Compounder Fund: Teladoc Health Investment Thesis - 16 Jun 2021

Data as of 12 June 2021

Compounder Fund’s investment in Teladoc Health (NYSE: TDOC) can be traced to Livongo, which is one of the 40 companies in the fund’s initial portfolio.

We first bought shares of Livongo in July 2020. A few months after our investment, Livongo was acquired by Teladoc in October 2020 in a stock and cash deal. After assessing the deal and the business prospects of the combined Teladoc and Livongo entity, we decided to keep the Teladoc shares that were given to Compounder Fund as part of the acquisition. We also added more Teladoc shares in January 2021. This article describes our investment thesis for Teladoc.

Company description

Teladoc, which is based and listed in the USA, provides virtual healthcare services. Virtual healthcare refers to healthcare services that are administered to patients remotely over the internet with the help of video and audio technology. Instead of having to physically visit a healthcare facility, patients can receive the medical care they require through virtual consultations (through a video or phone call) on Teladoc’s platform with the company’s licensed in-house and third-party doctors and other healthcare professionals.

Patients can access Teladoc’s platform with a computer or mobile device, and can either do it online or via Teladoc’s app. Here’s a useful walk-through video from Teladoc on how its platform works. Since 2015 (and likely even earlier), Teladoc has consistently clocked a median response time of less than 10 minutes for a patient to receive a virtual general medical consultation from the time the patient requests for one.

Through Teladoc, patients can find the medical help they require for hundreds of medical subspecialties, ranging from the flu and upper respiratory infections, to mental health issues and chronic, complicated medical conditions (such as diabetes, hypertension, cancer, and congestive heart failure). Teladoc’s solutions for helping patients to manage chronic medical conditions were boosted significantly with its acquisition of Livongo in October 2020.

Livongo’s solutions aim to promote sustainable behavioural changes in patients, “based on easy, real-time data capture supported by intuitive devices; insights driven by data science; and a human touch when the member needs it.” According to Livongo’s 2019 annual report, the company has solutions for patients to manage diabetes, hypertension, prediabetes, their weight, and their behavioural health. As an example of how Livongo helps patients, its solution for diabetes management involves the following: An interactive blood glucose meter that is connected to the web; unlimited blood glucose test strips; personalised messages to support behaviour change; and coaching and monitoring. Patients whose blood glucose levels rise or fall to dangerous levels will also receive a call from Livongo’s in-house Certified Diabetes Educators (CDEs) within minutes.

Teladoc also provides enterprise-level telehealth technology solutions for hospitals and health systems. This service came from Teladoc’s acquisition of InTouch Health in July 2020. InTouch Health’s technology portfolio is an end-to-end telehealth solution for hospitals and health systems. It encompasses “patient intake, emergent and scheduled encounters, robust televideo sessions, access to medical images, full application-specific clinical documentation tools – including interfaces to health system EMRs [electronic medical records], and complete operational and clinical reporting and analytics.” It also includes support for medical devices, such as robots, carts, and tablets used in hospital networks.

In 2020, Teladoc facilitated 10.6 million telehealth consultations. In addition, from July 2020 to the end of the year, Teladoc also completed 2.1 million telehealth sessions that were associated with InTouch Health. The most common way that patients access Teladoc’s services is through mobile devices and in fact, the company considers its mobile app to be foundational to its business. We think that having a mobile-friendly experience is critical for Teladoc’s future growth in a mobile-dominated world (when it comes to the web, users in the USA spent nearly double the time on mobile than on desktops in 2018, according to data from Mary Meeker’s Internet Trends 2019 report).

Teladoc’s entire suite of virtual healthcare services are provided largely on a business-to-business (B2B) basis. The company’s clients, which number in the thousands, include: Employers, including over 50% of the Fortune 500; more than 50 health plans including some of the largest in the USA; more than 600 hospitals and health systems; and insurance and financial services companies. For certain virtual healthcare services, Teladoc serves consumers directly as well as through channel partners.

The B2B model works well for Teladoc in the USA. In 2019, more than 183 million Americans (56.4% of the country’s population) obtained their healthcare insurance coverage from their employers, according to the United States Census Bureau. And based on data from Statista, 61% of US employees in the same year were under self-funded healthcare insurance plans. Self-funded healthcare insurance plans refer to those where companies choose to directly pay for some or all of the healthcare services used by their employers rather than purchasing health insurance products for them. What these mean is that American companies are likely to be happy if their employees can access high-quality medical care at lower prices. A few years ago, Teladoc commissioned a study that was performed by Veracity Analytics. The study found that a number of Teladoc clients saved an average of US$472 per general medical visit when their associated-individuals used Teladoc’s services compared to receiving medical care in other settings for the same diagnosis. Meanwhile, Livongo’s diabetes management program has also been shown to generate average annual savings of US$1,908 per participant.

Teladoc earns revenue from its virtual healthcare services through a few different fee structures. They are: (1) subscription-based access fees that are typically charged monthly and depend on the number of members using Teladoc’s services; (2) visit fees, which are the fees earned by Teladoc when individuals associated with Teladoc’s clients receive a virtual consultation through Teladoc; and (3) a combination of access fees and visit fees. The visit fees and the combination of access fees and visit fees apply to only some of Teladoc’s clients; most of the company’s clients prefer just access fees.

At the end of 2020, Teladoc had 51 million unique US paid members and 22 million visit fee only individuals who have access to the company’s virtual healthcare services, including 0.6 million members with access to the company’s chronic care solutions. Teladoc does not clearly define the terms “paid member” and “visit fee only individual.” But we believe that (1) a paid member refers to a Teladoc-registered individual associated with a Teladoc client that is under a fee structure with only access fees, and (2) a visit fee only individual refers to a Teladoc-registered individual associated with a Teladoc client that is under a fee structure with only visit fees.

The access fees earned by Teladoc are mostly paid by its clients on behalf of their associated individuals (employees, dependents, policy holders, card holders, beneficiaries, clinicians etc.). In some cases, the access fees are paid by the members. For visit fees, they are also paid by either Teladoc’s clients or members, but it’s unclear to us which party pays more.

In the first quarter of 2021, Teladoc earned total revenue of US$453.7 million. Of this, 85.6% (or US$388.2 million) came from access fees while 12.0% (or US$54.5 million) came from visit fees. The remaining 2.4% (or US$11.1 million) came from a category that Teladoc calls “other.” It comprises revenue associated with virtual healthcare devices and equipment that are related to InTouch Health’s solutions. From a geographical perspective, Teladoc is focused on the USA with the country accounting for 91.7% of the company’s total revenue in the quarter (or US$415.9 million) while international markets collectively accounted for the remaining 8.3% (or US$37.8 million).

Teladoc’s revenue breakdown for the first quarter of 2021 is more useful than a breakdown for 2020 because the company’s acquisitions of InTouch Health and Livongo happened in July 2020 and October 2020, respectively. In the first quarter of 2021, InTouch Health and Livongo collectively contributed around US$147 million, or around a third, of Teladoc’s total revenue.

Investment thesis

We have laid out our investment framework on Compounder Fund’s website. We will use the framework to describe our investment thesis for Teladoc.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

The USA currently has a population of 332 million people, according to the United States Census Bureau. As of 31 March 2021, Teladoc has 51.5 million paid US members. From this, it’s clear that there’s still significant room for the company to grow its member count given the current penetration rate of around 15.5%.

But the more important statistics are these:

- In Teladoc’s 2015 IPO prospectus (the company held its initial public offering in July 2015), the company shared data from the CDC (Centres for Disease Control and Prevention) showing that there are 1.25 billion in-person ambulatory care visits in the USA per year, including those at primary care offices, hospital emergency rooms, outpatient clinics, and other settings.

- Of the 1.25 billion in-person ambulatory care visits, Teladoc estimated that around a third (or 417 million) could be treated through telehealth.

- In the first quarter of 2021, Teladoc completed 3.2 million telehealth visits and 1.1 million telehealth sessions that are associated with InTouch Health. Annualising these numbers bring us to 12.8 million telehealth visits and 4.4 million InTouch-Health-associated telehealth sessions, which collectively represent just 4% of the 417 million annual in-person ambulatory care visits in the USA that could be addressed with telehealth solutions.

- Teladoc’s chronic care management solutions have 658,000 enrolled members as of 31 March 2021. According to Livongo, there are 31.4 million diabetes patients and 39.6 million hypertension patients in the USA.

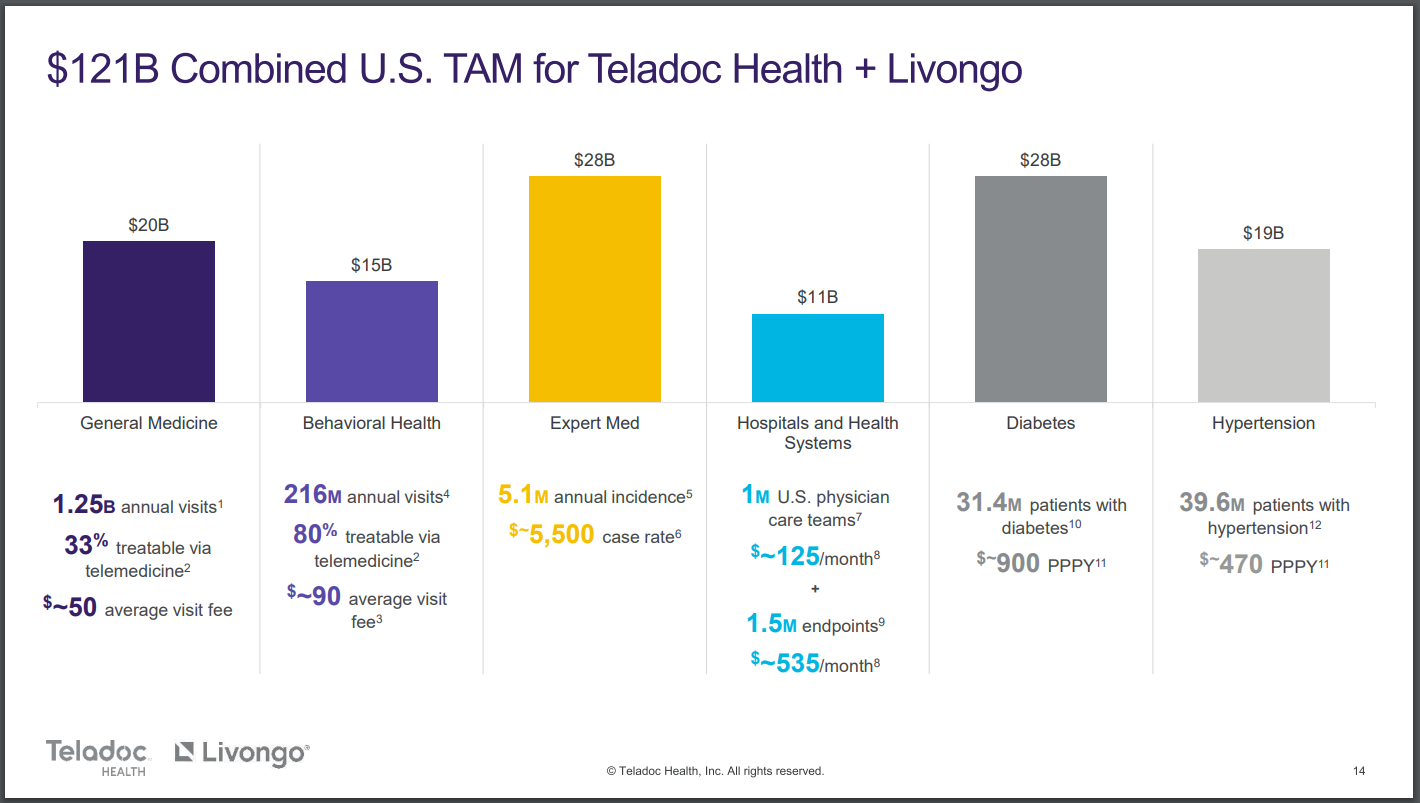

- During Teladoc’s September 2020 presentation on its acquisition of Livongo, the company shared that the combined Teladoc & Livongo would have a total addressable market of US$121 billion, as illustrated in the chart below. For perspective, Teladoc’s annualised revenue from the first quarter of 2021 is ‘only’ US$1.81 billion.

Source: Teladoc September 2020 presentation on acquisition of Livongo

We think there’s a good chance that Teladoc will be able to take advantage of the growth opportunities that it’s seeing. From the perspective of patients, we think that virtual healthcare provides a much better experience compared to visiting a doctor in person, for some medical conditions at least. There’s no need to wait in queues or go through the hassle of leaving home. According to a study conducted by J.D. Power in late 2019, telehealth services received an overall customer satisfaction score of 851 (out of 1,000) and this is among the highest “of all healthcare, insurance and financial services industry studies conducted by J.D. Power.” In J.D. Power’s study, Teladoc received the highest score among telehealth providers. During a January 2021 investor presentation, Teladoc’s CEO Jason Gorevic shared that the company enjoys a high net promoter score (NPS) of more than 60 across its virtual healthcare services. Meanwhile, Livongo itself has a high NPS of 64 as of end-2019, according to Teladoc’s September 2020 presentation on its acquisition of Livongo. And even more importantly, Teladoc’s services save patients money. Earlier, we shared that Teladoc helped generate an average of US$472 in savings per virtual consultation and that Livongo’s diabetes management program generates average annual savings of US$1,908 per participant

(J.D. Power is a global provider of consumer insights. Meanwhile, the NPS ranges from -100 to +100 and it measures the willingness of customers to recommend a company’s product or service to others and can be a gauge of customer loyalty and satisfaction.)

Another thing we want to point out about Teladoc’s market opportunity is that the emergence of the COVID-19 pandemic in 2020 may have permanently boosted the growth prospects for the telehealth market. Teladoc shared the following in its 2020 annual report:

“We believe that favorable existing macro trends were accelerated by the impacts of the COVID-19 pandemic, driving greater consumer trial and use of virtual care, and increased adoption by employers, health plans, hospitals and health systems, and health care providers. In combination with the expansion of our capabilities, we believe that these trends present significant opportunities for virtual healthcare to address the most pressing, universal healthcare challenges through trusted solutions, such as ours, that deliver convenient, high quality care; empower consumers to manage and improve their health; and enable providers to offer their best care for their patients.”

2. A strong balance sheet with minimal or a reasonable amount of debt

Teladoc ended the first quarter of 2021 with cash and investments of US$722.6 million, and significantly higher debt of US$1.35 billion (in the form of convertible senior notes). This is a risk, but not close to being a red flag for us for a few reasons.

First, Teladoc’s revenue is highly recurring in nature (there will be more on this later). Second, of Teladoc’s US$1.35 billion in convertible senior notes, 53% (or US$721.1 million) are notes that mature in 2027, and the rest mature in May and June 2025. This means that Teladoc’s convertible senior notes are long-term in nature, which lessens the liquidity risk faced by the company.

3. A management team with integrity, capability, and an innovative mindset

On integrity

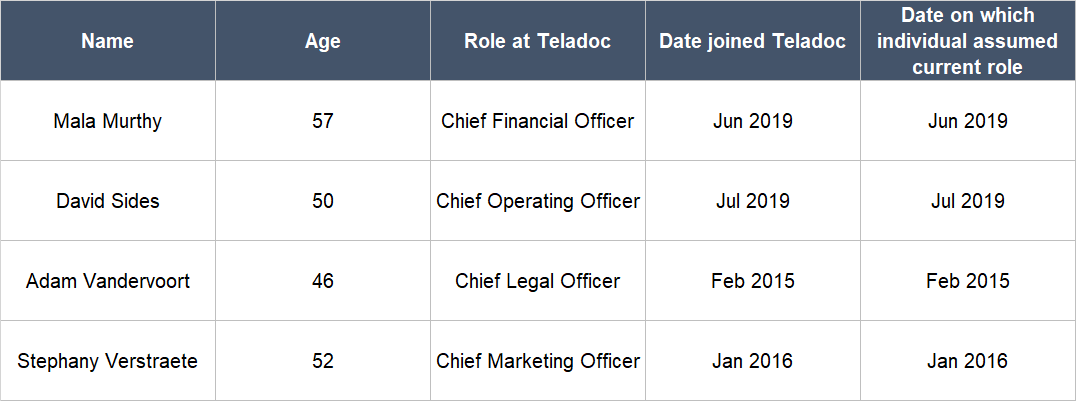

Teladoc is led by the 49-year old Jason Gorevic, who has been the company’s CEO since June 2009. We appreciate the fact that Gorevic is relatively young but already has a dozen years of leadership experience at Teladoc. The other important executives in Teladoc’s leadership team are shown in the table below. They are fairly young (in a business sense) since they are mostly around Gorevic’s age. We also like that Vandervoort and Verstraete each have a few years under their belt in their current roles with Teladoc. Meanwhile, although Murthy and Sides are both relatively new to Teladoc, they both have had ample leadership experience at other firms prior to their stint with the company.

Source: Teladoc proxy statement

We think that Teladoc’s management team has a compensation plan that, on balance, is well-structured. Here are the key points:

- In 2020, Gorevic received a base salary of US$550,000 and a short-term cash bonus of US$1.1 million. These are reasonable amounts when compared to the scale of Teladoc’s business. For the year, Gorevic was also granted stock awards with a target amount of 54,623 Teladoc shares. At Teladoc’s share price of US$155 as of 12 June 2021, the value of Gorevic’s target stock awards works out to US$8.46 million (US$155 multiplied by the target number of Teladoc shares of 54,623). This dwarfs the base salary and short-term cash bonus that Gorevic earned for 2020.

- Gorevic’s stock awards consist of a target of 27,311 in restricted stock units (RSUs) that vest over a three-year period, and a target of 27,312 in performance stock units (PSUs) that also vest over a three-year period.

- Of Gorevic’s target number of PSUs, 60% (or a target of 16,387 PSUs) depend on Teladoc’s revenue performance over a one-year period; 25% (or a target of 6,828 PSUs) depend on the company’s adjusted EBITDA (earnings before interest, taxes, depreciation, and amortisation) performance over a one-year period; and the remaining 15% (or a target of 4,097 PSUs) depend on the company’s operating margin performance over a two-year period.

- For the target number of PSUs that are associated with each of the three business-performance measures (revenue, EBITDA, and operating margin), the actual number of PSUs that Gorevic can earn ranges from 0% to 200% of the target.

- Teladoc does not provide any clarity on what kind of revenue, EBITDA, and operating margin performance the company needs to achieve in order for Gorevic to earn 200% of the target number of PSUs for each metric. But since Teladoc has reported its results for 2020, the company’s directors have determined that Gorevic should earn 200% of the target number of PSUs for both the revenue and EBITDA measure. No decision has been made on the number of PSUs Gorevic will actually earn for Teladoc’s operating margin performance since the performance period (two years) has yet to be completed.

- In 2020, Teladoc’s revenue and adjusted EBITDA grew by 97.7% (to US$1.09 billion) and 298.5% (to US$126.8 million), respectively. With this context, we think it’s reasonable for Gorevic to earn 200% of the target number of PSUs that are associated with Teladoc’s performances in revenue and adjusted EBITDA in 2020.

- To sum up the nature of Gorevic’s stock awards:

- They dwarf the value of Gorevic’s base salary and short-term cash bonus, meaning that the lion’s share of his compensation in 2020 came from his stock awards.

- The stock awards vest over multi-year periods, which in turn mean that most of Gorevic’s compensation in 2020 is tied to the long-term business performance of Teladoc. Technically, his PSUs depend on Teladoc’s short-term business performance and this is something we do not like. But the PSUs are still linked to the company’s long-term business performance because they vest over multiple years.

- In 2020, the sum of the base salary and cash bonus earned by each of the other members of Teladoc’s management team – Murthy, Sides, Vandervoort, and Verstraete – ranged from US$0.65 million to US$1.08 million. These are again, very reasonable sums when compared to the scale of Teladoc’s business. Furthermore, Murthy, Sides, Vandervoort, and Verstraete were granted stock awards for the year that (1) have the exact same characteristics as Gorevic’s stock awards, and (2) have target numbers of RSUs and PSUs with monetary values (ranging from a sum of US$1.68 million to US$2.49 million) that dwarf the base salaries and cash bonuses.

We also like the fact that Gorevic has skin in the game. As of 23 March 2021, Teladoc’s CEO owns 560,970 shares of the company. At Teladoc’s 12 June 2021 share price of US$155, Gorevic’s shares are worth nearly US$87 million. In addition, he also controls 918,264 Teladoc stock options that are exercisable within 60 days of 23 March 2021. If Gorevic had exercised his Teladoc stock options and held the shares, those shares would be worth more than US$142 million at Teladoc’s share price of US$155 as of 12 June 2021.

On capability and ability to innovate

We think Jason Gorevic and his team have a good track record with Teladoc when it comes to execution and innovation. There are a few things we want to discuss.

First, under the leadership of Gorevic and his team, Teladoc has managed to grow its telehealth visits and paid US members significantly over the years. This is shown in the table below. The two metrics are important signs on the health of Teladoc’s business. For 2013 to 2020, Teladoc’s telehealth visits grew by 88.1% per year from 0.13 million to 10.6 million. Over the same period, Teladoc’s US paid members increased from 6.2 million to 51.8 million, or 35.4% annually. For 2020, telehealth visits and US paid members climbed by 156.2% and 41.1%, respectively. What’s worth noting here is that the utilisation rate of Teladoc’s services (given here by the number of telehealth visits per sum of US paid members and visit fee only individuals) has also improved by a factor of 7, from 0.02 to 0.14 from 2013 to 2020. We think this change in the utilisation rate over time is a useful proxy for the growth in the value that patients can derive from Teladoc’s services.

Source: Teladoc annual reports and IPO prospectus

In our view, Teladoc’s impressive growth in telehealth visits and paid members is related to two things: First, there’s the sound value-proposition that the company’s services provide to patients; and second, there’s the company’s ability to provide a good mobile experience for users. Earlier, we shared the following about Teladoc: (a) Patients enjoy a consistently fast median response time of 10 minutes with Teladoc; (b) the company has high customer-satisfaction; (c) the company’s services bring cost savings to patients; and (d) patients access Teladoc’s services mostly through mobile devices. We think Gorevic and his team deserves credit for all of these.

The second thing we want to discuss involves Teladoc’s healthy client retention. In its 2015 IPO prospectus, Teladoc mentioned that it had an average net dollar retention rate of 104% over the last three years. As far as we know, Teladoc no longer reports its retention rates on a regular basis. But during the company’s earnings conference calls for the third and fourth quarters of 2020, Gorevic mentioned that Teladoc’s client retention rate has historically been in the 90s-percentage range and has continued to remain there.

The third thing we’re bringing up is related to Teladoc’s acquisitions of InTouch Health and Livongo. We think they are shrewd moves by the company’s leaders. The two acquired entities are a great strategic fit for Teladoc for the following reasons:

- InTouch Health gives Teladoc a beachhead into winning enterprise customers – hospitals and health systems – who want to transform their patient experiences through telehealth solutions. Some of these customers likely wouldn’t funnel their patients to Teladoc’s telehealth services. So by providing these customers with telehealth-related technological tools, Teladoc is now able to ride on the growth of the entire telehealth market in another way beyond just directly providing telehealth services. Importantly, the technological innovations Teladoc comes up with for its own telehealth services could also be provided to these enterprise customers, thereby potentially improving the returns from Teladoc’s investments in research and development.

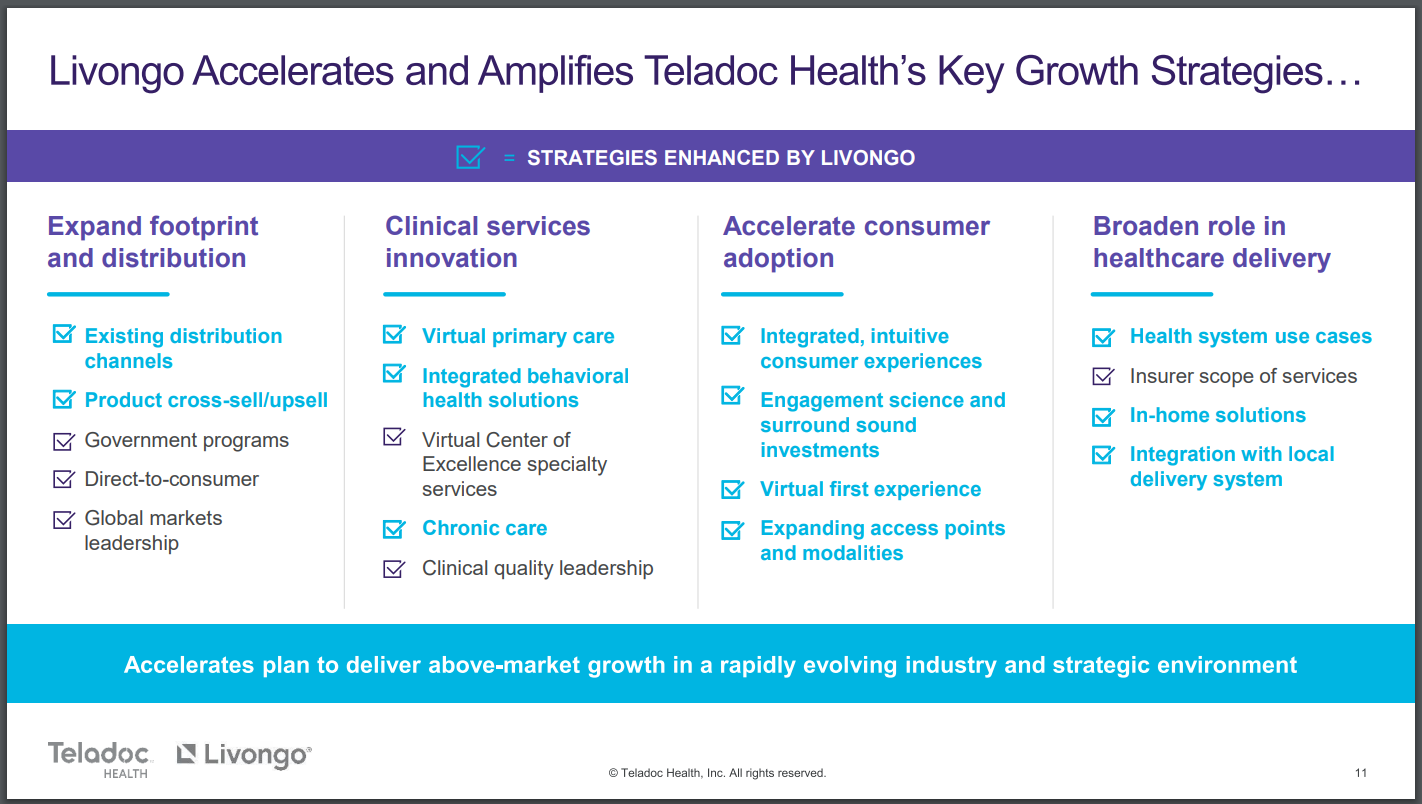

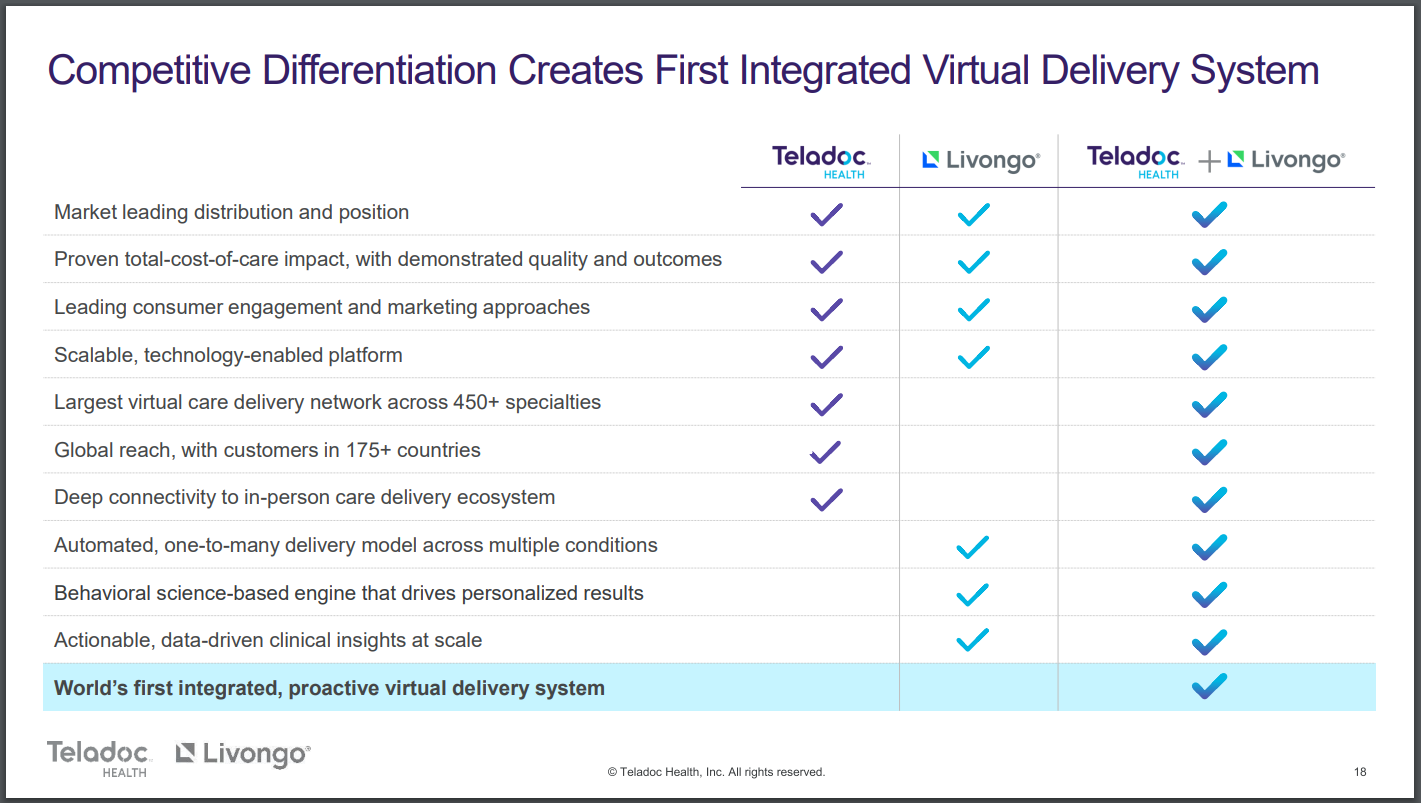

- The acquisition of Livongo brings Teladoc a big step forward in becoming a single access point for whole-person end-to-end virtual healthcare. Livongo’s solutions, as mentioned earlier, are focused on chronic care management, and they significantly expand Teladoc’s chronic care portfolio. The two slides below, from Teladoc’s September 2020 presentation on the Livongo acquisition, shows the areas of Teladoc’s business that are strengthened with the addition of Livongo. There’s also the opportunity for significant cross-selling between the two as Teladoc can refer its base of users to Livongo.

Source: Teladoc September 2020 presentation on acquisition of Livongo

But only the passage of time can prove if the acquisitions of InTouch Health and Livongo will turn out to be sound. The verdict’s still out on whether Gorevic and his team can successfully integrate the two entities. For now, we’re comforted by the sound strategic rationale for the deals. We also want to positively highlight Gorevic’s use of Teladoc shares to pay for the acquisitions. InTouch Health had a price tag of US$1.07 billion, of which 84.4% came from issuing 4.6 million Teladoc shares. Teladoc acquired Livongo for US$13.94 billion, and 93.1% of the deal was paid for with 60.4 million Teladoc shares. The use of Teladoc shares resulted in dilution to Teladoc’s existing shareholders. But we think the positive impact of protecting the health of Teladoc’s balance sheet outweighs the negative impact from the dilution.

The fourth thing we want to discuss is related to the possibility that a strong network effect is forming at Teladoc. Teladoc can be seen as an online platform that connects medical professionals with patients – and so, the presence of more medical professionals attracts more patient-usage, which attracts more medical professionals and so on. Over time, such a network effect could be hard to break, if Teladoc continues to provide a great user experience for both medical professionals and patients. We’ve already shared that from 2013 to 2020, Teladoc had experienced significant growth in its number of telehealth visits, paid members, and utilisation rate. To us, this is a sign that a strong network effect could potentially be forming at Teladoc – and it’s to the credit of Gorevic and his team that this is happening. In an investor conference that happened earlier this month, Gorevic said:

“The breadth of our product portfolio and the clinical capabilities that we have is absolutely number one. And we have always sought to stay ahead of the curve and stay ahead of the competitive pack when it comes to the breadth of the portfolio, in our value proposition to employers and health plans and providers, but even more importantly, to the consumer who knows that they can turn to us regardless of what their healthcare needs are. And so that breadth in the market is really unmatched. And it is significantly differentiated versus all the point solutions that are out there, and we win, in many cases, because of that breadth.”

Lastly, Gorevic and his team appear to have built a good corporate culture at Teladoc. Glassdoor is a website that allows a company’s employees to rate it anonymously. Currently, Teladoc has a 4-star rating out of 5, and Gorevic has a 93% approval rating as CEO, far higher than the average Glassdoor CEO rating of 69% in 2019. 74% of Teladoc-raters on Glassdoor also say that they will recommend a friend to work at Teladoc.

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

As we mentioned earlier, the lion’s share of Teladoc’s revenue comes from access fees (85.6% in the first quarter of 2021) which are on a subscription model. But just having a subscription model does not equate to having recurring revenues. If Teladoc’s business has a high attrition rate (the rate of customers leaving after their contracts expire), it has to constantly fill a leaky bucket. Fortunately, that does not seem to be the case for Teladoc. As mentioned earlier, Teladoc has a healthy track record of client retention.

Meanwhile, a significant but minority portion of Teladoc’s revenue comes from visit fees (12.0% in the first quarter of 2021), which we think is also recurring. These are revenues that Teladoc earns on a per-visit basis. And since people do fall ill from time to time, and would need to visit a doctor when they’re ill, this creates a recurring visit-fee revenue stream for Teladoc.

5. A proven ability to grow

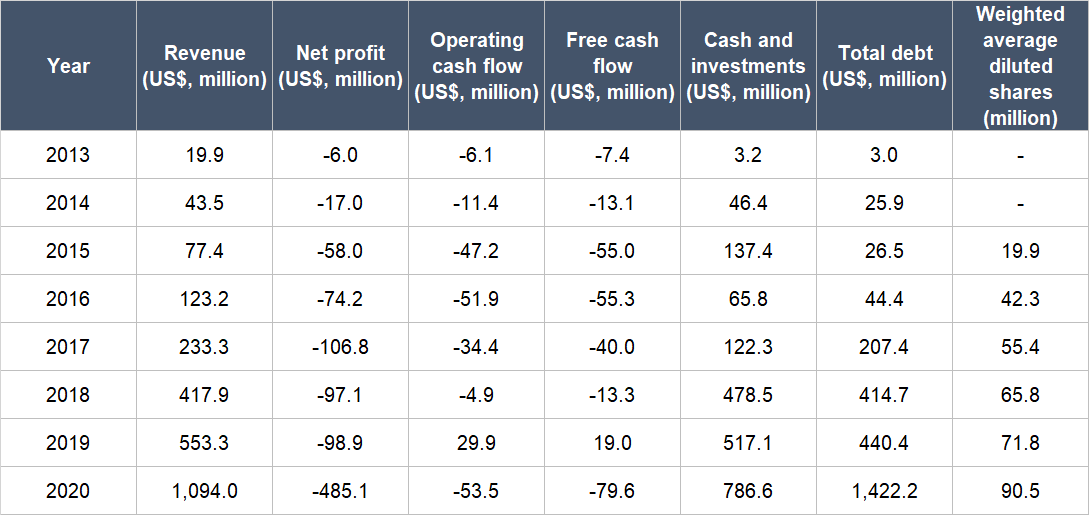

The table below shows the key financial figures for Teladoc from 2013 (the earliest we could find) to 2020:

Source: Teladoc IPO prospectus and annual reports

A few key things to highlight from Teladoc’s historical financials:

- Revenue had compounded impressively at 74.0% per year from 2013 to 2019. Teladoc’s growth was slowing in the later periods of this time frame (for example, revenue was up by ‘just’ 32.4% in 2019), but 2020 was a spectacular year for the company as its topline grew by 97.7%. During 2020, the emergence of the COVID-19 pandemic accelerated the adoption of telehealth services. Moreover, Teladoc also benefited from the acquisitions of InTouch Health and Livongo in the second half of the year; excluding revenues from InTouch Health and Livongo, Teladoc’s revenue increased by 75% in 2020.

- Teladoc did not generate any profit for the whole time frame under study. From 2015 (the year of its IPO to 2019), Teladoc’s net profit margin improved every year and climbed from -75.0% to -17.9%. But in 2020, the net profit margin declined dramatically to -44.3% as the net loss widened from US$98.9 million in 2019 to US$485.1 million in 2020. We’re keeping an eye on things here, but we’re not concerned. The net loss ballooned in 2020 largely because Teladoc endured significant one-time expenses that are related to the acquisitions of InTouch Health and Livongo (we estimate the one-time expenses to be around US$420 million).

- Teladoc produced negative operating cash flow as well as negative free cash flow from 2013 to 2018. The good thing is that from 2015 to 2018, Teladoc’s operating cash flow margin (operating cash flow as a percentage of revenue) improved every year and stepped up from -61.0% to -1.2%. The free cash flow margin also enjoyed a similar dynamic for the same time period and stepped up from -71.1% to -3.2%. 2019 was a turning point for Teladoc as it produced positive operating cash flow and free cash flow, with margins of 5.4% and 3.4%, respectively. 2020 saw the company’s cash flows turn negative again, as it clocked an operating cash flow margin of -4.9% and a free cash flow margin of -7.3%. It’s disappointing to see Teladoc regress. But we’re not worried for two reasons. First, Teladoc’s operating cash flow and free cash flow margins in 2020 are still significantly better than in 2017 and are roughly in-line with what’s seen in 2018. Second, Teladoc’s operating cash flow in 2020 was negatively impacted – to the tune of around US$112.7 million – from cash outflows that are related to inventory-spending and accounts payable. We believe that the spikes in cash outflows for the two categories seen in 2020 are likely to be resolved with time.

- Teladoc’s balance sheet had weakened over the years, as the net-cash position seen in 2013 had gradually turned into a net-debt position by 2020.

- We only started looking at Teladoc’s share count since 2015 because it was listed in July of the year. At first glance, Teladoc’s number of shares appeared to have increased significantly by 112.5% from 2015 to 2016. But the number we’re using is the weighted average diluted share count. Right after Teladoc got listed, it had a share count of around 37 million. This means that the increase in 2016 is much milder at around 14%. From 2016 to 2020, Teladoc’s weighted average diluted shares increased by 20.9% per year, with the increase in 2020 being 26.0%. These rates of dilution are all higher than what we typically like to see. But at the same time, as long as Teladoc’s business grows at a much faster pace than its diluted share count, there will be a positive impact on shareholder value. For perspective, Teladoc’s revenue grew by 72.6% from 2016 to 2020, and by 97.7% in 2020. Nonetheless, we will be watching Teladoc’s dilution in the future.

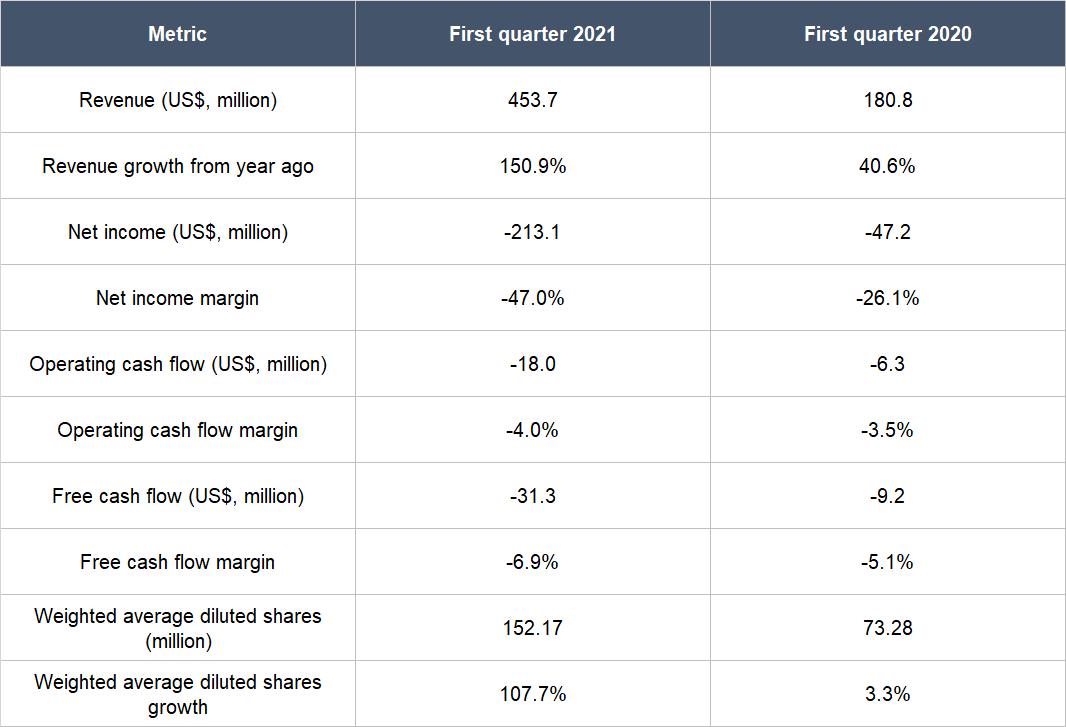

Teladoc posted impressive year-on-year revenue growth of 150.9% for the first quarter of 2021 – as illustrated in the table below – driven by the acquisitions of InTouch Health and Livongo. Unfortunately, Teladoc’s net income, net income margin, operating cash flow, operating cash flow margin, free cash flow, and free cash flow margin all took a step backwards from a year ago. The good thing is that the declines in the operating cash flow and free cash flow margins were not significant. Teladoc’s weighted average share count also surged by 107.7% during the quarter – thankfully, this is dwarfed by the company’s revenue growth.

Source: Teladoc quarterly earnings update

There’s a potentially troubling point about Teladoc’s business performance in the first quarter of 2021. The company ended the quarter with 51.5 million paid members, which was flat compared to the end of 2020 (51.8 million members). Moreover, the company expects to end 2021 with between 52 million to 54 million paid members, meaning member-growth is going to decelerate significantly from 2020, when it was up by 156%. The good thing is that Teladoc’s management expects member-growth to reaccelerate in 2022. During the earnings conference call for the first quarter of 2021 and in an investor conference that happened earlier this month, CEO Jason Gorevic said:

“[Earnings conference call for first quarter of 2021] I would say the membership increases, and the sales that we’re closing over the course of this year will have a much bigger impact on 2022 than on 2021. And actually, I have great confidence in what 2022 looks like based on the current status of our pipeline and our line of sight into significant deals. Where we’re likely to see upside in 2021 is in increased Livongo chronic care enrollment. We’ve factored in essentially no flu season in the back half of this year.”

“[June 2021 investor conference] So we added, as you said, we have added 15 million members last year. There is no question that some of those would have been January 1, 2021, adds, but they needed to service immediately. And so we accelerated the launch of a lot of those populations. And at that point, we then had to refill the pipeline with new opportunities. And we’ve given, I think, a fair amount of data relative to the size of the pipeline and the membership opportunity. And on the last quarterly call, we mentioned a large East Coast blue plan. That was a win that will result in some membership additions And as we look at our pipeline today for what we expect to add in the first half of ‘22, we feel very good about sort of reaccelerating membership growth.”

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

Despite many years in operation (the company was founded in 2002), Teladoc is still burning cash today. But we believe that Teladoc’s cash flow picture will improve significantly as its business gains even more scale in the future. As we mentioned earlier, the company’s operating cash flow and free cash flow margins were improving in each year from 2015 to 2019 and even turned positive in 2019. Teladoc regressed in 2020, cashflow-wise, but we think it is temporary.

Valuation

The Livongo acquisition was announced by Teladoc on 5 August 2020. On 4 August 2020, Teladoc had a share price of US$249, which we took to be the price at which we would be ‘buying’ Teladoc’s shares.

We like to keep things simple in the valuation process. In Teladoc’s case, we think the price-to-sales (P/S) ratio is currently an appropriate metric to gauge the value of the company, since the company does not have a long history yet of generating substantial free cash flow. On 4 August 2020, at the share price of US$249, Teladoc had a P/S ratio of around 26, which is high and is a risk. For context, if we assume Teladoc had a 20% free cash flow margin back then, the P/S ratio translates to a price-to-free cash flow (P/FCF) ratio of 130 (26 divided by 20%).

But we’re willing to pay a premium for Teladoc. The company is operating in the growing field of telehealth, and in our opinion, is actually creating this tailwind (Teladoc is the USA’s first telehealth platform). As we explained earlier in the “Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market” sub-section of this article, we think Teladoc has a good chance of growing its business at a rapid clip in the future.

For perspective, Teladoc carried a P/S ratio of around 17 at the 12 June 2021 share price of US$155.

The risks involved

There are a few risks that we think could harm the health of our Teladoc investment. In no particular order, they are…

First, there is the risk of a potential slowdown in Teladoc’s growth. Earlier, we shared:

“There’s a potentially troubling point about Teladoc’s business performance in the first quarter of 2021. The company ended the quarter with 51.5 million paid members, which was flat compared to the end of 2020 (51.8 million members). Moreover, the company expects to end 2021 with between 52 million to 54 million paid members, meaning member-growth is going to decelerate significantly from 2020, when it was up by 156%. The good thing is that Teladoc’s management expects member-growth to reaccelerate in 2022.”

So while management’s confident about Teladoc’s member-growth in 2022, it’s still an open question at the moment. If Teladoc’s member-growth continues to stagnate, it could mean that the telehealth market has approached a saturation point a lot earlier than we expected.

Another risk we’re watching is key-man risk. We think that Jason Gorevic has done an admirable job leading Teladoc since he joined as CEO a dozen years ago. He’s still just 49, so we think he likely still has many more years left in the tank to continue leading Teladoc. But should he leave the company, we will be keeping an eye on the leadership transition.

The third risk that’s on our mind is related to the integration of Teladoc and Livongo. The Livongo acquisition, which involved a significant sum – US$13.94 billion – for Teladoc’s current scale, was completed just a few months ago in October 2020. We believe the two companies can create significantly more value as a merged entity. But there’s no guarantee that Teladoc can successfully integrate Livongo. To complicate matters, Livongo announced shortly before the acquisition was completed that some of its key leaders – including CEO Zane Burke – would be leaving their posts when the deal’s done. The good thing is that the early signs look positive. For example, in April 2021, Teladoc had enabled the first wave of members to access and register for Livongo’s programs from within the Teladoc app.

A fourth risk we’re watching is the possibility of Teladoc’s future cash flows being weak. Earlier, we said that “we believe… Teladoc’s cash flow picture will improve significantly as its business gains even more scale in the future.” Our belief stems from the idea that when a company operates a technological platform – such as the platform Teladoc is operating to connect medical professionals with patients – the costs involved are often fixed in nature. And what this means is that as more revenue accrues to such a company, its margins will improve over time. But there’s a possibility that one of Teladoc’s main expenses – the expense-category related to the company paying the medical professionals in its network for virtual consultations – is not largely fixed in nature. If so, then Teladoc may never be able to achieve a healthy cash flow margin.

Another risk we’re observing is Teladoc’s weak balance sheet. The company has significantly more debt than cash, as we mentioned earlier. If Teladoc’s business stumbles, even temporarily, the company’s weak balance sheet could cause it to suffer even more harm. But as we also said, we’re comforted by Teladoc’s high levels of recurring revenue, and the fact that its debt is long-term in nature.

The last important risk for us is Teladoc’s high valuation. We think Teladoc’s business deserves a premium valuation because it is likely to grow at a rapid clip for many years. But if the company’s growth falls short – even if it’s due to temporary problems – there could be a painful fall in its share price. A situation like this has already happened, with Teladoc’s share price declining sharply in recent months (from a peak of more than US$290 in mid-February 2021 to US$155 as of 12 June 2021), in a time frame that coincides with the low member-growth projections given by Teladoc’s management that we talked about earlier.

Summary and allocation commentary

To sum up Teladoc, it has:

- A huge market opportunity in the form of the telehealth market

- A balance sheet that, while having more debt than cash, does not overly concern us because of the recurring nature of the company’s revenues and the long maturity of its debt

- A leader in Jason Gorevic who has (1) built Teladoc into a company that is creating the tailwind of the telehealth market; (2) a compensation plan that is well-structured, on balance; and (3) a solid record of innovation and execution

- High levels of recurring revenue from both contracts and customer-behaviour

- An excellent long-term track record of revenue growth

- A good chance of being able to generate strong free cash flow in the future.

There are risks to our investment in Teladoc that we’re watching, such as a potential slowdown in growth; key-man risk; the possibility that Livongo’s integration is botched; the possibility of Teladoc producing weak cash flows in the future because one of its key expense categories may not be largely fixed in nature; a weak balance sheet; and a high valuation.

We first purchased shares of Livongo in July 2020 for Compounder Fund’s initial portfolio. At the time, we allocated around 1% of the portfolio to Livongo. Shortly after, we received cash and shares of Teladoc after Teladoc acquired Livongo. In January 2021, we bought more shares of Teladoc and our allocation was increased to nearly 2%, which can be considered a medium-sized allocation. Although we acknowledge the myriad risks involved, we’re intrigued by the growth opportunities in the telehealth market and we think Teladoc is a very strong player in the space.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share. Of all the other companies mentioned in this article besides Teladoc, Compounder Fund does not own shares in any of them. Holdings are subject to change at any time.