Compounder Fund: Activision Blizzard Investment Thesis - 19 Mar 2021

Data as of 17 March 2021

Activision Blizzard Inc (NASDAQ: ATVI), which is based and listed in the USA, is one of the 40 companies in Compounder Fund’s initial portfolio. This article describes our investment thesis for the company.

Company description

Activision Blizzard is a leading developer and publisher of video, computer, and mobile games. The company has three important business segments, each of which are game development studios themselves:

- Activision Publishing earns revenue from selling games, in-game sales, and licensing fees from related or third-party distributors. The key gaming franchise from Activision Publishing is Call of Duty, a first-person shooter game. The segment also has a professional global esports league, Call of Duty League, that is based on the Call of Duty franchise.

- Blizzard Entertainment earns revenue from selling games, in-game sales, licensing fees from related or third-party distributors, and subscription fees. It is the creator of the World of Warcraft, Hearthstone, Overwatch, Warcraft, StarCraft, Diablo, and Heroes of the Storm gaming franchises. The key franchises of Blizzard Entertainment currently include World of Warcraft (a subscription-based massive multiplayer online role-playing franchise), Hearthstone (a franchise featuring online collectible cards that are based on the Warcraft universe), Diablo (a horror-themed action role-playing franchise), and Overwatch (a team-based, first-person action franchise). Blizzard Entertainment also houses the Overwatch League, a professional global esports league that is based on the Overwatch franchise.

- King Digital Entertainment is a creator of mobile games and its key property is Candy Crush, a “match three” franchise. The studio’s revenue comes predominantly from in-game sales and in-game advertising.

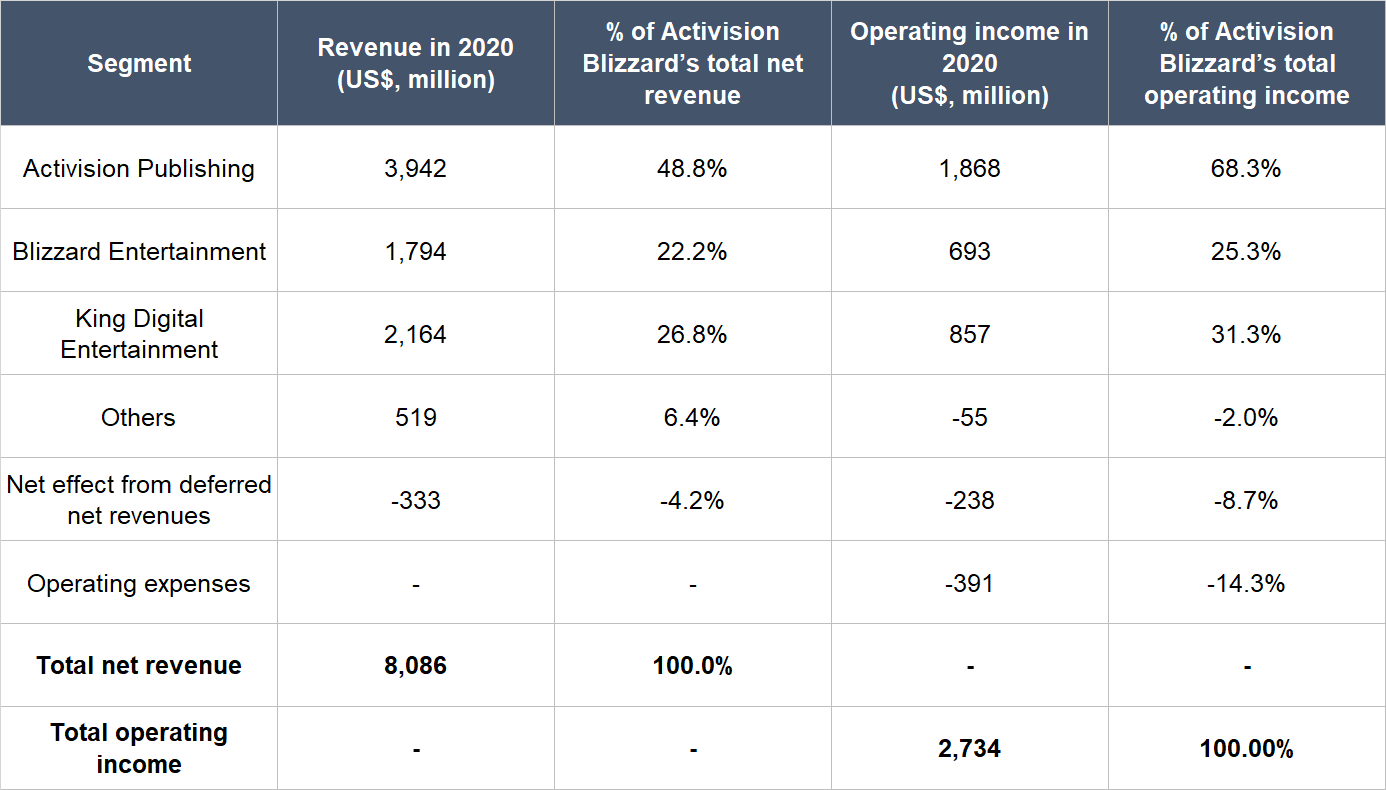

The table below shows a segmental breakdown of Activision Blizzard’s revenue and operating income in 2020:

Source: Activision Blizzard annual report

In 2020, close to half of Activision Blizzard’s net revenue came from Activision Publishing while about a quarter each was derived from Blizzard Entertainment and King Digital. It’s worth noting that Activision Publishing is also the biggest driver of Activision Blizzard’s bottom-line, with a 52.6% operating income margin (operating income as a percentage of revenue) and a 68.3% share of the company’s total operating income.

Among all of Activision Blizzard’s gaming franchises, the three most important ones are Call of Duty, Candy Crush, and World of Warcraft. Together, they accounted for 76% of the company’s total net revenue in 2020.

From a geographical perspective, Activision Blizzard’s revenue base is somewhat diversified. In 2020, 54.8% of the company’s net revenue of US$8.09 billion was from the Americas, 33.1% was from EMEA (Europe, Middle East, and Africa), and the remaining 12.0% was from the Asia Pacific region.

Investment thesis

We have laid out our investment framework in Compounder Fund’s website. We will use the framework to describe our investment thesis for Activision Blizzard.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

Not many people may realise this, but gaming (as in computer and video games, and not gambling) is a huge market. According to research firm Mordor Intelligence, the global gaming market was US$162 billion in 2020 and is expected to compound at 10.5% annually to reach US$296 billion in 2026. This growth-projection for the worldwide gaming market looks plausible to us, since the market had historically grown by around 17.5% per year from 2014 to 2020, according to estimates from Activision Blizzard.

As mentioned earlier, Activision Blizzard raked in ‘just’ US$8.09 billion in net revenue in 2020. This means the company currently only has a mid single-digit share of the growing worldwide gaming market. Activision Blizzard currently owns three gaming franchises – Call of Duty, World of Warcraft, and Candy Crush – that generate more than US$1 billion in annual net bookings each; it expects two additional franchises to reach a similar scale over the next couple of years. (Net bookings for a given period is net revenue plus deferred net revenue.)

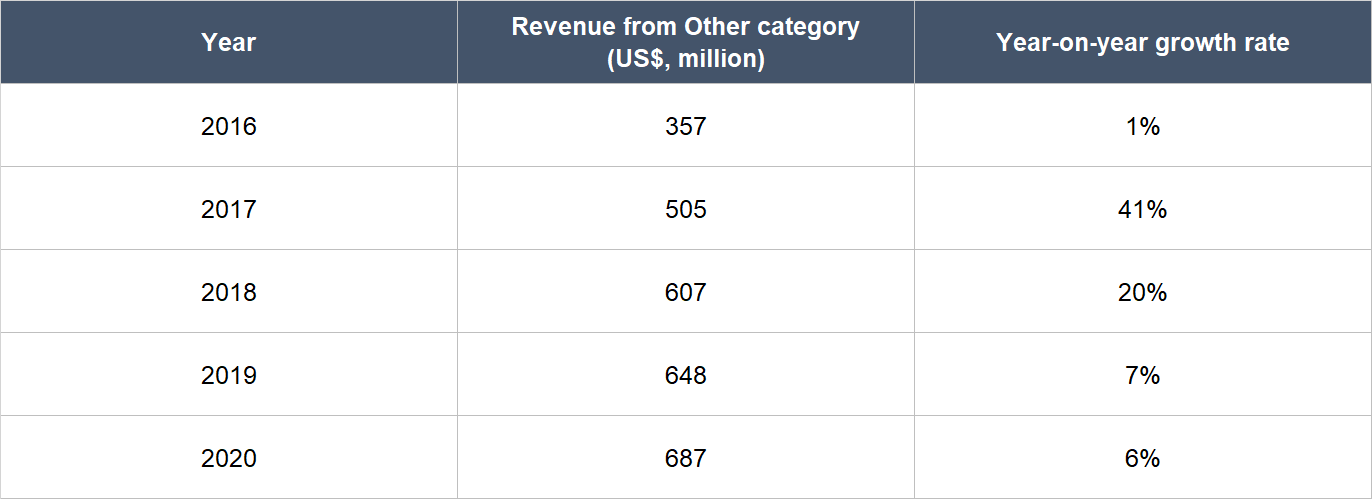

The rising popularity of esports is cited by Mordor Intelligence as one of the gaming market’s growth drivers. We mentioned earlier that Activision Blizzard has a presence in esports through the Call of Duty League and the Overwatch League. Activision Blizzard’s revenue can be categorised according to platforms in the following way: Console, PC, Mobile & Ancillary, and Other. The Other category houses Activision Blizzard’s distribution business as well as its esports leagues. Although still tiny for the company, the Other category has seen its revenue nearly double from 2016 to 2020. The Overwatch League and Call of Duty League started their inaugural seasons in 2018 and 2020, respectively.

Source: Activision Blizzard annual reports

Esports could be huge in the future – as an early sign of its progress, esports will be an official medal event for the first time ever at the Hangzhou 2022 Asian Games. Grandview Research estimates that the global esports market was US$1.1 billion in 2019 and could compound at an impressive annual rate of 24.4% from 2020 to 2027. Having esports leagues could open up new revenue opportunities for Activision Blizzard in the future, such as from advertising or viewing rights (much like how professional sports teams today earn revenue from advertisers and the broadcasting of matches).

Speaking of new revenue opportunities, Activision Blizzard could also tap on other forms of media – such as movies or programs on streaming services – to monetise its library of intellectual property in the future. An analogue would be how Marvel successfully brought its comic book characters to the silver screen via the Marvel Cinematic Universe (MCU); according to The DisInsider, the MCU has so far featured 23 films that have grossed over US$22.5 billion. Some of Activision Blizzard’s franchises have lush stories about their in-game universe (such as Diablo for instance) that could provide attractive fodder for the creation of content in other media formats. The company has taken some steps in this area, such as with the 2016 film, Warcraft, which was based on the Warcraft gaming franchise. But it’s still early days for Activision Blizzard in this area.

The Metaverse angle for Activision Blizzard is also intriguing to us. In an excellent January 2020 essay, venture capitalist and media-business analyst Matthew Ball described the Metaverse as having the following qualities:

“The Metaverse, we think, will…

1. Be persistent – which is to say, it never “resets” or “pauses” or “ends”, it just continues indefinitely

2. Be synchronous and live – even though pre-scheduled and self-contained events will happen, just as they do in “real life”, the Metaverse will be a living experience that exists consistently for everyone and in real time

3. Have no real cap to concurrent participations with an individual sense of “presence” – everyone can be a part of the Metaverse and participate in a specific event/place/activity together, at the same time and with individual agency

4. Be a fully functioning economy – individuals and businesses will be able to create, own, invest, sell, and be rewarded for an incredibly wide range of “work” that produces “value” that is recognized by others

5. Be an experience that spans both the digital and physical worlds, private and public networks/experiences, and open and closed platforms

6. Offer unprecedented interoperability of data, digital items/assets, content, and so on across each of these experiences – your “Counter-Strike” gun skin, for example, could also be used to decorate a gun in Fortnite, or be gifted to a friend on/through Facebook. Similarly, a car designed for Rocket League (or even for Porsche’s website) could be brought over to work in Roblox. Today, the digital world basically acts as though it were a mall where though every store used its own currency, required proprietary ID cards, had proprietary units of measurement for things like shoes or calories, and different dress codes, etc.

7. Be populated by “content” and “experiences” created and operated by an incredibly wide range of contributors, some of whom are independent individuals, while others might be informally organized groups or commercially-focused enterprises”

Put simply, the Metaverse is something like a pervasive digital world that is interlinked with the real world. And the economic opportunities may be immense. In the same blog post we referenced just above, Ball wrote:

“Even if the Metaverse falls short of the fantastical visions captured by science fiction authors, it is likely to produce trillions in value as a new computing platform or content medium. But in its full vision, the Metaverse becomes the gateway to most digital experiences, a key component of all physical ones, and the next great labor platform.”

Ball was clear in his essay that the Metaverse is not merely a digital or virtual economy like what can be found in Activision Blizzard’s World of Warcraft franchise:

“It’s also helpful to consider what the Metaverse is often, but incorrectly, likened to. While each of these analogies is likely to be a part of the Metaverse, they aren’t actually the Metaverse. For example, The Metaverse is not…

…4. A “digital and virtual economy” – These, too, already exist. Individual games such as World of Warcraft have long had functioning economies where real people trade virtual goods for real money, or perform virtual tasks in exchange for real money. In addition, platforms such as Amazon’s Mechanical Turk, as well as technologies such as Bitcoin, are based around the hiring of individuals/businesses/computational power to perform virtual and digital tasks. We are already transacting at scale for purely digital items for purely digital activities via purely digital marketplaces.”

But Activision Blizzard does have long experience with operating an expansive digital world in the form of World of Warcraft (the franchise was first created in 2004; see here for a video explaining the game). We think this experience could be valuable for Activision Blizzard if it wants to participate in the Metaverses if and when it emerges as an important part of the global economy.

To be clear, the opportunity with the Metaverse and the possibility of monetisation of content through other media formats beyond games are not clear-cut growth opportunities for Activision Blizzard. The clearest opportunity the company has, in our opinion, is the huge global appetite for gaming (the US$162 billion market in 2020). Activision Blizzard’s opportunity with esports is somewhat in-between.

2. A strong balance sheet with minimal or a reasonable amount of debt

Activision Blizzard exited 2020 with US$8.65 billion in cash and investments, and just US$3.61 billion in total debt. This looks like a rock-solid balance sheet to us and it puts the company in a great position to invest for future growth (either organically or via acquisitions).

It helps too that the company has a long history of generating positive free cash flow, which is something we will touch on later.

3. A management team with integrity, capability, and an innovative mindset

On integrity

Having been Activision Blizzard’s CEO since February 1991, the 58 year old Robert (or Bobby) Kotick is the company’s key leader.

In 2019, Kotick total’s remuneration consisted of a base salary of US$1.76 million, an annual bonus of US$2.87 million, other miscellaneous compensation of US$0.09 million, and stock-awards that have a target value of US$28 million. His total pay package was thus a hefty US$32.72 million. But this is a rounding error when compared to the scale of Activision Blizzard’s business. For perspective, the company’s profit and free cash flow in 2019 were US$1.50 billion and US$1.72 billion, respectively. But more importantly, we think Kotick’s stock awards are well-structured on balance after considering the pros and cons:

- The pros:

- 69.6% of the US$28 million came from stock option awards that vest over four years and four months.

- 17.9% of the US$28 million was from performance-based restricted stock units (PSUs) that are based on Activision Blizzard’s earnings per share growth over a three year period from 2019 to 2021. Depending on the actual growth of the company’s earnings per share, the actual number of PSUs that would be awarded to Kotick ranges from 0% to 250% of the target.

- 12.5% of the US$28 million was from PSUs that are based on Activision Blizzard’s total shareholder return relative to the S&P 500’s total return over a three year and four month period. Depending on the gain of Activision Blizzard’s share price (including dividends) relative to the S&P 500 (again including dividends), the actual number of PSUs that would be awarded to Kotic ranges from 0% to 250% of the target.

- The various types of stock awards that were granted to Kotick in 2019 are positives in our view because they link his compensation for the year to the long-term business performance of the company.

- The cons:

-

- All the stock awards mentioned above would vest if, at any time prior to 31 December 2021, Activision Blizzard’s share price reached US$79.96 and stayed there or higher for at least 90 consecutive trading days.

- Whether or not Kotick’s 2019 stock awards had already vested early because of the movement in Activision Blizzard’s share price is not important for our purposes here. We think that this trait of Kotick’s stock awards in 2019 is a negative because it introduces a heavy emphasis on Activision Blizzard’s shorter-term share price movement.

We also appreciate the fact that Kotick currently controls 4.815 million Activision Blizzard shares based on his latest regulatory filings. At the company’s 17 March 2021 share price of US$92, Kotick’s stake is worth more than US$445 million. We think this gives him significant skin in the game and puts him in the same boat as Activision Blizzard’s other shareholders.

Another positive point that we see regarding Kotick’s integrity is the excerpt below from his 2019 shareholders’ letter: He was willing to own up to his mistakes. He wrote:

“Our top and bottom-line results were down significantly from our prior year performance, even though our industry grew during the same period. This isn’t the level of excellence we have maintained for most of the last 30 years we have managed the company. It is said, “Vision without execution is hallucination”, and our 2019 results were impacted by poor execution managing our content pipeline and not moving quickly in the management of our costs. To address this, we made important organizational changes to better position us for the continued delivery of games and better financial performance, and we expect 2020 will begin to reflect the benefit of these changes.”

On capability and ability to innovate

We rate Robert Kotick and his team highly on this front, and there are a few things we want to discuss.

The first is the history of Activision Blizzard. The company was created in 1979 as the first independent, third-party, console video game developer. Activision enjoyed some small successes but by 1991, it was nearly bankrupt, as it had US$30 million in debt and merelyt US$2 million in assets. With just US$440,000, Kotick and a group of investors effectively bought over the company in the same year. Since then – as we had mentioned earlier – Kotick has been leading Activision. In July 2008, Kotick merged Activision with Vivendi Games, which owned Blizzard Entertainment, and the combined entity was named Activision Blizzard. As part of the merger, Vivendi became Activision Blizzard’s majority shareholder, although Kotick still remained at the helm of the company. Then in February 2016, Activision Blizzard acquired mobile games developer King Digital for US$5.8 billion.

Unlike the debt-riddled and failing Activision that existed in 1991 just before Kotick assumed control, the Activision Blizzard of today is a massive gaming company with a global reach, and billions of dollars in revenue, cash flow, and cash on hand.

Second, under Kotick’s leadership, Activision Blizzard has successfully built enduring gaming franchises. World of Warcraft, currently one of the company’s top three franchises in terms of net revenue, was created in November 2004. In December 2020 – nearly 16 years after the game was born – its eighth expansion, Shadowlands, sold 3.7 million units on launch day to become the fastest selling PC game of all time industry-wide. The expansion also helped World of Warcraft reach its highest levels of player engagement in a decade. Blizzard Entertainment – the segment within Activision Blizzard that houses World of Warcraft – ended 2020 with 29 million monthly users.

Call of Duty, which is another of Activision Blizzard’s top three franchises by revenue, is another good example of a highly successful gaming franchise with longevity. The franchise was launched 18 years ago in 2003. In December 2020, the company announced that the Call of Duty franchise had generated over US$3 billion in net bookings (net bookings would be net revenue plus any deferred revenue) over the last 12 months.

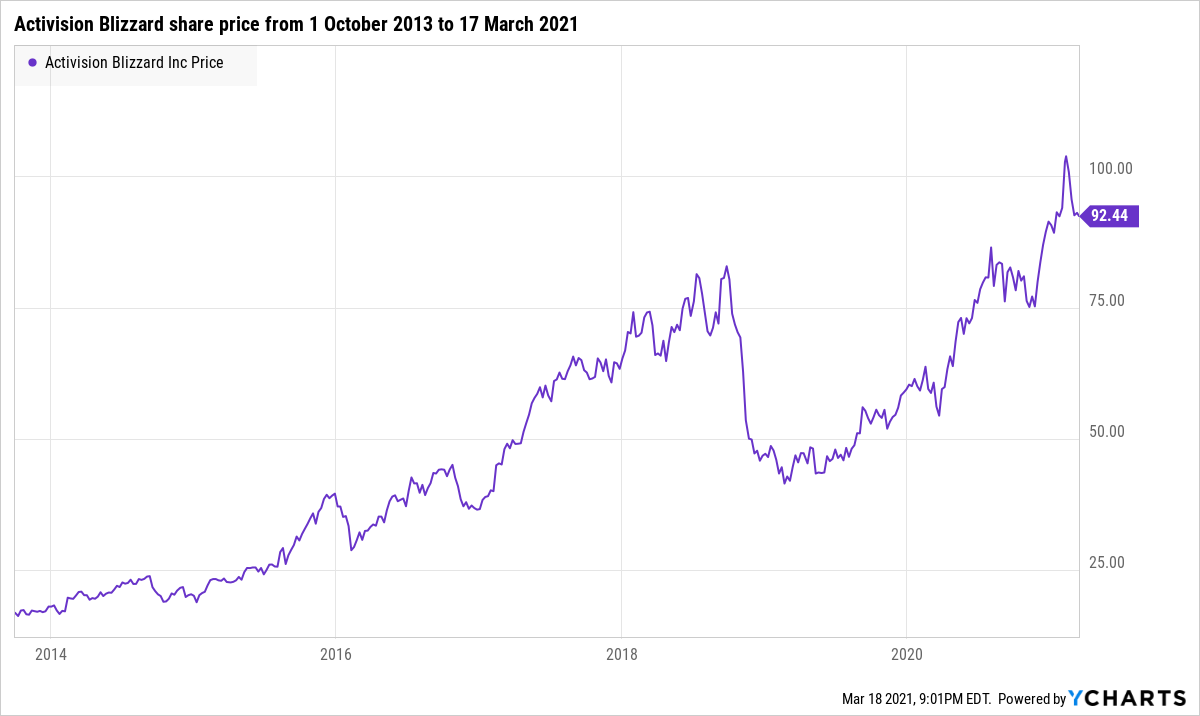

The third thing we want to discuss is Kotick’s skill at capital allocation. There are two major moves by him that we want to highlight. Firstly, in October 2013, Activision Blizzard bought back 429 million shares of itself from Vivendi for US$5.83 billion, or US$13.60 per share. The buyback looks like an extremely shrewd move to us, despite the company having to load up on debt, as it (a) significantly reduced the company’s share count, and (b) were done at a cheap price given the strong increase in the share price since the buyback was done. (There will be more on the debt load increase and the reduction in the share count later.) The chart below shows Activision Blizzard’s share price from the start of October 2013 to 17 March 2021. Secondly, there’s the aforementioned acquisition of King Digital for US$5.8 billion in February 2016. From 2017 to 2020, King Digital’s operating income had increased from US$700 million to US$857 million. Moreover, the purchase price is now only a low multiple (less than 6) of King Digital’s latest operating income.

The fourth point is related to the second and third. Under Kotick’s leadership, Activision Blizzard appears to have found a winning blueprint to expand the reach of its already-successful franchises. The blueprint involves the mobile format and we can’t help but wonder if the acquisition of King Digital, a successful mobile games developer behind the breakout hit Candy Crush, had a big role to play – if true, it adds another feather to the cap on Kotick’s ability to allocate capital. Coming to the blueprint, here are comments on the topic that Kotick shared in the company’s 2020 fourth-quarter earnings conference call (emphases are ours):

“In 2020, we introduced even more ways for players to connect and find community, particularly in Call of Duty. Our approach to the franchise has become the road map we are now applying to many of our other games. Within Call of Duty, we have meaningfully expanded social connections and improved engagement through free-to-play experiences on mobile phones, computers and game consoles. These initiatives expanded franchise reach with over 250 million people playing Call of Duty last year, more than tripling the 70 million people who played Call of Duty in 2018.

Our approach has made the franchise more social than ever, benefiting both our players and our business performance. Call of Duty players who play in groups with friends spend over three times more hours in the game and invest around three times more on in-game content compared to other players. And we’ve really only just started to scratch the surface of what’s possible for social interaction within our franchises, and we have initiatives under way to enhance the social nature of all of our key franchises. Call of Duty has also established a clear blueprint for franchise-based innovation and we’re applying this strategy across our other core franchises to grow reach, engagement and player investment.

As I mentioned, we had roughly 400 million monthly active players in 2020, and we’re accelerating our path to reach 1 billion players as we apply the Call of Duty framework across our other wholly owned franchises. Of course, we always begin the process with inspiration and creativity. We then offer great gameplay through free-to-play access to all consumers availability on mobile phones and continuous regular delivery of in-game content and premium content. In Call of Duty, we expect further growth, both in our traditional regions and new countries as we continue to enhance the player experience across all platforms.

In the Diablo franchise, Diablo Immortal, our upcoming free-to-play mobile title was extremely well received during its recent regional testing. And this has set the stage for the franchise to meaningfully expand its global reach. In addition to launching new Diablo content this year, our highly anticipated Diablo IV is on the horizon. As we execute on our Diablo pipeline, we expect the franchise to contribute meaningfully to our reach, engagement and player investment growth in the coming quarters and years ahead.

In our Warcraft franchise, we intend to deliver more frequent premium content to sustain and expand the World of Warcraft community. And we’ve made multiple mobile free-to-play Warcraft experiences, and they’re now in advanced development based on our franchises beloved IP. This will create opportunities for both existing players and new fans to experience the Warcraft universe in entirely new ways.”

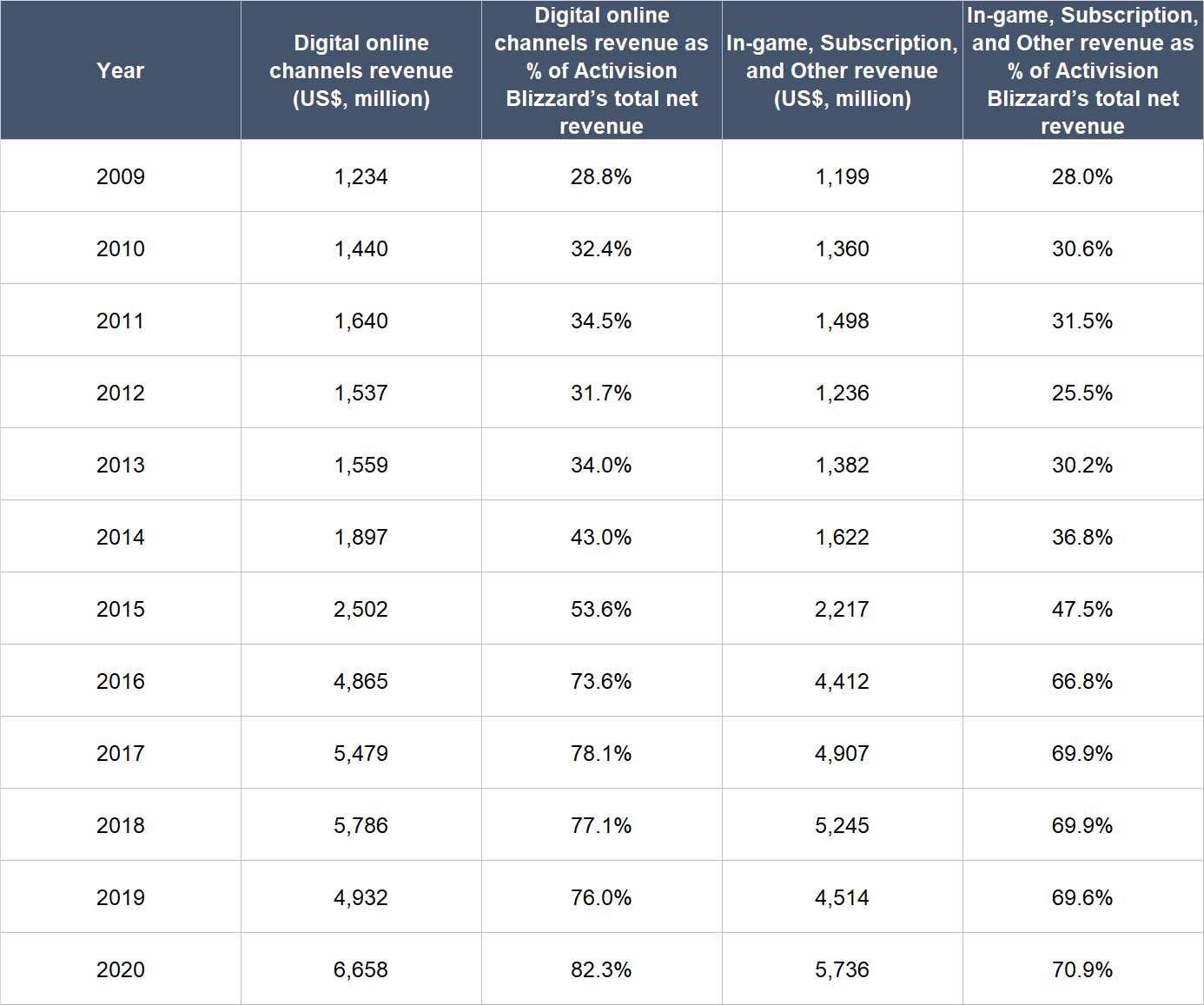

Fifth, we think Kotick and his team have done an excellent job over the years at growing Activision Blizzard’s recurring revenues and sales through digital channels. Both are related in our view, because having strong capabilities at selling games digitally lends to a better ability to build recurring gaming revenue streams. The growth of both is important because we think having digital and recurring revenues adds to the stability of the company’s business.

Activision Blizzard has two forms of recurring revenue: One, through a subscription model where gamers have to pay a recurring subscription fee to access a game; and two, through gamers purchasing in-game content. The World of Warcraft franchise is a great example of recurring revenue from a subscription model. As for in-game content, such content helps generate recurring revenue for Activision Blizzard because gamers can carry on making transactions within a game even after its purchase – a good example is the Call of Duty franchise, which features rich in-game content. The presence of purchasable in-game content (virtual goods for example) also helps Activision Blizzard to monetise free-to-play games such as Candy Crush.

The table below shows the following: (a) Revenues from Activision Blizzard’s digital online channels from 2009 to 2020; (b) revenues from digital online channels as a percentage of the company’s total net revenue from 2009 to 2020; (c) the “In-game, Subscription, and Other” revenue stream – the category that includes subscriptions and in-game purchases – from 2009 to 2020; and (d) revenues from the “In-game, Subscription, and Other” category as a percentage of the company’s total net revenue from 2009 to 2020. The key takeaways here are that all four metrics have increased substantially over time, and Activision Blizzard’s business is now largely recurring in nature.

Source: Activision Blizzard annual reports

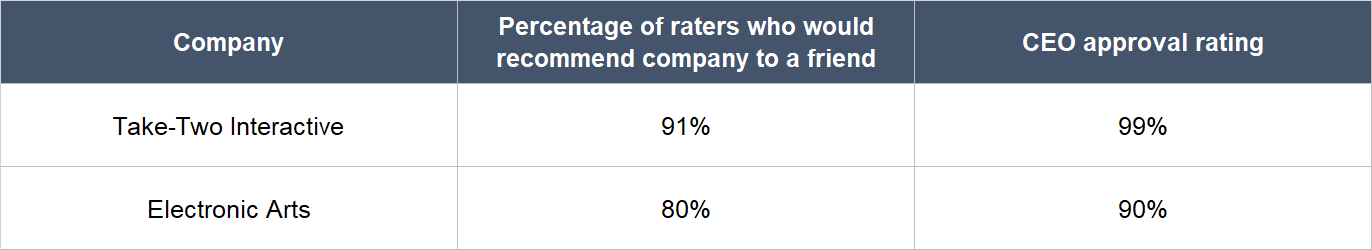

The sixth thing we want to discuss is not something positive, and it is our observation that Activision Blizzard does not seem to have a good corporate culture. Glassdoor is a platform that allows employees to rate their companies anonymously. Currently, only 49% of Activision Blizzard raters on Glassdoor would recommend a friend to work at the company and Kotick only has an approval rating of 62% as CEO, below the average Glassdoor CEO rating of 69% in 2019. For perspective, competitors such as Take-Two Interactive and Electronic Arts have far higher Glassdoor ratings, as the table below illustrates.

Source: Glassdoor

In other negative aspects of Activision Blizzard’s culture, Kotick has a history of laying off employees at the company. For instance, he fired 800 employees in March 2019 despite 2018 being a decent year financially for the company. Earlier this month, media outlets reported that Kotick had recently fired anywhere from 50 to 190 employees, despite 2020 being a great year financially. Activision Blizzard has managed to post good business results despite its seemingly poor culture, but we’re keeping an eye on things here.

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

In the past, the sale of games was a one-time thing. We remember the days when we would buy a game from a retail shop in the form of a CD and install it on our personal computers. And that was it. The transaction was one-time in nature, and we owned the game in perpetuity. But today, gaming revenue can be much more recurring in nature.

As we discussed earlier, Activision Blizzard has done very well in terms of shifting its business mix toward recurring revenues. We showed that the “In-game, Subscription, and Other” revenue stream for Activision Blizzard – the category that includes subscriptions and in-game purchases – was US$5.74 billion in 2020 and 71% of the company’s total net revenue in the year.

But there is still an element of revenue-uncertainty surrounding game developers, including Activision Blizzard. Each game has a limited shelf life before gamers’ interest starts to wane. This means that a game developer needs to maintain a steady pipeline of new games to retain gamers. What gives us comfort with Activision Blizzard is its solid history in developing and acquiring top gaming franchises that also have significant longevity (we mentioned earlier that Call of Duty and World of Warcraft were both launched in the early 2000s).

5. A proven ability to grow

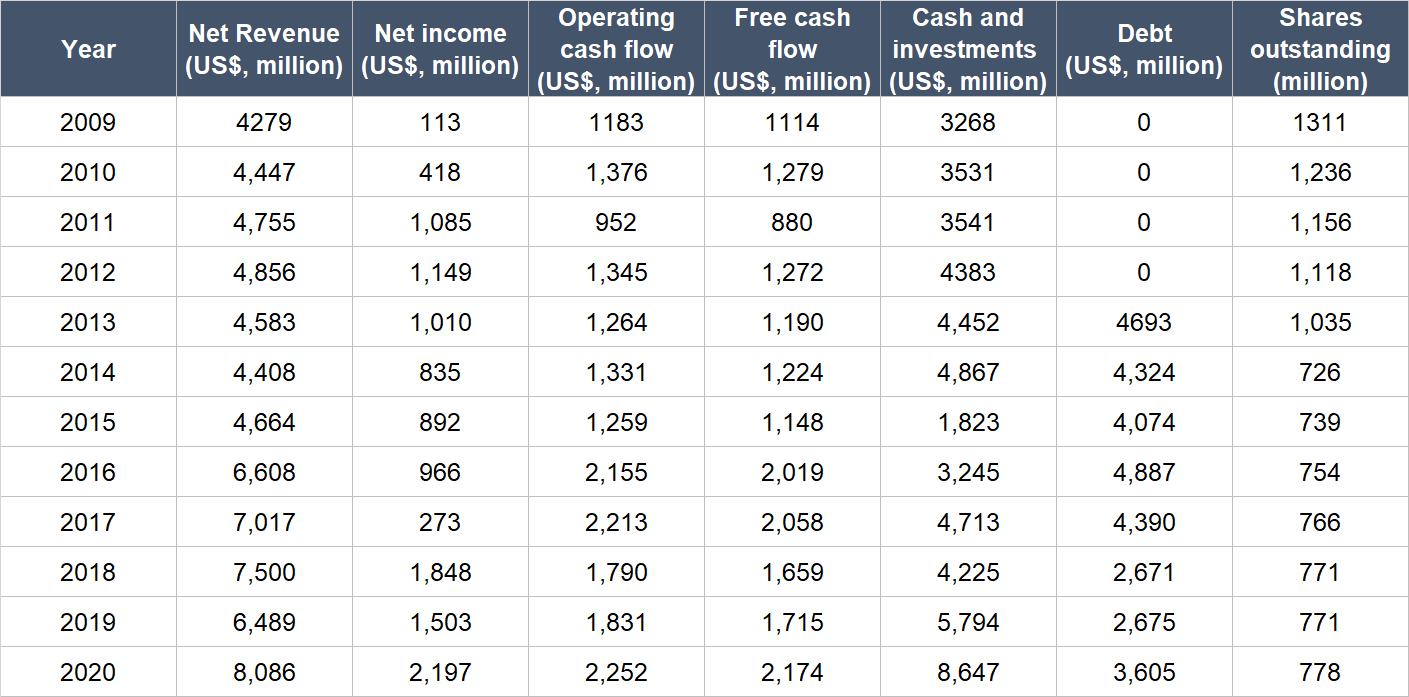

The table below shows Activision Blizzard’s key financials from 2009 to 2020. As we discussed earlier, the company came about from a merger that happened in July 2008. We chose 2009 as the starting point because it is the first full year of existence for the combined Activision Blizzard entity.

Source: Activision Blizzard annual reports

A few key things to highlight from Activision Blizzard’s historical financials:

- Revenue has compounded at merely 6.0% per year from 2009 to 2020. But from 2015 to 2020, the annual growth rate increased to a respectable 11.6%. Part of the growth was organic while part of it was fueled by the acquisition of King Digital in 2016.

- For 2009-2020, net income was consistently positive, but had fluctuated wildly. The annual growth rates for 2009-2020 and 2015-2020 were 31.0% and 19.8%, respectively.

- Activision Blizzard’s cash flow is much steadier and is what we’re focused on. Both operating cash flow and free cash flow were consistently positive and have similar growth profiles to the company’s revenue. From 2009 to 2020, operating cash flow and free cash flow compounded at annual rates of 6.0% and 6.3% respectively; from 2015 to 2020, the selfsame annualised growth rates were 12.3% and 13.6%. It’s also worth noting that Activision Blizzard had consistently high free cash flow margins (free cash flow as a percentage of revenue): The averages for 2009-2020 and 2015-2020 were 26.1% and 26.7%, respectively.

- The balance sheet was strong for the most part with debt being either zero or less than the cash and investments Activision Blizzard had on hand. It was only the 2013-2016 period where the company’s debt outweighed its cash and investments. There were good reasons for the balance sheet becoming weaker in that period. In 2013, there was a sharp increase in debt because of the aforementioned US$5.83 billion buyback of 429 million shares from Vivendi in October of the year. We also discussed earlier the US$5.8 billion acquisition of King Digital in February 2016. US$3.6 billion in cash was actually placed in escrow toward the end of 2015 for the deal. We excluded escrowed cash in the table on the company’s historical financials and this is why cash and investments fell sharply in 2015. But because of Activision Blizzard’s ability to generate free cash flow, the company’s balance sheet has strengthened rapidly.

- Dilution has not been a problem for the company. Because of the huge share buyback in 2013, Activision Blizzard’s weighted average diluted share count actually declined by 4.6% per year from 2009 to 2020. The table above also shows that the company’s share count had been increasing in more recent years, but the pace is glacial (1.0% per year from 2015 to 2020).

The current COVID-19 pandemic has hurt Activision Blizzard’s esports leagues, which depend on live in-person events for revenue. But the pandemic has had a net positive impact on Activision Blizzard as more people stayed at home, resulting in higher engagement with the company’s games. Although some of the positive effects Activision Blizzard has enjoyed from COVID-19 will likely be transient, we still think the longer-term prospects for the company are bright.

We know that Activision Blizzard’s revenue growth rate for 2009-2020 is not inspiring. This is because its business was essentially flat from 2009 to 2015. But we think the low-teens growth rate that the company experienced from 2015 to 2020 is a base level for what it could achieve in the years ahead. There are two things we want to point out. Firstly, we mentioned earlier that over the next couple of years, management expects to build two additional gaming franchises with billion-dollar net bookings on top of the three that the company already has (the trio are Call of Duty, Candy Crush, and World of Warcraft). Secondly, we also pointed out earlier that Activision Blizzard had (1) very successfully improved gamer-engagement and the social elements in its Call of Duty franchise in 2020, and (2) developed a blueprint for its other franchises based on its lessons from Call of Duty.

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

There are two reasons why we think Activision Blizzard excels in this criterion.

First, there’s still significant room to grow for the company. Its total revenue at the moment is only a tiny fraction of a global gaming market that is poised for growth in the years ahead. Earlier, we shared our reasons why Activision Blizzard could likely take advantage of this rising trend.

Second, Activision Blizzard has excelled at generating free cash flow for a long time. We already shared that the company’s average free cash flow margins were 26.1% for 2009 to 2020 and 26.7% for 2015 to 2020 – these are excellent margins. We don’t see why Activision Blizzard’s free cash flow margins would weaken in the years ahead, especially when we consider that the company’s revenue-mix from digital channels has been growing and will likely continue to do so.

Valuation

We like to keep things simple in the valuation process. In Activision Blizzard’s case, we think the price-to-free cash flow (P/FCF) ratio is an appropriate metric to gauge the value of the company. This is because Activision Blizzard has been extremely adept at producing free cash flow for many years.

We completed our purchases of Activision Blizzard shares with Compounder Fund’s initial capital in early August 2020. Our average purchase price was US$82 per Activision Blizzard share. At our average price and on the day we completed our purchases, the company’s shares had a trailing P/FCF ratio of around 45. This is not low and it’s a risk. But we’re comforted by (1) the company’s portfolio of strong gaming franchises and the growth potential that these existing franchises hold, (2) the high likelihood of new powerhouse franchises being developed by the company, and (3) the consistently high free cash flow margins the company has produced.

For perspective, Activision Blizzard carried a P/FCF ratio of around 33 at its 17 March 2021 share price of US$92.

The risks involved

There are five key risks that we see with our investment in Activision Blizzard.

First, there’s key-man risk. We credit much of Activision Blizzard’s success over the years to the leadership of its long-time CEO, Robert Kotick. Since taking over the company in 1991, he has completely transformed its business. If Kotick were to leave Activision Blizzard for any reason, we will be watching the leadership transition closely. The good thing is that he’s still relatively young at 58, so he should still have plenty of gas left in the tank to continue leading the company.

Another important risk in our view is the potential for a decline in popularity in Activision Blizzard’s popular, long-lived franchises. There are some small early signs of this happening, with Blizzard’s monthly active users falling from 41 million at the end of 2016 to 29 million at the end of 2020. We’re comforted by (1) the great reception enjoyed by the aforementioned Shadowlands expansion in the World of Warcraft franchise, and (2) the blueprint for higher gamer engagement that we discussed earlier. Nonetheless, we’re keeping an eye on things here.

Third, there’s the risk of the company failing to develop new popular franchises. Activision Blizzard has a long history of maintaining the popularity of its existing franchises and of creating new hits. For example, the company introduced the Skylanders franchise in 2011. Even though the franchise is no longer important to Activision Blizzard’s business today, it managed to generate US$3 billion in revenue by 2015. There’s also the introduction of Overwatch in 2016, a franchise which now has its own esports league. But there’s still a risk that Activision Blizzard may lose its touch in the future when it comes to creating new hit gaming franchises.

Fourth, there’s customer concentration risk at Activision Blizzard. Although the company does sell directly to end consumers, it also depends on its platform partners for substantial amounts of its revenue. In 2020, Sony, Apple, Google (the key subsidiary of Alphabet), and Microsoft accounted for 17%, 15%, 14%, and 11%, respectively, of Activision Blizzard’s total net revenue for the year.

Lastly, we think there’s valuation risk too. In our view, Activision Blizzard’s business is likely to grow comfortably at a mid-teens annual rate or more in the years ahead. And with its consistently high free cash flow margins, we think the company deserves its premium valuation. But if there are any hiccups in Activision Blizzard’s business in the future – even if they are temporary – there could be a painful fall in the share price.

Summary and allocation commentary

To sum up Activision Blizzard, it has:

- A large and growing market opportunity in the form of the gaming market, and the potential to create new revenue streams in the realms of esports and the metaverse

- A robust balance sheet with billions in cash and investments and significantly lower debt

- A CEO with well-aligned incentives, and an excellent track record of execution and innovation

- High levels of recurring revenue from subscription-based games and in-game transactions

- A long history of steady growth in revenue and free cash flow, with growth rates that have accelerated over the last five years compared to the last 11

- A high likelihood of producing a strong and growing stream of free cash flow in the future

There are important risks to note, such as key-man risk; the danger of the company failing to refresh its existing franchises or launch new hits; the presence of customer concentration; and a premium valuation.

After weighing the pros and cons, we initiated a 2% position in Activision Blizzard – a medium-sized allocation – with Compounder Fund’s initial capital. We think this is an appropriate weighting for a hits-based company that we think can compound revenue in the mid-teens range or higher in the years ahead while carrying a premium valuation.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share. Of all the companies mentioned in this article, Compounder Fund also currently owns shares in Alphabet, Apple, and Microsoft. Holdings are subject to change at any time.