Compounder Fund: Meituan Investment Thesis - 29 Oct 2020

Data as of 26 October 2020

Meituan (SEHK: 3690) is one of the 40 companies in Compounder Fund’s initial portfolio. This article describes our investment thesis for the company.

Company description

Meituan, which changed its name from Meituan Dianping earlier this month, is listed in Hong Kong but based in China. The current form of the company came about from the union of two firms, Meituan Corporation and Dianping Holdings, in 2015. Meituan Corporation first came to life in 2010 when co-founders Wang Xing and Mu Rongjun launched meituan.com to offer local deals for restaurants, theatres, spas, and other services. Dianping Holdings meanwhile, was first launched in 2003 as dianping.com by Zhang Tao. It focused on user reviews of restaurants and other lifestyle services.

When the merger happened in 2015, Meituan Corporation had grown into an e-commerce platform that provided on-demand food delivery, movie ticketing, hotel bookings, and both domestic and international travel bookings. Dianping Holdings, meanwhile, had a rich treasure trove of user-generated reviews on dining and other lifestyle service providers.

Today, Meituan (we will refer to the combined entity as Meituan from now on) is the dominant e-commerce platform in China for services, connecting merchants and consumers. You can think of Meituan as a ‘super app’ for food delivery, restaurant bookings, bike-sharing, ride-hailing, and other lifestyle services. If you live in Singapore such as us, Meituan can be seen as a combination of apps and websites we may use frequently such as Grab (for ride-hailing), Fave (for lifestyle services), Deliveroo (for food delivery), Agoda (for travel bookings), and Trip Advisor (for user reviews). Check out this recent video from venture capital firm GGV Capital to get a great feel for the wide variety of services available on the Meituan app, and how users can organise their physical life easily around Meituan’s platform.

Meituan does more than just connect merchants and consumers. The company also provides merchants with a wide range of services to manage and grow their businesses. These services include targeted online marketing tools for merchants to reach out to consumers; cloud-based ERP (enterprise resource planning) systems; integrated payments systems for easier collection of payment; supply chain management systems; and even financing solutions.

The company breaks down its business into three segments:

1. Food Delivery: This segment houses the food ordering and delivery services on Meituan’s e-commerce platform. Meituan’s revenue from this segment comes primarily from commissions that are based on the transacted volumes on its platform, and from providing online marketing services to merchants.

2. In-store, Hotel and Travel: Under this segment, Meituan provides a platform for merchants to sell vouchers, coupons, tickets, and reservations to consumers. In a similar fashion to the Food Delivery segment, Meituan earns revenue here through commissions based on the volume of transactions processed, and by selling online advertising space on its platform to merchants.

3. New Initiatives and Others: This segment consists of Meituan’s smaller ventures. This segment includes the company’s B2B food distribution services; micro-loan business; car-hailing services; the Meituan Instashopping e-commerce marketplace; and other services such as bike-sharing.

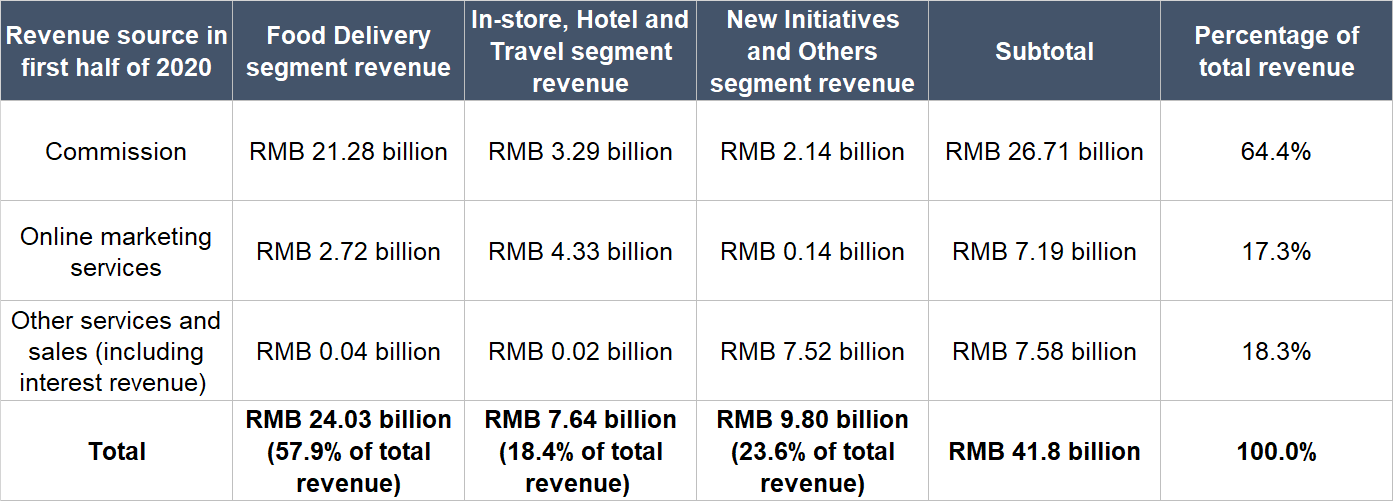

In the first half of 2020, Meituan pulled in revenue of RMB 41.48 billion (around S$8.3 billion). The table below shows a breakdown of the company’s revenue by business segment as well as by the type of activity.

Source: Meituan earnings update

Food Delivery is Meituan’s most important business segment in the first half of 2020 with a 57.9% share of the company’s total revenue. Even though the businesses in New Initiatives and Others are individually small for Meituan, the segment accounted for 23.6% of the company’s total revenue in the same period, more than the In-store, Hotel and Travel segment’s 18.4% share. On an overall basis, commission-based revenue is currently the most important for Meituan and also for the Food Delivery segment.

Right now, Meituan is a China-centric company, with most of its revenue in the first half of this year coming from the country.

Investment thesis

We have laid out our investment framework in Compounder Fund’s website. We will use the framework to describe our investment thesis for Meituan.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

Food Delivery segment

Let’s discuss the opportunity for the Food Delivery segment first, using data from iResearch that can be found in Meituan’s IPO prospectus (the company listed its shares on Hong Kong’s stock market in September 2018). The market for on-demand food delivery from restaurants more than doubled from RMB 126 billion in 2016 to RMB 305 billion in 2017. iResearch expects this market to compound at 31.0% annually from its 2017 level to hit RMB 1,542 billion in 2023. For perspective, Meituan’s Food Delivery segment exited the second quarter of 2020 with a trailing gross transaction volume (GTV) and revenue of RMB 404.37 billion and RMB 55.33 billion, respectively. These numbers show clearly that there’s significant room for growth for the company’s Food Delivery segment.

It’s possible that the growth of China’s market for on-demand food delivery could be much higher from 2020 onwards than iResearch’s forecasts. The current COVID-19 pandemic has altered consumer behaviour and also significantly accelerated the adoption of delivery services by restaurant operators in China. Meituan shared the following comments in its earnings updates for the first half of 2020:

“[First quarter of 2020]

On the consumer side, the pandemic has further accelerated the cultivation of consumption behavior, helping to further educate some of our targeted potential consumers in a positive way. Our platform’s diversified supply and consistently good experience sufficiently meet the demand of most people. Notably, we have seen increasing consumer preference for high ticket size categories during the pandemic due to the increasing adoption of food delivery for formal meals, further diversification of high-quality supplies on our platform and growing preference for branded restaurants. These positive factors in combination have driven the strong growth of the average value per order for the first quarter of 2020, increasing by 14.4% year-over-year…… More notably, the pandemic has further accelerated the digitization process, especially for many branded restaurants with high quality supply, which have traditionally focused on in-store dining instead of delivery services. In the first quarter of 2020, a large number of premium restaurants, highly-rated restaurants, chain restaurants, Black Pearl restaurants and five-star hotel restaurants, which did not have or had very limited food delivery services, initiated food delivery operations as their primary vehicle for business operations due to the pandemic. Participation by these restaurants increased high-quality supply on our platform in the long term, while we reinforced our importance to small- and medium-sized independent restaurants as food delivery almost became their sole source of income during the pandemic.

[Second quarter of 2020]

On the merchant side, a further recovery in merchant operation and consumer consumption led to the strong marketing demand from merchants in the second quarter of 2020. Meanwhile, the pandemic has accelerated the restaurants’ online migration, increasing the mix of high-quality merchants on our platform during the period. Notably, the number of newly-onboard branded merchants increased by more than 110% in the second quarter as compared to the prior year period. Their increased demand for online traffic has accelerated their adoption of our online marketing services. As a result, online marketing services revenues experienced rapid growth in the second quarter of 2020, increased by 62.2% year-over-year.”

Data from iResearch in Meituan’s IPO prospectus also showed that the company was the clear leader in the online on-demand food delivery market in China. In the first quarter of 2018, Meituan accounted for 59.1% of the market, based on GTV; the next largest competitor had a share of 36.0%. Moreover, Meituan had the largest delivery network in the world as of 2017, based on the 2.9 billion deliveries the company performed during the year (it’s worth noting too that Meituan had a large network of 531,000 daily active delivery riders in the fourth quarter of 2017). There’s good reason for us to believe that Meituan has continued to retain its leadership in China’s food delivery market: In 2018 and 2019, the company produced robust growth in its number of food delivery transactions, transacting users, and active merchants (we will show these later).

We think that Meituan’s status as a top-dog in China’s food delivery market means that it has a network effect (more merchants leading to more consumers leading to more merchants, and off the virtuous cycle goes) that could repel competitors. This bodes well for the company’s future growth in this area.

We want to highlight too that Meituan also earns revenue in the Food Delivery segment from online marketing services. We believe that revenue from online marketing services carry a much higher profit margin than commission revenue, since there are high costs involved with operating a large fleet of delivery riders. Meituan has built a huge database (the company processed 8.72 billion food delivery transactions in 2019) that could be valuable for restaurants’ advertising needs. It is difficult for us to pin a number down for the growth potential of the Food Delivery segment’s online marketing services business. But it suffices to say that the opportunity looks huge to us – we believe Meituan is barely scratching the surface in this area. We showed earlier that online marketing services revenue from Meituan’s Food Delivery segment surged by 62.2% year-on-year in the second quarter of 2020.

In-store, Hotel and Travel segment

The current COVID-19 pandemic, and the resulting travel restrictions implemented by China and other countries around the world to fight the virus, has hurt Meituan’s In-store, Hotel, and Travel segment. The company took the biggest hit in the first quarter of 2020, when commission revenue declined by a staggering 50.6% year-on-year. Here’s a table showing the segment’s decline in business activity in the first two quarters of 2020:

Source: Meituan quarterly earnings updates

It’s clear that COVID-19 has severely dented the short-term prospects for Meituan’s In-store, Hotel and Travel segment. But the situation in China is improving. In the second quarter of 2020, the segment’s commission revenue experienced a year-on-year decline that was less steep than in the first quarter (-23.7% vs -50.6%).

We’re taking a much longer-term view here. We believe that Meituan’s In-store, Hotel and Travel segment will return to growth when COVID-19 is no longer a serious health threat in China. Statista estimates that the revenue generated by hotels in China will fall by 47.6% in 2020. But the market is then expected to grow by 21.9% per year from 2020 to 2025 to reach RMB 659.8 billion. For perspective, Meituan’s GTV for the In-store, Hotel and Travel segment in 2019 was RMB 222.1 billion; meanwhile, the segment’s revenue in the 12 months ended 30 June 2020 was RMB 20.18 billion. These numbers suggest that there’s plenty of room for long-term growth in the In-store, Hotel and Travel segment. This is because the numbers for China’s hotel market alone are already much bigger than the segment’s, even though the segment has more than just a hotel-booking business.

There’s also a network effect at play here, which is another positive sign on the potential for growth in Meituan’s In-store, Hotel and Travel segment. According to an April 2020 report from Trustdata, Meituan is currently the top hotel-aggregator in China, having surpassed previous market leader Trip.com in 2019. Having more hotels on Meituan’s platform will lead to more travellers, leading to more hotels on the platform, and so on.

New Initiatives and Others segment, and other growth prospects for Meituan

It’s hard for us to pin down the addressable market for Meituan’s New Initiatives and Others segment. But we believe the opportunities are immense. For a sense-check, iResearch’s data that is cited in Meituan’s IPO prospectus showed that China’s entire consumer service e-commerce market had GTV of RMB 2,705 billion in 2017, and it is expected to compound by nearly 20% annually from 2017 to reach RMB 8,011 billion by 2023. Meituan’s overall GTV in 2019, at RMB 682.1 billion, is small in comparison.

We think that Meituan is one of those rare companies that are creating new markets. Earlier, we discussed iResearch’s growth forecasts for China’s on-demand food delivery market and Meituan’s growth prospects in that space. On a surface level, it may seem like Meituan is riding on the trend of growing consumer interest in on-demand food delivery. But we think the deeper truth is that it is Meituan that is helping to power the growth of the market. Put another way, the company is not merely riding a tailwind, it is creating one. We believe the same dynamic also exists for the company’s other two segments, namely, In-store, Hotel and Travel, and New Initiatives and Others. By applying this vein of thinking, we won’t be surprised to see new, large addressable markets appear for Meituan in the future, since we think there’s a powerful innovative streak in the company (more on the company’s history with innovation later!).

The high potential within Meituan to find new avenues for growth is something we call optionality, a term coined by The Motley Fool’s co-founder David Gardner. Optionality describes the trait a company has of being able to evolve and find entirely new ways to grow. We prize companies that exhibit optionality and we think Meituan is one such company.

2. A strong balance sheet with minimal or a reasonable amount of debt

Meituan’s balance sheet is robust. It exited the second quarter of 2020 with RMB 58.46 billion in cash, cash equivalents, and short-term investments. In comparison, total debt was just RMB 3.32 billion. Even if Meituan’s total lease liabilities of RMB 1.65 billion were added to the total debt (a sum of RMB 4.97 billion), it would still be significantly lower than the company’s cash and short-term investments.

3. A management team with integrity, capability, and an innovative mindset

On integrity

Meituan is led by one of the co-founders of Meituan Corporation (a precursor to the current-day Meituan), the 41-year old Wang Xing. He currently holds the positions of executive director, CEO, and Chairman of the Board, and he has effectively held the same roles since Meituan Corporation’s founding in 2010.

The other key leaders in Meituan are the other two co-founders of Meituan Corporation, Mu Rongjun and Wang Huiwen, who are both 40. Mu Rongjun is an executive director of Meituan, with a functional role that’s equivalent to a CFO. Wang Huiwen (we’re using his full name to avoid confusion with Wang Xing) is also an executive director and heads Meituan’s food delivery business and other new initiatives.

We think that Meituan’s management team exhibits integrity. Here are the key reasons why:

- In 2019, Wang Xing, Mu Rongjun, and Wang Huiwen’s total compensation were RMB 5.46 million, RMB 41.36 million, and RMB 149.11 million each, respectively. These sums did not change much from 2018, with growth of between 4% and 16% each. In contrast, Meituan experienced a 49.5% jump in revenue in 2019, and the company turned profitable and generated positive free cash flow after making losses and posting negative free cash flow for a few years. It’s worth noting too that Wang Xing, Mu Rongjun, and Wang Huiwen’s total compensation are low when compared to the scale of the company’s business – in 2019, Meituan’s profit and free cash flow were RMB 2.24 billion and RMB 2.57 billion, respectively.

- There have been no form of sales transactions between Meituan and Wang Xing, Mu Rongjun, and Wang Huiwen from 2015 to 2019.

- As of 30 March 2020, Wang Xing owned 573.19 million Meituan shares, a stake that’s worth HK$150 billion (around S$27 billion) at the company’s 26 October 2020 share price of HK$262. Mu Rongjun, meanwhile, controlled 125.98 million Meituan shares as of 30 March 2020; these shares are worth HK$33 billion (around S$6 billion) at the HK$262 share price.

- Putting it all together, Meituan’s key leaders have (1) huge economic stakes in the company, (2) compensation that grew at a pedestrian rate in 2019 compared to the company’s business growth, (3) relatively low compensation in 2019 compared to the scale of the company’s business, and (4) not entered into any sales transactions with the company for years. These lead us to the opinion that Meituan’s management team are individuals with integrity and also interests that are well aligned with the company’s other shareholders.

We note that Wang Huiwen announced in January this year that he will stop being involved with day-to-day managerial duties at Meituan in December. It’s a pity that he will be stepping away from the daily hustle at the company. But we’re not worried. The transition seems well-planned (so there’s no hint of any malfeasance), and he will remain as a director of Meituan.

Another important thing we note is that all of Wang Xing’s Meituan shares are of the Class A variety. Meituan has two share classes: (1) Class A, which are not traded and hold 10 voting rights per share; and (2) Class B, which are publicly traded and hold just 1 vote per share. As a result, Wang Xing controlled 46.08% of Meituan’s voting power (as of 30 March 2020) despite holding only 9.9% or so of Meituan’s total shares. A manager having significant control over the company can potentially be bad for shareholders. This concentration of Meituan’s voting power in the hands of Wang Xing means that we need to be comfortable with him at the company’s helm. We are.

On capability and ability to innovate

We rate Wang Xing and his team highly on this front, and there are a few things we want to discuss.

First is the excellent multi-year track record of Meituan’s leadership team at growing the company’s important business metrics. The metrics include Meituan’s (a) overall GTV, (b) number of transacting users and active merchants on its platform, (c) average number of transactions made per user, (d) number of food delivery transactions processed, (e) number of domestic hotel room nights booked through its platform, and (f) monetisation rates – revenue divided by GTV – for its three business segments, Food Delivery, In-store, Hotel and Travel, and New Initiatives and Others. The track record for 2015 to 2019 are all shown in the table just below and the growth for each metric has been incredible (we don’t have any data before 2015 because Meituan’s IPO happened in September 2018).

Source: Meituan IPO prospectus and annual reports

The following table illustrates the growth of Meituan’s important business metrics in the first and second quarters of 2020. The first half of 2020 was generally a tough time for the company but it still managed to produce growth in a number of areas, such as Food Delivery GTV in the second quarter, number of food delivery transactions in the second quarter, and number of transacting users and active merchants in the first and second quarters.

Source: Meituan quarterly earnings updates

Second, we think Wang Xing and his team have infused Meituan with a purpose beyond profit that should serve the company well in its search for growth. There’s a deep meaning behind Meituan’s name. The company’s IPO prospectus explained that “”Meituan “美团”, means “beautiful and together” in Chinese, reflecting Wang Xing’s aspiration to make life better for everyone through Meituan.” The company’s mission is to “help people eat better, live better.” Given Meituan’s excellent history at attracting users to its platform, it’s clear to us that the company is delivering on its mission. But Wang Xing is thinking beyond just serving customers well. In our view, he wants to genuinely create a better life for all people. Here are some examples of the company’s actions during COVID-19 that speak to this:

- In the first quarter of 2020, at the height of China’s struggles with COVID-19, Meituan offered rebates, subsidies, free traffic support, and more to merchants in its Food Delivery segment to “relieve some of their burden.”

- Meituan launched a pioneering, widely-lauded contactless delivery service in the first quarter to minimise health risks for both delivery riders and consumers.

- In the first quarter, Meituan introduced a series of measures for merchants in its In-store, Hotel and Travel segment to ease their short-term liquidity problems and restore their operations. The measures included the exemption of commissions, extensions on subscription periods, and access to financing at favourable interest rates. Meituan also (1) established safety programs and guided its merchants in improving their safety measures to help rebuild consumer confidence, and (2) worked with local governments to distribute vouchers to stimulate consumer demand for local services.

- Meituan’s New Initiatives and Others segment was essential in the first quarter of 2020 in fulfilling consumers’ daily needs, such as for fresh produce and other daily necessities. The company also launched a new brand under its marketplace model known as Caidaquan (菜大 全) to “enable traditional farm markets to digitize their operations and provide high-quality fresh produce to consumers with more efficiency.” In addition, Meituan provided free bike-sharing services to medical professionals in Hubei Province, and also made sure medical institutions in 34 cities in China had adequate supply of food.

- During the second quarter of 2020, when Beijing suffered from a new outbreak of COVID-19, Meituan jumped into gear and quickly rolled out targeted support and commission rebate programs for merchants.

- Meituan commented in its 2020 second quarter earnings update that its delivery network served as a stabilising force for China’s society during the pandemic by “creating abundant employment opportunities.”

Third, Wang Xing’s long history with entrepreneurship and failure (before finding success with Meituan) also impressed us. After graduating from Tsinghua University in 2001 with a bachelor’s degree in electronic engineering, Wang Xing left for the USA to pursue a PhD in computer engineering at the University of Delaware. But in 2004, he dropped out of his PhD program and went back to China. In the subsequent years after returning home, Wang Xing started a number of entrepreneurial projects, including Xiaonei (a social network for university campus students), Taofang.com (a website for real estate deals and rentals), and Fanfo (a social bulletin board similar to Twitter). Some or all of these projects included Wang Huiwen and/or Mu Rongjun. But none of the projects gained major traction. It was only when the three of them started work on Meituan Corporation in 2010, the early incarnation of the present-day Meituan, that they eventually found success.

Fourth, Meituan has a wonderful track record of successful innovation and of working with technology. For instance, Meituan uses big data and artificial intelligence (AI) technologies to provide a better experience for consumers. The company provides personalised recommendations and also optimises delivery times by intelligently matching orders to delivery riders based on the real-time location of the riders.

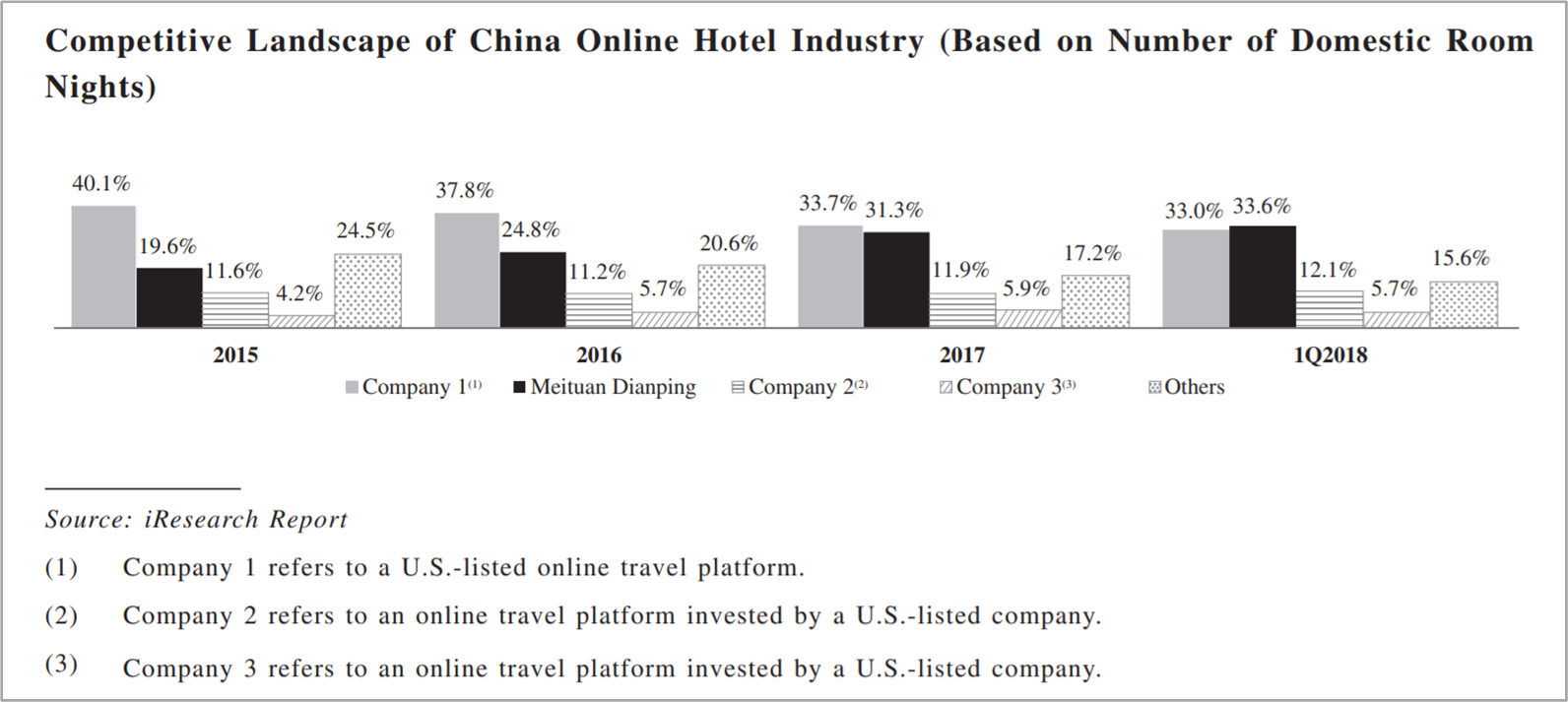

In another example, Meituan introduced its on-demand food delivery service in 2013, which has since grown into the company’s most important business segment. Even more impressively, Meituan’s food delivery service has been gaining market share over the years, overtaking the then-market-leader in 2016. The chart below shows Meituan’s rising market share (the black bar) from 2015 to the first quarter of 2018. The market-leader back in 2015 is likely to be Ele.me, which is backed by the Chinese tech-juggernaut Alibaba.

Source: Meituan IPO prospectus

In yet another instance, Meituan also launched its hotel booking platform in 2013. This business has also grown significantly and won market share in an impressive manner. The chart below shows Meituan’s share of China’s online hotel industry from 2015 to the first quarter of 2018, based on the number of domestic room nights booked. In a similar manner to the food delivery market, Meituan was not the leader of the online hotel booking space in China in 2015. But Meituan’s market share increased in each year that is shown, and the company had more hotel room nights booked on its platform, compared to any other competitor, by the first quarter of 2018. (The previous market leader is likely to be Trip.com.)

Source: Meituan IPO prospectus

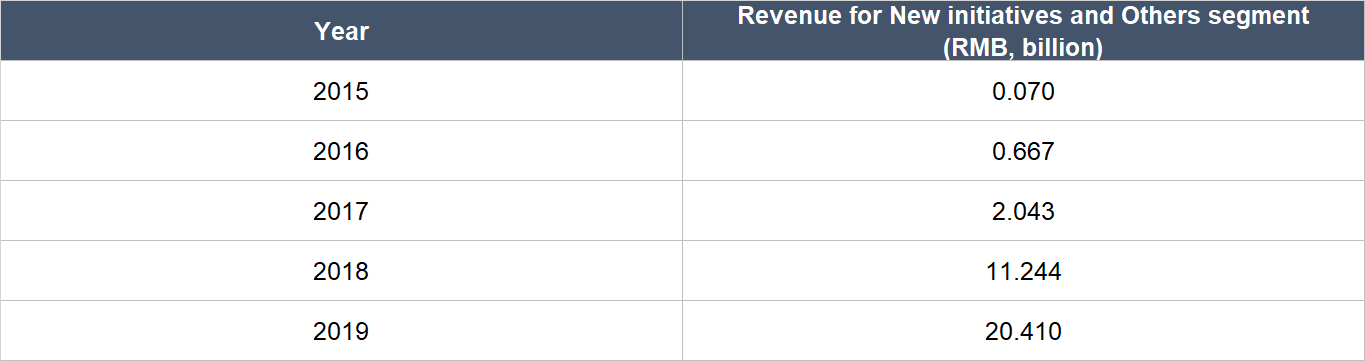

A further example can be seen in the growth of Meituan’s New Initiatives and Others segment. The table below shows the segment’s revenue surging from merely RMB 70 million in 2015 to RMB 20.4 billion in 2019. Not all of Meituan’s “new initiatives” will pan out. For example, in 2018, Meituan incurred a RMB 1.3 billion impairment expense for intangible assets that are related to its bike-sharing service. But we believe the potential upside from Meituan’s willingness to innovate far outweighs any risks associated with the failure of new ventures. Moreover, Meituan’s balance sheet is currently flush with cash, which gives the company the financial flexibility to try new initiatives.

Source: Meituan annual reports

On Tencent’s support of Meituan

Tencent, one of China’s main technology companies, is a major shareholder of Meituan. As of 31 December 2019, Tencent owned 1.054 billion Meituan Class B shares – that’s around 18% of Meituan’s overall share count. Tencent has been invested in Meituan since the merger between Meituan Corporation and Dianping Holdings (Tencent was an investor in Dianping Holdings).

Having Tencent as a major investor comes with massive benefits for Meituan. Sitting on Meituan’s board as a non-executive director is Martin Lau, who is an executive director and the president of Tencent. This means that it’s likely that Tencent’s leadership will be happy to pitch in should Meituan’s management team ever require some help. Most importantly, Meituan’s services are integrated into Tencent’s WeChat app. WeChat is a superapp with a huge reach and variety of services. As of 30 June 2020, WeChat had 1.2 billion monthly active users.

We think it may make sense too to give credit to Wang Xing and his team for forging a close relationship between Meituan and Tencent, so that Meituan can benefit from Tencent’’s vast user base.

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

We believe that Meituan’s revenue is recurring in nature because of customer-behaviour. The online ordering of food delivery, the booking of hotels and local services, and the usage of car-hailing services to get around, are activities that consumers will perform over and over again. The question is, will consumers and merchants stick with Meituan’s platform? We think they will.

As we mentioned earlier, Meituan is the dominant e-commerce platform in China for services. Consumers rely on Meituan to find services and Meituan provides merchants with the ability to reach hundreds of millions of consumers. To us, the value proposition that Meituan provides to both consumers and merchants is exceedingly difficult for any competitor to replicate. So we think that consumers and merchants are likely to continue using Meituan for years into the future, leading to recurring revenue for the company.

5. A proven ability to grow

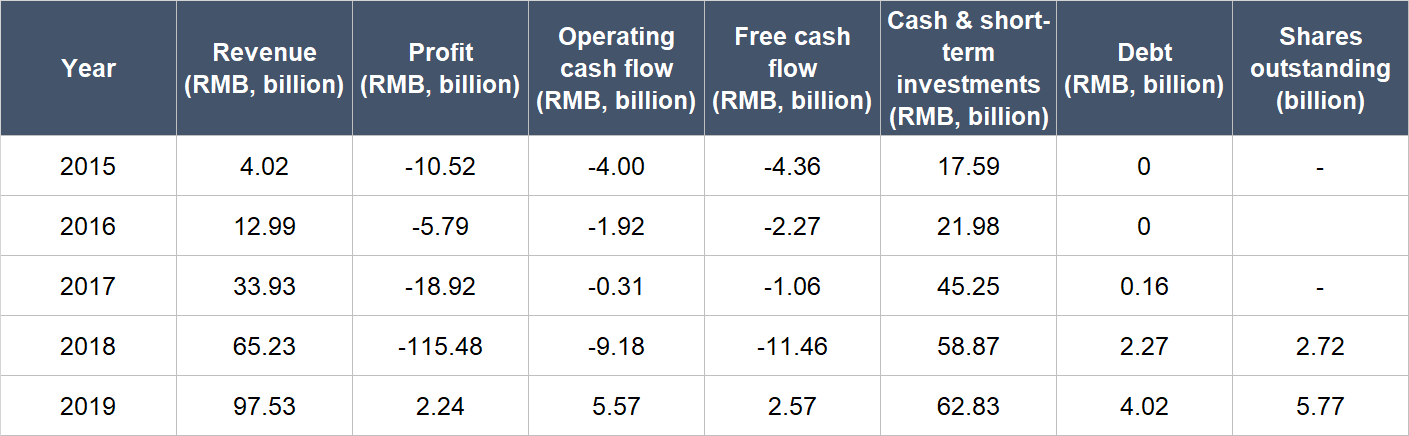

Meituan has a short history as a public-listed company (its IPO was only in September 2018), so we don’t have much financial data to study. But we like what we see. The table below shows Meituan’s key financial figures from 2015 to 2019:

Source: Meituan IPO prospectus and annual reports

There are a few things to note from Meituan’s historical financials:

- From 2015 to 2019, Meituan’s revenue has compounded at a rapid pace of 122% per year. Growth has slowed more recently, but Meituan’s revenue was still up by an impressive 49.5% in 2019.

- The company was loss making for a number of years before turning profitable in 2019.

- There was another welcome change in 2019 for Meituan – the company recorded its first positive operating cash flow and free cash flow numbers, showing signs that it could be less dependent on outside capital for growth in the future.

- The balance sheet was really strong throughout the whole time period we’re looking at, with debt being either zero or low compared to the company’s cash and short-term investments.

- At first glance, Meituan’s share count appeared to more than double from 2018 to 2019. (We only started counting from 2018 since Meituan was listed in September of the year.) But the number we’re using is the weighted average share count. Right after Meituan got listed, it had a share count of around 5.5 billion, which is much more acceptable compared to the weighted average share count for 2019. Moreover, in the first half of 2020, Meituan’s weighted average share count grew by only 1.4% year-on-year.

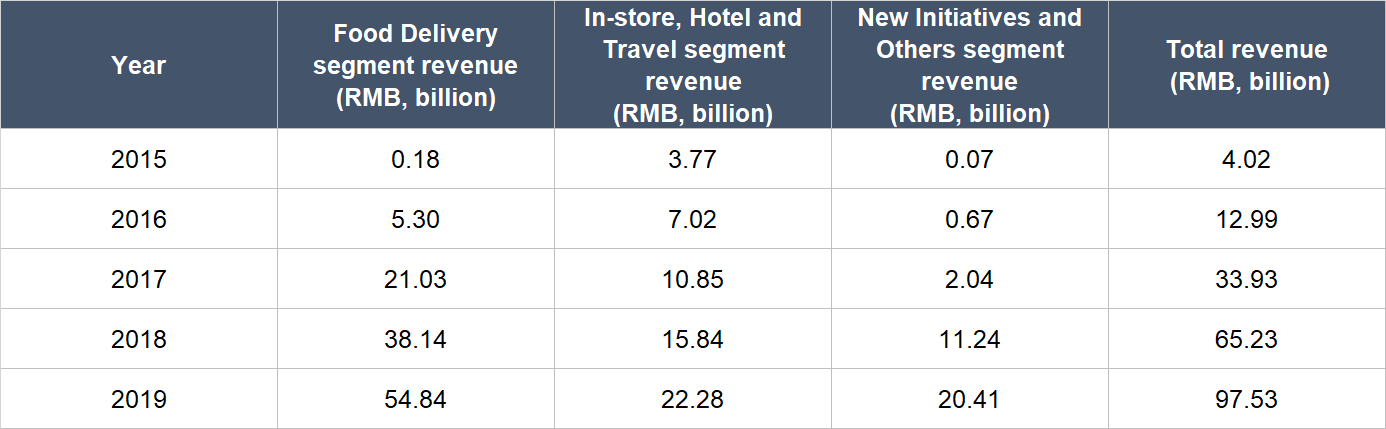

The table below shows Meituan’s segmental revenue growth from 2015 to 2019. What’s clear is that all three segments showed spectacular top-line growth in that period.

Source: Meituan IPO prospectus and annual reports

The first quarter of 2020 was a horrible time for Meituan, as revenue declined and losses deepened. But the second quarter showed improvement with a 9% increase in revenue and a strong 152% surge in net profit. The company’s operating cash flow also improved significantly in the first half of 2020. All these are shown in the table below. And as we mentioned earlier, we’re looking at the long run here with Meituan. We think the company will be able to produce strong growth for years into the future – COVID-19 is merely a short-term hiccup.

Source: Meituan quarterly earnings updates

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

The rapidly-growing Meituan was burning cash in the past. But in 2019, the company started generating positive operating cash flow and free cash flow. Despite the emergence of COVID-19, we also showed earlier that the company managed to generate positive operating cash flow in the first half of 2020 (RMB 545.3 million), a reversal from the negative operating cash flow seen in the first half of 2019 (-RMB 149.8 million). We think that Meituan’s cash flows in 2019 and the first half of 2020 demonstrate that its business has attractive cash economics when it has scale.

So as Meituan’s topline increases in the future (and we think it likely will, since there’s plenty of room for the company to grow, as we discussed earlier), free cash flow should follow suit.

Valuation

We completed our purchases of Meituan shares with Compounder Fund’s initial capital in late-July 2020. Our average purchase price was HK$189 per Meituan share. At our average price and on the day we completed our purchases, Meituan shares had a trailing price-to-sales (P/S) ratio of 9.9. We like to keep things simple in the valuation process. We think the P/S ratio is a suitable gauge of Meituan’s value, since it currently does not have a long history of generating profit and free cash flow.

To us, this P/S ratio looks like a fair price to pay for a company that could likely compound its revenue at an annual rate of at least 30% over the next five years or longer. For perspective, if we assume Meituan has a free cash flow margin of 15% today (something we think the company can achieve when it becomes a more mature business), the company will have a price-to-free cash flow ratio of 66 (9.9 divided by 15%). This looks reasonable to us for a company with very strong top-line growth prospects such as Meituan.

At Meituan’s 26 October 2020 share price of HK$262, the company’s shares have a trailing P/S ratio of 13.7.

The risks involved

We see five main risks with Meituan.

Ownership structure: Meituan is a China-based internet company that is listed in Hong Kong. This also means that it is using a variable interest entities (VIE) shareholder structure to get around China’s laws that restrict foreign ownership in internet companies that are based in the country. Under the VIE structure, Meituan’s shareholders do not own the China business directly, but rather, own entities domiciled in the Cayman Islands that receive economic benefits from the China business through a series of contracts. If the Chinese government should one day deem the contracts to be invalid in the future, owners of Meituan’s Hong Kong-listed shares – such as Compounder Fund – could see their stakes be wiped out. We think the chances of China messing around with the VIE structure are very low, since there are many huge Chinese tech companies listed outside of China with the VIE structure; this includes Tencent and Alibaba. The economic fallout in the country could be severe if the government makes negative changes to the VIE structure. But it is still a risk that’s on the top of our minds.

Key-man risk: As with most of Compounder Fund’s holdings, a large part of our thesis is built around a strong management team. We believe that Wang Xing is a talented business leader who has been the central figure for Meituan’s growth. Should he leave the company for whatever reason, we’ll be keeping a close eye on the leadership transition. The good thing is Wang Xing is young at just 41 years old, so he should still have plenty of years ahead of him to continue leading Meituan.

Fraud risk: There’s always the risk of fraud with any public-listed company – this is why it is important to build a diversified portfolio. It doesn’t matter where the company is based or listed. But with Chinese companies, we believe that the risk of fraud is slightly higher than, say, US companies, because corporate governance standards in China are not as robust as in the West. The risk that Meituan ends up being a fraud is not zero, but we think the chances are really low. This is because Tencent’s stake in Meituan is worth nearly HK$277 billion (or nearly S$50 billion) as of 26 October 2020, which means Tencent will likely want to keep an eye on Meituan’s business activities. And given Meituan’s close business-ties with Tencent (there’s the integration of Meituan’s services into WeChat, and Martin Lau’s position as a director of Meituan), we think it would not be difficult for Tencent to watch over Meituan’s shoulders.

Valuation risk: We see Meituan’s valuation as being reasonable, but it’s also not low. If there are any hiccups in Meituan’s business growth – even if they are temporary in nature – there could be painful declines in the company’s share price. This is a risk we’re comfortable taking as long-term investors.

COVID-19 risk: Meituan’s business suffered badly when COVID-19 flared up in China in the first half of 2020. In recent weeks, Europe has seen a resurgence in COVID-19 after managing to tame its spread earlier this year. China appears to have brought the virus under control so far, but if there’s a prolonged case of fierce spreading of COVID-19 taking place in the country again, Meituan’s business could be hurt.

Summary and allocation commentary

Meituan Dianping exhibits all the characteristics that we look for in Compounders. To summarise:

- Meituan has multiple business segments that each have rapidly expanding addressable markets because of the company’s innovative spirit.

- The company has a pristine balance sheet with cash and investments that significantly outweigh debt

- Meituan has a brilliant leader in Wang Xing, who is a serial entrepreneur and innovator and who has a great track record in execution. In addition, he has a high ownership stake in Meituan, thereby creating alignment between himself and the company’s shareholders.

- Meituan’s revenue streams are recurring because of repeat consumer use and the incredible value that its platform delivers to both consumers and merchants.

- The company has enjoyed tremendous top-line growth since 2015, and it turned profitable and free cash flow positive in 2019.

- There are strong economics in Meituan’s business that come with scale, and this gives us confidence that the company will generate a robust stream of free cash flow in the future.

There are important risks to note, such as Meituan’s use of the VIE ownership structure; the risk of the company’s growth prospects being dented should Wang Xing leave for any reason; the non-zero chance that the company turns out to be a fraud case; a valuation that’s not low; and the risk of the company’s business being harmed if there’s another flareup of COVID-19 cases in China.

But we still want Compounder Fund to tag along for the ride in Meituan’s potential growth. So the key question is what’s a sensible weighting for Meituan to have in Compounder Fund’s portfolio. After weighing the risks and the rewards, we decided to initiate a 2.0% position in Meituan – a medium-sized allocation – with Compounder Fund’s initial capital.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share. Of all the companies mentioned in this article, Compounder Fund also currently owns shares in Tencent. Holdings are subject to change at any time.