Compounder Fund: Chipotle Mexican Grill Investment Thesis - 25 Aug 2020

Data as of 24 August 2020

Chipotle Mexican Grill (NYSE: CMG) is one of the 40 companies in Compounder Fund’s initial portfolio. This article describes our investment thesis for Chipotle (pronounced “chi-POAT-lay”).

Company description

The business of Chipotle, a company based and listed in the US, is simple. It runs fast-casual restaurants mainly in the US. Its namesake restaurants serve Mexican food – think burritos, burrito bowls (a burrito without the tortilla), tacos, and salads. A fast-casual restaurant is one with food quality that’s similar to full-service restaurants, but with the speed and convenience of fast food.

At the end of June 2020, Chipotle had 2,626 namesake restaurants in the US and 40 namesake restaurants in other countries. The company also operated three restaurants in the US that are not under the Chipotle brand. That’s it for Chipotle’s business… on the surface.

Investment thesis

We have laid out our investment framework in Compounder Fund’s website. We will use the framework to describe our investment thesis for Chipotle.

1. Revenues that are small in relation to a large and/or growing market, or revenues that are large in a fast-growing market

In the 12 months ended 30 June 2020, Chipotle raked in US$5.62 billion in revenue with its 2,600-plus namesake restaurants. This sounds like Chipotle’s business is already massive. But it really isn’t. For perspective:

- Number of Subway restaurants in the US in 2018, according to Satista: 24,798

- Number of McDonald’s restaurants in the US currently: 14,428

- According to data from the St Louis Federal Reserve, total retail sales of restaurants and other eating places in the US in 2019 was US$669 billion. Over the 12 months ended June 2020 (which includes negative impacts on restaurants from COVID-19), the figure was still a massive US$604 billion.

These numbers show that Chipotle still has plenty of runway to grow.

2. A strong balance sheet with minimal or a reasonable amount of debt

As of 30 June 2020, Chipotle held zero debt and US$906.6 million in cash and investments. This is a rock solid balance sheet.

For the sake of conservatism, we note that Chipotle also had US$3.01 billion in operating lease liabilities. Given the ongoing restrictions on human movement in the US because of the country’s battle against COVID-19, restaurants in general are operating in a really tough environment. The good thing for Chipotle is that 93% of its total operating lease liabilities of US$3.01 billion are long-term in nature, with payment typically due only from 30 June 2021 onwards.

3. A management team with integrity, capability, and an innovative mindset

On integrity

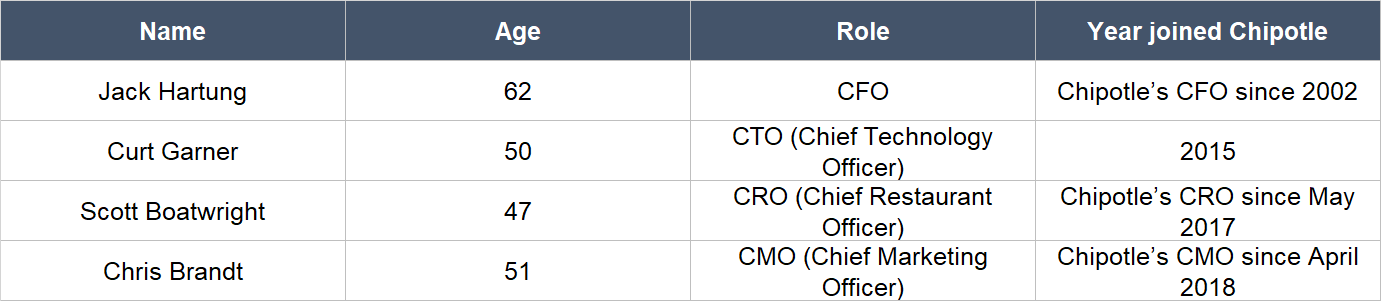

Chipotle’s CEO is currently Brian Niccol, 46. Niccol joined Chipotle as CEO in March 2018 and was previously running the show at fast food chain Taco Bell. We appreciate Niccol’s relatively young age. The other important leaders in Chipotle, most of whom have relatively young ages too (a good thing in our eyes), include:

Source: Chipotle 2019 proxy statement

In 2019, Niccol’s total compensation (excluding US$2.3 million of compensation for legal and tax fees that are related to his initial employment by Chipotle) was US$13.6 million. This is a tidy sum of money. But of that, 62% came from stock awards and stock options. The stock awards are based on (1) the three-year growth in Chipotle’s comparable restaurant sales (more on the comparable restaurant sales metric later); and (2) the three-year average cash flow margin (cash flow as a percentage of revenue) for Chipotle’s restaurants. Meanwhile, the stock options vest over three years. These mean that Niccol’s compensation in 2019 depended on multi-year changes in Chipotle’s stock price and important financial metrics. We thus think that Niccol’s compensation structure is sensible and aligns his interests with Compounder Fund as a shareholder of the company.

We want to highlight too that the other leaders of Chipotle that we mentioned earlier have similar remuneration plans as Niccol. In 2019, they received 69% of each of their compensation for the year in the form of stock awards and stock options with the same characteristics as Niccol’s.

On capability and innovation

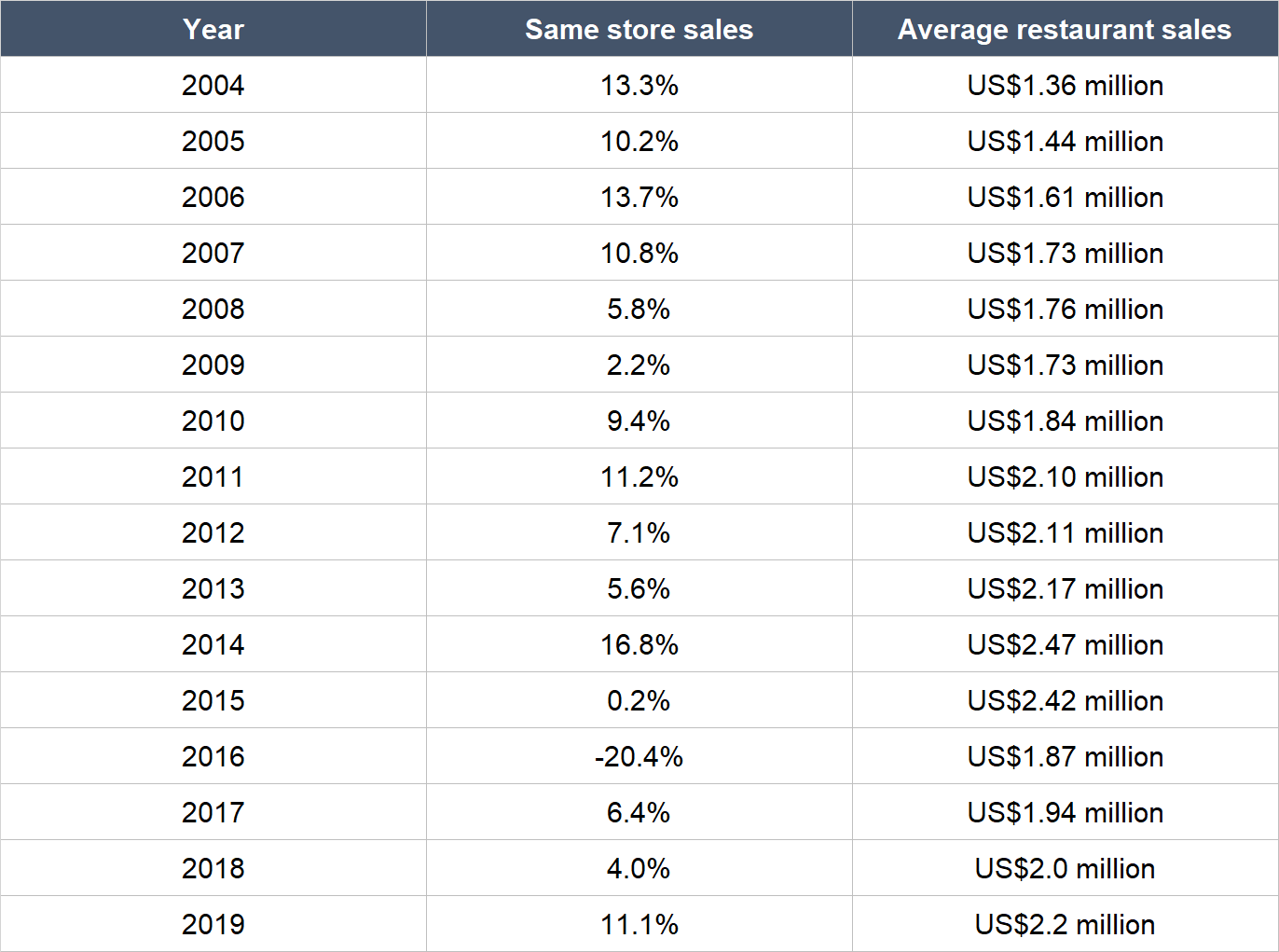

There are a few key numbers that can tell us how well a restaurant company is run: (1) Same store sales growth, and (2) average restaurant sales. The latter is self-explanatory but some of you may not be familiar with the former. Same store sales growth – also called comparable restaurant sales growth – typically represents the change in period-over-period revenue for a company’s restaurants that are in operation for 12 months or more (it’s 13 months in the case of Chipotle). So what same store sales growth measures is essentially the growth in revenue for a restaurant company from its existing stores. The table below shows Chipotle’s same store sales growth and average restaurant sales from 2004 to 2019:

Source: Chipotle annual reports

You can see that the company fared really well on both fronts until 2015, when there were some struggles before growth started resuming in 2017. When discussing Chipotle’s management, we want to break up the story into two portions. The first stretches from Chipotle’s founding to 2015, while the second is from 2015 to today.

On capability and innovation: First portion of the story

Chipotle was founded by classically-trained chef Steve Ells in 1993. He had been leading the company as CEO from its founding to early 2018. Ells created the company’s first restaurant with what we think is a pretty simple but radical idea. According to the first page of Chipotle’s IPO prospectus, Ells wanted to “demonstrate that food served fast didn’t have to be a “fast-food” experience.” The first page of the prospectus continued:

“We use high-quality raw ingredients, classic cooking methods and a distinctive interior design, and have friendly people to take care of each customer — features that are more frequently found in the world of fine dining.”

Ells never floundered on his initial vision for serving great food, not even when Chipotle was owned by – you’ll never guess it – McDonald’s. All told, Chipotle was under McDonalds for eight years from 1998 to 2006. McDonald’s gave Chipotle the operational knowledge needed to scale from 13 restaurants to almost 500. But Ells frequently clashed with McDonald’s management over cultural differences. Here are two quotes from a brilliant Bloomberg profile of Chipotle’s entire history from 1993 to 2014 that describes the differences:

1. “What we found at the end of the day was that culturally we’re very different. There are two big things that we do differently. One is the way we approach food, and the other is the way we approach our people culture. It’s the combination of those things that I think make us successful.”

2. “Our food cost is what runs in a very upscale restaurant, which was really hard for McDonald’s. They’d say, “Gosh guys, why are you running 30 percent to 32 percent food costs? That’s ridiculous; that’s like a steakhouse.”

Nonetheless, Chipotle became a fast-growing restaurant company under McDonald’s. Its success even spawned the “fast-casual” category of restaurants in the US. For a feel of what fast-casual means, the closest example we can think of in Singapore will be the Shake Shack burger restaurants here (there’s one in Jewel Changi Airport, one along Neil Road, and one at Liat Towers). The food is of much better quality than traditional fast food outlets and the price point is a little higher, but the serving format is quick and casual.

After leaving McDonald’s umbrella via an IPO in January 2006, Chipotle continued to succeed for many years. As we mentioned earlier, Chipotle enjoyed strong growth in same store sales and average restaurant sales from 2004 to 2015. A beautiful example of Chipotle’s relative success over McDonald’s can be found in the Bloomberg profile. There’s a chart showing Chipotle’s much higher same-store sales growth since its IPO:

Source: Bloomberg article

To us, one of the key reasons behind Chipotle’s growth was its unique food culture. The company calls this “Food with Integrity.” Here’s how Chipotle described its food mantra in its IPO prospectus:

“Our focus has always been on using the kinds of higher-quality ingredients and cooking techniques used in high-end restaurants to make great food accessible at reasonable prices. But our vision has evolved. While using a variety of fresh ingredients remains the foundation of our menu, we believe that “fresh is not enough, anymore.” Now we want to know where all of our ingredients come from, so that we can be sure they are as flavorful as possible while understanding the environmental and societal impact of our business. We call this idea “food with integrity,” and it guides how we run our business.”

This is how Chipotle discussed “Food with Integrity” in its annual report for 2015; the focus on serving tasty, fresh, sustainably-produced food still remained in 2015:

“Serving high quality food while still charging reasonable prices is critical to our vision to change the way people think about and eat fast food. As part of our Food With Integrity philosophy, we believe that purchasing fresh ingredients is not enough, so we spend time on farms and in the field to understand where our food comes from and how it is raised. Because our menu is so focused, we can concentrate on the sources of each ingredient, and this has become a cornerstone of our continuous effort to improve our food.”

Another key contributor to Chipotle’s strong restaurant performance, in our opinion, is its Restaurateur program. The program, which started in 2005, is meant to improve employee-performance at each restaurant while providing excellent career prospects. Here’s a description of it from a 2014 Quartz article:

“During a busy lunch rush at a typical Chipotle restaurant, there are 20 steaks on the grill, and workers preparing massive batches of guacamole and seamlessly swapping out pans of ingredients. Compared to most fast-food chains, Chipotle favors human skill over rules, robots, and timers. Every employee can work in the kitchen and is expected to adjust the guacamole recipe if a crate of jalapeños is particularly hot.

So how did the Mexican-style food chain come to be like this while expanding massively since the 2000s?

In 2005, the US company underwent a transformation that would make its culture as distinct as its food. As more than 1,000 stores opened across the US, the company focused on creating a system where promoting managers from within would create a feedback loop of better, more motivated employees. That year, about 20% of the company’s managers had been promoted from within. Last year, nearly 86% of salaried managers and 96% of hourly managers were the result of internal promotions.

Fundamental to this transformation is something Chipotle calls the restaurateur program, which allows hourly crew members to become managers earning well over [US]$100,000 a year. Restaurateurs are chosen from the ranks of general managers for their skill at managing their restaurant and, especially, their staff. When selected, they get a one-time bonus and stock options. And after that they receive an extra [US]$10,000 each time they train a crew member to become a general manager.”

The Restaurateur program was the brainchild of Monty Moran. Moran joined Chipotle as COO (Chief Operating Officer) in March 2005 and became Co-CEO with Ells in January 2009. Moran stepped down from his position as Co-CEO in late 2016.

On capability and innovation: Second portion of the story

2015 was a turning point for Chipotle. In the second half of the year, a food-safety crisis erupted. Around 500 people became ill from E.Coli, salmonella, and norovirus after eating at the company’s restaurants. This badly affected consumer confidence at Chipotle, which manifested in the sharp declines in the company’s same store sales growth and average restaurant sales in 2016.

What were initially strengths – Chipotle’s food and people culture – ended up causing problems for the company. “Food with Integrity” meant that every restaurant used a lot of raw food ingredients and had to do a lot of food preparation within its own four walls; the company’s people culture involved measuring performance based on a restaurant’s throughput (or how fast it can take an order, make the order, and serve it). These two things combined meant that food safety could at times be compromised.

After the late-2015 food safety issue flared up, Ells and his team embarked on fixing the issues at the company. But they struggled, and 2016 became a painful year for Chipotle. Monty Moran left as Co-CEO in late December 2016; around a year later, Ells stepped down from his CEO position and assumed the role of executive chairman. Ells left Chipotle completely in March this year. Brian Niccol, who already had leadership experience at a fast food chain (Taco Bell), succeeded Ells as CEO in March 2018.

When Niccol first came onboard, we remember being worried. We were concerned that he would dilute Chipotle’s food and people culture by introducing a more sterile way of doing business, such as the methods found in traditional fast food chains. But Niccol and his team have managed to retain what is special about Chipotle while improving the areas that needed fixing.

In Chipotle’s latest annual report (for 2019), the company still placed an emphasis on “Food with Integrity”:

“Serving high quality food while still charging reasonable prices is critical to ensuring guests enjoy wholesome food at a great value. We respect our environment and insist on preparing, cooking, and serving nutritious food made from natural ingredients and animals that are raised or grown with care. We spend time on farms and in the field to understand where our food comes from and how it is raised. We concentrate on the sourcing of each ingredient, and this has become a cornerstone of our continuous effort to improve the food we serve. Our food is made from ingredients that everyone can both recognize and pronounce.

We’re all about simple, fresh food without the use of artificial colors or flavors typically found in fast food—just genuine real ingredients and their individual, delectable flavors.”

The Restaurateur program still exists, but there is a more holistic framework at Chipotle for evaluating and improving employee performance compared to the past.

Niccol and his team have also directed Chipotle to invest heavily in digital and other initiatives, such as: Digital/mobile ordering platforms; digital pick-up shelves; digital order pick-up drive-through lanes that are cutely named “Chipotlanes”; delivery and catering; and a rewards program. These investments have seen massive success. Here are some data points:

- In 2017 Chipotle started upgrading second-make lines in its restaurants to specifically handle digital and delivery orders, so as not to disrupt the company’s in-restaurant food preparation procedures; the company ended 2019 with nearly all restaurants having these upgraded second-make lines.

- 2019 also saw Chipotle complete the rollout of digital pick-up shelves across all its restaurants, and expand delivery capabilities to over 98% of its store base.

- In 2018 digital and delivery sales grew by 43% and accounted for 10.9% of Chipotle’s overall revenue; in 2019, digital and delivery sales surged by 90% and accounted for 18.0% of total revenue; in the first quarter of 2020, digital and delivery sales were up 81% and were 26.3% of total revenue; in the second quarter of 2020, digital and delivery sales were up 216% and represented 61% of total revenue.

- Chipotle introduced a rewards program in March 2019 that kicked off with 3 million members. At end-2019, there were 8.5 million members; in the first quarter of 2020, the member count jumped to 11.5 million and ended the second quarter of 2020 at an impressive 15 million.

- Chipotle enjoyed a strong uptick in same store sales growth and average restaurant sales in 2019; in the first two months of 2020, same store sales growth was a sensational 14.4%.

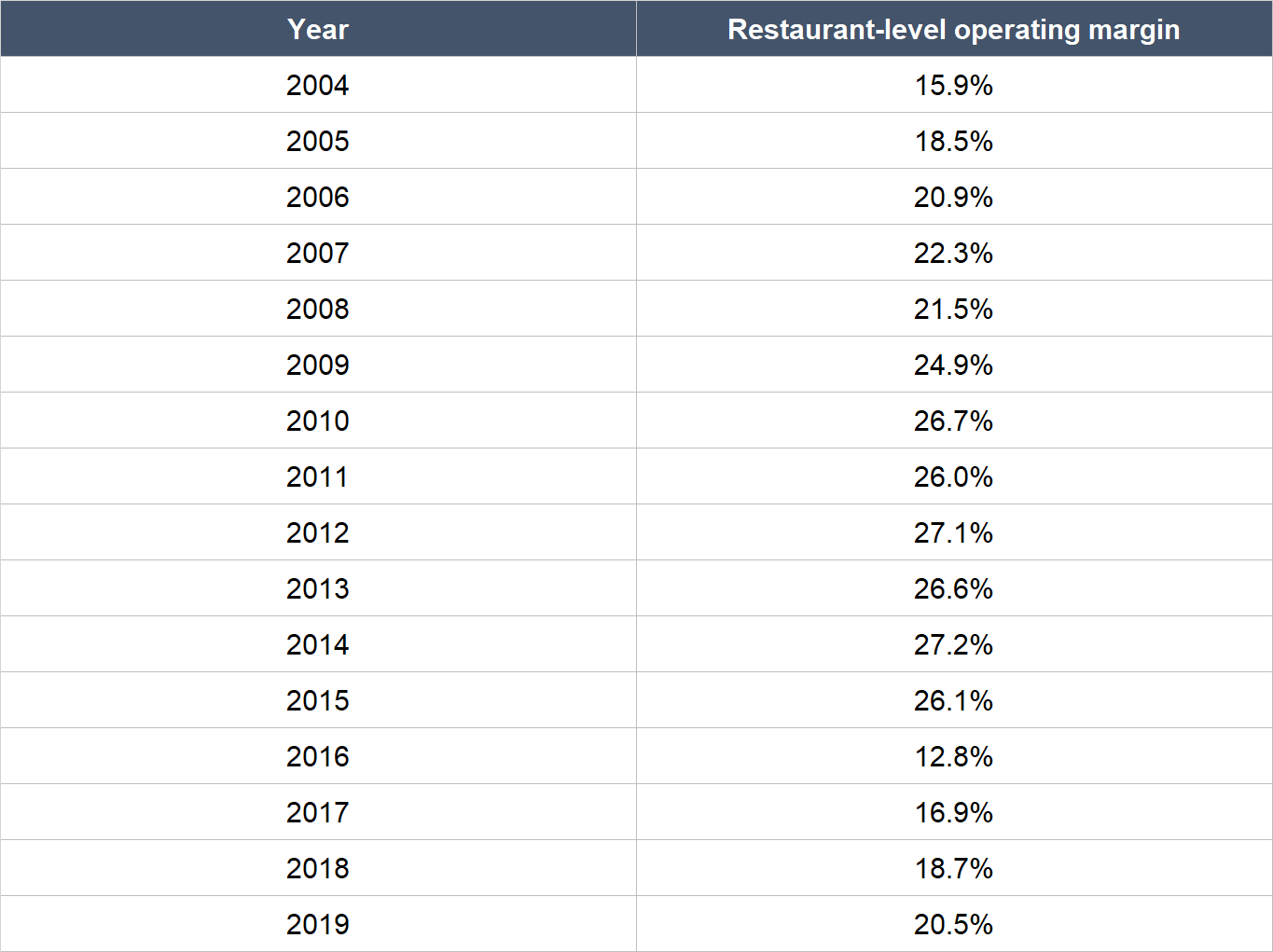

The work isn’t done. Chipotle’s restaurant-level operating margin was 20.5% in 2019, up from 18.7% in 2018 but a far cry from the high-20s range the company was famous for prior to the food safety issue. But in all, we give Niccol an A-plus for his time at Chipotle so far. He has only been at the company for a relatively short while, but the transformation has been impressive.

Source: Chipotle annual reports

4. Revenue streams that are recurring in nature, either through contracts or customer-behaviour

We think it’s sensible to conclude that restaurant companies such as Chipotle enjoy recurring revenues simply due to the nature of their business: Customers keep coming back to buy food.

5. A proven ability to grow

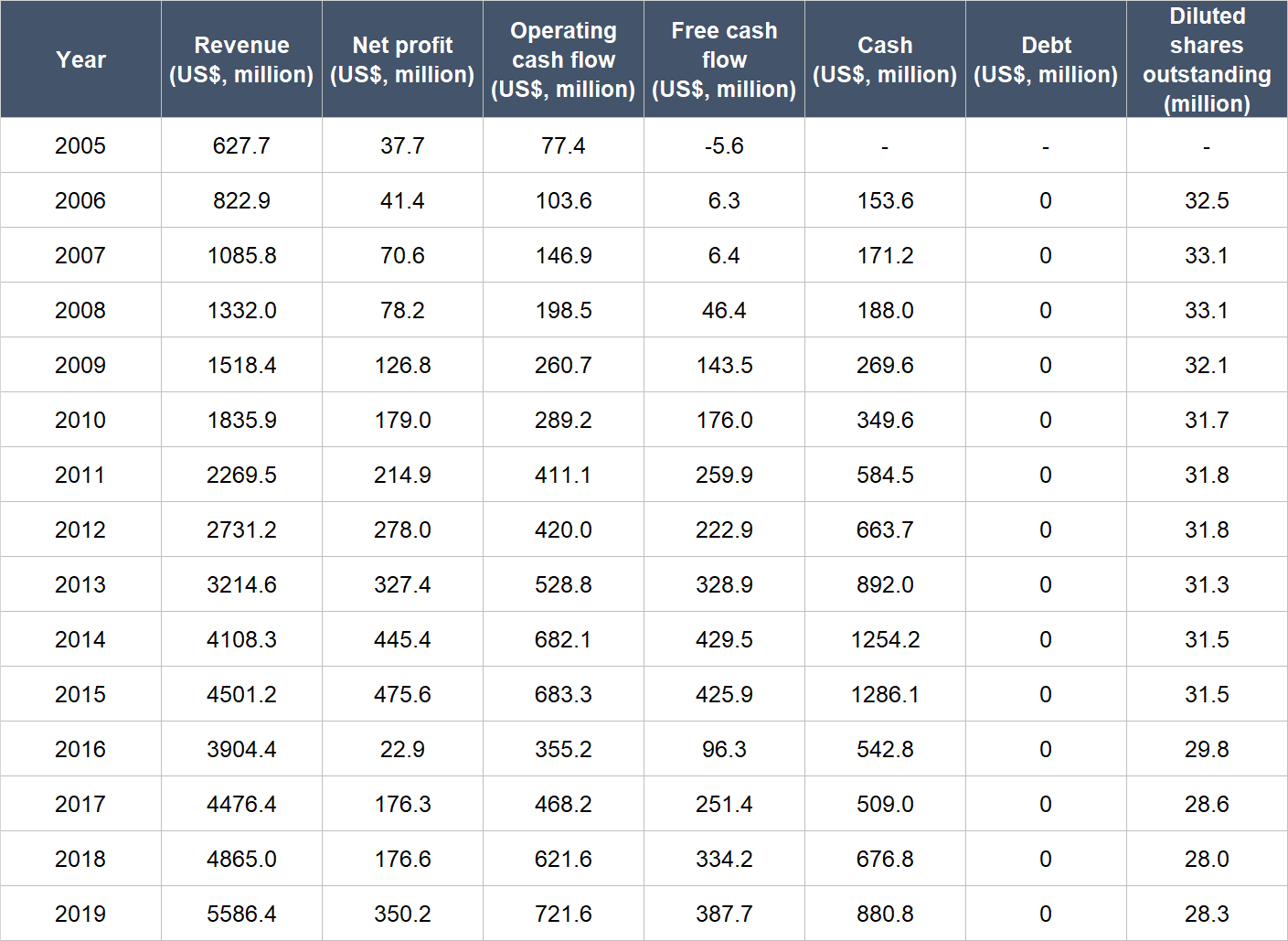

The table below shows Chipotle’s important financials from 2005 to 2019:

Source: Chipotle annual reports

A few key points about Chipotle’s financials:

- Revenue compounded at an impressive rate of 21.8% from 2005 to 2015. Net profit stepped up at an even faster pace of 28.9% per year over the same period. Operating cash flow was consistently positive from 2005 to 2015 and compounded at a similarly strong annual rate of 24.3%. Free cash flow was positive in every year from 2006 to 2015, and became strong from 2008 onwards.

- 2016 was a year when Chipotle reset its business after it suffered from food safety issues, as mentioned earlier. Some of the 2019 numbers for Chipotle are still lower than in 2015. But it’s worth noting that net profit, operating cash flow, and free cash flow compounded at 40.9%, 24.1%, and 24.2%, respectively, from 2017 to 2019. It’s also a positive, in our eyes, that Chipotle managed to produce solidly positive operating cash flow and free cash flow in 2016, at the height of its struggles with the food safety problems.

- Chipotle’s balance sheet was rock-solid for the entire time period we’re looking at, with debt being zero all the way. This is made even more impressive when we consider the fact that the company had expanded its restaurant count significantly from 2005 to 2019 (see table below). We salute a restaurant company when it is able to grow significantly without taking on any debt.

- Dilution has not happened at Chipotle, since its diluted shares outstanding has actually declined from 2006 to 2019.

Source: Chipotle annual reports

In the first half of 2020, Chipotle’s business encountered some speed bumps through no fault of its own. The US has been hit hard by the ongoing COVID-19 pandemic (in fact, the country has the most number of COVID-19 cases and deaths in the world). To fight the virus, the US went into lockdown in March. Some states have reopened recently, but there are also some that are reversing their reopenings. The curbs on human movement in the US have understandably affected Chipotle’s business and there may be more pain in the coming quarters. But we think the company has still handled the crisis really well (another feather in Brian Niccol’s cap). Here are some data we picked up from the company’s earnings updates and earnings conference calls for the first and second quarters of 2020 (we had already discussed some of them earlier in this article):

- As of mid-July 2020, around 30 of Chipotle’s restaurants remain fully closed; these restaurants are mostly inside malls and shopping centers. The company started reintroducing in-store dining in the middle of May and around 85% of its restaurants are offering limited in-restaurant and/or patio dining; the remaining restaurants serve only to-go orders, including delivery, order-ahead-and-pick-up, and walk-in takeaways.

- Chipotle’s revenue increased 7.8% year-on-year to US$1.41 billion in the first quarter of 2020, and was down just 4.8% from a year ago to US$1.36 billion in the second quarter.

- The company’s balance sheet remains robust with zero debt and US$906.6 million in cash and investments as of 30 June 2020.

- Chipotle was profitable in both the first and second quarters of 2020. The company’s profit was US$76.4 million in the first quarter, down 13.3% year-on-year; meanwhile profit in the second quarter was US$8.2 million, down 91.0% year-on-year.

- Operating cash flow for the first quarter of 2020 was unchanged from a year ago at US$182.1 million; free cash flow was down 12% to US$104.4 million. For the second quarter, operating cash flow actually increased slightly by 4.2% to US$122.9 million while free cash flow was down by just 12.7% to US$35.1 million. We’re mightily impressed with (1) Chipotle’s ability to generate cash flow even in the difficult circumstances seen in the first half of 2020, and (2) management’s decision not to shrink Chipotle’s capital expenditure. Management thinks that maintaining a normal level of growth-oriented capital spending even in the face of the current COVID-19 pandemic will pay off in the long-term. We agree.

- Same store sales in the first two months of 2020 were up 14.4%. In March, it was down by 16%, with the week ending March 29 being the worst with a decline of 35%. April’s same store sales was down 24%, while in May it was down by just 7%. June’s same store sales was up by 2% while in July (as of 23 July 2020) there was same-store sales growth of 6.4%.

- Digital and delivery sales were up 103% year-on-year in March to account for 37.6% of Chipotle’s total revenue; in the second quarter of 2020, digital and delivery sales were up 216% and represented 61% of total revenue. In July, digital sales continued to be strong with a mix of nearly 50%.

- Digital sales have traditionally been stickier for Chipotle and remains so to-date. Since Chipotle’s sales hit a bottom in March 2020, the company has been able to retain 70% to 80% of its digital sales gains while concurrently recovering 40% to 50% of in-store sales.

- Relative to the pre-COVID environment, Chipotle’s in-store ordering is currently down by around 37%, while delivery and order-ahead-and-pickup are up by 125% and 140%, respectively.

- The company is rewarding its employees. In the 2020 first-quarter earnings conference call, management shared the following: (1) Employees who were willing and able to work between 16 March and 10 May were given a 10% increase in hourly rates; (2) a discretionary bonus of nearly US$7 million for the first quarter of 2020 was given to field leaders, general managers, apprentices, and eligible hourly employees; (3) US$2 million in assistance bonuses have been made available for general managers and their apprentices for their services in April; and (4) Emergency lead benefits were expanded to accommodate those directly affected by COVID-19.

- Chipotle’s rewards program has increased from 8.5 million members at end-2019 to 11.5 million in the first quarter of 2020 and then to 15 million in the second quarter of 2020; the rate of enrollment to the rewards program has also “roughly doubled during the COVID crisis.”

- Chipotle is continuing to develop new restaurant units, although there were construction-related delays earlier in the year and uncertainty regarding potential future delays.

- In the first quarter of 2020, Chipotle opened 19 restaurants, of which 11 have a Chipotlane, the company’s digital-order pick-up drive-through lane. There were 37 new restaurant openings in the second quarter, of which 21 had a Chipotlane. Chipotle now has 100 restaurants with a Chipotlane. Compared to an overall restaurant-count of more than 2,600, there’s ample room to increase the percentage of restaurants that have Chipotlanes. Restaurants with Chipotlanes are performing really well: (a) Chipotlane-restaurants have a higher digital mix of orders of nearly 60%, of which two-thirds are in the higher-margin order-ahead-and-pickup format; (b) Chipotlane-restaurants older than 13 months – just 13 of them – produced sales in the second quarter of 2020 that were more than 10% higher than non-Chipotlane-restaurants; (c) recently opened Chipotlane-restaurants have sales that are 30% higher than non-Chipotlane-restaurants.

- Management intends to have more than 60% of Chipotle’s restaurant openings this year to come with a Chipotlane, and with the goal of exceeding 70% in 2021. Chipotle’s rock-solid balance sheet, and the pull-back in real estate spending from other businesses, is allowing the company to develop a robust pipeline of new stores. In fact, the company expects to accelerate store openings in 2021 from 2020.

- Chipotle recently launched new tests on its menu, including a new cilantro-lime cauliflower rice item and offering quesadillas only through digital orders. Management has expressed optimism that having digital-only items can allow Chipotle more room for menu-innovation. This is because having digital-only menu items helps improve the food-preparation workflow in Chipotle’s stores, resulting in an overall better experience for team members and customers. Management has a goal of introducing one to two new menu items per year.

- If Chipotle’s aforementioned sequential improvement in same store sales growth continues, management is confident that the company can continue generating positive free cash flow in the second half of 2020. In the month of June, with same store sales growth at 2%, Chipotle’s average restaurant sales had an annual run-rate of more than US$2.2 million and the company enjoyed a 20% restaurant-level operating margin that we think is highly respectable with all things considered. Management was also encouraged by Chipotle’s performance – particularly on the digital front – during the COVID-19 crisis, and now has confidence that the company can hit average restaurant sales of US$2.5 million per year earlier than expected; at that sales level, management also expects to achieve a strong restaurant-level operating margin of around 25%.

6. A high likelihood of generating a strong and growing stream of free cash flow in the future

There are two reasons why we think Chipotle excels in this criterion.

First, the restaurant operator has done very well in producing free cash flow from its business for a long time. It even managed to produce a solid stream of free cash flow in 2016 (during its food safety crisis) and in the first half of 2020 (in the midst of the COVID-19 pandemic).

Second, there’s still tremendous room to grow for Chipotle. Yes, there’s plenty of short-term uncertainty now because of COVID-19. But when it clears, customers should still continue to flock to the company’s restaurants. Chipotle is nowhere near saturation when it comes to its restaurant-count, and the US restaurant market is significantly larger than the company’s revenue. We want to repeat that digital sales are sticky for Chipotle. So the current surge in digital sales for the company during this COVID-19 period could become a strong foundation for Chipotle’s future growth when the pandemic eventually clears.

Valuation

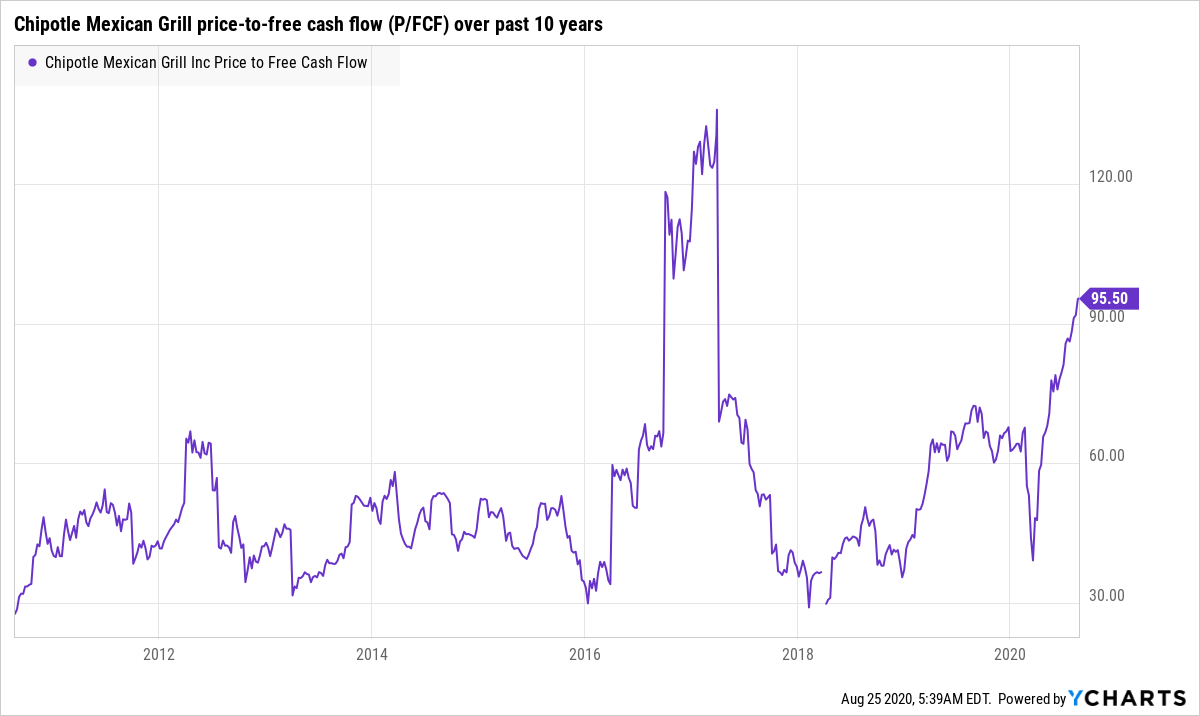

We like to keep things simple in the valuation process. In the case of Chipotle, we think the price-to-free cash flow (P/FCF) ratio is an appropriate measure for its value. The company operates restaurants, which is a cash-generative business, and it has been adept at producing free cash flow over time.

On a trailing basis, Chipotle has a trailing P/FCF ratio of around 88 at Compounder Fund’s average purchase price of US$1,142 per share. There’s no way to sugar-coat this, but Chipotle’s P/FCF ratio is high. The chart below shows Chipotle’s historical P/FCF ratio over the past 10 years:

We can see that Chipotle’s current P/FCF ratio is also high when compared to history. The next few quarters will be a massive test for the company. But Chipotle is well-positioned to survive the COVID-19 crisis as we discussed earlier. It is also putting in place the building blocks for future growth – such as well-designed drive-through lanes and digital/mobile ordering platforms – once the ongoing health crisis becomes a memory. We don’t want to make light of business closures because it is a painful process for the business’s stakeholders. But we want to highlight that from 1 March 2020 to 10 July 2020, at least 15,770 restaurants in the US have permanently closed, according to data from Yelp, and more may be on the way. Restaurant-closures at a large scale are likely to be net-positive for Chipotle from multiple angles including: (1) Soaking up demand from diners; (2) higher availability of talent; and (3) more sites to choose from for restaurant openings and relocations.

So we’re comfortable investing in Chipotle despite the seemingly high P/FCF ratio, which could become even higher over the next few quarters if the company’s free cash flow falls, temporarily.

The risks involved

The biggest risk confronting Chipotle at the moment has to be the economic slowdown and restrictions on human movement that have appeared because of COVID-19. But we’re comforted by two things. One, we had discussed extensively in this article how Chipotle is faring relatively well during the pandemic. Two, even if the COVID-19 situation worsens in the US from here, Chipotle is very likely to survive. Management commented in the 2020 first-quarter earnings conference call:

“Finally, although we don’t currently need access to the debt markets, we’re working on a [US]$250 million to [US]$500 million revolving credit facility with our banking partners to provide us additional access to funding should it be needed. Even before adding this facility, our balance sheet along with the CARES tax deferrals can sustain us for well over a year, and that assumes our comps are at the down 30% to down 35% level where our restaurants breakeven. Last week trend gives us optimism that our comps will continue to improve in the coming months.”

With all these being said about COVID-19 and Chipotle, we’re still keeping a close eye on the situation.

Another big risk affecting Chipotle is food safety. Chipotle was well on its way to recovering from its food safety issue that flared up in late 2015 before COVID-19 struck. The company has dramatically improved its food safety measures compared to in 2015, but we don’t think it’s possible to completely eliminate the chances of food safety problems appearing again in the future. If Chipotle is unfortunate to have to deal with another food safety problem during this ongoing COVID-19 pandemic, its reputation with consumers could be dealt a crippling blow.

The last big risk we’re watching are changes to Chipotle’s unique food and people culture. CEO Brian Niccol has done a great job in improving Chipotle’s business operations while retaining the things that make Chipotle special. We think that Chipotle’s food and people culture have been tremendous drivers of the company’s growth, so we want to keep track of changes in these areas. If Chipotle’s food and people culture are to change in the future, we will be watching the developments. We want to share this choice comment from Niccol in Chipotle’s 2020 second-quarter earnings conference call that we think highlights his respect for the company’s culture:

“What has always attracted me to Chipotle and what I believe is a key point of differentiation is our unique purpose of cultivating a better world and a culture that has always been committed to fostering a diverse, inclusive and safe environment where everyone can belong and have the opportunity to build personal and professional success and make a positive difference in their family and communities. This isn’t always easy, especially given the unrest and uncertainty at the moment, but we must do what is right, even when it’s hard.

More recently, Chipotle has taken several actions to help drive out inequality and injustice, including listening sessions with our employees, financial contributions to organizations advocating against systemic racism and forming a multicultural employee resource group. The bottom line is that we’re all in this together and when we do our part, we can make a difference to our employees, our food, our business practices and in our communities.”

Summary and allocation commentary

Chipotle’s a fast-casual restaurant company with a unique people and food culture. From its founding in 1993 to 2015, it managed to grow tremendously under the watch of founder Steve Ells – and it grew without using debt, which is a mightily impressive feat. Food safety issues erupted in late 2015, which caused setbacks for Chipotle. But new CEO Brian Niccol came in and made significant positive changes at the company. Chipotle was well on its way to recovery when COVID-19 struck. Thankfully, the changes that Niccol has implemented, such as the digital investments, have served Chipotle well. The company looks well positioned to survive – and maybe even thrive in the aftermath of – the current COVID-19 crisis (in other words, Chipotle could be an antifragile company!). Changes to consumer behaviour in the current environment also appear to be building a solid foundation for Chipotle’s future growth when the crisis ends.

There are risks to note of course. A prolonged recovery from COVID-19 could hurt Chipotle’s business near-permanently. The occurrence of another food safety issue during COVID-19 will also be disastrous for the company.

After weighing the pros and cons, we decided to initiate a 2.5% position – a medium-sized allocation – in Chipotle with Compounder Fund’s initial capital. We think this allocation strikes the appropriate balance between the company’s growth prospects, high valuation, and the uncertainties caused by COVID-19.

And here’s an important disclaimer: None of the information or analysis presented is intended to form the basis for any offer or recommendation; they are merely our thoughts that we want to share.