen anything that worries us on this front, so we’re comfortable with a2 Milk’s business.

Investment thesis

We have laid out our investment framework in Compounder Fund’s website and will use the framework to describe our investment thesis for a2 Milk.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

We think that the infant formula market provides a2 Milk with the largest runway for growth. At a high level view, the global infant formula market was US$52 billion in 2018, according to Global Market Insights, and is expected to compound at nearly 10% annually to reach US$98 billion by 2025. The growth-projection for the global infant formula looks sensible to us because of powerful secular trends such as greater consumer demand for wellness products, and a rising middle class in Asia. As a reminder and for perspective, a2 Milk’s revenue in FY2020 was merely NZ$1.73 billion (or around US$1.15 billion).

We believe a2 Milk is well-positioned to win its fair share of the growing infant formula market for a few reasons.

First, the a2 Milk brand is gaining traction among Chinese consumers and there’s still significant room for growth. In FY2020, a2 Milk’s revenue from the China & Other Asia geography jumped by 65.1% to NZ$699.4 million. Of the NZ$699.4 million, NZ$337.7 million came from the sale of a2 Milk’s China-label ( a2 至初 – pronounced “a2 zhi chu”) infant formula products in mother and baby stores in China, and growth in this channel was over 100% in FY2020. Meanwhile, NZ$341.1 million of the NZ$699.4 million came from cross-border e-commerce sales of a2 Milk’s English-label (a2 Platinum) infant formula products to China; growth from this channel was 40.3%.

a2 Milk’s value-share within both channels are still low. In the mother and baby stores channel, the company’s value-share was just 2.0% in FY2020. We also want to highlight that only 19,100 mother and baby stores in China carried a2 Milk’s products at the end of FY2020; according to a September 2019 investor presentation by a2 Milk, there are a total of more than 120,000 mother and baby stores across China. In the cross-border e-commerce channel, a2 Milk’s value-share was 21.7% in FY2020. China’s infant formula market is highly fragmented, with the top five brands in the country holding a collective market share of just 37%; we think the fragmentation points to a huge opportunity for a2 Milk to win mind-share among Chinese consumers.

Second, the a2 Milk brand has strong momentum in Australia. Back in FY2018, a2 Milk’s a2 Platinum label of infant formula products had a 32% value-share in the Australian grocery and pharmacy channels, up from around 12% in FY2015. In FY2019 and FY2020, a2 Milk’s infant nutrition business in Australia and New Zealand grew revenues by 35.3% and 14.1%, respectively. With NZ$745.1 million in infant nutrition product sales in Australia and New Zealand in FY2020, a2 Milk remains the market brand leader for infant formula in the Australian grocery and pharmacy channels.

Third, USA could be a trump card. a2 Milk currently sells only liquid milk products in the USA. But the company could begin introducing infant formula products there in the future as its brand recognition improves. a2 Milk’s revenue in the USA was up 91% in FY2020 to NZ$66.1 million, with around half of the growth coming from existing stores that the company’s products are sold in. At the end of FY2020, a2 Milk’s distribution in the USA grew from 13,100 stores a year ago to 20,300. If a2 Milk can succeed in the USA, we believe it may create a platform for product innovation and for the company to introduce infant formula products to the county.

We are not forgetting the liquid milk market for a2 Milk because it also provides a significant growth opportunity for the company.

In FY2020, the company’s liquid milk sales in Australia and New Zealand was up 14.1% to NZ$152.5 million and the business ended the year with a market share of 11.3%; the a2 Milk brand continues to be the market-leading brand in fresh milk there. We think a2 Milk can continue eking out market-share gains due to its strong brand position – a2 Milk is the largest liquid milk brand advertiser in the Australian market.

We mentioned above that a2 Milk’s liquid milk sales in the USA is growing rapidly. But the company has barely milked the opportunity. According to a2 Milk’s September 2019 investor presentation, the premium refrigerated milk market in the US is US$12.8 billion, compared to a combined US$1.7 billion in Australia and New Zealand. Based on its strong growth in FY2020, we expect a2 Milk’s growth momentum in the USA to continue in the years ahead.

2. A strong balance sheet with minimal or a reasonable amount of debt

As of 30 June 2020, a2 Milk has a stellar balance sheet with NZ$854.2 million in cash, zero debt, and just NZ$16.8 million in short and long-term lease liabilities. Moreover, it helps that a2 Milk has been generating strong free cash flow in the past few years (more on this later when we discuss a2 Milk’s historical financials).

Earlier this month, a2 Milk announced that it would be putting some of its money to use by entering a non-binding agreement to acquire a 75.1% stake in the New Zealand-based dairy manufacturer, Mataura Valley Milk, for NZ$270 million. Mataura Valley owns a new processing plant that is currently focused on milk powder production. a2 Milk’s outgoing CEO, Geoffrey Babidge, explained that if the deal went through, a2 Milk would invest a further NZ$100 million to enable Mataura Valley’s new plant to can infant formula. This will provide a2 Milk with a vertically integrated facility that processes fresh milk and produces finished infant formula products.

a2 Milk is currently still in negotiations with Mataura Valley Milk, so nothing’s set in stone yet. But if the deal does go through, we don’t foresee a2 Milk running into any financial difficulties, since the acquisition’s total price tag – including the additional NZ$100 million investment – is well within a2 Milk’s means. Commenting on the deal, Babidge also said: “Because our business is growing so rapidly, we thought it important that a component of the product that we are selling should be sourced internally.” We agree. The acquisition seems like a smart move to us too, as it will give a2 Milk tighter control over its own supply chain, reducing its reliance on third-parties to produce its products.

Currently, most of a2 Milk’s products are processed and manufactured by the company’s strategic partners that include Synlait and Fonterra. This arrangement has made a2 Milk into an incredibly asset-light business with fat margins (we will discuss this when we touch on a2 Milk’s historical financials). But it also introduces risks, since a2 Milk does not have full control over its supply chain; the company owns a 19.8% stake in the Australia- and New Zealand-listed Synlait, but it is only a minority shareholder.

3. A management team with integrity, capability, and an innovative mindset

There’s been some management shuffles at a2 Milk that we want to comment on. a2 Milk’s current CEO is Geoffrey Babidge, who was appointed as interim CEO on 9 December 2019 when previous CEO Jayne Hrdlicka departed from her role after just 18 months in the seat. Hrdlicka clarified that she wanted to leave because being a2 Milk’s CEO required more travel than she had anticipated and the travelling was difficult for her to manage alongside her other commitments. Hrdlicka is also president and chair of Tennis Australia.

We can only speculate on what happened internally between Hrdlicka and a2 Milk’s directors. But Babidge’s appointment as interim CEO is comforting to us. Babidge was previously CEO and managing director of a2 Milk from July 2010 to July 2018. During this period of time, a2 Milk’s business grew significantly (more on this later), and we think Babidge deserves great credit.

On 11 August 2020, a2 Milk announced that David Bortolussi will succeed Babidge as CEO early in 2021. Babidge will remain as CEO until Bortolussi officially joins the company. Prior to his appointment as a2 Milk’s incoming CEO, Bortolussi was with the US-based clothing company HanesBrands. Here’s a description of Bortolussi’s experience that was given in a2 Milk’s announcement:

“David joins the company from his most recent role as Group President – International Innerwear, HanesBrands. He joined Pacific Brands in 2009 initially as Chief Financial & Operating Officer taking over as CEO in 2014, during which he restructured and transformed the business into a brand focused, leading omni-channel retailer with successful wholesale partnerships, delivering double digit compound annual growth in sales and earnings over the past five years. In 2016, HanesBrands acquired Pacific Brands and expanded David’s role to cover Australasia and subsequently its international innerwear operations outside of the Americas. Over this period, David has been responsible for and had extensive exposure to Pacific Brands and HanesBrands’ Asian sourcing markets, particularly China including various brand distribution partnerships in the region.”

We like what we see with Bortolussi. He has excellent omni-channel retail experience, and his knowledge with business-deals in China is likely to come in handy for a2 Milk’s growth in the Middle Kingdom.

On integrity

This is how Bortolussi’s remuneration plan with a2 Milk looks like:

- He will receive an annual base salary of NZ$1.75 million, which will be reviewed once a year

- For FY2021, he will receive a short-term incentive payment of a target of 120% of his annual base salary. The short-term incentive is “based on the achievement of performance objectives to be determined by the Board.”

- For FY2021, he can take up performance rights that are equivalent to 150% of his annual base salary “with vesting assessed over a three-year period based on performance hurdles and vesting conditions to be determined by the Board.”

We can’t tell for sure if Bortolussi’s remuneration plan is sensible, since we do not know what the performance objectives for the short-term incentive and performance hurdles for the long-term incentive are. But we are giving it a passing grade for now, since a2 Milk’s remuneration policy for its management team in FY2020 looks sound to us. Here are our observations:

- Babidge’s annual base salary in FY2020 was A$1.6 million.

- The company’s executive-remuneration structure in FY2020 had both short-term and long-term incentives. 49% of the CEO’s total target remuneration in FY2020 was in the form of the long-term incentive, 29% was from the short-term incentive, and the remaining 29% was from the annual base salary. For the company’s other key C-suite leaders, the long-term incentive accounted for 38%-45%, the short-term incentive 25%-28%, and the annual base salary 30%-34%.

- The short-term incentive is based on a few things: (1) financial factors such as overall revenue and net profit growth; and (2) business-performance factors such as scaling a2 Milk’s business in the USA, building a2 Milk’s brand in China and the USA, growing a2 Milk’s market-share and revenue in China, and delivering on employee-engagement and a2 Milk’s digital transformation.

- The long-term incentive is a form of stock-based compensation that will vest depending on the three-year annualised growth of a2 Milk’s revenue and earnings per share (EPS). The annualised growth-thresholds are 15% for revenue and also 15% for EPS. If one of the growth-thresholds are not met, then there will be no vesting for the long-term incentive.

Moreover, Bortolussi’s annual base salary of NZ$1.75 million looks reasonable to us, since it is only 0.45% of a2 Milk’s net profit of NZ$385.8 million in FY2020.

We are also impressed by management’s approach to marketing a2 Milk’s infant nutrition products. The company stresses the importance of breastfeeding as the gold standard of infant nutrition, and positions its range of infant formula as an alternative only when breastfeeding is not an option. To us, a2 Milk’s commitment to prioritise educating the public on good practices for babies’ health over business profits is a sign of the company’s strong culture and integrity.

On capability and innovation

Many dairy companies produce commoditised milk products. But not a2 Milk. The company positions itself as a premium brand for milk products and it has done so with wild success: a2 Milk’s gross profit margin expanded from an already impressive 35.2% in FY2015 to 56.0% in FY2020. For perspective, Fonterra, an a2 Milk partner and the second largest dairy producer in the world in 2018, according to the Canadian Dairy Information Centre, had a gross profit margin of merely 13.8% in the 12 months ended 11 July 2019.

We give management credit for this brand-magic, in particular, Susan Massasso, who joined a2 Milk in September 2013 as Chief Marketing Officer. She announced in November 2019 (shortly before Jayne Hrdlicka left as CEO) that she would resign from her role. But in February 2020 (after Geoffrey Babidge returned as CEO), a2 Milk revealed that Massasso would take on the newly created role of Chief Growth and Brand Officer. We’re glad that Massasso continues to be with a2 Milk to manage the company’s brand while also leading product innovation.

But life wasn’t always this good for a2 Milk. In 2004, the company had an initial public offering in New Zealand, only to then go bust later in the year. And it wasn’t until the second half of 2010, shortly after Geoffrey Babidge became CEO, that a2 Milk made its first-ever profit since its founding 10 years ago in 2000.

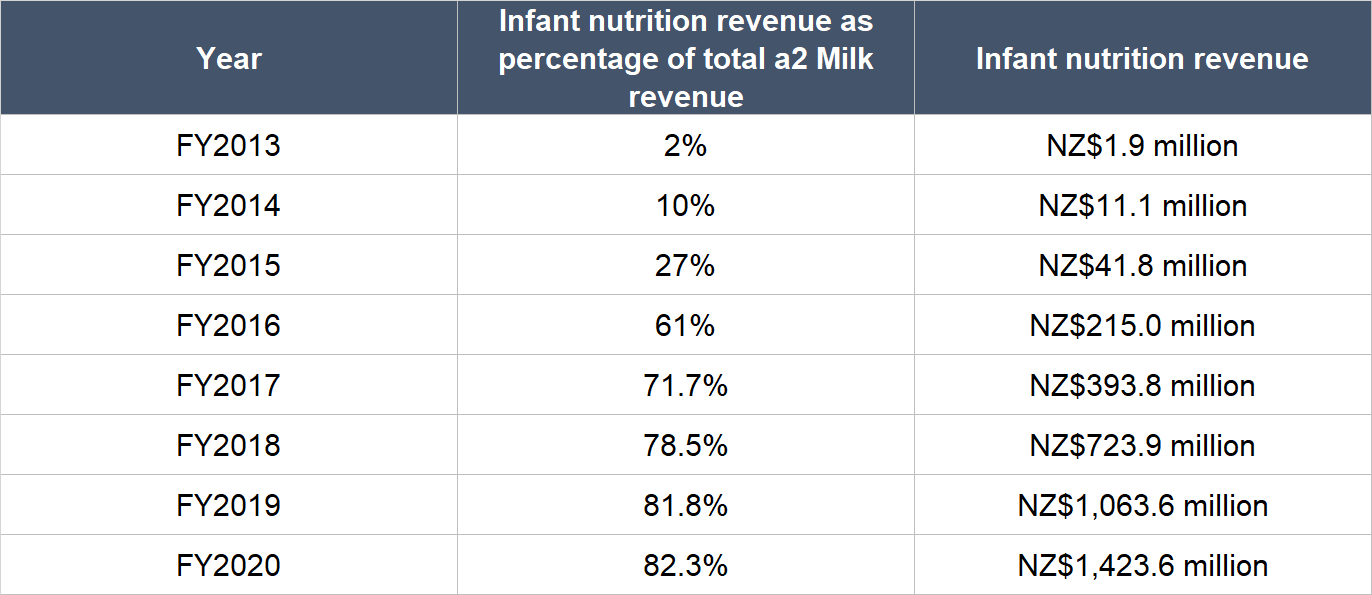

We think there were two transformative years for a2 Milk. The first is 2008, when a2 Milk shifted from licensing intellectual property related to A2 beta casein protein milk, to becoming a brand owner of premium branded milk products. The second is 2013, when the a2 Platinum infant nutrition products were launched in New Zealand, Australia, and China. a2 Milk’s infant nutrition business grew rapidly from there. Today, infant nutrition products account for the lion’s share of the company’s revenue. We think the growth of a2 Milk’s infant nutrition business – from essentially nothing just seven years ago in 2013 – is a testament to management’s operational excellence and ability to innovate.

Source: a2 Milk annual reports and earnings presentations

Here are other data points that give us confidence in a2 Milk’s leadership team:

- a2 MIlk’s physical retail distribution footprint in China has increased massively from 3,800 stores in June 2017 to 19,100 stores in June 2020.

- a2 Milk entered the US market in 2015 via the California region with approximately 500 stores; today, a2 Milk’s liquid milk products can be found in more than 20,000 stores across the USA. The company’s revenue in the country has also grown rapidly from NZ$13 million in FY2018 to NZ$35 million in FY2019 and then NZ$66 million in FY2020.

- a2 Milk’s liquid milk business has seen its total revenue compound at a respectable annual rate of nearly 14% from FY2013 to FY2020. The company’s market share in the liquid milk market in Australia has also been growing steadily, from 7.4% in FY2013 to 9.3% in FY2016 and then to 11.3% in FY2020. The market share gains are also another sign of the growing brand-power of a2 Milk; it helps too that a2 Milk was the largest brand advertiser in the Australia fresh milk category in FY2020.

- a2 Milk’s China-business has grown by leaps and bounds, with revenue in the China and Other Asia segment soaring from NZ$2.7 million in FY2014 to NZ$88.9 million in FY2017 and then to NZ$699.4 million in FY2020. We think that management’s willingness to invest in marketing (total marketing spend for a2 Milk in FY2020 was NZ$194.3 million, up 45% from FY2019), expand the company’s network of physical distribution channels in China, and the introduction of a Chinese label for infant nutrition products (a2 至初) are the big reasons for the company’s success in China so far.

We are also encouraged to see that a2 Milk’s leadership continues to prioritise growth over returning capital to shareholders. Here’s a relevant excerpt from a2 Milk’s FY2020 annual report:

“As we noted in February 2020, as part of the Board’s ongoing review of the most appropriate use of capital for the business, we continue to prioritise investment in growth initiatives ahead of returning capital to shareholders… With our cash balance growing it has become increasingly important for the business to review our capital requirements going forward. A significant review of our capital allocation framework was commenced in the second half with a view to defining the discipline and prioritisation of our financial parameters in a way that optimises and supports our long-term plan.”

Of course, all of the positive points we mentioned above about a2 Milk’s management team in the “On capability and innovation” sub-section of this article has nothing to do with incoming CEO David Bortolussi. But as we mentioned earlier, Bortolussi seems like a safe pair of hands to us. Moreover, he will have the support of Susan Massasso (the long-time brains behind a2 Milk’s brand-magic) and David Hearn (who has chaired a2 Milk’s board since March 2015). Bortolussi will also be able to tap onto the experience of Shareef Khan and Peter Nathan. Khan is a2 Milk’s Chief Operating Officer and first joined the company in June 2012; Nathan first joined a2 Milk in 2008 and became the CEO of a2 Milk’s Asia Pacific business in July 2017.

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

We think a2 Milk’s business has highly recurring revenue streams from consumer behaviour: Milk and infant formula products fall into the category of fast moving consumable goods which consumers tend to buy repeatedly. But there’s more to it. Here are a few reasons why we think a2 Milk has a high chance of winning repeat business from consumers:

- We believe that parents tend to stick to an infant formula brand once they have found one. (Changing a brand may result in an extremely unhappy baby and many sleepless nights!)

- Although the lifetime value of a customer is fairly short for purely infant formula products (generally, experts recommend weaning infants off infant milk formula after a year), a2 Milk also has Stage 3 and Stage 4 products that are catered to children above three years of age.

- Despite selling only premium milk products, a2 Milk has managed to grow its liquid milk market share in the Australia and New Zealand market. We credit this to a2 Milk’s strong brand positioning and growing appeal to health-conscious consumers in Australia and New Zealand.

- For infant nutrition products, parents are likely going to still be willing to spend on quality even during tough times. We’re encouraged by the fact that a2 Milk managed to post impressive growth in the first half of 2020 (the second half of the company’s FY2020), during the current COVID-19 pandemic. In the six months ended 30 June 2020, a2 Milk’s revenue jumped by 34.2% year-on-year to NZ$925.8 million, driving a 49.1% increase to NZ$0.27 in earnings per share.

5. A proven ability to grow

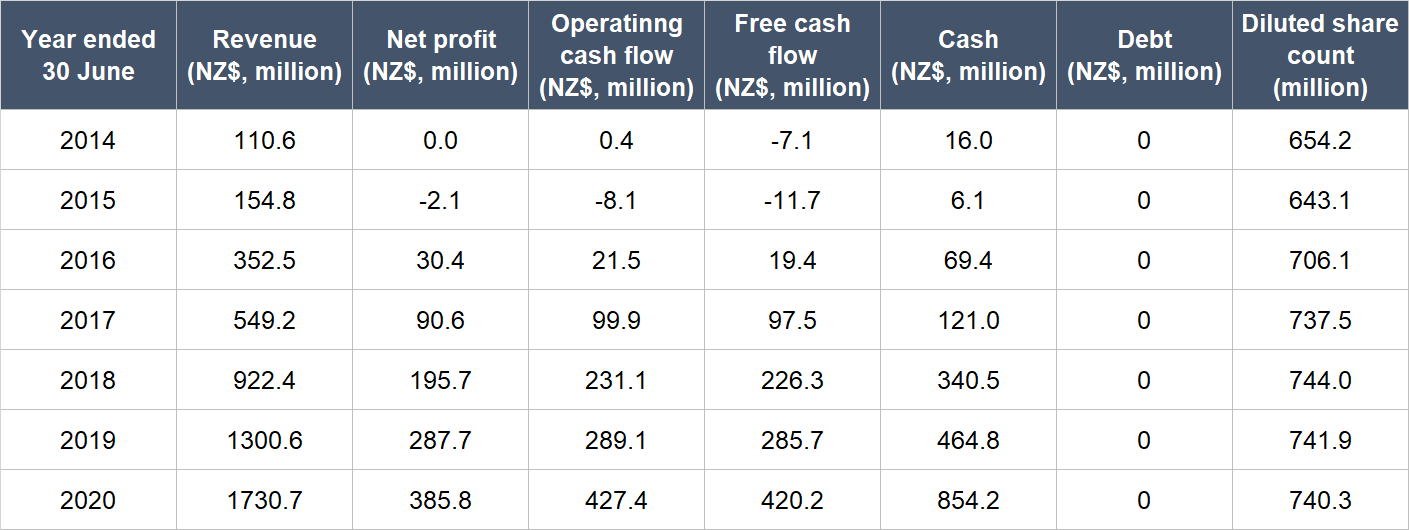

The growth of a2 Milk’s infant nutrition business is the most important pillar of our investment thesis for the company. So we only studied the company’s financials going back to FY2014, the year when the infant nutrition business started becoming important. The table below shows a2 Milk’s important financial figures from FY2014 to FY2020:

Source: a2 Milk annual reports

A few things to note for a2 Milk’s financials:

- Revenue has compounded at a rapid annual rate of 58.1% from FY2014 to FY2020. Revenue growth in FY2020 was slower at 33.1%, but it’s still a really strong performance.

- a2 Milk started to generate a profit consistently in FY2016, and from then to FY2020, the company’s net profit grew by 88.7% per year. In FY2020, a2 Milk’s net profit was up by a still-impressive 34.1%.

- Similar to net profit, a2 Milk’s operating cash flow and free cash flow became consistently positive starting from FY2016. From FY2016 to to FY2020, operating cash flow jumped by 111.2% per year while free cash flow did even better with annual growth of 115.7%. a2 Milk kept up its strong cash flow performance in FY2020, with operating cash flow and free cash flow growth of 47.9% and 47.1% in the year.

- The balance sheet has been strong throughout the entire timeframe under study, since debt was zero in each year.

- a2 Milk’s diluted share count had increased by a total of 13.2% from FY2014 to FY2020. This translates to an annual growth rate of merely 2.1%, which is negligible when compared to the company’s revenue, profit, and cash flow growth. In other words, there has been no dilution at a2 Milk in the past few years.

- a2 Milk is a capital light business. From FY2014 to FY2020, the company had total capital expenditure of merely NZ$31.1 million but revenue surged from NZ$110.6 million to NZ$1.73 billion (a more than 10-fold increase). The revenue growth was accompanied by significant jumps in net profit, operating cash flow, and free cash flow too. In FY2020, a2 Milk also achieved admirable net profit and free cash flow margins of 22.3% and 24.3%, respectively.

Despite the presence of COVID-19 creating uncertainties for the global economy, a2 Milk is still anticipating “strong” overall revenue growth for FY2021 and an EBITDA (earnings before interest, taxes, depreciation, and amortisation) margin that is just a smidge lower than in FY2020. Not all of the company’s markets are expected to perform well though – management expects revenue from the USA market in FY2021 to be around the same compared to FY2020.

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

We think a2 Milk excels in this criterion for two reasons.

First, a2 Milk has a high-margin business model and low capital expenditure requirements. Over the past few years, the company had clearly demonstrated its ability to generate strong free cash flow. So we think that a2 Milk is in a great position to continue churning out cash from its business in the years ahead.

Second, we see a2 Milk having a high chance of growing its revenue significantly in the future because of the strength of its infant nutrition business. The higher revenues should bring higher free cash flow too.

Valuation

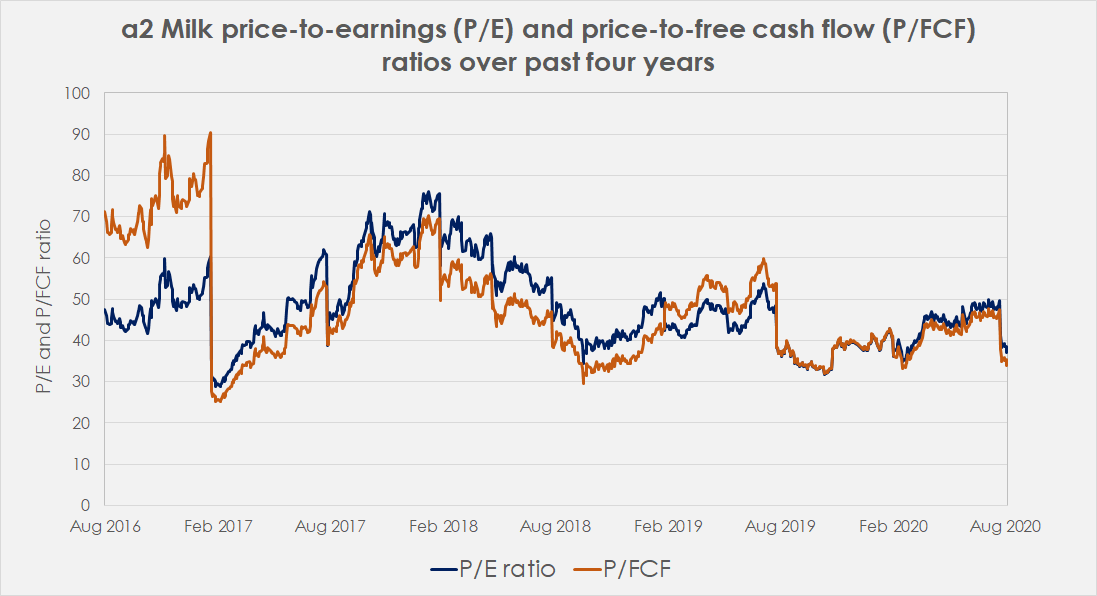

We like to keep things simple in the valuation process. In a2 Milk’s case, we think the price-to-earnings (P/E) and price-to-free cash flow (P/FCF) ratios are suitable gauges of the value of the business. This is because the company has consistently produced profits and free cash flow over the past few years.

We completed our purchases of a2 Milk shares with Compounder Fund’s initial capital in late July 2020. Our average purchase price was A$19.35 per a2 Milk share, which translates to NZ$21.09 based on an exchange rate of A$1 to NZ$1.09. At our average price and on the day we completed our purchases, a2 Milk’s shares had trailing P/E and P/FCF ratios of around 49 and 47, respectively. Although these valuations are on the wrong side of 30 and so appear to be high at first glance, history is on our side.

Source: S&P Global Market Intelligence

The chart above shows a2 Milk’s P/E and P/FCF ratios over the past four years (we chose a four-year timeframe and not five years so that we can remove the distortion from a2 Milk’s loss and negative free cash flow in FY2015). You can see that a P/E ratio of 49 and P/FCF ratio of 47 are actually not high compared to where the ratios have been over the past four years. Furthermore, a2 Milk has all the qualities we are looking for in Compounders and we think it’s likely that the company can compound its revenue at more than 20% per year over the next five to seven years. So we are comfortable with the company’s valuation.

For perspective, at a share price of A$17.47 as of 29 August 2020, a2 Milk has trailing P/E and P/FCF ratios of 37 and 34, respectively.

The risks involved

There are five main risks we see for a2 Milk:

- Brand risk: We think a2 Milk has been successful predominantly because of its strong brand rather than the actual health benefits (if any) that come with the company’s milk that contains only A2 beta casein protein. This puts the company’s business at risk of brand-mismanagement. We’re comforted by the incredible success that a2 Milk has enjoyed thus far in positioning itself as a premium brand for milk products in Australia, China, and the USA. But we are still mindful of the risk that a misstep by management or poor publicity may have on its brand and thus, its consumer-perception.

- Management change: Ideally, we would prefer stability at the helm of the companies we invest in. We explained earlier why we’re comfortable with a2 Milk’s leadership despite the recent management-shuffles. But we will still be keeping a close eye on how incoming CEO David Bortolussi performs.

- Geopolitical tensions between Australia and China: Political tension between Australia and China has been rising in recent times. For instance, earlier this year, China suspended beef imports from four major meat processing plants in Australia and also slapped an 80.5% tariff on Australia’s barley exports. Any escalation in the trade disputes between China and Australia – especially if the fights concern dairy exports from Australia to China – will very likely have a negative impact on a2 Milk’s business.

- Reliance on strategic partners: a2 Milk has strong relationships with its key partners who are suppliers (Synlait and Fonterra) and distributors (China State Farm). As mentioned earlier, in order to reduce reliance on key partners, a2 Milk recently entered discussions to acquire a majority stake in dairy products producer Mataura Valley Milk. But for now, a2 Milk is still heavily exposed to its key partners. In particular, a2 Milk’s China operations is reliant on China State Farm, which is the exclusive import agent in China for a2 Milk’s products. A fallout between a2 Milk and China State Farm at this current juncture could have huge negative implications on a2 Milk’s China business.

- Decline in demand because of a recession: We mentioned earlier that a2 Milk’s revenue growth in the USA is expected to be flat in FY2021. This is because management is “seeing that consumers [in the USA] are becoming more value conscious given economic uncertainties, high unemployment rates” as a result of COVID-19’s impact on the American economy. Earlier, we also discussed our view that demand for a2 Milk’s infant nutrition products is likely to be recession-proof. But there’s still a risk that a prolonged COVID-19-driven economic recession could hurt even a2 Milk’s infant nutrition business.

Summary and allocation commentary

To summarise a2 Milk, it:

- Has plenty of room for growth in the fast-growing global infant formula market. In China, the company commands only a small share of the market. In Australia, it has a market-leading position and continues to enjoy double-digit sales growth. Meanwhile, the US looks like a huge long-term growth opportunity, even if COVID-19 has created some headwinds for now.

- Boasts a rock-solid balance sheet with no debt.

- Has a sensible remuneration policy for its management team, and leaders who have displayed operational excellence and innovativeness over the years.

- Has a business with recurring revenues because of customer-behaviour.

- Has an excellent track record of rapid growth in revenue, profit, and free cash flow in the past few years – and there’s no dilution too!

- Is likely to continue generating a strong and growing stream of free cash flow in the years ahead.

There are risks we’re watching with a2 Milk, such as the risk of brand-mismanagement; recent management shuffles; geopolitical tension between China and Australia; a heavy reliance on strategic partners; and the possibility of the company’s business being hurt by a recession.

After weighing the pros and cons, and also the company’s valuation, we decided to initiate a 2.5% position in a2 Milk – a medium-sized allocation – with Compounder Fund’s initial capital. We think a2 Milk has a high-quality business, but we thought a medium-sized allocation (for us, a large position will have a 4.0% weighting with Compounder Fund’s initial capital) is more appropriate given the uncertainty related to incoming CEO David Bortolussi. We do think Bortolussi is a safe pair of hands, but we prefer to approach the situation with a little more prudence.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share.