Compounder Fund: Adyen Investment Thesis - 11 May 2022

Data as of 9 May 2022

Adyen (ENXTAM: ADYEN), which is based and listed in the Netherlands, is a company in Compounder Fund’s portfolio that we invested in for the first time in April 2022. This article describes our investment thesis for the company.

Company description

Adyen is a Surinamese word for “start over again.” It’s an apt name for the company. Adyen’s founders – Pieter van der Does and Arnout Schuijff – were founders of and senior executives in an international payment service provider named Bibit that was sold to the Royal Bank of Scotland in 2004. In 2006, Adyen was created with the aim of facilitating digital payments by building a modern – and better – payments infrastructure that connects directly with card networks and local payment methods.

In a typical card-based payment transaction that involves a merchant and a consumer, there are a number of different participants that interact to ensure that the merchant can successfully sell, and the consumer can successfully pay, for a product or service:

- There’s the acquirer, which signs card acceptance agreements with merchants and provides them with access to card networks. The acquirer is responsible for (1) assessing a merchant’s fraud- and bankruptcy-risks, (2) delivering funds from the card networks – received from issuers – to merchants, and (3) routing transactions to the card networks

- There’s the card networks, which can be seen as the pipes in which funds from consumers flow to merchants. The largest and most popular networks would be those operated by Visa and Mastercard. The networks’ responsibilities include connecting and switching transactions between acquirers and issuers, authorising electronic payments, and clearing and settlement.

- There’s the issuer, whose role is to (1) provide consumers with credit/debit cards, (2) conduct identity and compliance checks, and (3) authorise merchants to accept payments once the issuer receives authorisation requests from the card networks

- There’s the payment gateway, which provides merchants with the software or hardware (such as the point-of-sale, or POS, terminal) to accept payments

- There’s the processor, whose functions include authorization, data transmission, data security, and settlement; in some cases, an acquirer will perform the same functions as a processor, in other cases, the acquirer outsources these functions to a processor

- There’s the risk manager, which helps an acquirer assess a transaction for fraud

And when a typical card-based payment transaction takes place, there are a chain of events that happen:

- The consumer provides his card to a POS terminal in a physical retail store, or card details to a payment gateway online

- The transaction data is sent to the acquirer

- The acquirer checks for fraud, sometimes with the help of a risk manager

- The card network routes the transaction to the appropriate issuer

- The issuer confirms the consumer’s identity and authorises the transaction

- The card network sends the authorisation to the acquirer

- The acquirer forwards the authorisation to the POS terminal or payment gateway, and the merchant can proceed with the transaction and issue a receipt to the consumer

- The merchant sends a capture request to the acquirer through its POS terminal or payment gateway

- The acquirer transfers the capture request to the appropriate card network

- The card network sends the capture request to the appropriate issuer, and the consumer will be able to see the transaction on his statement

- The card network calculates the net settlement positions for the acquirer and issuer, informs both parties of the amount, and sends a transfer order to a settlement bank

- The settlement bank then facilitates the the transfer of funds between the acquirer and the issuer

- The acquirer transfers the funds to the merchant’s account

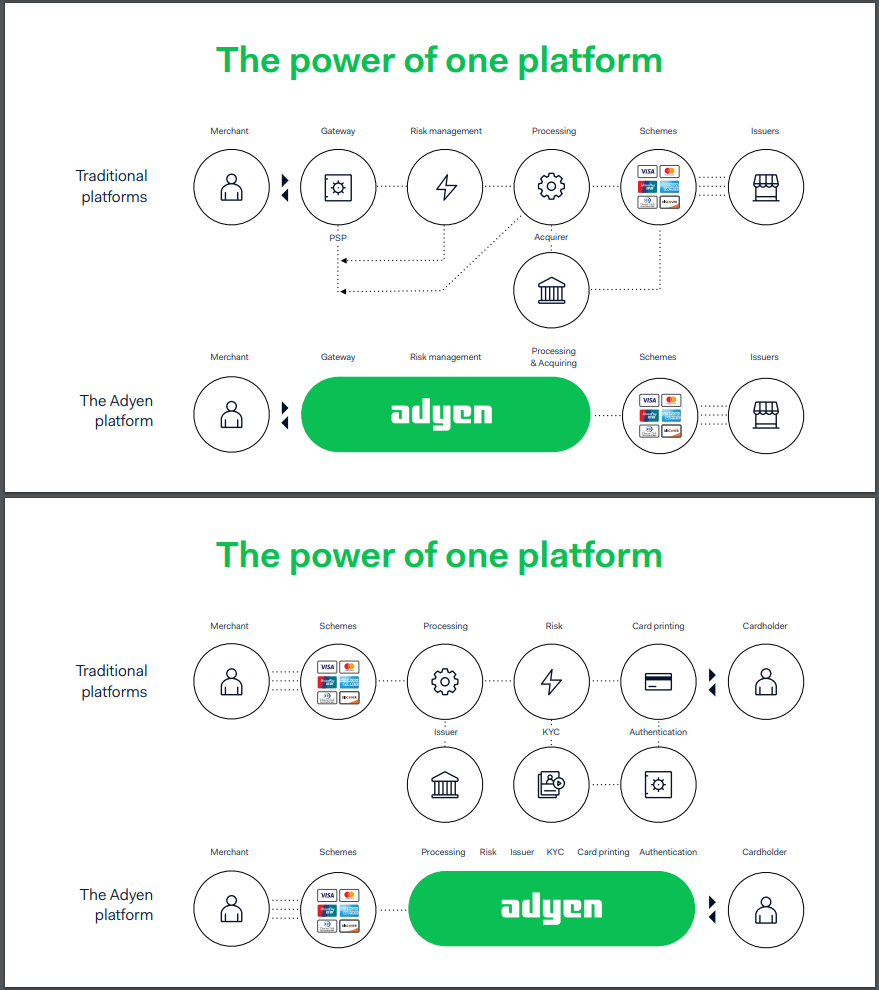

With so many parties and steps involved in a card-based payment transaction, there can be tremendous complexity for merchants to navigate with legacy providers. For example, a merchant may have to separately integrate with many different acquirers and payment gateways and this means having to deal with separate reporting and working with multiple types of POS hardware, potentially leading to loss of data and a lower acceptance rate; according to a 2019 presentation by an Adyen executive, merchants who use legacy providers experience a 10% failure rate when consumers try to pay online, in-store, or on mobile. There can thus be tremendous value for merchants in working with a “full-stack” payments services provider. This is where Adyen shines. Today, Adyen runs a single, fully integrated global payments platform, covering gateway (both online and offline); risk management; processing and acquiring; issuing; and settlement activities. Figure 1 below shows how Adyen has housed all the different functions under one roof, reducing complexity for merchants.

Figure 1; Source: Adyen 2020 September Capital Markets Day

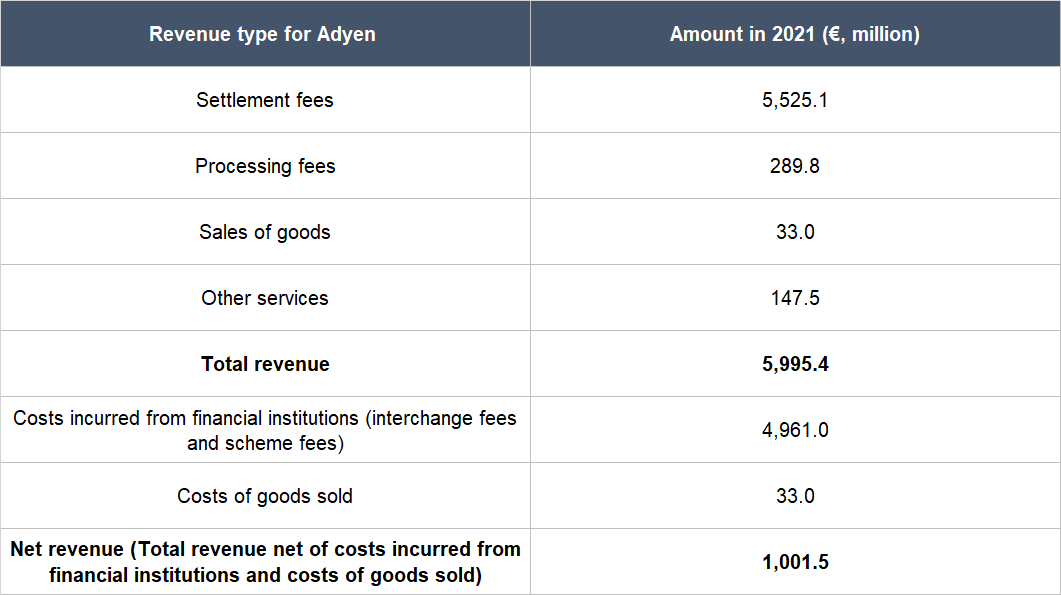

For providing its payments services, Adyen has a variety of revenue sources that include:

- Settlement fees: These are paid by merchants for Adyen’s acquiring services and are usually based on a percentage of the transaction’s value. Within settlement fees are interchange fees and payment network fees (sometimes called scheme fees) that Adyen collects from merchants and passes on to issuers and the card networks, respectively. The settlement fees also include markups that Adyen charges to merchants for providing acquiring services.

- Processing fees: These are fixed fees on a per transaction basis that merchants pay Adyen for using the company’s platform.

- Sales of goods: These are revenues from Adyen selling POS terminals and their related accessories to merchants.

- Other services: These comprise foreign exchange service fees, third party commissions, and issuing services fees.

Using an example of a €100 transaction that involves Adyen as the acquirer, risk manager, and processor, the total settlement fee will be 1.7%, or €1.70. Of the €1.70 in settlement fee, €1.00 goes to the issuer in the form of the interchange fee, €0.50 goes to the card networks (the Visas or the Mastercards of the world) as the scheme fee, and €0.20 belongs to Adyen as the acquiring markup. The total processing fee is €0.06 and this accrues fully to Adyen. What the merchant ends up collecting is €98.24, or 98.24% of the total value of the transaction.

In 2021, Adyen processed €516 billion in payments volume and earned €6.0 billion in total revenue. Table 1 below lays out Adyen’s total revenue for the year and its various sources. It also shows Adyen’s net revenue of €1.0 billion. When we assess Adyen, this is the important revenue figure. The net revenue number nets out certain costs from Adyen’s total revenue; nearly all of these costs consist of the interchange fees and payment network fees that Adyen collects from merchants and passes on to issuers and the card networks. Adyen’s net revenue and payments volume for 2021 works out to a take rate (net revenue as a percentage of volume) of 0.19%. It’s important to note that Adyen’s leaders do not manage the business for the take rate – instead, their focus is on growing Adyen’s net revenue.

Table 1; Source: Adyen 2021 annual report (numbers may not tally due to rounding)

There are businesses of different sizes all across the world and Adyen’s focus at the beginning was large international businesses, or the Enterprise segment; this segment remains the core of Adyen’s business today, accounting for nearly 97% of the company’s payments volume in 2021. But in recent years, Adyen has been investing in its payments platform to cater to mid-market merchants too. Adyen has also smartly targeted platform businesses – these include software-as-a-service (SaaS) platforms, commerce platforms, on-demand platforms, marketplaces, as well as social networks – that service large numbers of small, medium enterprises (SMEs). Through these platform businesses, Adyen can efficiently reach SMEs with its payments platform. Some of Adyen’s current merchants include Booking.com, eBay, Etsy, McDonald’s, Microsoft, Spotify, Tiffany & Co, and Upwork (eBay, Etsy, and Upwork are examples of the platform businesses that enable Adyen to tap on the SME segment). Although Adyen’s core merchants are in the Enterprise segment, there is no significant customer concentration. Adyen’s top 10 merchants made up just 20% of its net revenue in 2021, and no single merchant accounted for more than 10% in 2021, 2020, 2019, and 2018.

From a geographical perspective, Adyen’s key markets are EMEA (Europe, Middle East, and Africa) and North America. These two geographies accounted for 39.2% and 48.4% of Adyen’s total revenue in 2021. The remaining 12.4% of total revenue comes from the Asia Pacific (7.3%) and Latin America (5.1%) regions.

Investment thesis

We have laid out our investment framework in Compounder Fund’s website. We will use the framework to describe our investment thesis for Adyen.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

The global electronic payments market is huge and growing. Adyen’s 2018 IPO prospectus (the company was listed in June of that year) cited data from Nilson, a global card and mobile payment industry researcher, showing that global electronic payments volume had grown at a compounded annual rate of 14% from US$5.3 trillion in 2006 to US$23.0 trillion in 2017. Nilson also expects this volume to reach more than US$52 trillion by 2026. We think it’s logical that global electronic payments volume will increase in the years ahead, since paying electronically is a much better consumer experience. Moreover, e-commerce requires electronic payments and e-commerce itself is a growing trend – according to Statista, global e-commerce retail sales have nearly tripled from US$1.8 trillion in 2016 to US$4.9 trillion in 2021.

As it stands, Adyen is barely scratching the surface with the global electronic payments market. The company’s €516 billion in processed payments volume in 2021 is only around 2% of the market’s value in 2017.

It’s also worth noting that Adyen is currently in the pilot phase of a new financing product (Adyen Capital) where the company helps its platform businesses facilitate financing offers for their users. In Adyen’s 2022 Capital Markets Day event held on 31 March this year, management gave an example of how Adyen Capital works (see video around the 1:03:30 to 1:05:30 mark). The example involves a user (a cafe owner) of a SaaS platform for food & beverage retail outlets. With Adyen Capital, the SaaS platform can show the cafe owner a pre-qualified loan amount that the user can access whenever he/she has need for additional funds for the cafe. The loan amount can be pre-qualified by Adyen because the company has all the user’s data. If the user chooses to take up the loan, repayment is convenient – Adyen and the SaaS platform automatically takes a certain percentage of the user’s daily sales until the loan amount, plus a reasonable amount of interest, is repaid. Adyen Capital expands Adyen’s addressable market beyond just electronic payments and management expects the new service to become a “meaningful standalone net revenue” contributor over the long run. The opportunity for providing financing to SMEs could be huge. Here are some perspectives we found to be useful:

- The annual volume of small business loans under US$250,000 in the USA alone was US$232 billion in 2019. But even in a developed economy such as the USA, more than half (53%) of SMEs surveyed in 2017 by the Federal Reserve could not obtain the full amount of financing they required. The problem of SMEs being underserved by banks in other parts of the world are likely to be as acute as, or worse than, in the USA.

- The USA accounts for around a quarter of global GDP, and SMEs make up around 90% of businesses worldwide.

2. A strong balance sheet with minimal or a reasonable amount of debt

Adyen ended 2021 with €4.6 billion in cash and zero debt. On the surface, this looks like an incredibly robust balance sheet. But we do note that Adyen is required to pay out some of this cash to merchants and financial institutions. From this perspective, not all of the company’s cash effectively belongs to it. It’s hard to tell what the amount is, but we think it is still safe to conclude that Adyen has a strong balance sheet.

It helps too that Adyen has a long history of generating strong operating cash flow and free cash flow, which we will discuss in the “A proven ability to grow” subsection of this article.

3. A management team with integrity, capability, and an innovative mindset

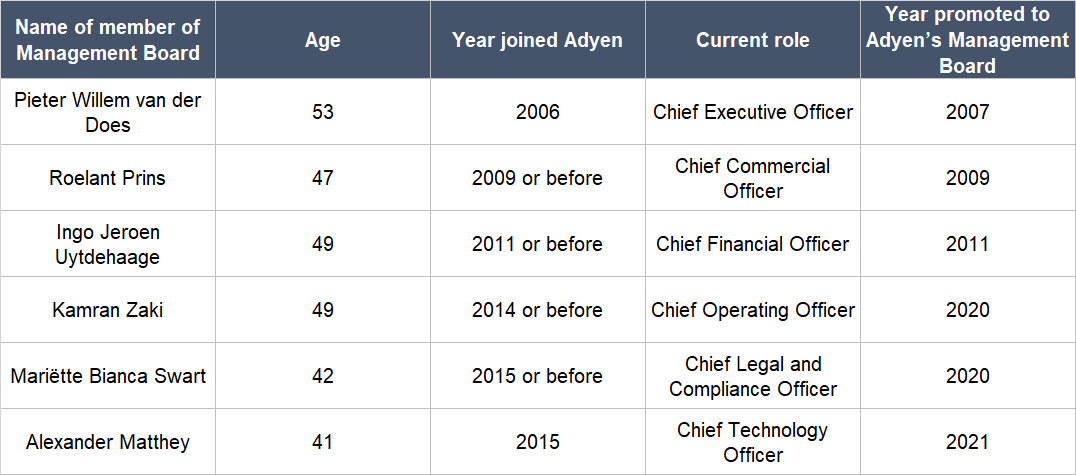

On integrity

Adyen’s CEO is its co-founder Pieter van der Does, who has been in the company’s Management Board since 2007. Arnout Schuijff, Adyen’s other co-founder, stepped down from his Chief Technology Officer (CTO) role in January 2021 in a planned move, and was succeeded by Alexander Matthey. Adyen’s Management Board consists of individuals who are responsible for the day-to-day management of the company and all its members are shown in Table 2 below. All of Adyen’s current key leaders have been at the company for a number of years and at least some of them were promoted to the Management Board (it’s also possible that all of them – with the exception of van der Does – were promoted). We appreciate the long tenures that Adyen’s senior leadership have at the company, their young ages, and the fact that some – or all – of them were promoted to the Management Board.

Table 2; Source: Adyen’s 2021 annual and transparency reports

We don’t have much details on Adyen’s compensation structure for its Management Board. But we know three things that are shown in Table 3 below: (1) Their compensation in each year from 2018 to 2021 were not high, and the sums are rounding errors when compared to Adyen’s net income and free cash flow; (2) the growth of their compensation in those years were a lot lower than the growth in Adyen’s business; and (3) their compensation actually declined in 2019 even though Adyen posted strong growth. We think these are great signs of the integrity that Adyen’s senior leaders possess.

Table 3; Source: Adyen annual reports

Another positive sign, in our view, is the skin in the game that van der Does, Prins, and Uytdehaage have. As of 31 December 2021, they controlled 1.023 million, 0.287 million, and 0.195 million Adyen shares, respectively. At Adyen’s stock price of €1,417 as of 9 May 2022, van der Does, Prins, and Uytdehaage’s respective stakes are worth over €1.4 billion, €403 million, and €273 million. We note that van der Does has given irrevocable instructions for his bank to sell 100,000 shares from April 2022 to March 2023 in equal portions on a monthly basis at prevailing market prices when the sales are made. But the number of shares involved in the sale instruction is only a small minority of van der Does’s overall stake in Adyen and will still leave him with considerable skin in the game.

On capability and innovation

We think Adyen’s management team is exceptional when it comes to innovation and their ability to execute and there are a number of things we want to discuss.

Firstly, there’s Adyen’s long history of improving its suite of services. In the “Company description” section of this article, we mentioned that Adyen runs a single, fully integrated global payments platform, covering gateway (both online and offline); risk management; processing and acquiring; issuing; and settlement activities. But the company did not have all these services from the get-go. In its early days, Adyen was only an online payment gateway that partnered with existing acquirers. In 2010, Adyen added risk management functions. In 2012, the company obtained a pan-European acquiring license, which allowed it to provide acquiring services. 2015 was the year Adyen introduced a POS offering, which gave the company exposure to offline electronic payments and paved the way for the company to pursue growth opportunities in unified commerce, where merchants sell both online and offline. In 2017, Adyen received an European banking license, which improved the company’s settlement functions (previously, Adyen had to rely fully on third-party banks for settlement to merchants). 2019 saw Adyen introduce issuing services and this gave Adyen’s merchants the ability to issue cards for a variety of use cases, either online, in-app, and/or in-store.

We think it’s worth highlighting that from the beginning, Adyen has built all its services in-house, on a single code base, and this allows the company to provide all its services under one single platform. Having a single platform, as we discussed in the “Company description” section of this article, helps solve important pain points for merchants when it comes to accepting electronic payments. The single code base and platform also allows Adyen’s developers to improve its services, or solve problems, rapidly. We credit Adyen’s co-founders – especially van der Does – for having the foresight to implement the idea of having a single code base and platform.

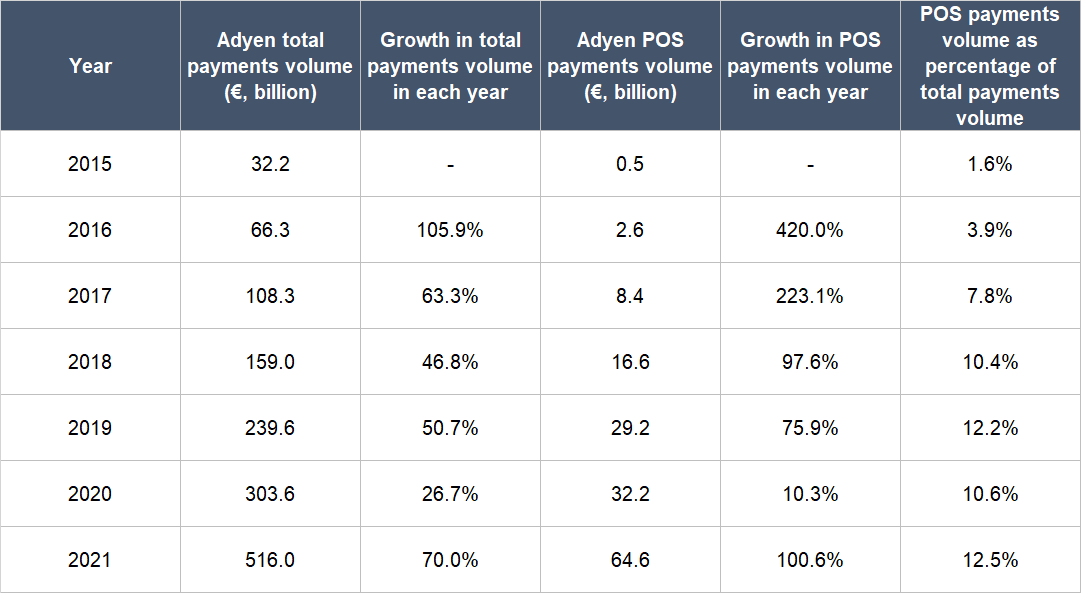

Adyen’s excellent track record of introducing new services over time has led to the second point we want to discuss: The company’s impressive growth in total payments volume and POS payments volume over time. As a payments company, changes in the payments volume Adyen processes is a great indicator of the demand that merchants have for the company’s services. From 2015 to 2021, Adyen’s total payments volume compounded at 58.8% annually, rising from €32.2 billion to €516 billion. POS volume compounded at an even faster rate of 124.8% in the same period – soaring from €0.5 billion to €64.6 billion – to take up an increasing share of Adyen’s total payments volume. Table 4 below shows a more granular history for both volumes (note the strong triple and double-digit growth rates).

Table 4; Source: Adyen annual reports and IPO prospectus

Thirdly, Adyen’s management team has executed the land-and-expand strategy brilliantly. The strategy starts with Adyen initially winning some payment volume from a merchant, before winning additional volume over time. Since its IPO, more than 80% of Adyen’s payments volume growth for each half-year period (Adyen reports its results half-yearly) has consistently come from merchants that were already on its platform when the period began. Moreover, volume churn – the amount of payments volume leaving Adyen’s platform – has been less than 1% in each year going back to 2015, which is the earliest data we can find.

Figure 2; Source: Adyen annual report

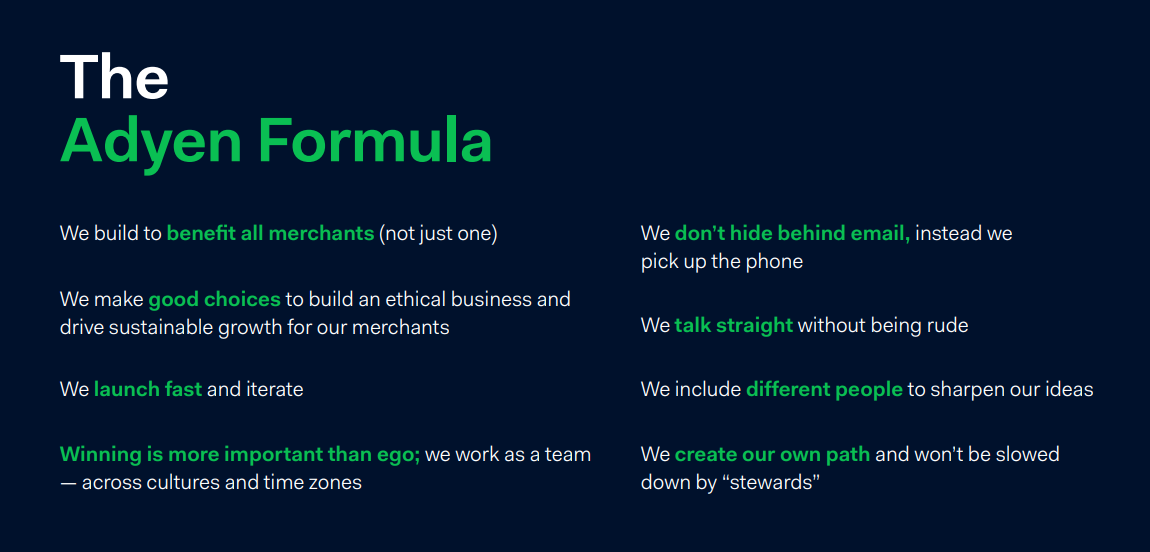

Lastly, we think van der Does and his team have built a wonderful culture at Adyen. The culture starts with the beautifully crafted Adyen Formula, a set of guiding principles for everyone within Adyen, which is shown in Figure 2 above. While it’s good to see the Adyen Formula, the important thing is that Adyen’s management team appears to be walking the talk. Here’re some supporting data that we see:

- Adyen’s software development team runs a weekly release cycle for software updates. And as mentioned earlier, all of Adyen’s services are built in-house, by the company’s own developers.

- Glassdoor is a platform for employees to rate their companies anonymously. Currently, 88% of Adyen-raters on Glassdoor would recommend a friend to work at the company. van der Does also has a 96% approval rating as CEO, far higher than the average Glassdoor CEO rating of 69% in 2019.

- In 2016 and 2017, less than 2% of Adyen’s workforce whom management deemed to be essential personnel or key talent left the company; in 2021, barely any employees left Adyen.

- Members of Adyen’s senior management team meets with every new hire before they join the company; for perspective on the amount of work management has been doing to safeguard Adyen’s culture in this aspect, the number of full-time Adyen employees has more than tripled from 668 at the end of 2017 to 2,180 at the end of 2021.

One other aspect about Adyen’s culture that we think is worth highlighting is the company’s name. The meaning behind the Surinamese word “Adyen” – “start over again” – is an important window into how van der Does thinks about Adyen’s role in the world. He and Schuijff saw the massive problems with the legacy payments industry, and even after working on the payments technology company Bibit, they wanted to “start over” by building a much better infrastructure for payments. van der Does’ burning desire to solve problems in the payments space – reflected in the company’s name – should centre Adyen well in the years ahead as it continues finding innovative solutions for merchants’ problems with payments.

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

We see Adyen’s revenue as highly-recurring in nature. Its revenue, as we described in the “Company description” section of this article, comes from fees that it charges merchants for payment services whenever a merchant transacts with a consumer. These transactions are likely to be repeated often, which then creates a stream of recurring revenue for Adyen.

Lending further weight to our view that Adyen has a high level of recurring revenue is the company’s history of (1) having the lion’s share of its volume growth come from existing merchants on its platform, and (2) very low volume churn of less than 1%; we touched on both traits in the “A management team with integrity, capability, and an innovative mindset” sub-section of this article.

But as Adyen’s business ultimately depends on the level of consumer spending, its payments volume could still decline temporarily when economic conditions turn rough. This said, our eyes are fixed on the long-term opportunity with Adyen and we think the company does have strong recurring revenue over the long run.

5. A proven ability to grow

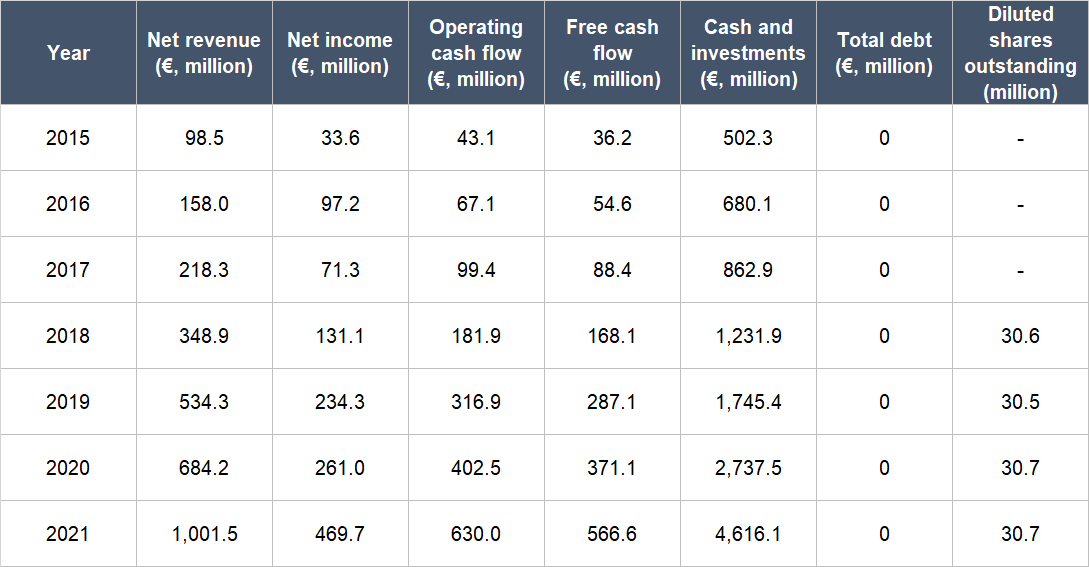

Table 5 below shows Adyen’s key financial figures from 2015 (the earliest data we could find) to 2021:

Table 5; Source: Adyen annual reports and IPO prospectus

A few important things to highlight from Adyen’s historical financials:

- Net revenue grew in each year for the entire time period and had compounded at an impressive annual rate of 47.2%. Growth in 2021 did not slow down, coming in at 46.4%.

- Adyen was profitable in each year and its net income grew even faster than net revenue, climbing by 55.2% annually from 2015 to 2021, and by 80.0% in 2021. The company’s net income margin (net income as a percentage of net revenue) also increased from an already remarkable 34.1% in 2015 to 46.9% in 2021, and came in at an average of 42.1% for the entire time period we’re studying.

- Adyen’s operating cash flow and free cash flow both had similar dynamics as its net income. First, there’s the high annualised growth rates for 2015-2021 of 56.4% and 58.1% for operating cash flow and free cash flow, respectively. Second, in 2021, both cash flow measures increased by north of 50% (56.5% for operating cash flow and 52.7% for free cash flow). Third, the free cash flow margin (free cash flow as a percentage of net revenue) rose from an already outstanding 36.8% in 2015 to 56.6% in 2021, and averaged at 46.4% for those six years. (The operating cash flow shown in Table 5 is Adyen’s EBITDA, or earnings before interest, taxes, depreciation, and amortisation; the company’s reported operating cash flow includes the inflow of funds that consumers have paid merchants for transactions, and these are funds that do not actually belong to Adyen.)

- The balance sheet was rock-solid throughout the whole time frame we’re looking at, with debt being zero in each year.

- Adyen’s diluted share count had barely changed from 2018 (the year of its IPO) to 2021, so dilution has not been a problem for the company’s shareholders.

During Adyen’s 2022 Capital Markets Day event, management reiterated their aim to continue growing Adyen’s net revenue and achieve a compounded annual growth rate “between the mid-twenties and low-thirties in the medium term.” In Adyen’s IPO prospectus, the same aim was mentioned, but the actual revenue growth rate from 2018 to 2021 was 42.1% per year.

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

There are three reasons why we think Adyen excels in this criterion.

First, the company already has a multi-year track record of producing strong free cash flow and exceptional free cash flow margins, as we discussed in the sub-section above.

Second, there’s still tremendous room to grow for Adyen in the electronic payments space alone. The company’s solutions solve important problems for merchants, and management is highly innovative. These traits should lead to higher revenue for Adyen over time. If the free cash flow margin stays high – and we don’t see any reason why it shouldn’t – that will mean even more free cash flow for Adyen in the future.

This brings us to the third reason: Adyen’s new issuing service is likely to improve its free cash flow margins in the future. In the “Company description” section, we wrote that Adyen has to pass on interchange fees to issuers. But with its relatively new issuing service, Adyen can also act as the issuer in a transaction, thus capturing more net revenue for itself. Adyen’s issuing volumes are still tiny today compared to acquiring volumes (tens of millions of euros vs hundreds of billions of euros), so there’s plenty of growth opportunities there.

Valuation

We like to keep things simple in the valuation process. In Adyen’s case, we think the price-to-earnings (P/E) ratio and price-to-free cash flow (P/FCF) ratio are suitable gauges for the company’s value. This is because Adyen has been adept at producing positive and growing net income as well as free cash flow for a number of years.

We completed our initial purchases of Adyen shares in early-April 2022. Our average purchase price was €1,871 per share. At our average price and on the day we completed our purchases, Adyen’s shares had trailing P/E and P/FCF ratios of around 122 and 101, respectively. These ratios are high. But we’re happy to pay up, since Adyen excels under our investment framework for Compounder Fund.

For perspective, Adyen carried P/E and P/FCF ratios of around 92 and 76, respectively, at its 9 May 2022 share price of €1,403.

The risks involved

We see a few key risks that could harm our investment in Adyen:

- First is key-man risk. We think Pieter van der Does, Adyen’s co-founder and CEO, has been a key architect of Adyen’s past successes. If he should leave the company for any reason, we’ll be watching the leadership transition. The good thing is he’s still young (in a business sense) at 53, so he’s likely to still have plenty of gas left in the tank to lead Adyen to new heights.

- Competition is the second risk we’re watching with Adyen. The payments space is highly competitive and Adyen has to muscle against payment-processing units of large banks as well as well-financed payments technology startups such as Stripe. There are no guarantees that Adyen will continue to win in the future, but the company has so far handled the competition admirably. We also think that Adyen’s single integrated payments platform, built in-house and on a single code base, provides a lot of value to merchants, so the odds of success are firmly in the company’s favour.

- The third risk we have our eyes on is regulations. Payments itself is a highly regulated market, and lawmakers could impose limits on Adyen’s business activities, such as its fee structure. Adding to the complexity is that Adyen has a banking license in Europe. In general, banks are highly regulated businesses, with regulatory requirements on the amount of capital they need to hold to buffer for risks, depending on their business activities. Adyen’s ability to invest for growth could be hampered if banking regulations become more onerous in the future.

- Fourth, there is the risk of recessions. In the “Revenue streams that are recurring in nature, either through contracts or customer-behaviour” sub-section, we mentioned that Adyen’s payments volume could suffer if consumer spending turns tepid when economic conditions are rough.

- The last important risk we’re keeping our eyes on is valuation risk. We think Adyen’s business is likely to grow at a rapid clip for many years. But it has a really high valuation. So if there are any hiccups in Adyen’s business – even if they are temporary – there could be a painful fall in the share price. This is a risk we’re comfortable taking as long-term investors.

Summary and allocation commentary

To sum up, Adyen has:

- A growing opportunity in the global electronic payments market, and a suite of services that solves a whole host of important payment-related problems for merchants

- A formidable balance sheet with high levels of cash and zero debt

- A management team with (1) compensation and ownership that demonstrates integrity, and (2) an excellent long-term history of execution and innovation

- High levels of recurring revenues through (1) taking a small cut of transactions that are likely to be repeated often, (2) high merchant-retention, and (3) winning additional payments volume from existing merchants over time.

- A multi-year track record of exceptional free cash flow and net income margins, and excellent growth in net revenue, net income, operating cash flow, and free cash flow

- A high likelihood of producing a growing stream of free cash flow in the future

There are risks to note, such as key-man risk; a highly competitive landscape in the payments market; the potential for regulators to crimp Adyen’s growth; the chance that future recessions could lower payments activity on the company’s platform; and the high valuation that the company’s shares carry.

After considering the pros and cons, we decided to initiate a position of around 0.8% in Adyen in April 2022. We appreciate all the strengths we see in Adyen’s business, but our enthusiasm is currently tempered by the company’s high valuation.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share. Of all the other companies mentioned in this article, Compounder Fund also owns shares in Etsy, Mastercard, Microsoft, and Visa. Holdings are subject to change at any time