Compounder Fund: Portfolio Update (July 2022) - 14 Jul 2022

Jeremy and I intend to share frequent but non-scheduled updates on how Compounder Fund’s portfolio looks like. The last time we shared an update on this was for Compounder Fund’s portfolio as of 10 April 2022. In the update, I shared all 50 holdings that were in the fund’s portfolio at that time. Since then, there have been no changes to the fund’s holdings, although some involuntary removals could soon happen.

First, there’s the acquisition of Activision Blizzard by Microsoft that I first discussed in the most recent update. Activision’s shareholders approved the all-cash deal in late April and it is expected to be completed before 30 June 2023, subject to regulatory approval by US authorities. Our intention with Activision’s shares – which could change depending on developments at both companies and the stock market in general – remains. We intend for Compounder Fund to hold onto its Activision shares and receive the cash from Microsoft once the acquisition is completed. Doing so can prevent Compounder Fund from paying unnecessary trading fees. Moreover, the significant gap between Activision’s stock price and the acquisition price that I first mentioned in the most recent update still exists; selling now would mean forfeiting a potential gain of around 20% (a stock price of US$78 as of 10 July 2022 compared to the acquisition price of US$95; a stock price of US$80 was previously mentioned).

Second, Pushpay announced in late-April and late-May that it had received unsolicited and non-binding offers by multiple third parties, including two existing shareholders, to acquire the company. After Pushpay received the first offer, management appointed investment bank Goldman Sachs as a financial advisor. There’s been no update by Pushpay since, but we assume that discussions are ongoing between the company’s leaders and these third-parties. Jeremy and I think Pushpay’s long-term growth prospects are healthy and we intend for Compounder Fund to hold onto its Pushpay shares for now (our intention is, again, subject to change depending on developments at the company and stock market in general). We’ll make new decisions as and when Pushpay releases information about the offers.

Compounder Fund is able to accept new subscriptions once every quarter with a dealing date that falls on the first business day of each calendar quarter. In the middle of June 2022, Jeremy and I successfully closed Compounder Fund’s seventh subscription window since its initial offering period (which ended on 13 July 2020). This new capital was deployed quickly in the days after the last subscription window’s dealing date of 1 July 2022. Jeremy and I invested the new capital in five existing Compounder Fund holdings. They are (in alphabetical order): Adyen, Datadog, dLocal, Microsoft, and TSMC.

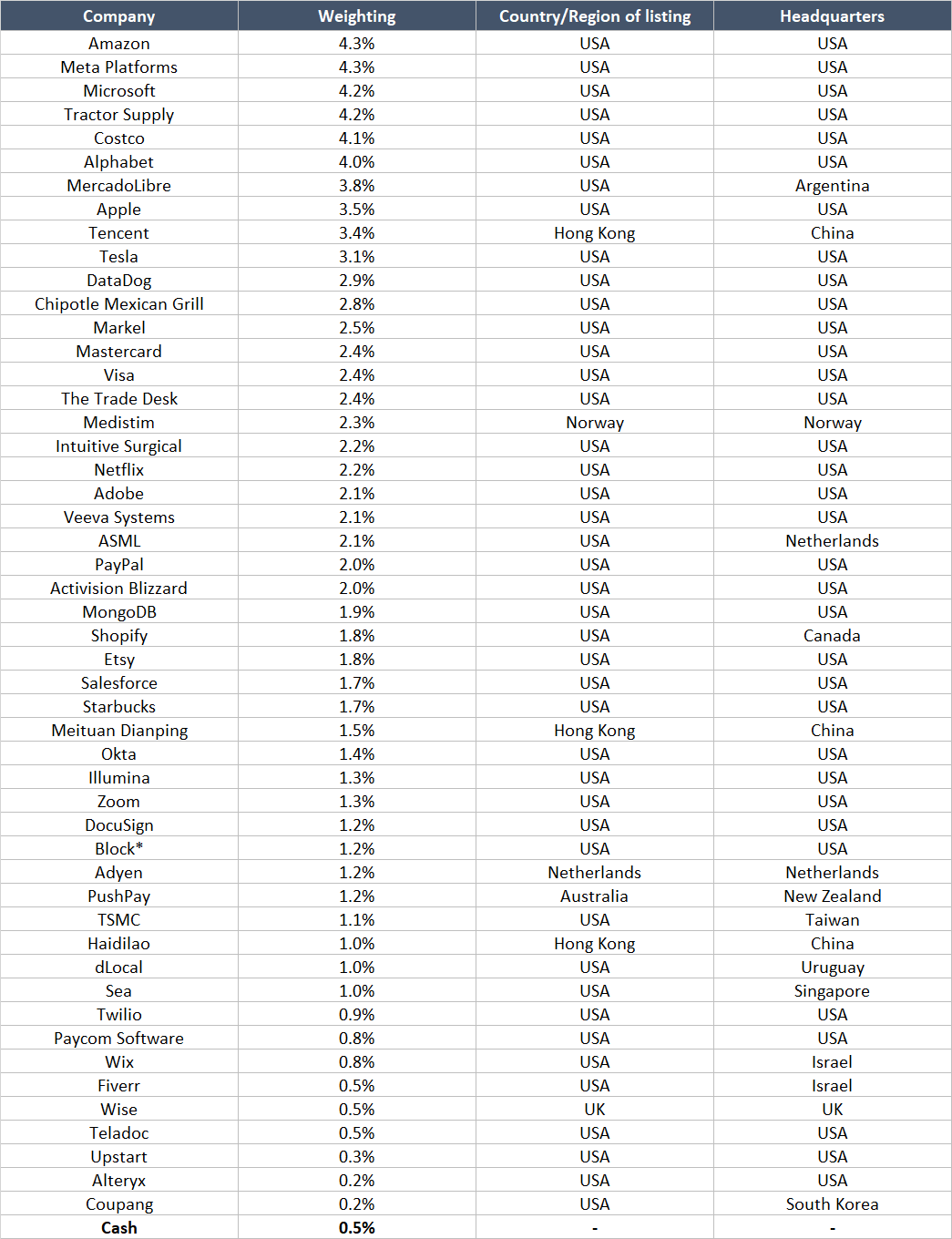

In Compounder Fund’s Owner’s Manual, we mentioned that “if Compounder Fund receives new capital from investors, our preference when deploying the capital is to add to our winners and/or invest in new ideas.” Not all of the five existing holdings in Compounder Fund’s portfolio that we added capital to have seen their stock prices rise strongly after we initially invested in them. But all of them have executed well since our investments and they’ve produced great results (with the exception of Adyen, because the company has yet to release any new earnings updates since our initial investment). They are winners, according to our definition. Here’s how Compounder Fund’s portfolio looks like as of 10 July 2022:

Table 1

*0.3% of the Block position comes from Block shares that are listed in Australia, but for all intents and purposes, we see the Australia-listed Block shares as being identical to the US-listed variety

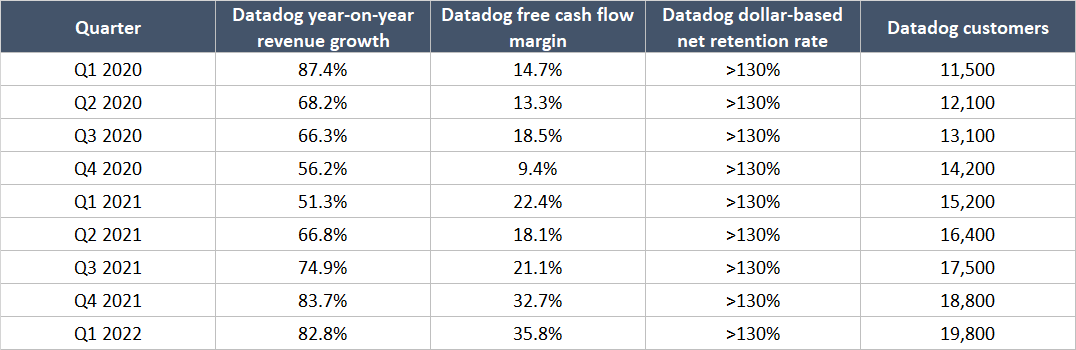

Our biggest addition in early-July 2022 was to Datadog, which provides a software platform for companies to monitor and analyse the performance of their technology stack (see our thesis on Datadog for more details). The company’s growth has been impressive. Table 2 shows Datadog’s revenue growth and free cash flow margin in each quarter going back to 2020; note the rapid increases in revenue and the improvement in the free cash flow margin to an excellent 35.8% currently. The table also lays out the high dollar-based net retention rate and robust growth in customer numbers that Datadog has achieved.

Table 2

Source: Datadog earnings updates

Datadog’s platform is becoming ever more critical for companies that are migrating to the cloud and/or undergoing a digital transformation. These trends are still early and, in our view, they are durable over the long run. Moreover, Datadog’s business could be resilient even in the face of a weakening economy. Here are some pertinent comments from Datadog’s management in the company’s latest earnings conference call held in May this year:

“We remain confident that cloud migration and digital transformation are drivers of our long-term opportunity and our multiyear trends that are still early in their lifecycles. We believe it is increasingly critical for companies to embark on these journeys in order to move faster, create competitive differentiation, enable strategic change, and serve their customers. And we believe we can help customers manage the complexity that comes with this transformation and that the Datadog unified platform is more than ever critical to understand, improve and secure their modern stacks and businesses…

…[Question] As the economic environment and the outlook for GDP growth continues to be a little bit wobbly with higher rates, how should we think about the defensibility of the Datadog consumption business?

[Answer] We believe that digital and cloud projects are still very high priority and are not being deprioritized. We haven’t seen that. We think we’re still early on. So with the data we have so far, we think there will be continued strong investment. There is always some volatility across our customer base. Our customer base is very well diversified across industries, and we benefited from that over time. So whereas we’re not macro forecasters, and there may well be some sensitivity. We believe the long-term trends in digital migration and cloud will still be very strong throughout that cycle.”

Despite the impressive execution by Datadog’s management and the presence of powerful and lasting tailwinds behind the company’s back, the stock price was down by 47% in the first half of 2022. We think the wide divergence between Datadog’s stock price and business fundamentals presents a good chance for us to add to our position in the company.

We’re sharing all this information with the public and with the fund’s investors for two reasons. First, we believe deeply in investor education and want Compounder Fund’s return and actions to be a source for people to learn about investing. Second, we believe that this transparency will help investors of Compounder Fund develop comfort with our investing process over time, which is great; in turn, this will also free us from the time-consuming activity of dealing with questions on how we invest, and thus give us more to invest better for our investors.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share. Holdings are subject to change at any time.